India’s Aggressive Investment Reforms: If you’ve been following global economic trends, you’ve probably seen India in the headlines more than usual. And it’s not just about cricket, Bollywood, or spicy food — it’s about serious business reforms that could reshape the country’s place in the global economy. The government is making some bold moves — slashing GST complexity, supercharging its Production-Linked Incentive (PLI) scheme, and pushing for a simpler, cleaner regulatory framework. These aren’t just policy tweaks; they’re part of a bigger play to make India a manufacturing powerhouse and investment magnet. If you’re an investor, entrepreneur, or simply someone who’s curious about how emerging markets change the global game, this story is worth your time. Let’s break it down in plain English, peppered with real-world examples and enough data to keep the pros happy.

India’s Aggressive Investment Reforms

India’s latest reforms are more than just policy updates — they’re a deliberate strategy to make the country a central player in the global economy. GST relief cuts red tape, PLI tweaks target high-growth industries, and land reforms promise faster, cleaner setups for manufacturing. If these reforms are implemented consistently and backed by efficient execution, India could see a decade of strong growth, creating opportunities for businesses of all sizes — from local startups to multinational giants.

| Topic | Key Points & Data | Source/Reference |

|---|---|---|

| GST Relief | Reduced slabs from 5 to 3, faster refunds, simplified compliance; real-time PAN verification for high-value transactions | Official GST Portal |

| PLI Scheme Tweaks | $2.7B boost to electronics manufacturing; potential $7B investments; ~91,000 new jobs expected | Gov. of India PLI Scheme |

| Simpler Future | Land reform proposals, uniform stamp duty, digitization, and reduced compliance burden for MSMEs | CII India |

| Economic Impact | Manufacturing share target: from ~15.4% GDP to 25%; stronger investor confidence | Economic Times |

From Patchwork Taxes to a Unified System: How We Got Here

Before the Goods and Services Tax (GST) was introduced in 2017, India’s tax system was a maze. Businesses had to navigate a mix of federal excise duties, state VAT, entry taxes, and service taxes. Shipping goods across state borders often meant delays, paperwork, and sometimes literal roadblocks.

The idea behind GST was to create a “One Nation, One Tax” system — much like a nationwide sales tax — to simplify trade and reduce compliance headaches. But over time, the system became complicated again with five different tax slabs, long refund cycles, and overlapping compliance rules.

The new round of GST reforms in 2025 aims to fix that — by reducing slabs, digitizing verification, and linking business records so fraud is harder and compliance is smoother.

GST Relief: Why Businesses Are Finally Smiling

The 2025 GST reforms bring some major wins for businesses:

- Three tax slabs instead of five — less confusion for pricing and billing.

- Real-time PAN verification for large transactions (₹2 lakh or more), cutting fraud and speeding up trust in the system.

- Linked systems between GST numbers, bank accounts, and business IDs, so verification is automatic.

- Faster refunds — in some cases, down from 90 days to 30 days.

Small and medium enterprises (SMEs) stand to benefit the most. For example, a small textile exporter in Jaipur can now process refunds in weeks, freeing up working capital and allowing them to take on larger orders.

The PLI Scheme: India’s Big Carrot for Manufacturers

If GST reform is about making the playing field smoother, the Production-Linked Incentive (PLI) scheme is about rewarding players who perform.

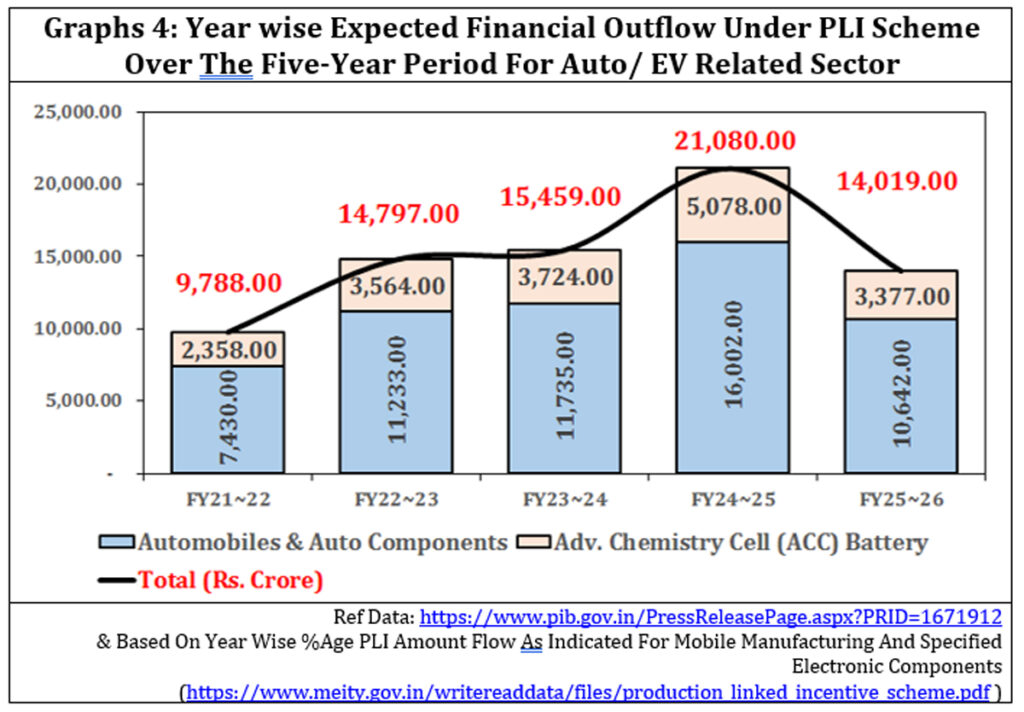

Launched in 2020, PLI offers direct financial incentives to companies that manufacture in India and meet certain production and sales targets. It’s a performance bonus from the government, and in 2025, it’s getting even more focused.

What’s new in 2025:

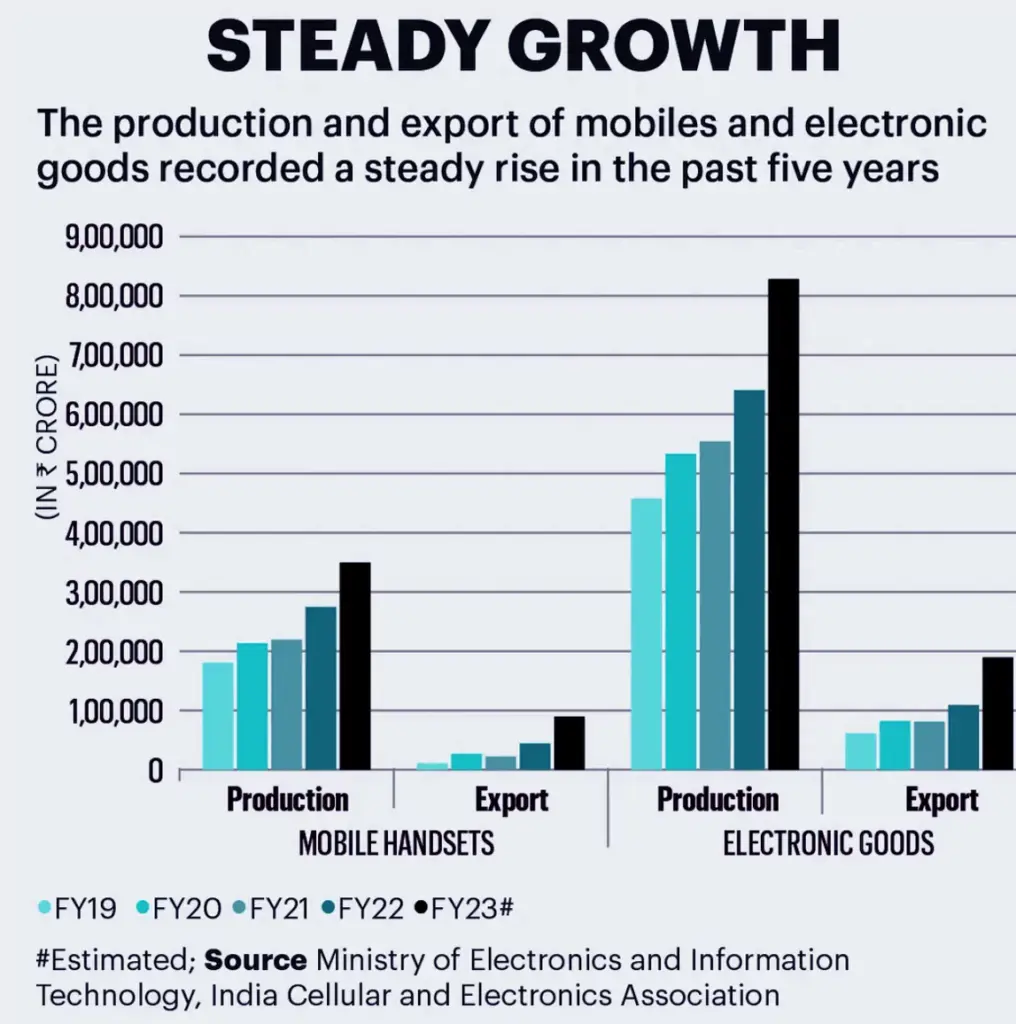

- $2.7 billion boost to electronics — from display panels to EV batteries.

- Expected to attract $7 billion in private investment and create ~91,000 jobs over the next five years.

- Priority given to global supply chain industries like semiconductors, smartphones, and electric vehicles.

One major beneficiary has been Apple’s contract manufacturing partners. In 2024–25, iPhone production in India jumped 162%, much of it tied to PLI incentives and global “China-plus-one” strategies.

Global Comparison: Where India Fits

| Country | Incentive Model | Avg. Corporate Tax Rate | Notable Advantage |

|---|---|---|---|

| India | PLI, GST reforms, land digitization | 22% | Large domestic market + skilled workforce |

| Vietnam | Tax holidays, export incentives | 20% | Proximity to East Asia manufacturing hubs |

| Mexico | USMCA trade benefits | 30% | Access to U.S. market without tariffs |

| China | Subsidies, special economic zones | 25% | Massive supply chain infrastructure |

India’s unique selling point? It combines scale (1.4 billion people), skills (a strong engineering base), and stability (democratic governance) — plus these reforms.

Land and Regulatory Simplification: The Next Frontier

Taxes and incentives are important, but setting up a physical facility still means dealing with land acquisition, zoning, and local approvals — which can be slow and unpredictable.

The Confederation of Indian Industry (CII) has pitched reforms that could be as game-changing as GST:

- A GST-like land council to standardize rules across states.

- Uniform stamp duty rates nationwide.

- Fully digitized land records to cut down on disputes and corruption.

For investors planning billion-dollar manufacturing hubs, faster land deals can mean the difference between green-lighting a project or walking away.

Real-World Examples of Reform Impact

Domestic success story: A Pune-based EV battery manufacturer tapped into the PLI program, secured funding for expansion, and is now supplying to multiple global automakers. Their revenue doubled in two years, and they expanded their workforce by 40%.

Foreign investment example: A U.S.-based semiconductor equipment company set up a plant in Tamil Nadu in 2024. Thanks to faster GST refunds and land digitization in the state, they reduced project setup time by nearly 40% compared to earlier operations in Southeast Asia.

Sector-by-Sector Impact of India’s Aggressive Investment Reforms

- Electronics: Smartphones, displays, and EV batteries lead the way in PLI benefits.

- Pharma: Expect new PLI phases targeting bulk drug manufacturing to reduce import dependence.

- Textiles: GST simplification could make Indian apparel more competitive in global markets.

- Renewable Energy: Land reforms could accelerate solar and wind projects by cutting acquisition delays.

The Challenges That Remain

No reform is perfect, and India’s transformation has its speed bumps:

- Bureaucratic inertia: While rules are simpler, actual processes on the ground can still lag.

- Uneven state adoption: Some states embrace reforms faster than others, leading to an uneven investment climate.

- Global competition: Vietnam, Indonesia, and Mexico remain aggressive with their own incentives.

Future Outlook: Vision 2047 and the Growth Path

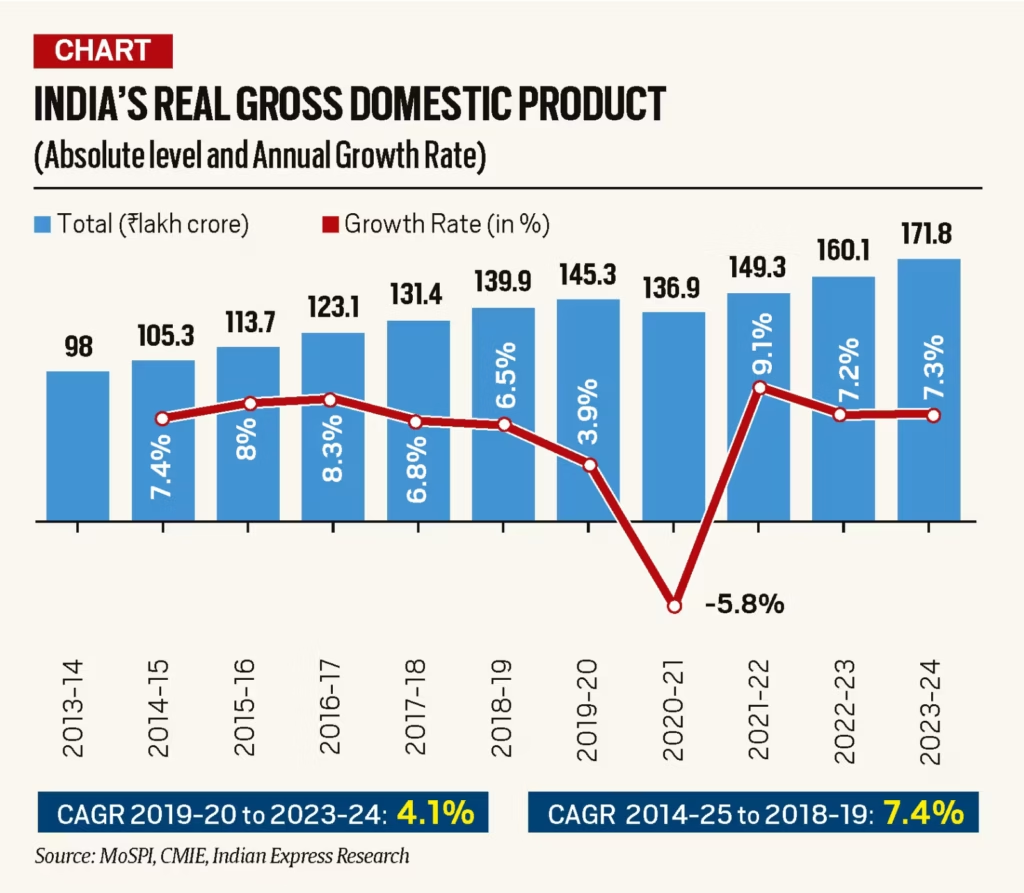

India has set its sights on becoming a developed nation by 2047 — the 100th year of its independence. That includes raising manufacturing’s share of GDP from ~15.4% to 25%, improving infrastructure, and attracting more foreign direct investment (FDI).

According to the IMF, India is projected to grow at 6–6.5% annually through 2026, with manufacturing and exports driving much of the momentum. The Reserve Bank of India is also pushing for digitalization of compliance systems to further cut delays.

Practical Advice for Stakeholders

For Global Businesses

- Partner with Indian suppliers benefiting from GST and PLI.

- Explore electronics and EV components as India builds global supply chains.

For Indian MSMEs

- Use GST simplification to clean up compliance and focus on scaling.

- Seek partnerships with PLI beneficiaries to enter high-growth sectors.

For Investors

- Track which states implement land reforms first — these could become manufacturing hotspots.

- Diversify into sectors that will gain indirectly, like logistics and packaging.

Tusharkanti Satapathy Joins GST Appellate Tribunal as New Member

Gold and Silver Traders Demand GST Reduction to 1% on Gold Jewellery

Vodafone Idea Faces ₹21.39 Crore GST Penalty for Alleged Short Payment Under RCM!