India Proposes Tax Cuts on Small Cars: If you’ve been tracking global markets, you’ve probably noticed the buzz around India in recent days. Big news just dropped: India proposes tax cuts on small cars, and the markets are reacting like fireworks on the Fourth of July. Prime Minister Narendra Modi’s government has unveiled its most sweeping tax reform since 2017, and the announcement has already sent Indian auto stocks soaring. But what does this really mean—for consumers, professionals, investors, and the auto industry as a whole? Let’s break it down in simple terms.

India Proposes Tax Cuts on Small Cars

The India tax cuts on small cars proposal is more than just an economic adjustment—it’s a bold policy move with far-reaching implications. By slashing GST from 28% to 18%, simplifying the tax system, and timing the change around the festive season, the Modi government has signaled its intent to fuel demand, create jobs, and strengthen India’s position in the global auto market. For consumers, it means more affordable cars and insurance. For professionals, it opens up new career opportunities. And for investors, it could represent one of the most promising emerging-market plays of the year.

| Element | Details |

|---|---|

| Proposal | GST on small cars cut from 28% → 18%; Insurance GST from 18% → 5%/0% |

| Reform Structure | New two-slab GST system (5% and 18%); sin goods taxed at 40% |

| Implementation | Likely around Diwali 2025, pending GST Council approval |

| Market Impact | Auto Index +5%; Maruti/Hyundai/Hero MotoCorp up 6–9% |

| GDP Boost Potential | Household spending could rise by 0.7–0.8% of GDP |

| Employment Impact | Potential for 50,000+ new jobs in auto & insurance sectors |

| Official Source | Government of India GST Portal |

A Look Back – Why This Reform Matters

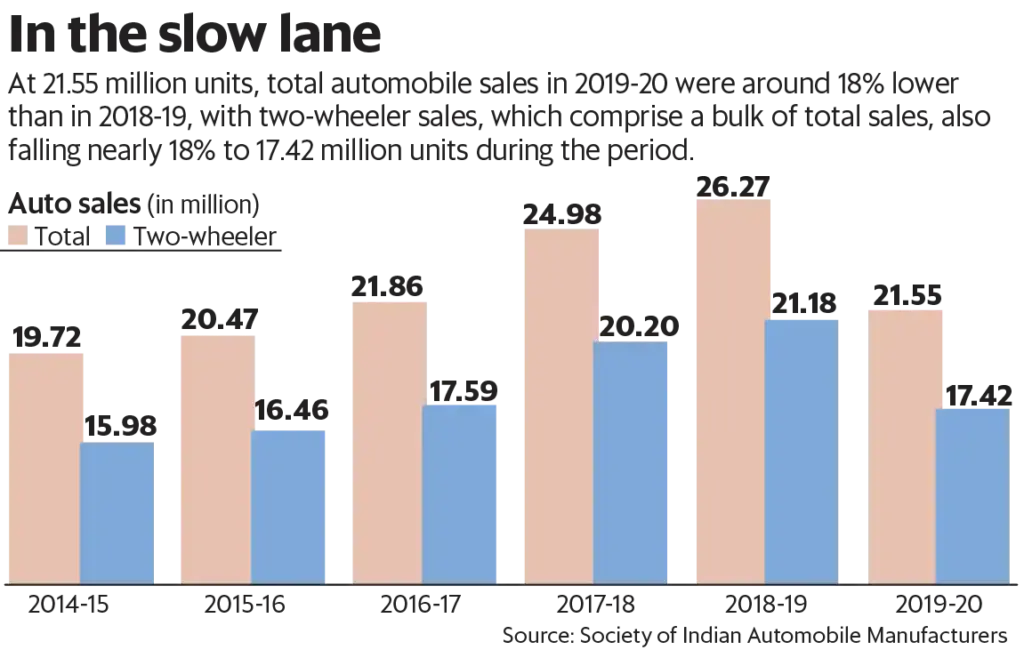

India’s current GST (Goods and Services Tax) system was introduced in 2017 to unify a complicated patchwork of state and federal taxes. While it simplified trade, autos were placed in the highest 28% slab, making small cars disproportionately expensive for the average family.

That move hurt the very segment that once powered India’s car market: compact, affordable cars. Over the past decade, SUVs began dominating sales—similar to how trucks and crossovers dominate in the U.S.—leaving small cars struggling to compete.

This reform aims to reverse that trend, reignite demand, and make small cars affordable again for India’s growing middle class. It is not just a tax cut; it is a signal that the government wants to rebalance the auto market.

The Market’s Fast and Furious Reaction

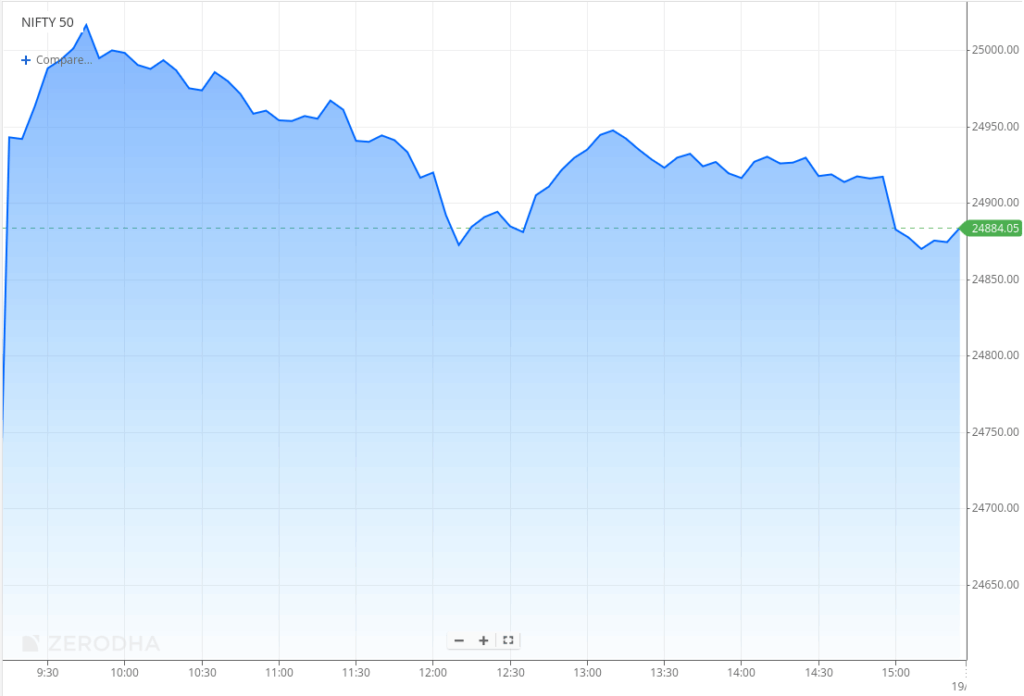

The moment the announcement hit, Indian markets lit up.

- The Nifty Auto Index surged nearly 5%, touching its highest level in ten months.

- Maruti Suzuki—India’s largest carmaker—jumped close to 9% in a single session.

- Hyundai Motor India followed closely, gaining around 8–9%.

- Hero MotoCorp, a leader in motorcycles, climbed 6–7%.

- Insurance companies such as ICICI Prudential, SBI Life, and LIC rose between 2–5% on expectations of cheaper policies due to GST cuts.

Even the broader market celebrated: the Nifty 50 Index gained 1.3%, marking its best trading day in three months.

How India’s Auto Taxes Stack Up Globally?

To appreciate this move, let’s put it in a global context.

- United States – Cars are generally subject to state sales tax, ranging 4–10%, depending on location. No nationwide auto GST exists.

- European Union – Cars are hit with VAT of 19–25%, often with additional carbon emission or luxury taxes.

- China – Standard VAT of 13%, plus purchase taxes for certain categories.

- India – At 28%, India’s small cars were among the most heavily taxed globally.

Reducing that rate to 18% doesn’t just help affordability—it puts India closer to global norms, making the market more competitive for both local and foreign automakers.

Consumer Impact – A Real-Life Example

Imagine an Indian middle-class family buying a small car priced at ₹600,000 (~$7,200).

- Before the cut: With 28% GST, the final price balloons to about ₹768,000 (~$9,200).

- After the cut: At 18% GST, the price drops to about ₹708,000 (~$8,480).

That’s a savings of ₹60,000 (~$720)—equivalent to months of household expenses for many families. For first-time buyers or budget-conscious households, that difference could be the deciding factor.

India Proposes Tax Cuts on Small Cars in Detail – From Four Slabs to Two

Old GST Structure

- 5%, 12%, 18%, and 28% slabs

- Extra cess on “sin goods” like tobacco, luxury cars, and soft drinks

New Proposal

- Only two slabs: 5% and 18%

- Luxury and sin goods taxed at 40%

- Insurance premiums reduced to 5% or exempted altogether

This simplified structure reduces compliance headaches for businesses and makes prices more predictable for consumers. Think of it as switching from a cluttered, confusing playbook to a clean two-option strategy—easy to follow, efficient to execute.

Expert Opinions – What Analysts Are Saying

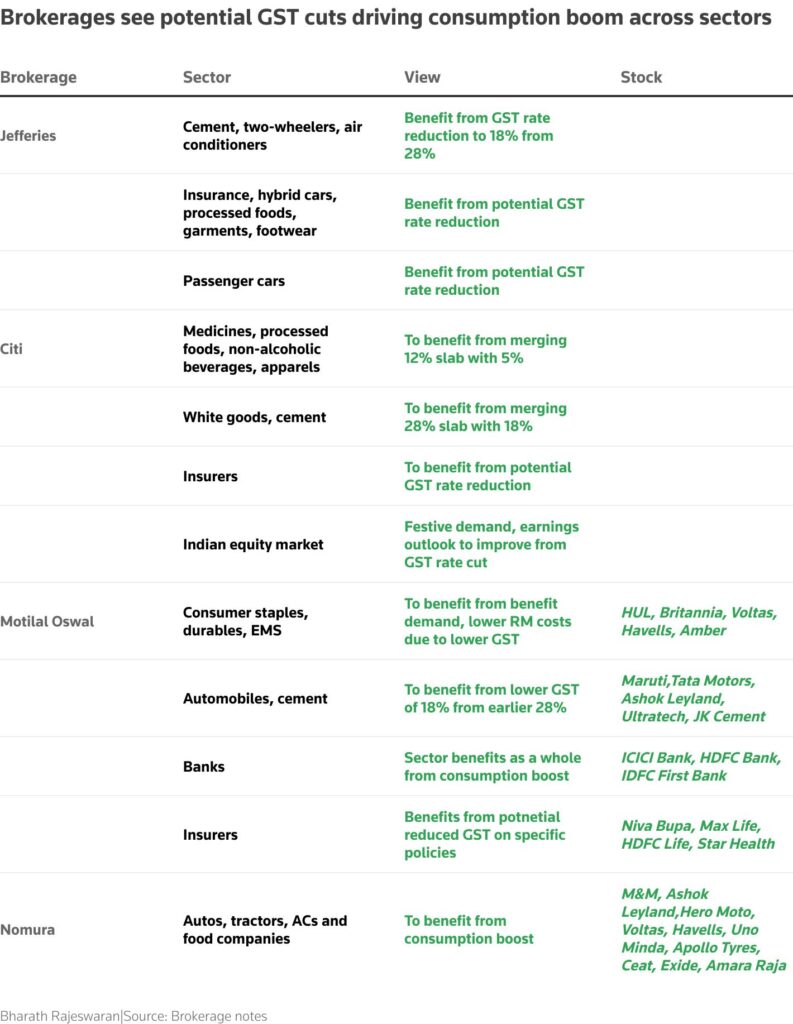

- Jefferies: “Maruti Suzuki stands to gain the most as affordability improves significantly in its core small car segment.”

- Nomura: Highlights Mahindra & Mahindra, Ashok Leyland, and TVS Motor as key winners from increased demand.

- Citi Research: Estimates reforms plus prior income tax cuts could boost household consumption by 0.7–0.8% of GDP.

- Geojit Investments: Predicts strong sales during the festive season, with auto and cement stocks leading the charge.

These endorsements from global brokerages lend credibility to the idea that this isn’t just a short-term market rally, but a longer-term structural boost.

Jobs and Economic Ripple Effects

This reform isn’t just about cheaper cars—it’s about the economy as a whole.

- Jobs: Rising demand could create over 50,000 jobs across auto manufacturing, dealerships, and insurance.

- Supply Chains: Cement, steel, and tire manufacturers will benefit from higher vehicle output.

- Insurance Growth: Lower premiums mean higher adoption rates, especially in rural areas where coverage remains low.

- GDP Growth: By boosting household consumption, reforms could add a noticeable push to India’s already strong growth trajectory.

Risks and Challenges

Like any policy, there are risks:

- Government Revenue Loss – Cutting GST rates means less money in the treasury, at least in the short term.

- SUV Popularity – Even with cuts, consumer preference for SUVs may continue to overshadow small cars.

- Inflation – If demand spikes, supply chains could get strained, pushing up prices.

- Execution – The reform still requires smooth approval and rollout by the GST Council.

These risks don’t undo the benefits but are important to consider for a balanced outlook.

Looking Ahead – India’s Auto Future

The government’s long-term goals include boosting electric vehicle (EV) adoption and positioning India as a global auto manufacturing hub under the “Make in India” program. Lowering taxes, simplifying GST, and reducing insurance costs are all steps that help both conventional vehicles and EVs.

For example, cheaper insurance reduces the total cost of owning a car, making EVs—which already have higher upfront costs—more attractive. Add government subsidies and foreign investment, and India could become a key EV market in the next decade.

Practical Takeaways – How You Can Benefit

- Car Buyers in India – Consider waiting until after Diwali 2025 to take advantage of lower GST rates.

- Investors – Watch for opportunities in Indian auto stocks or ETFs such as INDA or EPI.

- Insurance Holders – Expect lower premiums, making it a good time to review or expand your coverage.

- Professionals – The auto and insurance sectors could see hiring booms; keep an eye on job opportunities.

NMMC Rolls Out Property ID Cards – Here’s How It Will Change Tax Payments

Income Tax Department Raids Over 10 Locations Across Tamil Nadu