Income Tax Raids 18 Locations in Jaipur and Kota: When the Income Tax Department (ITD) shows up at your business, it’s not a routine audit—it’s the kind of visit that can change your company forever. On September 2, 2025, IT officials carried out raids across 18 different locations in Jaipur and Kota, Rajasthan, focusing on some of the biggest names in the real estate and pan masala sectors. This was not a small-scale operation. Nearly 150 officers and staff participated, combing through files, computers, and even physical assets. The move reflects India’s ongoing effort to tackle tax evasion, black money, and undeclared income, issues that have long plagued its economy.

Income Tax Raids 18 Locations in Jaipur and Kota

The Income Tax raids in Jaipur and Kota on September 2, 2025, highlight India’s ongoing struggle against tax evasion and black money. By targeting heavyweights in real estate and pan masala, the IT Department is sending a strong message: no industry is untouchable. For businesses, the takeaway is clear: compliance is non-negotiable. Whether you’re a property developer in Rajasthan or a startup in Silicon Valley, transparent accounting builds trust and ensures long-term growth. In today’s digital age, the safest way to succeed is to play by the rules.

| Aspect | Details |

|---|---|

| Date of Raids | September 2, 2025 |

| Cities | Jaipur & Kota, Rajasthan |

| Locations Targeted | 18 |

| Groups Involved | High Fly Real Estate, Siddheshwar Gums (Signature Pan Masala), Gokul Kripa Group |

| Core Allegations | Tax evasion, benami properties, undeclared income, fake documentation |

| Past Raids | Over 5,500 searches in 2023-24, ₹15,000 crore undeclared income detected |

| Legal Authority | Income Tax Act, 1961 (Sections 132 & 133A) |

| Reference | Income Tax India Official Website |

Who Was Targeted?

Authorities zeroed in on three major business groups:

- High Fly Real Estate Group (Jaipur): 8 locations raided. Accused of funneling unaccounted money into land and property deals.

- Siddheshwar Gums / Signature Pan Masala (Kota): 3–4 sites targeted. Investigators suspect hidden taxable income and irregular financial records.

- Gokul Kripa Group (BRB Developers, Jaipur): 6 premises searched, linked to undeclared wealth and suspicious transactions.

Both real estate and pan masala are industries with massive cash circulation, making them magnets for unaccounted money.

Historical Context: India’s Legacy of Tax Raids

India has a long history of headline-grabbing raids:

- 2013 – DLF Real Estate: Investigated for irregularities in land deals.

- 2017 – Film Industry: Stars like Vijay and Madhuri Dixit were raided for alleged under-reporting.

- 2020 – Sahara India Pariwar: Officials uncovered assets worth over ₹2,000 crore.

- 2021 – Kanpur-based Gutkha Firms: More than ₹300 crore in unaccounted assets were seized.

These operations highlight a pattern: sectors handling large sums of cash are most likely to face tax scrutiny.

Legal Framework Behind the Raids

The IT Department doesn’t act without authority. The Income Tax Act, 1961 empowers them under:

- Section 132: Allows search and seizure if tax evasion is suspected.

- Section 133A: Permits survey operations on business premises.

- Section 133C: Deals with collecting information from third parties to aid investigations.

Case law such as Pooran Mal v. Director of Inspection (1974) established that evidence seized during raids can be used in legal proceedings, even if obtained without prior notice.

Why Real Estate and Pan Masala?

These industries are cash-intensive:

- Real Estate: Often, property deals are partly in cash. For example, a ₹1 crore ($120,000) flat may be officially sold at ₹70 lakh, with ₹30 lakh exchanged under the table. This allows both buyers and sellers to dodge taxes.

- Pan Masala and FMCG: The market is worth billions, with heavy distribution across urban and rural India. Much of this business happens off the books.

According to the Central Board of Direct Taxes (CBDT), real estate accounts for 30–40% of India’s black money circulation.

The Global Perspective

How does this compare to other countries?

- United States: The IRS often conducts criminal tax probes, sometimes in coordination with the FBI. They focus on digital records and large-scale fraud rather than hidden cash.

- United Kingdom: HM Revenue & Customs (HMRC) uses “task forces” for targeted industries, such as construction or offshore accounts.

- India: Still a heavily cash-based economy. Raids often uncover stashes of cash, gold, or benami (proxy-owned) properties.

This shows why raids in India tend to be more dramatic and physical compared to Western nations.

Economic and Market Impact of Income Tax Raids 18 Locations in Jaipur and Kota

Big raids don’t just affect the companies targeted. They ripple through the economy:

- Stock Market Fluctuations: Shares of related companies often dip after such raids.

- Investor Confidence: Foreign investors worry about transparency and regulatory risks.

- Business Sentiment: Local businesses may shift toward more transparent accounting to avoid becoming the next target.

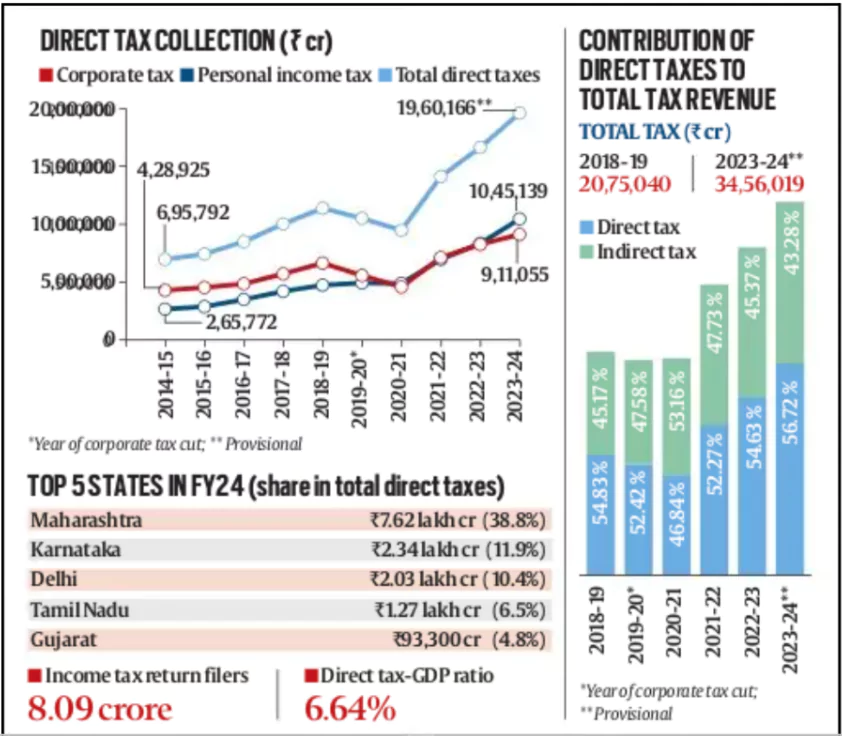

- Tax Revenues: In 2023-24, raids across India unearthed over ₹15,000 crore in undeclared income, boosting the government’s coffers.

Famous Outcomes from Past Raids

Not all raids end with headlines fading away. Some result in landmark penalties:

- Sahara Group (2020): Assets worth ₹2,000 crore seized; investigations continue in court.

- Jain Hawala Case (1990s): Political leaders implicated after large sums of hawala money were uncovered.

- Gutkha Firms (2021): Massive cash hoards and luxury vehicles seized, leading to long-term bans and penalties.

These examples show that raids often lead to long-term legal battles, reshaping entire industries.

How Raids Are Conducted?

Here’s a breakdown:

- Pre-Raid Intelligence: Surveillance, whistleblower tips, and financial data analysis.

- Early Morning Raids: Teams arrive simultaneously at different sites, usually between 6–7 AM.

- Seizures: Cash, jewelry, gold, property papers, digital data.

- Questioning: On-the-spot interrogation of employees and executives.

- Post-Raid Analysis: Forensic accounting, linking transactions, and building cases.

Think of it like a real-life version of a financial crime drama.

Expert Views

Tax consultant Rakesh Gupta told Economic Times, “These raids act as deterrents. Once a high-profile group is raided, other businesses in similar industries become more cautious.”

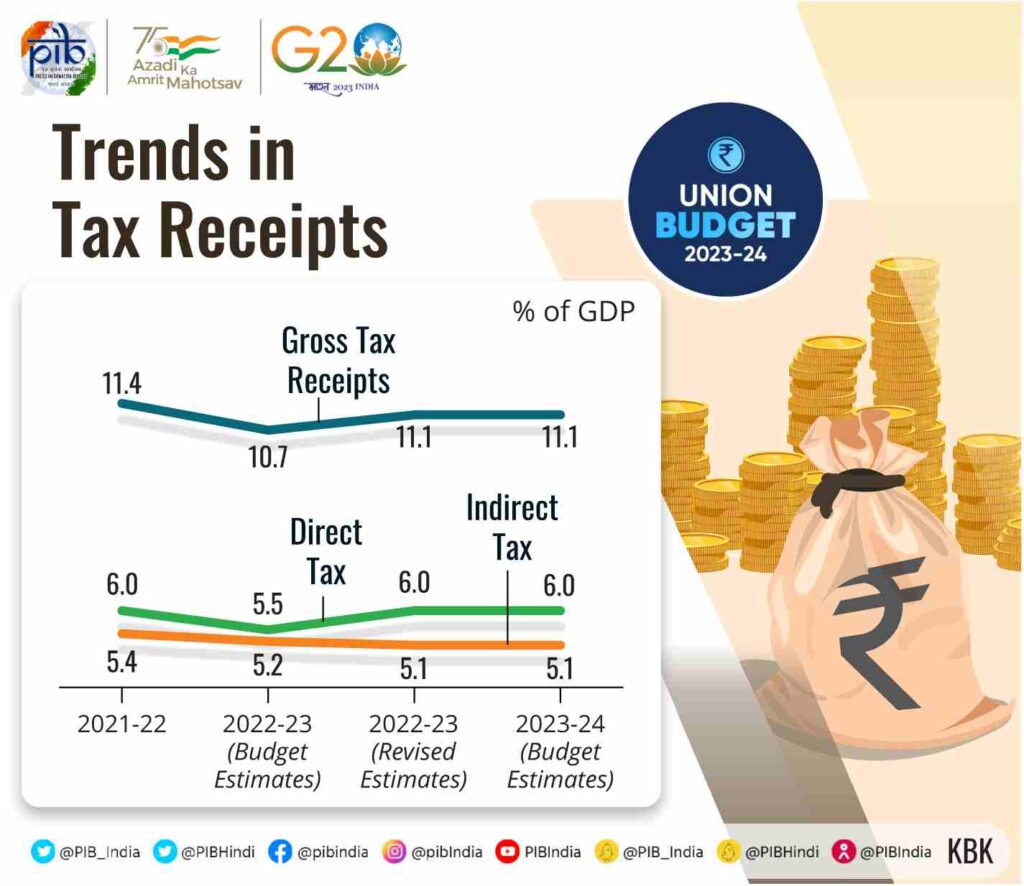

Economist Dr. Surbhi Sharma argues that India’s tax-to-GDP ratio of 11–12% is well below the OECD average of 15–18%, and cracking down on black money is critical to improving this figure.

Compliance Guide for Businesses

Here’s a practical checklist for staying clear of trouble:

- Maintain digital financial records with proper audit trails.

- Use ERP or accounting software like Tally, Zoho, or QuickBooks.

- Declare all income honestly—avoid underreporting.

- Consult a CPA or tax advisor regularly.

- Train staff to follow compliance practices.

- Avoid cash transactions beyond permissible limits under the Income Tax Act.

- Keep updated with notices and circulars from the CBDT.

₹332 Crore Bogus Copper Supply Scam Uncovered in Telangana Tax Fraud Raid

Massive GST Raid in Thrissur Uncovers ₹100 Crore Jewellery Tax Fraud, 36 Kg Gold Seized

Shocking Demand – Should Tax Crimes Lead to Citizenship Denaturalization?

Looking Ahead: Tech and Future Raids

With digitization, India’s tax system is evolving.

- AI and Data Analytics: Algorithms flag unusual patterns in GST and PAN-linked transactions.

- PAN-Aadhaar Linkage: Reduces fake identities and benami deals.

- Digital Banking Push: Less reliance on cash, making tax evasion harder.

Future raids may rely less on physical searches and more on real-time monitoring of digital transactions.