Income Tax Act 2025 Effective April 1: The Income Tax Act 2025 has officially been notified by the Government of India, marking one of the most significant shifts in the country’s taxation history. While some early reports suggested the law would apply from April 1, 2025, the official notification clarifies that it will actually take effect from April 1, 2026. This means taxpayers, professionals, and businesses still have one financial year to prepare for the changes. And they’ll need it—because this is not just a small tweak, it’s a complete overhaul of the system that has governed direct taxation in India for more than 60 years.

Income Tax Act 2025 Effective April 1

The Income Tax Act 2025, effective from April 1, 2026, is India’s most ambitious tax reform in decades. By simplifying tax slabs, embracing digital-first compliance, and cutting down litigation, it promises a system that is easier for taxpayers and friendlier for businesses. While the Finance Act 2025 already applies from April 1, 2025, the real transformation begins in FY 2026–27. With one year to prepare, taxpayers and professionals alike should begin transitioning now. This isn’t just a new law—it’s the beginning of a new era in Indian taxation.

| Aspect | Details |

|---|---|

| Act Name | Income Tax Act, 2025 |

| Notification Date | August 21, 2025 (President’s assent) |

| Effective Date | April 1, 2026 |

| Who’s Affected? | Salaried employees, businesses, startups, NRIs, HNIs |

| Finance Act 2025 | Select provisions effective from April 1, 2025 |

| Official Source | Government Gazette Notification |

Why the Income Tax Act 2025 Effective April 1 Matters?

India’s tax system has long been criticized for being too complex, inconsistent, and litigation-heavy. The Income-tax Act of 1961, though amended countless times, became so layered that even seasoned professionals struggled to keep up.

The Income Tax Act 2025 promises a fresh start. Its objectives include:

- Simplifying tax laws with clearer, plainer language.

- Reducing the number of disputes clogging up Indian courts.

- Aligning India with OECD global tax practices.

- Supporting the Digital India initiative with online-first compliance.

For context, the United States undertook a similar simplification with the Tax Reform Act of 1986, while the UK modernized its system under the Making Tax Digital program. India’s reform is equally ambitious.

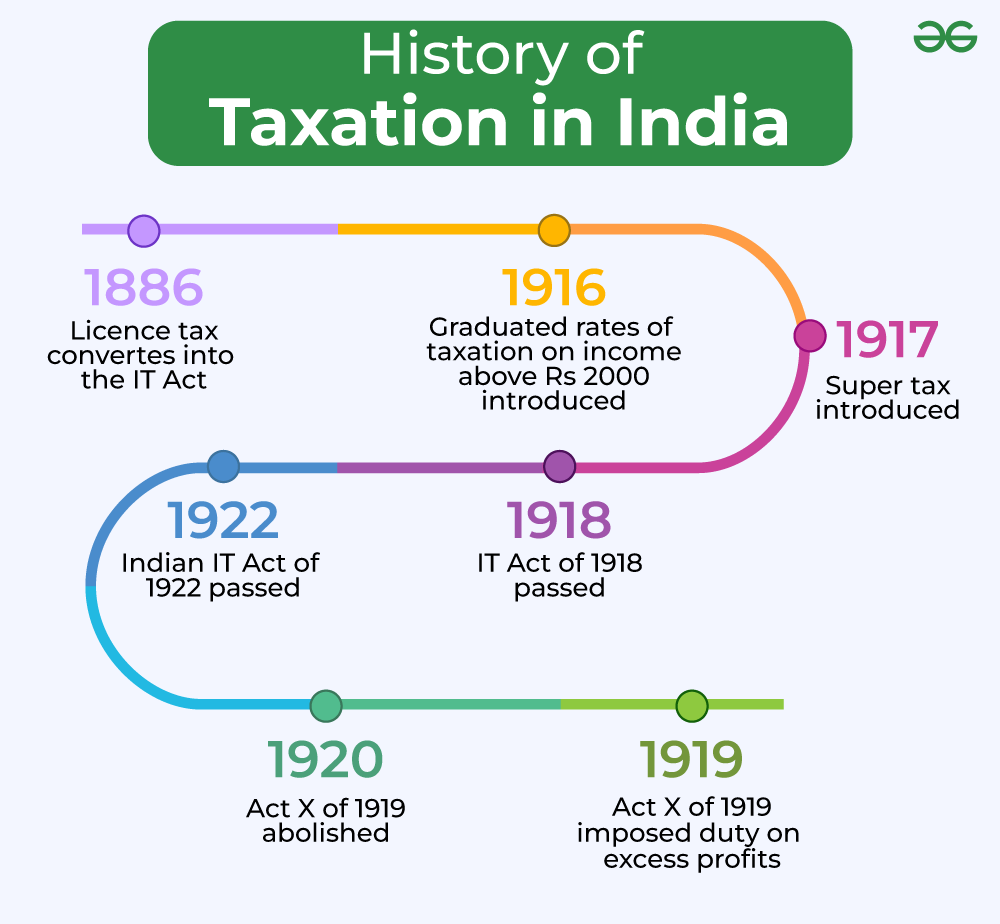

Why Replace the 1961 Act?

The original Act served its purpose well but carried baggage:

- More than 9,000 amendments over the years made it bulky.

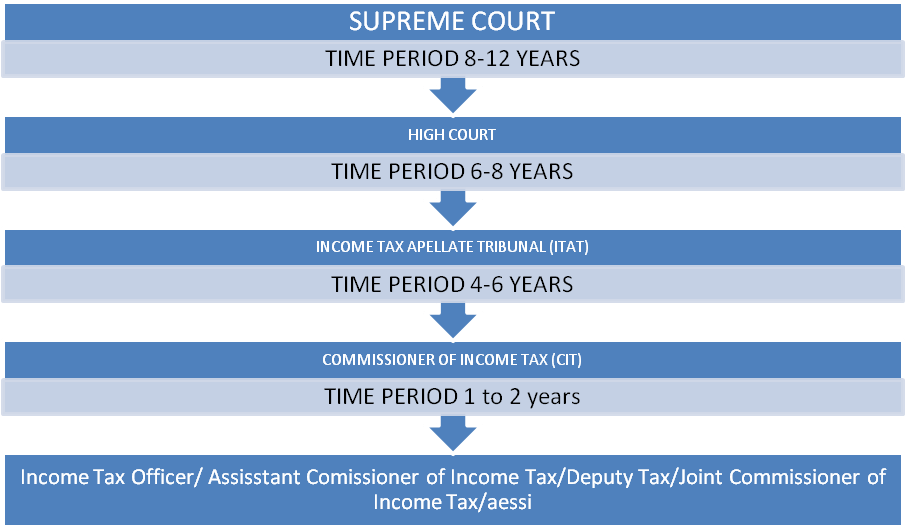

- Average tax litigation time stretched beyond 6 years.

- Over 4.5 lakh cases were pending in courts as of 2024 (source: Economic Times).

- Compliance costs for businesses in India were estimated to be 3x higher than in OECD countries.

With a growing digital economy and over 80 million Indian smartphone taxpayers, the old system was simply outdated.

Breaking Down the Key Changes

New Timeline

The Act takes effect on April 1, 2026, covering income earned during FY 2026–27. Your first return under the new system will be filed in July 2027.

Simplified Tax Slabs

The government is expected to move to fewer, broader slabs, cutting confusion. For instance, a salaried worker earning ₹18 lakh annually may now fall into just one or two brackets, instead of juggling multiple.

Digital-First Filing

Pre-filled returns, AI-powered audit selection, and e-verification will become the norm. Much like how the IRS in the US or the Australian Tax Office offers pre-filled returns, Indian taxpayers can expect greater convenience.

Litigation Reduction

The new Act defines key terms clearly and limits discretionary powers of officers. Faster timelines for appeals mean disputes should resolve in months, not years.

Impact on Different Stakeholders

Salaried Employees

- Easier deductions and exemptions with digital verification.

- Broader standard deduction is expected.

- No more manual submission of bills for HRA or LTA.

Businesses and Startups

- Easier integration of GST and direct tax compliance.

- Relief for startups facing the “angel tax.”

- Simplified depreciation rules for assets.

High-Net-Worth Individuals and NRIs

- Clearer treatment of global income.

- Transparent rules around Double Tax Avoidance Agreements (DTAA).

- Simplified disclosure of foreign assets.

The Indian Economy

- Lower compliance costs free up resources for investment.

- Reduced litigation improves Ease of Doing Business rankings.

- Higher transparency could attract more FDI inflows.

Step-by-Step Transition Guide

- Check Current Exemptions

See which deductions may continue under the new law. For example, Section 80C investments (like PPF or ELSS) may be streamlined. - Move to Digital Recordkeeping

Start storing salary slips, rent receipts, and investment proofs digitally. - Update Accounting Systems

Businesses should adopt ERP and accounting software aligned with the upcoming Act. - Engage a Tax Professional

Don’t wait until 2026—start consultations in FY 2025–26 to understand changes. - Test Run in FY 2025–26

Use the year before rollout to simulate tax calculations under both systems.

Economic Impact: The Bigger Picture

According to government estimates:

- Simplification could reduce litigation by 30–40% in the first three years.

- Digital compliance could save taxpayers ₹20,000 crore annually in administrative costs.

- Better clarity may add 0.2–0.3% to GDP growth over five years.

For a growing economy like India’s, these numbers are game-changers.

Global Comparisons

- US: Simplified corporate tax rates under the 2017 Tax Cuts and Jobs Act.

- UK: “Making Tax Digital” ensures most small businesses file online.

- Australia: Pre-filled individual tax returns are now standard.

India’s move is in line with these global reforms, signaling confidence to investors and taxpayers alike.

Practical Examples

- A salaried worker earning ₹12 lakh a year: Instead of calculating exemptions across multiple categories, the taxpayer may now claim a single broader deduction, reducing errors.

- A small business investing in new machinery: Depreciation claims could be auto-calculated through a digital portal, eliminating disputes.

- An NRI with income in the US and India: Clearer rules mean fewer headaches when filing in both countries.

What Experts Are Saying?

- KPMG India: “The Act balances simplification with modernization. Transition management is the key.”

- PwC India: “Litigation reduction will significantly improve compliance and investor confidence.”

- Independent Economists: “Digital-first tax administration is essential for India’s $5 trillion economy goal.”

Shree Cement Stock in Focus – Income Tax Order Rectification Sparks Market Buzz

Experts Push for 40% Sin Tax on Alcohol, Cigarettes and Junk Food

Professional Impact and Career Opportunities

For Chartered Accountants, CPAs, lawyers, and finance consultants, the Act opens new opportunities:

- Advisory demand will rise as businesses navigate the transition.

- Upskilling in digital tax filing and AI-driven systems is essential.

- Career growth in tax-tech startups, which will play a major role in compliance automation.

For students, specializing in taxation during this period could be highly rewarding.