Income Tax Dept Offers Relief to Black Money Holders: If you’ve ever been worried about forgetting to report a small foreign asset on your Income Tax Return (ITR), you’re not alone. Many taxpayers, especially those with minor overseas holdings, have faced anxiety over potential penalties or even jail time under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015. But here’s some good news: the Income Tax Department has introduced a significant relief measure. On August 18, 2025, the Central Board of Direct Taxes (CBDT) issued Instruction No. 01/2025, amending previous guidelines to provide relief to taxpayers with minor undisclosed foreign assets. This move aims to ease compliance burdens and focus enforcement efforts on more substantial cases of tax evasion.

Income Tax Dept Offers Relief to Black Money Holders

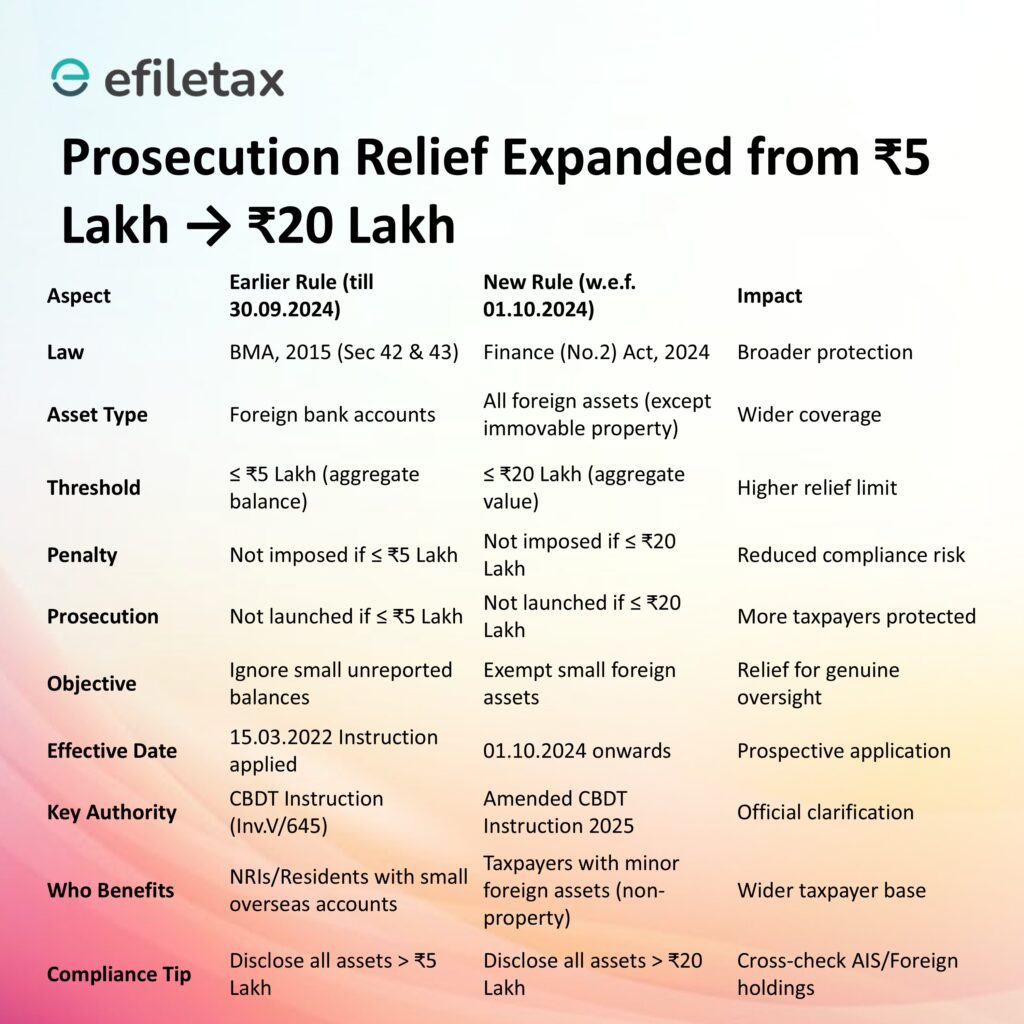

The recent amendment by the CBDT provides significant relief to taxpayers with minor undisclosed foreign assets. By raising the exemption threshold to ₹20 lakh and excluding immovable property, the government acknowledges the challenges faced by individuals in reporting small foreign holdings. This move not only reduces the compliance burden but also ensures that enforcement efforts are focused on more substantial cases of tax evasion. If you fall under the category of taxpayers with minor foreign assets, this is a welcome development. However, it’s essential to remain vigilant and ensure that all foreign assets are accurately reported in your ITR to avoid any future complications.

| Aspect | Details |

|---|---|

| New Instruction | CBDT Instruction No. 01/2025 dated August 18, 2025 |

| Exemption Threshold | ₹20 lakh for undisclosed foreign assets (excluding immovable property) |

| Effective Date | Retrospective from October 1, 2024 |

| Applicable Assets | Foreign assets excluding immovable property |

| Penalty & Prosecution | No penalty under Sections 42/43 and no prosecution under Sections 49/50 if conditions met |

| Official Reference | CBDT Circular |

Understanding the Black Money Act

Before diving into the relief measures, let’s quickly recap what the Black Money Act entails. Enacted in 2015, the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act targets individuals who conceal their foreign income or assets from the Indian tax authorities. The Act imposes stringent penalties and prosecution provisions to deter such practices.

However, the government recognizes that not all non-disclosures are intentional or malicious. Many taxpayers inadvertently overlook minor foreign assets, leading to unnecessary penalties and legal hassles. To address this, the CBDT has introduced measures to provide relief to such genuine taxpayers.

What’s New in Instruction No. 01/2025?

Increased Exemption Threshold

Previously, the exemption from penalties and prosecution under the Black Money Act applied only to undisclosed foreign bank accounts with an aggregate balance of up to ₹5 lakh. This limitation often left taxpayers with other types of foreign assets, such as small investments or deposits, vulnerable to penalties.

With the new instruction, the exemption threshold has been raised to ₹20 lakh, and it now encompasses all types of undisclosed foreign assets, excluding immovable property. This means that if the total value of your foreign assets (excluding property) does not exceed ₹20 lakh, you won’t face penalties or prosecution under Sections 42, 43, 49, or 50 of the Black Money Act.

No Penalty or Prosecution

The key relief provided by the new instruction is the assurance that no penalty will be imposed under Sections 42 or 43, and no prosecution will be initiated under Sections 49 or 50, if the conditions are met. This is a significant departure from the previous stance, where even minor non-disclosures could lead to severe consequences.

It’s important to note that this relief applies only to foreign assets (excluding immovable property) and does not extend to undisclosed foreign real estate holdings. Such properties remain subject to the original provisions of the Black Money Act.

Practical Implications for Taxpayers

Who Benefits?

This relief measure is particularly beneficial for:

- Employees of multinational companies: Individuals who have worked abroad and maintained small balances in foreign bank accounts or investments.

- Frequent travelers: Those who have made small deposits or investments in foreign countries during their travels.

- Retirees with overseas pensions: Individuals receiving pensions or benefits from foreign sources that may not have been disclosed.

These taxpayers often face challenges in reporting minor foreign assets, leading to unintentional non-compliance. The new instruction provides them with much-needed relief and clarity.

Who Doesn’t Benefit?

The relief does not apply to:

- Undisclosed foreign immovable property: Real estate holdings abroad remain subject to the original provisions of the Black Money Act.

- Deliberate concealment: Cases where there is intentional concealment of foreign income or assets.

In such cases, the tax authorities will continue to take stringent actions, including penalties and prosecution.

Real-Life Example

Let’s consider a real-life scenario to understand the practical application of this relief:

Scenario: An individual, let’s call him Raj, worked in the United States for a few years and opened a savings account there. Upon returning to India, Raj forgot to report the balance in his U.S. bank account while filing his ITR. The balance in the account was ₹15 lakh.

Previous Situation: Under the earlier provisions, Raj would have faced penalties and possibly prosecution for not disclosing the foreign bank account.

Current Situation: With the new instruction, since the total value of Raj’s undisclosed foreign assets (the U.S. bank account) is ₹15 lakh, which is below the ₹20 lakh threshold, he will not face penalties or prosecution.

This example illustrates how the new instruction provides relief to taxpayers who inadvertently overlook minor foreign assets.

Income Tax Dept Offers Relief to Black Money Holders: Steps to Ensure Compliance

To ensure compliance and avoid any potential issues:

- Review your foreign assets: Take stock of all your foreign assets, including bank accounts, investments, and deposits.

- Assess the value: Determine the total value of these assets.

- Report accurately: Ensure that all disclosed foreign assets are accurately reported in your ITR.

- Seek professional advice: If you’re unsure about any aspect, consult a tax professional to guide you through the process.

By following these steps, you can ensure that you’re in compliance with the Black Money Act and benefit from the relief measures provided.

Tips for Voluntary Disclosure and Staying Compliant

Even with the new relief measures, it’s always smart to stay proactive when it comes to foreign assets. Voluntary disclosure not only avoids potential penalties but also builds trust with tax authorities. Here are some practical tips:

- Maintain Accurate Records: Keep track of all foreign bank accounts, investments, and other assets. Record dates, balances, and transaction details to ensure accurate reporting.

- Use Online Tax Portals: Utilize official tax filing portals to report foreign income. They often include step-by-step guidance, making compliance easier.

- Consider Professional Help: If you have multiple overseas assets or complex financial arrangements, consult a certified tax professional who understands both domestic and international tax laws.

- Review Annually: Don’t wait until tax season. Conduct an annual review of your foreign assets to ensure nothing is overlooked.

- Stay Updated on Regulations: Tax laws evolve frequently. Keep an eye on CBDT notifications and amendments to stay compliant with the latest rules.

- Document Your Intent: If you voluntarily disclose any asset, maintain records showing it was unintentional and promptly reported—this can help in case of scrutiny.

ITR Filing FY 2024-25: 8 Must-Have Documents for AY 2025-26

ITR-6 Excel Utility Released – Check If You Need to File This Year

ITR Refund Delayed? Here’s Why It’s Taking Longer and How You Can Track Your Status