India May Remove 12 Percent GST Slab: When it comes to taxes, most people just want things simple, fair, and easy to understand. That’s why the recent news that India may remove the 12 percent GST slab and cut taxes on essentials is grabbing serious attention—not just in New Delhi, but around the world. India’s Goods and Services Tax (GST) has been both a reform and a riddle since its introduction in 2017. Now, Prime Minister Narendra Modi has announced a “next-generation GST reform” that could change the way Indians shop, spend, and save money. If you’ve ever felt like GST rules were too complicated, this reform is aimed right at you.

India May Remove 12 Percent GST Slab

India’s decision to remove the 12 percent GST slab and cut taxes on essentials is one of the most ambitious tax reforms since GST’s launch in 2017. While the government may face short-term pain through revenue loss, the long-term benefits—cheaper essentials, simpler compliance, stronger consumption—could transform India’s tax landscape. For households, this means more money in their pockets. For businesses, it means fewer headaches. And for the economy, it means a cleaner, leaner, more competitive system that could put India ahead on the global stage.

| Point | Details |

|---|---|

| Reform Announcement | PM Modi announced GST reforms in Independence Day speech (Aug 15, 2025) |

| Current GST Slabs | 5%, 12%, 18%, 28% |

| Proposed Change | Removal of 12% slab; items to move to 5% or 18% |

| Essentials Impact | ~99% of goods in 12% slab to shift to 5% |

| High-End Goods | Some luxury items to remain at 18% or special 40% sin tax |

| Implementation | Expected by Diwali 2025 (October) |

| Official Reference | Government of India GST Portal |

GST: A Quick History Lesson

The Goods and Services Tax (GST) came into effect in July 2017, after decades of debate. It was supposed to be India’s “tryst with tax destiny”—replacing dozens of indirect taxes like VAT, excise duty, service tax, and octroi with one unified system.

- Before GST, a product could be taxed multiple times as it moved across states.

- For example, a refrigerator made in Gujarat could attract excise duty at the factory, VAT in Maharashtra, and octroi at a Mumbai checkpoint.

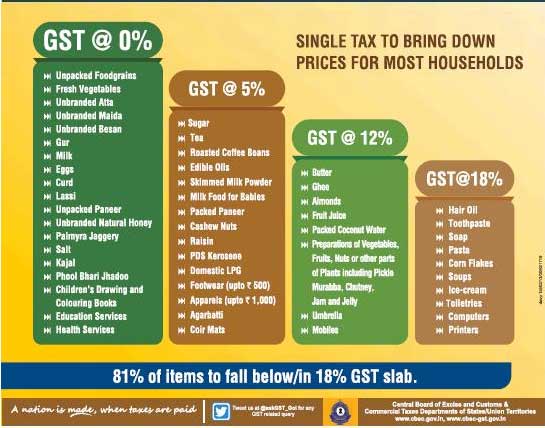

- GST simplified that mess into one system, but the multiple slabs (5%, 12%, 18%, 28%) ended up creating confusion of their own.

Critics often argued that the 12% slab sat awkwardly between “essentials” and “luxuries,” leading to disputes about what belonged where.

What Exactly Will Change?

The government is now planning to scrap the 12% slab altogether. Here’s how items could shift:

- Down to 5%: Around 99% of products currently taxed at 12%—such as packaged food, basic clothing, household essentials, and personal hygiene items.

- Up to 18%: A handful of goods, likely mid-range electronics, processed foods, or budget appliances.

- 28% to 18%: High-value consumer goods like refrigerators, washing machines, and air conditioners may move down to 18%, giving consumers some relief.

- New 40% “Sin Slab”: Products like tobacco, cigarettes, and pan masala may be taxed at an even higher special rate to discourage harmful consumption.

Why India May Remove 12 Percent GST Slab?

The logic is simple: make essentials cheaper, reduce complexity, and encourage compliance.

- Boosting Consumption – With cheaper groceries and healthcare products, households will have more disposable income.

- Supporting MSMEs – Micro, small, and medium enterprises (MSMEs) form the backbone of India’s economy, contributing nearly 30% of GDP. A simpler tax system makes compliance easier.

- Increasing Transparency – By merging slabs, there’s less room for interpretation, disputes, and tax evasion.

- Global Competitiveness – Multinationals prefer countries with straightforward tax regimes. Simplification could attract more foreign direct investment.

- Social Justice – Lower rates on essentials help poorer households the most, reducing inequality.

Expert Insights

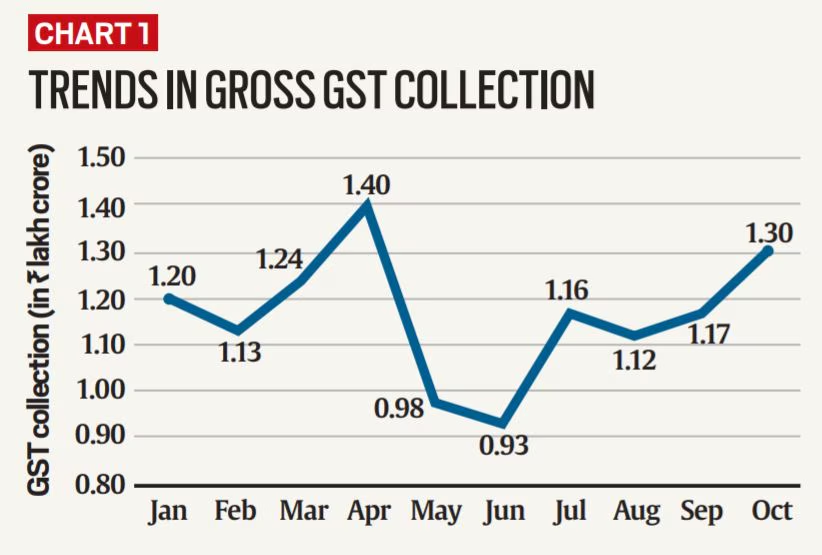

According to Reuters, India may face a short-term revenue hit of around ₹500 billion (~0.15% of GDP). But many experts argue the benefits outweigh the risks.

- Citi Research says the shortfall could be offset by increased consumer demand and higher compliance.

- Economist Arvind Panagariya has long pushed for a two-rate system, calling multiple slabs “a tax jungle.”

- Government sources told the Economic Times that the reform is being timed with Diwali 2025 to “give households a festive season boost.”

A Global Comparison

How does India’s proposed GST reform stack up against other countries?

- United States – The U.S. has no national GST. Instead, states levy sales taxes (0% to 9%), which is simpler but inconsistent across states.

- European Union – VAT systems dominate, with one standard rate (usually around 20%) and one or two reduced rates for essentials.

- Singapore – One of the simplest systems in the world: a flat 9% GST across all goods and services.

- Australia – A single 10% GST, with exemptions for essentials like fresh food and healthcare.

India’s new approach—basically two slabs plus a sin tax—moves it closer to the EU model, balancing affordability with revenue needs.

Practical Examples: What Changes for Consumers

Here’s what you might notice in your shopping basket if the reform kicks in:

- Breakfast cereal: Drops from 12% → 5%

- Hand sanitizers: 12% → 5%, cheaper healthcare for all

- Ready-to-eat meals: 12% → 5%, more affordable convenience food

- Budget smartphones: 12% → 18%, slightly more expensive

- Luxury fridge: 28% → 18%, giving middle-class families relief

For an average household, this could mean monthly savings of ₹500–₹1,000, depending on spending habits.

A Case Study: The Restaurant Owner

Take Ravi, who owns a mid-sized restaurant in Pune.

- Right now, he pays 12% GST on many ingredients and supplies.

- Under the new structure, most of those could fall to 5%.

- Lower input costs could allow him to reduce menu prices or increase profit margins.

Multiply Ravi’s story by 63 million small businesses in India, and the nationwide impact becomes clear.

Risks and Challenges

Of course, no policy reform is without hurdles:

- Revenue Loss – ₹500 billion is a big number, and the government will need to make up for it.

- Transition Period Confusion – Businesses will need to reconfigure billing systems, which could lead to mistakes.

- Inflation Risk – Goods moving from 12% to 18% could see price hikes.

- Monitoring Misuse – Retailers might misclassify products unless enforcement is strict.

Still, experts argue these are short-term pains for long-term gains.

How Households and Businesses Can Prepare?

Households:

- Look for price drops on food, medicines, and hygiene items after Diwali.

- Budget for possible hikes on mid-range electronics or processed foods.

- Track savings to reinvest in other needs.

Businesses:

- Update accounting software and billing systems to reflect new slabs.

- Train staff to apply correct rates.

- Revisit pricing strategies—pass savings to customers or use them to boost margins.

Step-by-Step Guide to GST Reform

- Understand Current Rates – 5%, 12%, 18%, 28%.

- See What’s Changing – 12% slab removed; most goods → 5%, some → 18%.

- Prepare for Essentials Relief – Groceries, medicines, hygiene products become cheaper.

- Watch for Mid-Range Shifts – Certain processed foods or gadgets may cost more.

- Timeline – GST Council meets in September 2025; rollout expected by Diwali.

Tusharkanti Satapathy Joins GST Appellate Tribunal as New Member

Big GST Cuts, But Who Really Benefits? Profiteering Worries Raise Red Flags

Fake ITC & Duplicate GST Demand: Delhi HC Declines Writ, Orders Appeal Route