India’s New Tax Law Now Targets Your Cloud Data: When we talk about taxes, most folks in the U.S. think about filing their 1040s, scrambling for W-2s, or firing up TurboTax. But halfway across the world, India has rolled out a new tax law that targets cloud data — and it’s shaking up the way individuals and businesses think about digital compliance. That’s right: your files on Google Drive, AWS, iCloud, or even old Yahoo accounts you never log into could now fall under India’s tax radar if they’re tied to undeclared income. Starting April 1, 2026, this will become law under the Income-tax Act, 2025. And this isn’t just an obscure piece of legislation. It could affect multinational corporations, startups, expats, and even freelancers with Indian clients. Let’s break it all down in plain English, with examples, stats, and some straight talk about what this law really means.

India’s New Tax Law Now Targets Your Cloud Data

India’s Income-tax Act, 2025 is a landmark move into the digital era of taxation. By targeting cloud data, India is signaling that the age of hiding money in digital shadows is over. For professionals, startups, and corporations alike, the message is clear: get your digital house in order. Transparency and compliance aren’t just good practices — they’re now your best defense. As governments worldwide follow India’s lead, the line between digital privacy and tax enforcement will continue to blur. The smart move? Stay informed, stay organized, and stay compliant.

| Topic | Details |

|---|---|

| Law Introduced | Income-tax Act, 2025 (effective April 1, 2026) |

| What’s New? | Authorities can access “virtual digital space” (cloud, emails, servers) in tax probes |

| Target | Cloud data, emails, social media, and remote servers linked to “undisclosed income” |

| Safeguards | Must have legal authorization, proportionality, and reasonable belief |

| Data Protection | Must align with India’s DPDP Act, 2023, ensuring privacy safeguards |

| Judicial Backing | Based on Supreme Court’s Puttaswamy ruling on privacy |

| Cloud Tax Clarification | Standard cloud services not taxed as royalties or fees (Delhi High Court ruling) |

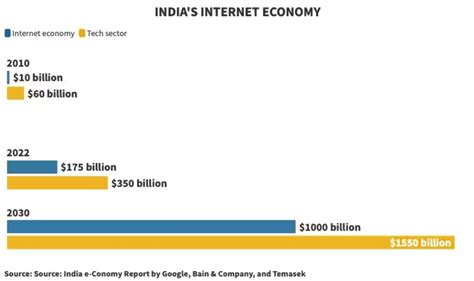

| Digital Economy Size | India’s digital economy projected to hit $1 trillion by 2030 |

| Official Resource | Government of India: Income Tax Department |

Why This Law Matters More Than Ever?

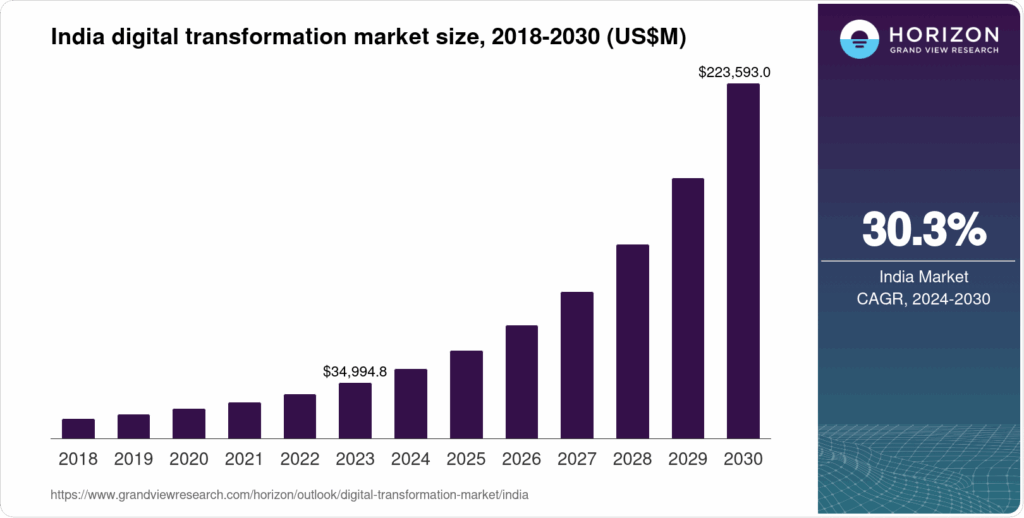

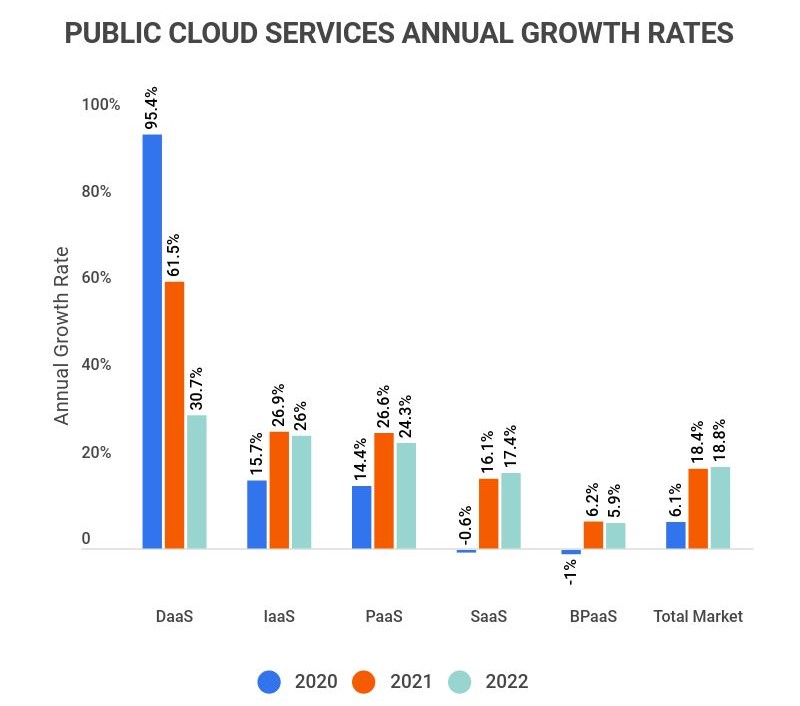

The digital economy is booming in India. According to NASSCOM, India’s digital economy is projected to hit $1 trillion by 2030, with cloud adoption growing at nearly 30% every year. Add to that India’s massive base of internet users — over 800 million people online — and you can see why tax authorities are chasing the money trail into digital spaces.

Until now, most tax investigations relied on physical records, banking transactions, or financial statements. But today, wealth can be hidden in crypto wallets, cloud servers, or online trading platforms. This law is India’s attempt to close that loophole.

Historical Context — India’s Tax Evolution

India’s tax system has always evolved to catch up with new business models.

- 2000s: Focus was on physical businesses and domestic tax reporting.

- 2016: India launched the Equalisation Levy, targeting digital advertising revenues from global tech giants like Google and Facebook.

- 2020: The scope expanded to e-commerce transactions, including online marketplaces.

- 2025: Now, the law explicitly moves into the virtual digital space, giving tax authorities the power to access cloud-stored information during probes.

This progression mirrors global trends. In the U.S., the IRS already requires disclosure of digital currency holdings. Europe, through the DAC7 directive, mandates reporting of income earned on online platforms. India is simply taking it one step further — making sure investigators can actually look inside digital accounts if needed.

How the India’s New Tax Law Now Targets Your Cloud Data Works in Practice?

Here’s the deal: the law isn’t giving tax officials free rein to snoop. Instead, it sets up a structured framework with checks and balances.

Legal Authorization

Officials must get clearance from a competent authority before accessing cloud accounts. This ensures accountability.

“Reason to Believe”

There must be evidence or suspicion that cloud-stored data contains proof of undisclosed income. Random fishing expeditions aren’t allowed.

Technical Overrides

Yes, authorities can override passwords, encryption, or access controls — but only after proper authorization.

Oversight and Review

A 31-member parliamentary committee is reviewing how the law will be enforced. This committee may recommend amendments to prevent misuse.

Pros and Cons of the New Law

| Pros | Cons |

|---|---|

| Closes loopholes in digital tax evasion | Raises privacy and surveillance concerns |

| Strengthens compliance in a trillion-dollar digital economy | Could be misused without strong oversight |

| Aligns with global tax enforcement trends | May intimidate startups and freelancers |

| Legal safeguards exist under India’s constitution | Practical implementation challenges (encryption, jurisdiction issues) |

Real-Life Scenarios

The Startup Founder

Imagine a U.S.-based startup founder outsourcing work to India. They store payroll spreadsheets and contracts on Dropbox. If Indian tax authorities suspect under-reporting of employee salaries in India, they could demand access to that Dropbox folder.

The Freelancer

An American designer gets paid by Indian firms and stores contracts on Google Drive. If payments don’t align with reported income, Indian investigators may request access to those files.

The Multinational Giant

Big tech firms like Amazon or Microsoft may not be taxed extra for providing cloud services, but their India-based clients’ records stored in the cloud could be accessed during audits.

Privacy and Constitutional Safeguards

Critics argue this law risks turning into a surveillance tool. After all, cloud accounts often hold deeply personal information.

India’s Digital Personal Data Protection (DPDP) Act, 2023 does provide privacy safeguards, but it explicitly allows data to be processed for legal obligations — which includes tax probes. The Supreme Court’s Puttaswamy ruling adds another layer, requiring any state intrusion to be fair, necessary, and proportionate.

In short: while the law is powerful, misuse can still be challenged in court.

Practical Steps for Compliance

So, what should you actually do if you’re a business owner, freelancer, or even an individual with ties to India? Here’s a checklist:

1. Keep Records Organized

Separate personal and professional cloud accounts. Store contracts, invoices, and payments in a clear, accessible manner.

2. Transparent Bookkeeping

Make sure your digital records match your reported tax filings. Don’t leave discrepancies that could raise red flags.

3. Stay Updated

Follow announcements from the Income Tax Department and industry bodies like NASSCOM.

4. Balance Security and Compliance

Use encryption and secure passwords, but don’t obstruct access during a legitimate investigation — that can land you in deeper trouble.

5. Consult Experts

Hire tax advisors who understand cross-border digital compliance. Especially if you’re based in the U.S. but earn from Indian clients, professional guidance is crucial.

International Implications

This law doesn’t just affect Indians. With U.S.-India trade valued at $191 billion in 2022, global companies will feel the ripple effects.

- Tech giants like AWS, Google, and Microsoft need clear policies for Indian clients’ compliance.

- Freelancers and small businesses abroad working with Indian firms must prepare for stricter scrutiny.

- Cross-border treaties may need adjustments to address digital access and jurisdictional boundaries.

It also sets a precedent for other countries. If India can do it, don’t be surprised if other nations roll out similar rules in the coming years.

Expert Take: The Bigger Picture

Tax experts see this as part of a global shift. Governments are waking up to the fact that digital wealth is real wealth. Whether it’s crypto, NFTs, or cloud-stored records, the ability to tax and audit digital holdings is now non-negotiable.

At the same time, businesses worry about data security. Could sensitive trade secrets be exposed during investigations? Will international data sharing agreements be strong enough to protect legitimate privacy concerns?

For now, the balance between tax enforcement and data protection remains delicate — and very much a work in progress.

India’s Tax Reform Needs Economics, Not Politics — The Hard Truth

India’s Oldest Citizens Now Contributing More To The Income Tax Kitty

India’s Tax Disputes Enter New Era as Govt Appoints Key Tribunal Members Nationwide