India’s Oldest Citizens Now Contributing More To The Income Tax Kitty: When we talk about income taxes in India, the usual suspects come to mind—young professionals, corporate executives, or business owners hustling in the country’s booming cities. But there’s a new and surprising group making headlines in the tax world: India’s oldest citizens, aged 70 and above, are now contributing more than ever to the nation’s income tax kitty. According to official data from the Income Tax Department of India, these senior citizens paid nearly ₹61,624 crore in taxes in FY 2023–24, accounting for around 5.9% of the nation’s total direct tax revenue.

Just four years ago, in FY 2019–20, that share was only 5.3%. In absolute terms, their contribution has more than doubled, rising from ₹25,970 crore to over ₹61,000 crore. That’s a massive 28% year-on-year jump. This is more than just a quirky statistic. It reflects larger shifts in India’s economy, society, and even demography. Seniors are not just living longer; they’re actively participating in the financial system, investing smarter, and, in turn, paying more taxes.

India’s Oldest Citizens Now Contributing More To The Income Tax Kitty

The fact that India’s oldest citizens are contributing more to the income tax kitty shows how far the nation has come in terms of longevity, financial literacy, and wealth creation. Seniors are no longer passive dependents—they’re active contributors with significant financial power. For individuals, the takeaway is to start planning early, diversify income, and use senior-friendly tax breaks. For policymakers, the challenge is ensuring tax fairness while recognizing that seniors are an increasingly vital part of India’s fiscal health.

| Metric | 2019–20 | 2023–24 / AY 2024–25 |

|---|---|---|

| Share of income tax by 70+ citizens | 5.3% (₹25,970 crore) | 5.9% (₹61,624 crore) |

| Total income tax collections | ₹9.47 lakh crore | ₹10.45 lakh crore |

| Growth in senior citizen contributions | — | 28% YoY increase |

| Main income sources | FD interest, pensions, rent | FD interest, rent, stocks, capital gains |

| Official Reference | Income Tax Department, Govt. of India |

The Evolution of Taxation for Seniors in India

Thirty years ago, the picture was very different. Senior citizens rarely appeared in tax records because:

- Shorter lifespans: Life expectancy was about 59 years for men and 60 for women in the 1990s. Many did not live long enough to spend decades in retirement.

- Wealth in physical assets: Gold, land, and informal savings dominated. These didn’t generate taxable annual income.

- Cumbersome compliance: Filing paper tax returns was complicated, discouraging many from declaring smaller incomes.

After the 1991 economic liberalization reforms, however, things changed. Indians in their 40s and 50s invested in property, stocks, and businesses. Fast forward three decades, those individuals are now in their 70s and reaping the rewards of compounding. With digital filing systems, stricter compliance, and tax deducted at source (TDS), they’re squarely part of the tax net.

Why India’s Oldest Citizens Now Contributing More To The Income Tax Kitty?

1. Longer Life Expectancy

India’s life expectancy has improved dramatically. By 2020, men were living to 68.6 years and women to 71.4 years. More seniors staying financially active means more tax returns filed each year.

2. Wealth Accumulated Over Decades

The generation that built wealth during liberalization is now cashing in. Properties bought for a few lakhs in the 1980s are today worth crores, and stock market investments from the 1990s have multiplied many times over. This creates taxable income from rent, dividends, and capital gains.

3. Stronger Compliance and Financial Awareness

Thanks to digital banking, mandatory TDS, and user-friendly filing systems, it’s difficult to bypass the tax system. Even conservative seniors who prefer fixed deposits find themselves paying taxes automatically on the interest earned.

How Do Seniors Earn (and Pay Taxes)?

While younger taxpayers mostly rely on salaries, seniors often have diverse income streams, such as:

- Pensions – Fully taxable as per income slabs.

- Fixed Deposits (FDs) – A popular safe choice, though taxed as regular income.

- Rental Income – Property investments made decades ago now yield significant rental earnings.

- Dividends and Stock Investments – Dividends above ₹10 lakh and short-term trading profits are taxable.

- Capital Gains – Selling real estate, mutual funds, or shares generates capital gains tax.

For example: Mr. Kumar, a retired government officer, earns ₹50,000 per month pension, ₹30,000 per month rental income, and interest on FDs worth ₹20 lakh. Even with exemptions, he falls into the taxable bracket, paying over ₹3 lakh annually in taxes. Multiply this across millions of such seniors, and the numbers become substantial.

Challenges Seniors Face in Taxation

Despite their growing contributions, seniors often struggle with:

- Digital Literacy – Not all seniors are comfortable using e-filing portals. Many depend on relatives or chartered accountants.

- Complex Rules – Different slab rates, exemptions, and capital gains rules can be confusing.

- Medical Costs – Rising healthcare expenses often clash with rising tax bills.

- Perception of Unfairness – Many seniors feel they’ve already contributed during their working lives and should not be burdened again.

Global Comparison

- United States: Retirees pay taxes on pensions, Social Security (in some cases), and retirement account withdrawals.

- United Kingdom: Income tax applies to pensions and other income sources, though seniors get a “personal allowance.”

- India: Seniors enjoy higher exemption limits—₹3 lakh for ages 60–79 and ₹5 lakh for those above 80. However, diversified income streams mean many still exceed those limits.

This puts India in line with global trends where retirees continue contributing significantly to government revenue.

Expert Insights

- Niyati Shah, 1 Finance: Seniors’ tax contributions will keep growing due to diversification and awareness.

- Shravan Shetty, Primus Partners: Warns that over-reliance on seniors could be risky if their tax contributions rise faster than younger populations.

Looking Ahead: The Future of Senior Taxation in India

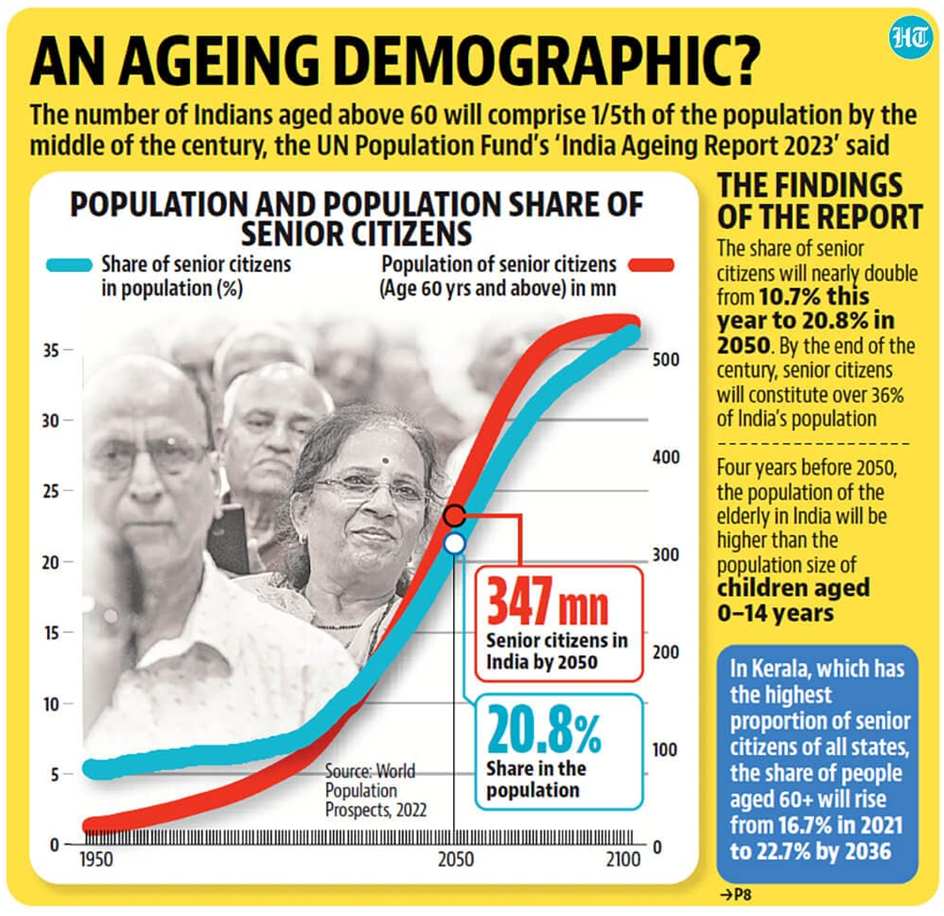

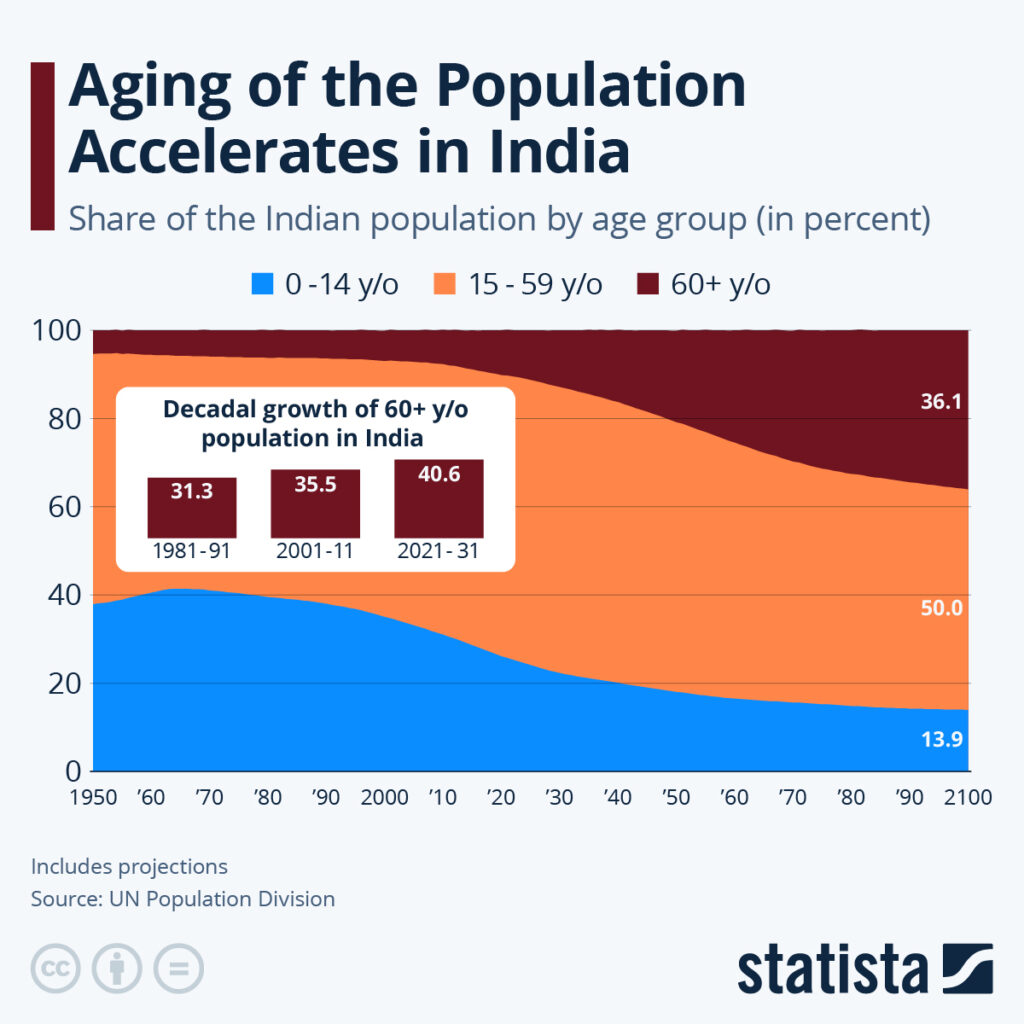

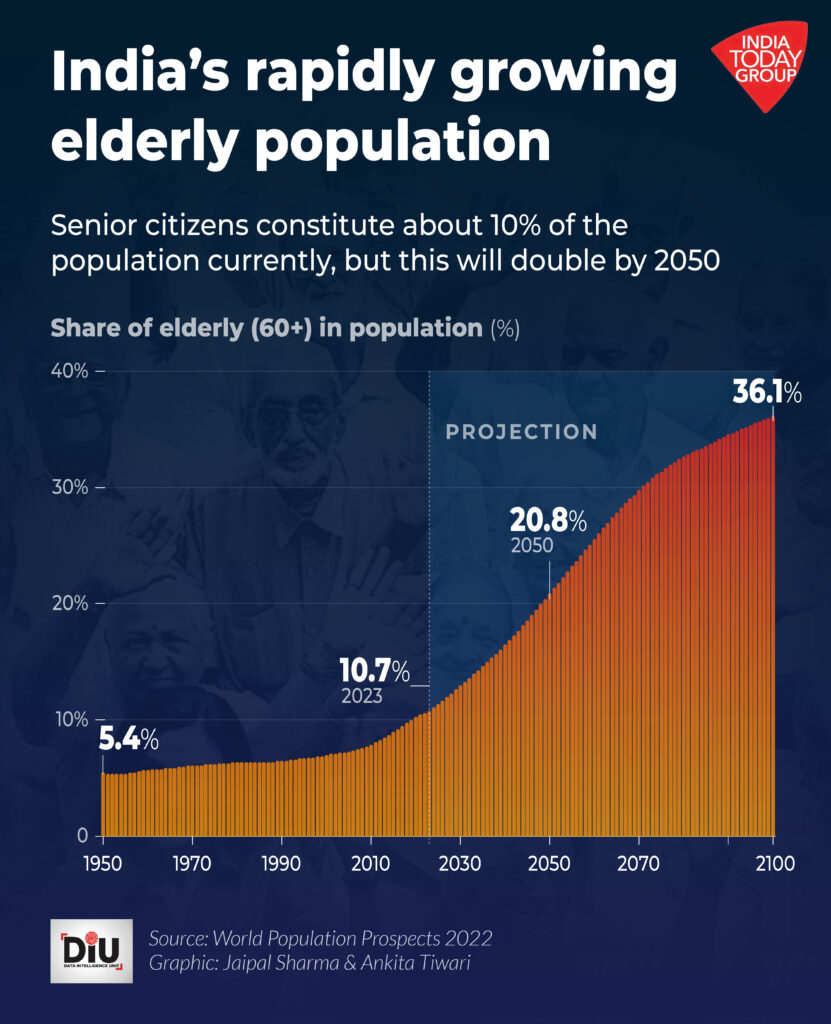

The United Nations estimates that by 2050, nearly 20% of India’s population will be above 60—over 300 million people. If today’s trends continue, seniors may contribute 10–12% of total tax revenues in the coming decades.

For policymakers, this creates important questions:

- Should tax burdens on seniors be lightened, considering medical and living costs?

- Or should governments lean on them more, given their asset ownership?

- How can policies ensure fairness across age groups?

Practical Guide for Seniors: Managing Taxes Stress-Free

Step 1: Know Your Exemptions

- 60–79 years: ₹3 lakh exemption

- 80+ years: ₹5 lakh exemption

Step 2: Use Senior-Friendly Schemes

- Senior Citizens’ Savings Scheme (SCSS) – Secure returns and tax benefits under Section 80C.

- Pradhan Mantri Vaya Vandana Yojana (PMVVY) – Pension scheme with guaranteed payouts.

- Tax-Free Bonds – Interest is exempt.

Step 3: Plan Capital Gains Smartly

- Use indexation for long-term assets.

- Time sales across financial years to reduce liability.

Step 4: Claim Health Benefits

Medical insurance premiums (Section 80D) and specific medical treatments (Section 80DDB) are deductible.

Step 5: Get Professional Help

Chartered accountants or financial advisors can optimize filings and reduce errors.

Actionable Checklist for Seniors

- File taxes online or with a CA before deadlines.

- Use tax-saving schemes under Section 80C.

- Diversify income—beyond FDs to mutual funds and REITs.

- Keep receipts for medical expenses.

- Stay updated through Income Tax India.

Income Tax Department Raids Over 10 Locations Across Tamil Nadu

Shree Cement Stock in Focus – Income Tax Order Rectification Sparks Market Buzz

Half-Yearly Income Tax Digest 2025: Key ITAT Decisions Every Taxpayer Should Know