India Plans GST Cuts: If you’ve been following economic news, you’ve probably seen this headline everywhere: India plans GST cuts on hybrid cars and electronics. This move could be a game-changer not just for India’s massive consumer base but also for global automakers and electronics manufacturers who rely on Indian buyers to keep their sales ticking upward. Imagine this: your state suddenly slashes sales tax on SUVs, flat-screen TVs, and even everyday items like shampoo. Overnight, the cost of living feels lighter, shopping lists grow longer, and dealerships start running out of stock. That’s essentially the ripple India is about to create for its 1.4 billion people.

India Plans GST Cuts

India’s plan to cut GST on hybrid cars and electronics is more than just tax relief—it’s a strategic gamble. For consumers, it means cheaper products and more choices. For businesses, it promises higher sales and a friendlier tax structure. But for the government, it’s a balancing act between revenue and growth. This reform could reshape how Indians spend, how companies invest, and how global markets view India. Whether it’s a bold leap forward or a risky bet will depend on how the GST Council handles the rollout in the weeks ahead.

| Category | Current GST | Proposed GST | Impact/Benefit | Reference |

|---|---|---|---|---|

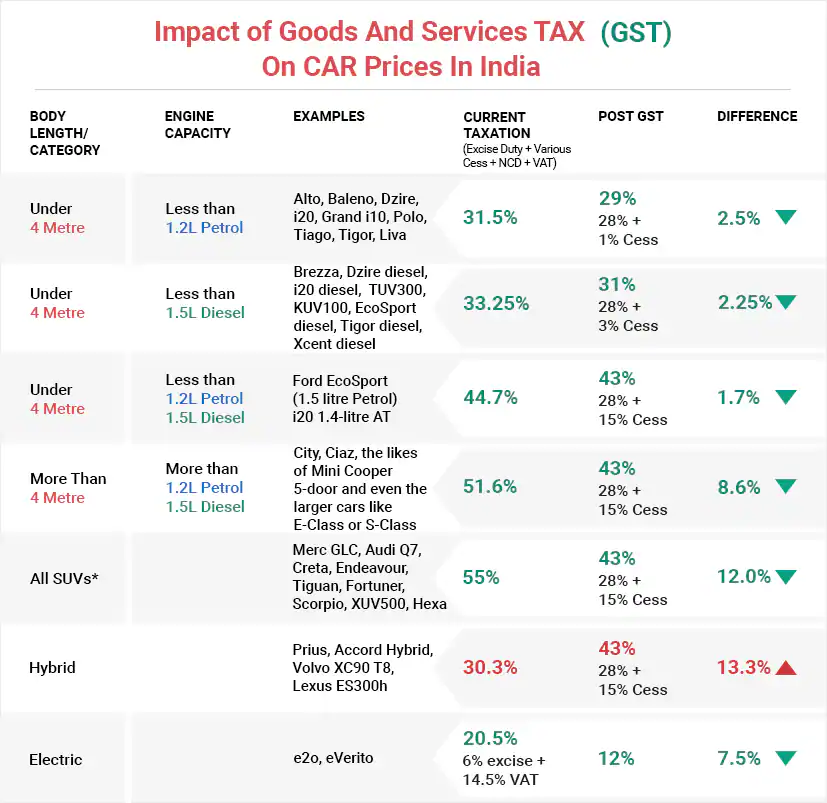

| Hybrid Cars (small) | 28% | 18% | Boost adoption, cheaper cars | Gov GST Portal |

| Electronics (ACs, TVs) | 28% | 18% | Lower consumer prices | Reuters |

| Personal Care Items | 18% | 5% | Affordable essentials | India Ministry of Finance |

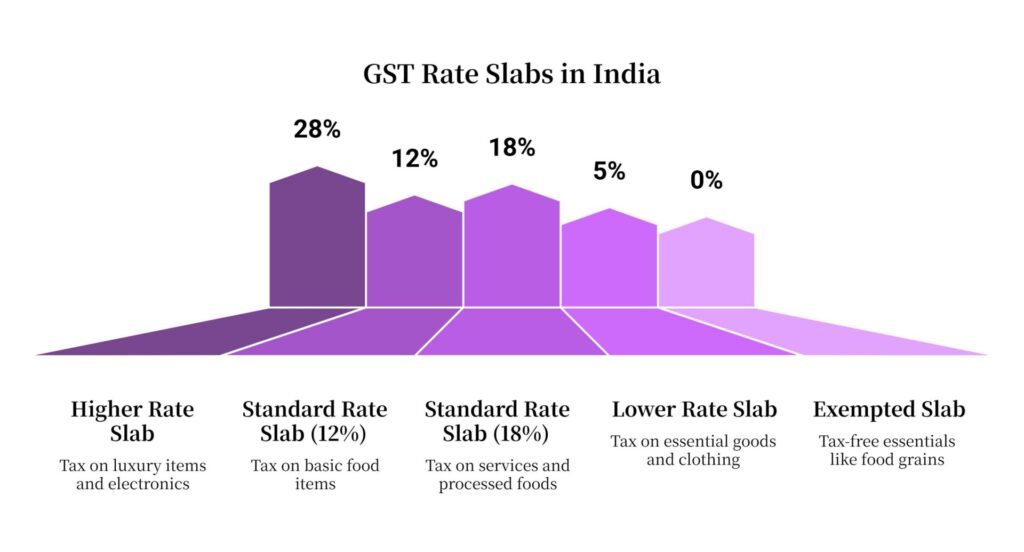

| GST Structure | 5%, 12%, 18%, 28% | 5% & 18% slabs | Simplified system for businesses | GST Council |

| Revenue Impact | $20–21 billion cost | TBD | States worry, but consumer boom expected | Reuters |

A Quick Primer: What’s GST Anyway?

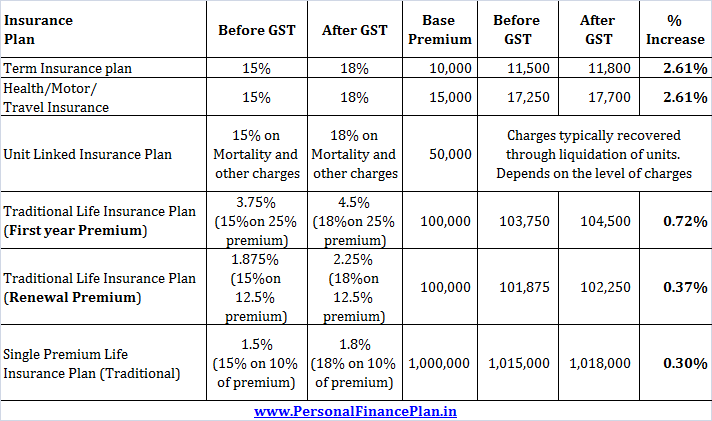

For American readers, GST—or Goods and Services Tax—is basically India’s version of sales tax. Before GST rolled out in 2017, India had a patchwork of state and central taxes that made trade messy. GST replaced all that with a single system meant to be cleaner and fairer.

But there was a catch: India created four main slabs—5%, 12%, 18%, and 28%, plus extra cess charges on luxury and “sin” goods like tobacco, alcohol, and SUVs. This complicated setup often hit middle-class items harder than expected.

Now, nearly a decade later, the government wants to simplify. The new plan would cut things down to just two slabs: 5% and 18%. That means less confusion, fewer loopholes, and (hopefully) lower prices for millions of products.

Why Hybrids and Electronics Are in the Spotlight?

There’s a reason hybrid cars and electronics are at the center of this tax cut conversation.

- Hybrid cars bridge the gap: Fully electric vehicles (EVs) aren’t mainstream in India yet. Charging stations are rare, and EV prices are steep. Hybrids like Toyota’s Hyryder and Maruti’s Grand Vitara offer a middle ground: better fuel efficiency without full reliance on charging infrastructure.

- Electronics = everyday lifestyle: In India, owning a TV or air conditioner is less about luxury and more about middle-class living. Dropping GST from 28% to 18% makes these essentials more attainable for millions of households.

- Timing with Diwali: The proposed cuts come right before Diwali, India’s biggest shopping season. Think of it like dropping taxes in the U.S. just before Black Friday—it’s a recipe for a consumer boom.

Historical Context: GST Since 2017

When India rolled out GST in 2017, it was touted as the biggest tax reform since independence. It unified the market and removed inter-state barriers. But as years passed, cracks showed:

- Businesses complained about compliance burdens.

- States argued they were losing revenue share.

- Consumers noticed high GST on items like electronics, leading to slower demand.

This new reform is being pitched as GST 2.0—a course correction to fix those problems while keeping growth in focus.

Real-Life Examples of Price Drops

- Car buyers: Right now, a hybrid SUV priced at ₹20 lakh ($24,000) faces 28% GST. Dropping it to 18% could cut prices by ₹2–3 lakh ($2,400–3,600). That’s enough to sway a family choosing between a traditional car and a hybrid.

- Electronics shoppers: A 55-inch Sony Bravia TV costs around ₹80,000 ($950). After tax cuts, it could fall closer to ₹65,000 ($780). Multiply that across millions of households, and you have a shopping surge.

- Personal care: Essentials like shampoo may drop from ₹250 ($3) to ₹200 ($2.40). Small, yes—but across 1.4 billion people, the savings add up fast.

Economic Impact: The Good, the Bad, and the Risky

The Upside

- Boost for demand: Lower prices = higher consumption, especially during festive seasons.

- Support for manufacturing: India’s “Make in India” initiative could see stronger domestic production as demand rises.

- Greener transport push: Hybrids reduce reliance on fossil fuels and act as a stepping stone toward EV adoption.

The Concerns

- Revenue loss: Experts estimate the reform could cost the government $20–21 billion. States worry about shrinking budgets.

- Inflationary risk: More demand could push prices higher in other areas, like food and services.

- EV slowdown: While hybrids get relief, EVs—especially luxury imports from Tesla or BMW—may face higher taxes. This could slow India’s clean-energy transition.

The Global Angle

India isn’t making this decision in isolation. Global factors are at play:

- Competing with China: Lower electronics taxes could make India a more attractive manufacturing hub.

- Auto industry watch: Toyota and Hyundai stand to gain in hybrid sales, while EV-only makers may feel sidelined.

- Investor confidence: Global investors are watching whether India can balance consumer relief with fiscal stability.

Industry and Expert Reactions

- Automakers: Toyota has long pushed for tax relief on hybrids. This change could finally reward their persistence.

- Electronics companies: Samsung and LG see India as one of their biggest growth markets. Lower GST means higher sales volume.

- Economists: Some warn that states may resist cuts unless the federal government guarantees compensation for revenue loss.

Comparing With the U.S. System

For Americans, think of this like Washington setting a single nationwide sales tax. Right now, U.S. states handle their own, ranging from 0% in Delaware to over 9% in Tennessee. India’s GST cuts aim to make things uniform and predictable—something the U.S. has never attempted.

Practical Guide for Consumers and Businesses

For Consumers

- Don’t rush big buys: Wait for official confirmation after the GST Council meeting on September 3–4.

- Plan Diwali shopping: Expect retailers to combine tax cuts with festive discounts.

- Look for financing deals: Banks usually roll out special loan and installment offers during festive seasons.

For Businesses

- Update pricing strategies: Electronics retailers and car dealers should prep for price adjustments.

- Boost inventory: Stock up now—demand will spike once cuts are official.

- Plan promotions: Use “GST slash” as a marketing hook to attract buyers.

Risks and Challenges Ahead

- Revenue Compensation: States rely on GST to fund programs. Without central compensation, they may resist reforms.

- Political Tensions: The ruling party may push reforms aggressively, while opposition-led states could delay or dilute implementation.

- Implementation Hiccups: Previous GST rollouts were rocky with tech glitches and compliance headaches. Businesses fear a repeat.

Big GST Cuts, But Who Really Benefits? Profiteering Worries Raise Red Flags

Medical Device Industry Warns Govt: Sudden GST Cuts Could Disrupt Entire Supply Chain

GST Cuts Cost Telangana ₹26,900 Crore in 2024-25, Says Deputy CM

Future Outlook

If the cuts go through, India could see:

- Short-term demand spike: Especially for mid-range cars and consumer electronics.

- Medium-term industrial push: Local factories may expand to meet rising demand.

- Long-term tax reform stability: Simplified slabs could make India more business-friendly and globally competitive.

However, if the government can’t manage the revenue shortfall, states may push back, leading to compromises or delays. Investors and businesses will be watching closely.