Indian Woman Quits UK After 10 Years: If you’ve been scrolling through global news recently, you might have seen the headline: “Indian Woman Quits UK After 10 Years, Calls Taxes ‘Insane’ and Costs Unbearable.” The story struck a nerve worldwide because it taps into something millions of immigrants, expats, and even Americans are grappling with: the balance between opportunity, taxation, and the rising cost of living in big cities. The woman at the center of this storm is Pallavi Chhibber, an Indian-born entrepreneur and blogger who lived in London for nearly a decade. In August 2025, she posted an Instagram video announcing she and her husband were leaving the UK. Her reasoning was blunt: the country had become too expensive, the taxes were “insane,” and she no longer saw long-term growth for herself or her family.

Indian Woman Quits UK After 10 Years

The story of an Indian woman leaving the UK after 10 years due to insane taxes and unbearable costs is much bigger than one headline. It reflects a universal struggle: balancing dreams of living abroad with the harsh realities of survival in high-cost, high-tax environments. For professionals everywhere, from London to Los Angeles, the same question applies: Am I thriving, or just surviving? The answer may require tough choices—but those choices can open the door to new opportunities, better financial health, and a more fulfilling future.

| Point | Details | Source |

|---|---|---|

| Who | Pallavi Chhibber, Indian entrepreneur & blogger | Hindustan Times |

| Reason for Leaving | High taxes (~50% total), unbearable living costs, limited opportunities | HT |

| Cost Example | Dinner at Dishoom restaurant: | HT |

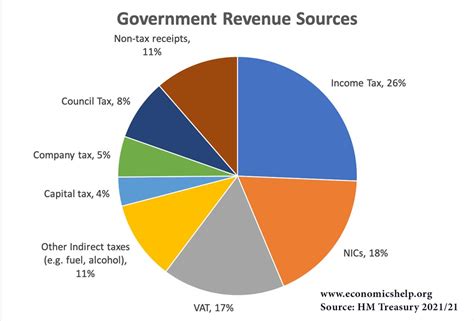

| UK Taxes | Income tax up to 45% + National Insurance; VAT 20% | UK Gov |

| UK Inflation (2025) | 6.2% annual average | ONS UK |

| Housing Costs | London rent for 1-BR averages $2,900/month | Numbeo |

| Announcement Date | August 29, 2025 | HT |

Why This Story Matters?

This isn’t just a personal decision by one family. It’s part of a larger conversation about whether living abroad in high-cost countries like the UK or the U.S. still makes sense for professionals.

For years, people from India, Asia, and even within the U.S. have dreamed of moving to global cities like London, New York, or San Francisco for better jobs and higher paychecks. But the reality has shifted. Many people now feel they’re working to survive, not to grow.

Pallavi’s viral comments highlighted that sentiment. She called London “obnoxiously expensive” and said nearly half of her salary was eaten up by taxes. That’s a tough pill to swallow for anyone who moved across the world chasing the idea of prosperity.

Historical Context: Why People Moved to the UK

For decades, the United Kingdom was one of the most attractive destinations for immigrants.

- In the 1990s and 2000s, the UK actively invited skilled workers, especially in healthcare, finance, and IT.

- London grew into a multicultural hub with immigrants making up nearly 37% of its population by 2020.

- For Indian professionals, the UK offered high salaries, world-class education for children, and a gateway to Europe.

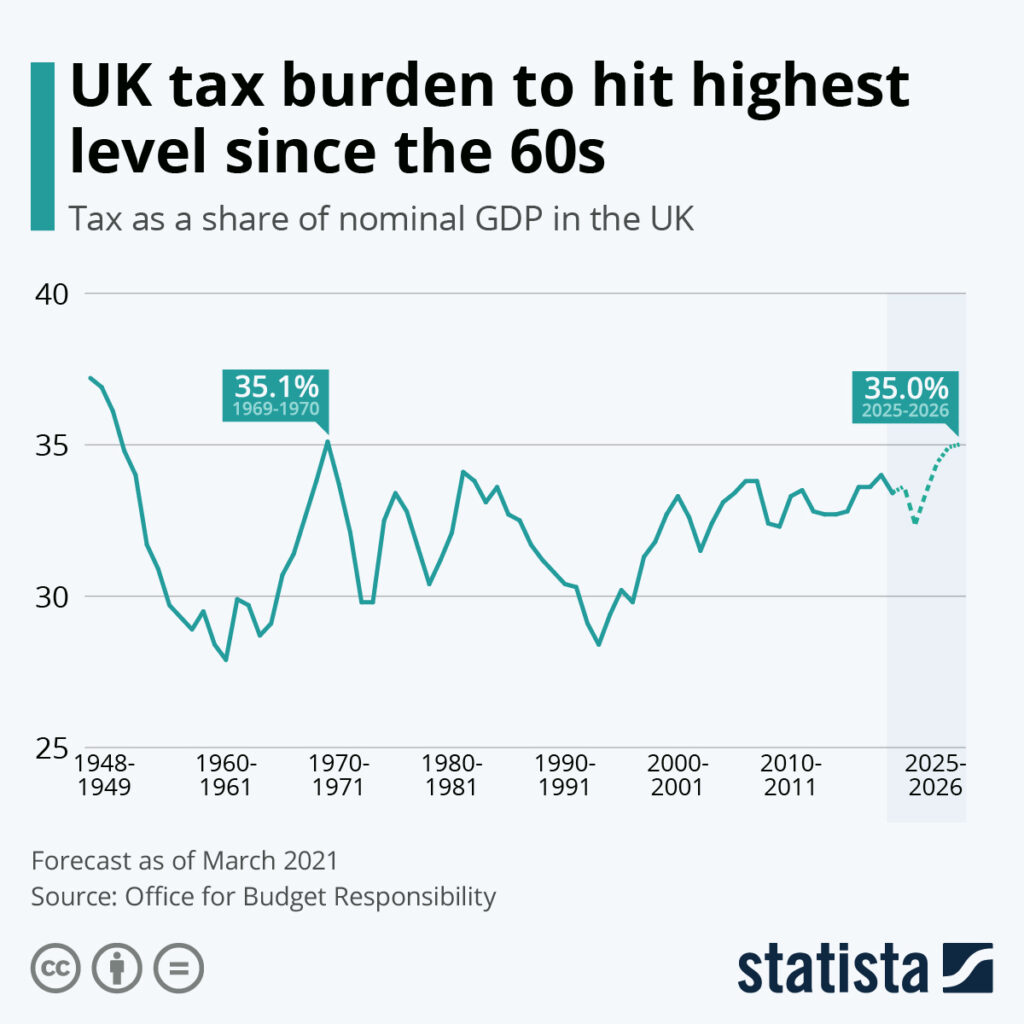

But over the past 10–15 years, things have changed. Inflation, housing shortages, and rising taxation have made life much harder. According to the UK’s Office for National Statistics, average wages haven’t kept pace with inflation since 2021. Housing prices in London jumped nearly 70% in the last decade, while rents soared far beyond what middle-class families can comfortably pay.

Indian Woman Quits UK After 10 Years: Breaking Down the Numbers

UK vs. USA Taxes

- United Kingdom

- Income tax: 20–45% depending on salary

- National Insurance: ~12%

- Value-Added Tax (VAT): 20% on most goods and services

- Net effect: Many middle-income households lose 40–50% of their pay to taxes and deductions

- United States

- Federal tax: 10–37% depending on income bracket

- State tax: 0–13% (varies by state)

- Payroll taxes: 7.65%

- Sales tax: 0–10% depending on state

While the U.S. can also feel expensive, the tax system allows more flexibility, especially in no-tax states like Texas or Florida. For immigrants in the UK, the lack of that flexibility makes the burden heavier.

Housing & Cost of Living

According to Numbeo, London ranks as one of the most expensive cities in the world:

- Rent for a one-bedroom apartment in central London averages $2,900 per month.

- A simple meal for two at a mid-range restaurant runs about $100.

- A monthly public transport pass is $190.

Compare this to:

- New York City: Rent for a similar apartment is $3,500, dinner for two $120, subway pass $132.

- Austin, Texas: Rent $2,100, dinner for two $70, but commuting costs can add $250 a month.

Clearly, London is right up there with America’s priciest cities.

Emotional & Professional Toll

Beyond money, there’s an emotional side. Pallavi mentioned that London no longer offered real career growth. It had become a city of survival, not opportunity.

This feeling is echoed by others. A Filipino nurse told the BBC that while she earned more in the UK than back home, after rent and taxes she could barely save enough to send money to her family. An American tech worker shared that even with a six-figure salary in London, savings were “near impossible.”

For families raising children, the pressure is even greater. Schooling, extracurriculars, and future job opportunities weigh heavily. For Pallavi, these factors played a huge role in her decision to move.

Practical Guide: Deciding Whether to Stay or Leave

If you’re an immigrant in the UK, U.S., or any expensive country, the same dilemma might be on your mind. Here’s how to think it through.

Step 1: Audit Your Finances

Calculate your real take-home pay after taxes, rent, food, and other bills. Many people don’t realize until they put it on paper that they’re effectively living paycheck to paycheck.

Step 2: Compare Alternatives

Look at other destinations:

- UAE: No income tax, booming expat community.

- Singapore: Top salaries, capped tax rate of ~22%.

- Portugal: Attractive residency programs and lower cost of living.

- India: Rapidly growing economy, especially in tech and startups.

Step 3: Focus on Growth, Not Just Survival

Ask yourself if your job or location offers upward mobility. If not, maybe it’s time for a change.

Step 4: Factor in Family & Kids

Think long term. Are your children going to have better opportunities abroad or back home?

Step 5: Always Have a Plan B

Before making big moves, line up another job or ensure you have sufficient savings.

Policy Perspective: What Governments Are Doing

The UK government has made small attempts to help, such as tax reliefs for startups and small businesses. But the average worker hasn’t seen meaningful relief.

The U.S. government has offered tax credits and partial student loan forgiveness, but housing affordability remains a massive crisis. Canada, while aggressively inviting immigrants, is also facing criticism for sky-high housing prices in Toronto and Vancouver.

The reality is: governments are struggling to balance economic growth with affordability. That leaves individuals to make their own tough choices.

Career Advice: How to Thrive Despite High Costs

For professionals still committed to staying in high-tax countries, there are strategies to thrive:

- Maximize tax deductions and use retirement accounts effectively.

- Consider moving within the country — from high-tax states like California to tax-free states like Texas.

- Develop side hustles or freelance work that can bring in additional untaxed or lower-tax income.

- Explore remote jobs that pay in USD or GBP but allow you to live in lower-cost countries part-time.

Father Wins Rs 4 Lakh Income Tax Case on Son’s Marriage Gift — Section 69A Explained

Zerodha Second Demat Account – How It Helps With Tax Saving

New £40,000 Pension Rule Could Hit Every UK Household; Here’s What You Need to Know