India Set to Announce Big Consumption Tax Cuts: When you read the headline India set to announce big consumption tax cuts by October to boost economy, it may sound like just another policy tweak. But in reality, this reform could reshape the way India’s consumers and businesses operate for years to come. Prime Minister Narendra Modi announced during his Independence Day speech on August 15, 2025, that the government will introduce sweeping GST reforms—often called GST 2.0—by October 2025. The plan is straightforward but ambitious: cut down India’s complicated four-tier GST structure to just two tax slabs (5% and 18%). This announcement comes at a critical moment. India’s economy is facing global trade pressures, especially after new U.S. tariffs on Indian goods. At the same time, domestic consumption needs a boost to maintain growth momentum. By simplifying taxes and lowering rates on everyday products, the government is betting big on its people’s spending power.

India Set to Announce Big Consumption Tax Cuts

India’s move to simplify GST into just two slabs—5% and 18%—is more than a policy change. It’s a bold attempt to boost consumer confidence, empower small businesses, and stimulate economic growth at a time of global uncertainty. Yes, there are risks of revenue shortfall and inflation. But if the reform works as planned, it could unleash a new wave of consumption-led growth, not just for India but for companies and investors worldwide. For consumers, October 2025 may bring the happiest Diwali shopping season in years.

| Aspect | Details |

|---|---|

| Announcement | Made by PM Narendra Modi on Independence Day, August 15, 2025 |

| Implementation | Expected by October 2025 (before Diwali festival season) |

| Old GST Rates | 5%, 12%, 18%, 28% |

| New GST Rates | Simplified to two slabs: 5% and 18% |

| Affected Goods | Around 99% of items in the 12% slab, such as butter, juices, dry fruits, shifting to 5% |

| Revenue Impact | Estimated revenue loss of ₹500 billion (~0.15% of GDP) |

| Stimulus Effect | Household spending projected to increase by 0.6–0.7% of GDP (Citi Research) |

| Reference | GST Council Official Website |

Understanding GST: A Quick Refresher

The Goods and Services Tax (GST) was first rolled out in India in July 2017. Before GST, the country had a patchwork of state-level and federal taxes that made it difficult for businesses to operate smoothly. GST was meant to unify the market under a single tax regime, similar to how the U.S. has a nationwide concept of sales tax but more standardized.

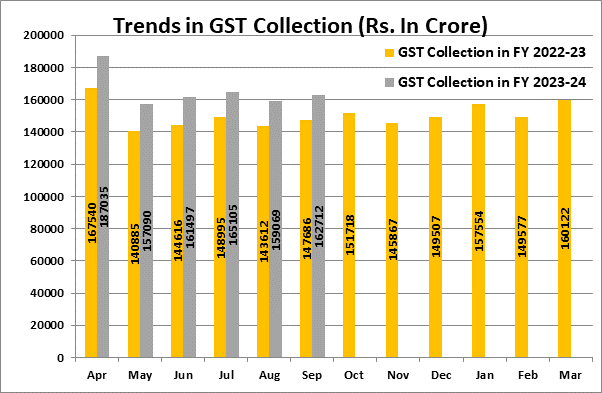

However, India’s GST system quickly grew complicated. With four main slabs (5%, 12%, 18%, and 28%), businesses and consumers often struggled to understand which products belonged where. Everyday goods could fall into different slabs based on small differences in packaging or branding, leading to disputes and confusion.

The new reform simplifies this mess by removing the 12% and 28% slabs altogether, leaving just 5% for essentials and 18% for most other goods and services.

Why the Timing Matters?

The timing of this tax cut is deliberate. October marks the start of India’s biggest shopping period, led by Diwali, which is often compared to Christmas and Black Friday in the U.S. Families purchase gold, electronics, clothes, and food in bulk during this period.

Lowering taxes right before this season means consumers will feel an immediate difference. For example:

- A juice box priced at ₹120 previously had a 12% GST, making it ₹134.40.

- With the new 5% slab, the same juice will cost ₹126.

It may not seem like much at first glance, but over a family’s monthly grocery bills, these savings add up significantly. Multiply that by hundreds of millions of households, and you get a surge in demand.

Global and Domestic Pressures

India’s economy has been growing rapidly, but it faces external challenges. New U.S. tariffs have hit Indian exports in sectors like textiles and metals. By focusing on domestic demand, the government hopes to insulate the economy from global shocks.

Domestically, high interest rates and inflation have pressured households. Tax relief, therefore, is a way to inject confidence back into the market. Economists argue that while the government will lose about ₹500 billion in tax revenue, the expected rise in consumer spending could more than make up for it by fueling broader growth.

Sector-Wise Impact of GST 2.0

Fast-Moving Consumer Goods (FMCG)

Products like snacks, packaged foods, juices, and butter moving into the 5% slab will directly benefit households. This is expected to raise sales volumes for companies like Nestlé India, ITC, and Hindustan Unilever.

Automobiles

Currently taxed at 28% plus an additional cess, automobiles could see relief if moved into the 18% slab. Lower taxes on cars and two-wheelers may encourage more middle-class families to make purchases. This is critical for the auto industry, which has faced a slowdown in recent years.

Housing and Real Estate

Materials like cement and paints, which often fall under higher slabs, moving into 18% will reduce construction costs. That could make housing projects more affordable, providing a boost to real estate developers.

E-Commerce

Online platforms like Amazon India and Flipkart stand to benefit as cheaper goods drive more online orders. Combined with festive discounts, tax savings will encourage consumers to shop more online.

Comparison with U.S. Tax Systems

For American readers, here’s how India’s system compares:

- U.S. sales tax rates vary by state, averaging between 6% and 10%.

- India’s old system taxed some goods at a whopping 28%, far above U.S. levels.

- The new simplified structure (5% and 18%) makes India’s tax rates more globally competitive, especially for everyday products.

This comparison shows why multinational companies operating in India see this as a positive reform. It makes pricing more predictable and compliance less burdensome.

Expert Opinions

Economists, trade associations, and business leaders have weighed in:

- Arvind Subramanian, Economist: “Simplifying GST will unlock ease of business, reduce compliance costs, and give India’s consumption-driven growth a big leg up.”

- Confederation of Indian Industry (CII): “This is the reform we’ve been waiting for. MSMEs will breathe easier with a simpler tax code.”

- Opposition Parties: Some argue the move is politically timed to curry favor before elections and warn of risks to government revenues.

Risks and Criticisms

Despite the optimism, there are challenges.

- Revenue Shortfall: Cutting taxes means less immediate revenue for the government. If spending does not rise as expected, deficits may grow.

- Implementation Issues: States, which share GST revenues with the central government, may resist changes if they feel shortchanged.

- Inflation Risks: While the reform lowers prices initially, higher demand during the festive season could trigger inflationary pressures.

Practical Advice As India Set to Announce Big Consumption Tax Cuts

For Indian Consumers:

- Delay large purchases like cars and appliances until after the tax cuts roll out.

- Expect lower grocery bills by October, especially on packaged foods and essentials.

For Small Businesses:

- Simplify compliance—recheck how your products are categorized under the new slabs.

- Pass tax savings to customers to increase loyalty and sales.

For Global Companies:

- Monitor India’s consumption trends closely—higher demand could benefit U.S. exporters in electronics, fashion, and food sectors.

- Stay updated through the GST Council’s official website.

Long-Term Outlook

The October reforms may just be the beginning. Policymakers have long debated moving toward a single GST rate, possibly between 12% and 15%. That would make India’s tax system one of the simplest in the world.

For now, GST 2.0 is a step toward greater transparency, reduced corruption, and stronger business confidence. If successful, it could encourage other emerging economies to pursue similar tax simplifications.

India’s Tax Reform Needs Economics, Not Politics — The Hard Truth

How India’s Broken Tax System Is Crippling the Circular Economy Revolution

India May Remove 12 Percent GST Slab And Cut Taxes On Essentials