India to Simplify Its Mammoth Income Tax Act: If you’ve ever thought filing your taxes in the U.S. was confusing, imagine flipping through an 800-page manual packed with dense legal jargon before you even open TurboTax. That’s been the reality for millions of Indians under the Income-Tax Act of 1961. But here’s the big shake-up: India is scrapping that old playbook and replacing it with a brand-new Income-tax Act in just six months. The Income-tax Act, 2025, officially approved in August 2025, promises to streamline compliance, reduce disputes, and bring the system firmly into the digital age. Beginning April 1, 2026, every Indian taxpayer — from salaried professionals to corporations — will file under this modern law. Think of it like replacing a clunky Windows 95 PC with a sleek cloud-based system overnight.

India to Simplify Its Mammoth Income Tax Act

India’s bold decision to simplify its mammoth Income-Tax Act in just six months is more than a domestic reform — it’s a global statement. By cutting clutter from 800+ sections to 536, embracing digital-first filing, and keeping middle-class relief intact, India has made taxation fairer, clearer, and future-ready. For taxpayers, this means fewer headaches. For businesses, it means predictability. For the world, it’s proof that even a massive democracy can streamline complex systems when there’s political will.

| Feature | Details |

|---|---|

| Old Law | Income-Tax Act, 1961 |

| New Law | Income-tax Act, 2025 |

| Time Taken | 6 months (July 2024 – Aug 2025) |

| Sections | Reduced from 800+ to 536 |

| New Concept | “Tax Year” replaces “Assessment Year” & “Previous Year” |

| Tax Exemption | ₹12 lakh (~$14,400) continues |

| Digital Filing | Faceless, online tax assessments |

| Effective Date | April 1, 2026 |

| Official Source | Government of India – Ministry of Finance |

A Quick History: How India’s Tax Code Got So Complicated

India’s Income-Tax Act of 1961 was introduced as a relatively lean framework. But as decades rolled on, governments kept bolting on amendments, exceptions, and provisos. Each budget session added new rules, tax incentives, and conditions.

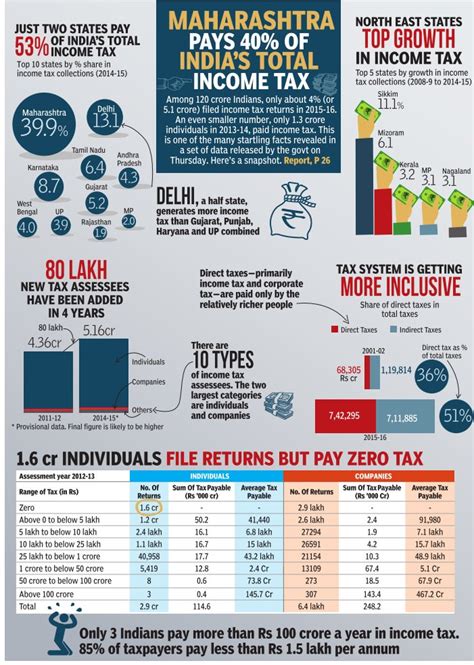

By the 2000s, the law was a patchwork quilt — hard to interpret even for professionals. Taxpayers needed consultants just to figure out if they were compliant. At the same time, aggressive tax collection led to hundreds of thousands of disputes, many stretching on for years.

For perspective: by March 2024, unresolved disputes totaled ₹13.4 trillion (about $160 billion). That’s nearly the size of the GDP of a mid-sized country, just locked in litigation. Compare that to the U.S., where the IRS backlog was estimated at 3.6 million cases in 2022 — still huge, but on a smaller scale given the economy’s size.

Why India to Simplify Its Mammoth Income Tax Act?

Several factors pushed reform over the finish line:

- Ease of Doing Business – Foreign investors flagged tax complexity as one of the biggest hurdles. Simplifying the law helps India compete globally.

- Middle-Class Pressure – Millions of households wanted clarity, not a guessing game.

- Digital India Push – As the country digitizes payments and business records, tax law needed to catch up.

- Political Will – Finance Minister Nirmala Sitharaman made simplification a core agenda item in the 2024 Budget.

What’s New in the Income-tax Act, 2025?

A Cleaner, Leaner Law

The new Act has 536 sections, down from more than 800. It uses tables, direct language, and fewer cross-references. Instead of explaining things three times, each rule is placed once and explained clearly.

One Simple Concept: “Tax Year”

Gone are terms like Assessment Year and Previous Year, which confused even professionals. Now there’s just Tax Year, which lines up more closely with how the U.S. and OECD countries describe taxation.

Digital-First Filing

India is moving to faceless, online tax assessments. This means most interactions will be electronic, reducing opportunities for corruption and harassment. The IRS has pushed online filing for years; India is essentially mandating it from the start.

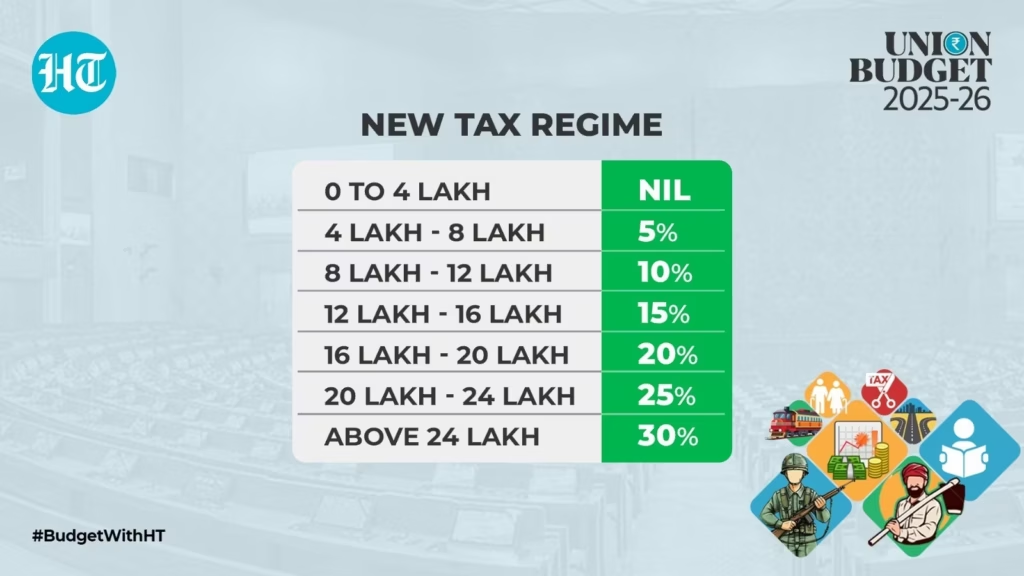

Relief for the Middle Class

The widely used ₹12 lakh exemption (roughly $14,400 annually) continues. That’s a strong reassurance for the salaried class, especially in urban India.

Closing Loopholes

- Crypto & Virtual Assets: Digital assets must be declared, or they’ll count as undisclosed income.

- Donations: Anonymous donations to certain trusts are now restricted, improving transparency.

Comparison: India vs. U.S. Tax Code

| Feature | India (2025 Act) | U.S. (Internal Revenue Code) |

|---|---|---|

| Pages | 622 pages | 6,500+ pages |

| Tax Year Concept | Yes (newly introduced) | Yes (standard) |

| Digital Filing | Mandatory faceless assessments | Optional but widely adopted |

| Standard Exemption | ₹12 lakh (~$14,400) | $14,600 (single filer, 2024) |

| Crypto Rules | Explicit inclusion | Taxed as property (IRS) |

This shows India leapfrogging into a leaner, more digital-friendly system, while the U.S. tax code remains bulky and complex.

Impact on Small Businesses and Startups

For small shops, freelancers, and startups, complexity meant extra costs. Many had to hire tax consultants just to stay compliant. With fewer sections and online filing, compliance time and costs will drop.

Startups in particular benefit because audits and disputes — which often lasted years — can now be resolved faster under clearer rules. India’s booming tech sector, from Bengaluru to Hyderabad, stands to gain significantly.

Global Significance

India is the fifth-largest economy. A smoother tax system means:

- More foreign investment – U.S. companies like Apple, Amazon, and Tesla can operate with fewer compliance risks.

- Boost for trade – Multinational firms see predictability in India’s taxation, reducing fear of arbitrary claims.

- Model for reforms – Countries in Asia and Africa with complex codes may see India as a template for modernization.

Lessons for Other Countries

India’s move to simplify its mammoth Income-Tax Act in just six months isn’t just about easing paperwork at home; it’s a case study for other nations grappling with outdated codes. Countries like Brazil and the Philippines, known for their complex tax systems, face similar hurdles with overlapping rules and high litigation. Even in the U.S., where the Internal Revenue Code stretches beyond 6,500 pages, debates around simplification resurface every election cycle. What makes India’s reform stand out is the speed and decisiveness: identifying complexity as a barrier, setting a six-month deadline, and delivering a law ready to implement. The lesson is clear — simplification is not only possible but also essential for promoting economic growth, encouraging compliance, and restoring trust between citizens and the state. If India can tackle decades of complexity in record time, other democracies may take note.

Step-by-Step Guide for Taxpayers

- Understand the “Tax Year” – Replace old terms in your vocabulary.

- Register Online – Use the Income Tax e-filing portal.

- Check Your Eligibility – Confirm if you qualify for the ₹12 lakh exemption.

- Declare Digital Assets – Don’t hide crypto or NFTs; the law explicitly covers them now.

- Seek Guidance Early – The first year may bring transitional confusion, so consider consulting a professional.

Risks and Challenges

- Implementation Hiccups – India is digitizing fast, but rolling out a new system nationwide could face bugs.

- Education Gap – Millions of taxpayers and small accountants must adapt to the new system.

- Old Disputes – The ₹13.4 trillion backlog under the 1961 Act remains and may take years to clear.

Expert Commentary

According to Dr. Arvind Subramanian, former Chief Economic Adviser:

“Tax complexity has been one of the single biggest drags on doing business in India. This reform is a monumental step toward a predictable, investment-friendly climate.”

Tax lawyer Anuradha Bhatia noted:

“By removing redundant sections and adopting digital processes, the new Act balances taxpayer relief with government transparency. This could cut litigation drastically.”

Government Notifies Income Tax Act 2025 Effective April 1

Income Tax Act 2025 Set To Replace 60-Year-Old Law From April