Income Tax Alert: Filing your Income Tax Return (ITR) is a huge step toward fulfilling your financial responsibilities, but it doesn’t end there. Many taxpayers in India believe that hitting the “submit” button is the finish line. In reality, unless you e-verify your ITR, your return is considered incomplete and invalid. That means no refunds, possible penalties, and in some cases, additional scrutiny from the Income Tax Department. So, if you want your return to count, your refund to come faster, and your record with the taxman to stay squeaky clean, you need to know exactly how e-verification works, why it matters, and how to do it without hassle.

Income Tax Alert

E-verifying your ITR is not a formality; it is a legal requirement. Without it, your return is invalid, refunds remain stuck, and penalties may follow. The government has made the process flexible by providing multiple verification methods like Aadhaar OTP, Net Banking, EVC, DSC, and even physical submission. But remember, you must complete this step within 30 days. By staying proactive and using whichever method works best for you, you can ensure smooth processing of your returns and timely receipt of refunds. Don’t let a small oversight derail your tax compliance.

| Point | Details | Source/Reference |

|---|---|---|

| Deadline | E-verify your ITR within 30 days of filing | Income Tax Department – India |

| Methods Available | Aadhaar OTP, Net Banking, Bank/Demat EVC, ATM EVC, Digital Signature Certificate (DSC), or Physical ITR-V | Economic Times |

| Why It Matters | Without e-verification, your ITR is invalid, refunds get stuck, and penalties apply | Business Standard |

| Refund Speed | Average refund issued within 20–25 days after e-verification | Mint |

| Validity | Aadhaar OTP valid for 15 minutes; EVC valid for 72 hours | TaxBuddy |

Why E-Verification Matters?

Think of e-verification as the final handshake that seals the deal with the tax authorities. Filing without e-verification is like mailing an application without signing it. Your ITR will not be processed, and any refund you are due will sit idle.

Under the current rules, you have just 30 days from the date of filing to complete verification. Earlier, taxpayers had 120 days, but the government reduced the timeline in 2024 to speed up refund processing and reduce backlogs.

According to official CBDT data, in FY 2023–24, over 7.8 crore ITRs were filed. Of these, close to 12 percent of refunds were delayed simply because taxpayers either missed the e-verification deadline or made errors in the process.

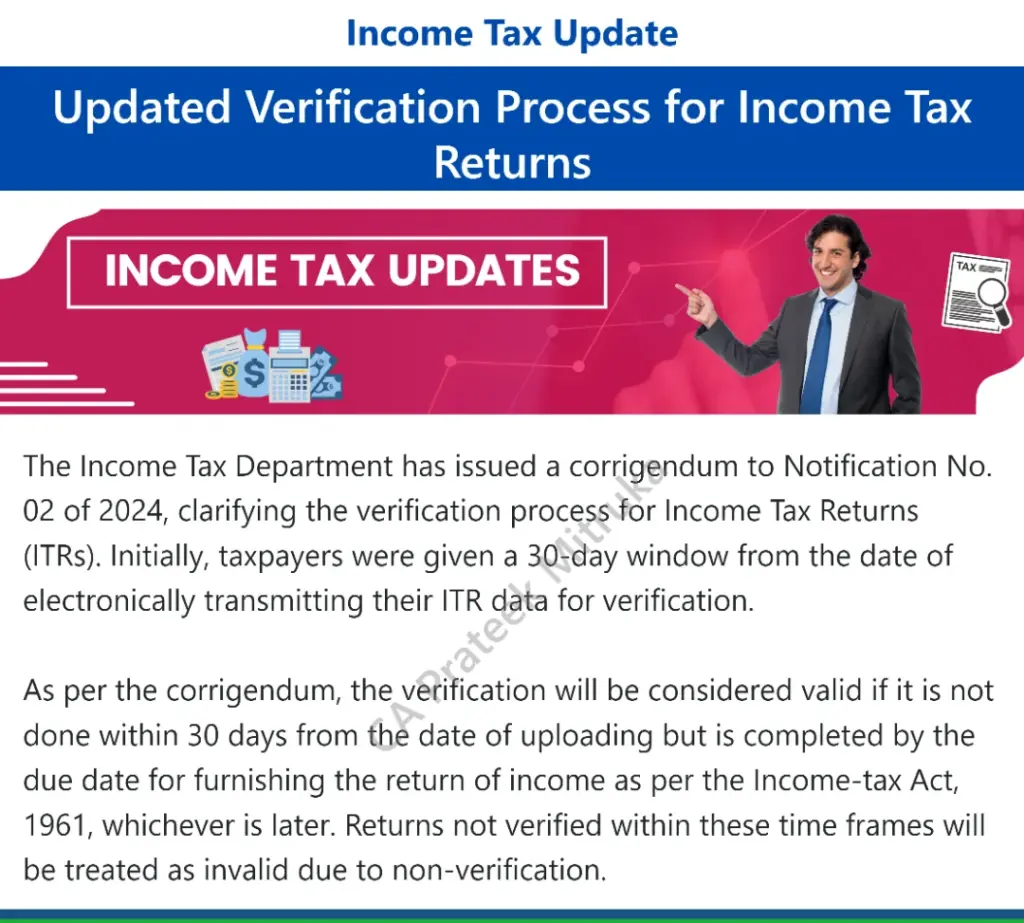

Legal Framework and Notifications

The rules around e-verification are backed by the Income Tax Act, 1961 and are enforced through notifications issued by the Central Board of Direct Taxes (CBDT). The key update was Notification No. 2/2024, effective from April 1, 2024, which shortened the e-verification window to 30 days.

Failure to verify within this time means your ITR is treated as “invalid,” and the law treats you as though you never filed in the first place. The only remedy is to re-file, often with penalties if deadlines have passed.

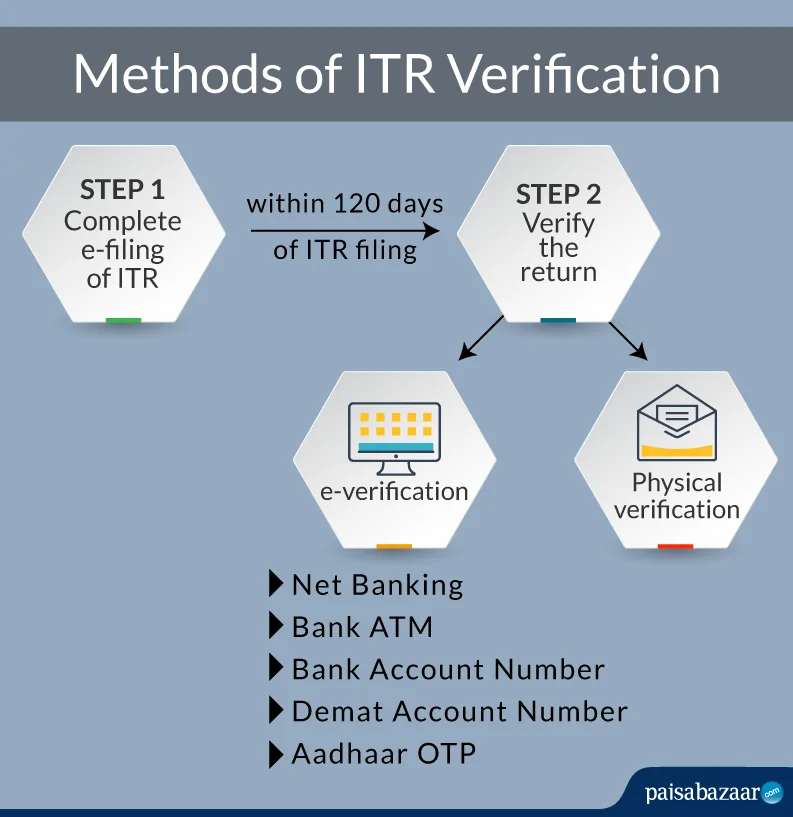

Methods of E-Verification

There are several ways to e-verify, giving flexibility to taxpayers from all walks of life.

Aadhaar OTP

This is the most popular option. It requires that your Aadhaar is linked with your PAN and that your mobile number is updated with Aadhaar. Once you select this method, a six-digit OTP is sent to your phone. Entering this OTP completes verification instantly.

Net Banking

If you bank with a registered institution such as SBI, HDFC, Axis, ICICI, or others listed by the department, you can log in to your net banking account and select the “e-verify ITR” option. This is reliable and widely used.

Electronic Verification Code (EVC)

An EVC is a 10-digit alphanumeric code generated through your bank account, demat account, or at select ATMs. This code is valid for 72 hours. It serves as a good backup if you cannot use Aadhaar OTP.

Digital Signature Certificate (DSC)

This method is typically used by businesses, companies, and professionals required to file with digital signatures. It requires a Class 2 or 3 DSC registered on the tax portal. The DSC must be used during filing itself and cannot be applied later.

ITR-V (Physical Submission)

For those less comfortable with technology, there is still the option of physically verifying the return. You can print out the ITR-V form, sign it, and send it to CPC, Bangalore. The form must reach within 30 days. Always use speed post and keep proof of delivery.

Income Tax Alert: Step-by-Step Guide to E-Verification

- Visit the Income Tax Portal.

- Log in using your PAN, password, and captcha code.

- Navigate to “My Account” and click on “e-Verify Return.”

- Select the ITR you want to verify.

- Choose your preferred verification method.

- Complete authentication using OTP, EVC, DSC, or upload ITR-V acknowledgment.

- Once successful, you will receive an acknowledgment number and a confirmation message by SMS and email.

What Happens If You Miss the Deadline?

If you fail to verify within 30 days:

- Your ITR becomes invalid.

- You may face penalties of up to ₹5,000 under Section 234F of the Income Tax Act.

- Interest charges may also apply if taxes are due.

- Refunds will not be issued until the process is corrected.

This is not just a bureaucratic delay. Treating the ITR as invalid can also affect your financial credibility, especially if you are applying for loans or visas that require proof of tax compliance.

Practical Case Study

Consider the case of Riya, a marketing manager in Dallas, who filed her parents’ returns in India on July 10, 2024. She assumed filing was enough and forgot to verify. By the time she remembered, it was well past the 30-day window. The ITRs were marked invalid, she had to re-file, pay a ₹5,000 penalty, and her parents’ refund of ₹22,000 was delayed by several months.

This example highlights that verification is just as important as filing.

Tips for Professionals and NRIs

- NRIs who may not have Aadhaar-linked mobile numbers should rely on Net Banking, Bank EVC, or DSC.

- Freelancers and independent professionals should keep both Aadhaar OTP and bank-based EVC handy for redundancy.

- Business owners required to use DSC must ensure their digital certificates are updated and registered on the portal before the filing season begins.

Data and Trends

The Income Tax Department reported that over 5 crore refunds were processed in FY 2023–24, most within 25 days of verification. On the flip side, refunds for unverified returns were delayed indefinitely, creating backlogs.

In 2024, authorities also reported an uptick in the number of taxpayers opting for Aadhaar OTP, accounting for nearly 70 percent of all verifications. Net Banking followed at around 20 percent, while DSC and ITR-V together made up less than 10 percent.

How India Compares Globally?

In the United States, the IRS e-file system requires taxpayers to verify using their prior-year Adjusted Gross Income (AGI), a PIN, or by mailing a signed form. Unlike India, the IRS does not offer multiple verification options like Aadhaar OTP or bank EVC. However, both systems share the same philosophy: filing is not complete without verification.

Countries like the UK also follow similar practices, often integrating verification with digital identity services.

Future of E-Verification

With the push toward Digital India, e-verification is expected to become even more streamlined. Upcoming features may include biometric verification, UPI-based e-signatures, and deeper integration with DigiLocker. This will likely reduce fraud, make compliance easier, and cut refund processing time even further.

Common Mistakes to Avoid

- Waiting until the deadline to verify, risking portal slowdowns.

- Forgetting to update your Aadhaar-linked phone number.

- Not pre-validating bank accounts or demat accounts.

- Assuming DSC can be used later when it must be done at the time of filing.

Online Gaming Income FY25 – Tax Rate, TDS Rules And ITR Reporting Explained

Government Notifies Income Tax Act 2025 Effective April 1

19 Major Bills Passed Including New Income Tax Act While Opposition Stayed Silent