India’s Tax Disputes Enter New Era: India has taken a major leap forward in reforming its indirect tax dispute resolution mechanism. The long-awaited Goods and Services Tax Appellate Tribunal (GSTAT) is finally coming to life with the appointment of judicial and technical members across the country. With over 15,000 GST appeal cases pending and businesses waiting years for refunds or judgments, this move is expected to drastically speed up justice delivery in tax disputes. The central government has set up a Principal Bench in New Delhi and approved 31 State Benches, aiming to provide quick, affordable, and specialized resolution of GST-related cases. Let’s break down what this means for taxpayers, businesses, and tax professionals — in plain English and in practical terms.

India’s Tax Disputes Enter New Era

The establishment of GSTAT is a watershed moment in India’s tax reform journey. For years, businesses, professionals, and taxpayers faced endless delays and unclear procedures when disputing GST issues. Now, with an expert-led, fully digital, and geographically distributed tribunal system, India is setting the stage for faster justice and improved compliance. The benefits of this move will be felt across every segment — from large multinational corporations to small traders and professionals. This is more than just a tribunal. It’s a commitment to tax justice, transparency, and the promise of better governance.

| Detail | Info |

|---|---|

| What Happened? | India appointed key members to GST Appellate Tribunal across all states |

| Principal Bench | Located in New Delhi with 3 members: 1 Judicial, 1 Technical (Centre), 1 Technical (State) |

| State Benches | 31 benches approved; 52 Judicial Members and 33 Technical Members appointed |

| Why It Matters | Over 15,000 pending GST cases to be heard and resolved |

| Salary for Members | ₹2,25,000 per month plus allowances |

| Tenure | 4 years or until age 67, whichever is earlier |

| Official Website | cbic.gov.in |

| Tribunal Rules Notified | GST Appellate Tribunal (Procedure) Rules, 2025 |

| Filing Mode | Mandatory online filing via GSTAT portal |

Why the GST Appellate Tribunal Was Needed?

When the Goods and Services Tax (GST) was introduced in 2017, it replaced a complex web of state and central taxes. However, one critical piece was missing from the original GST infrastructure — an appellate tribunal to hear and decide tax disputes.

For nearly eight years, taxpayers with grievances had to approach High Courts, which are already overwhelmed with thousands of cases. This not only delayed justice but also increased legal expenses and created uncertainty in business operations.

With the formation of GSTAT, India now has a specialized tax court system modeled on international best practices.

Understanding GSTAT: What Is It?

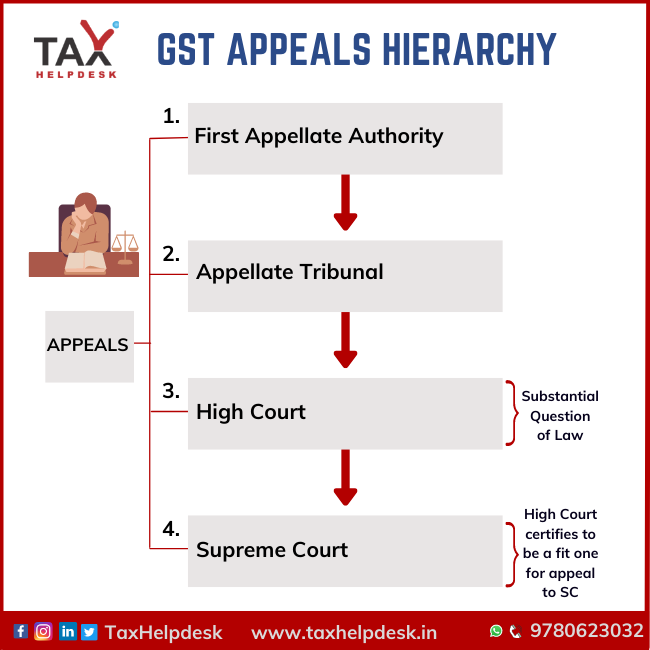

The Goods and Services Tax Appellate Tribunal (GSTAT) is a quasi-judicial body established under Section 109 of the CGST Act, 2017. Its primary purpose is to serve as the second-level appellate authority, hearing appeals against orders passed by the first appellate authority under the GST law.

Here’s what makes it significant:

- Dedicated platform solely for GST-related disputes

- Faster resolution compared to civil or high courts

- Expertise in indirect tax law

- Fully digitized filing and hearing process

Structure of the GST Appellate Tribunal

Principal Bench (New Delhi)

The Principal Bench of GSTAT will have:

- One Judicial Member: Justice (Retd.) Mayank Kumar Jain (ex-Allahabad High Court)

- One Technical Member (Centre): Anil Kumar Gupta (retired IRS)

- One Technical Member (State): A. Venu Prasad (retired IAS)

The Principal Bench will hear cases involving issues of national importance and those with jurisdiction across multiple states.

State Benches

The government has notified 31 State Benches, strategically placed across the country to ensure accessibility for taxpayers in all regions. These benches have:

- One Judicial Member

- One Technical Member (Centre or State, as per the case)

Appointments have been cleared by the Appointments Committee of the Cabinet (ACC), including 52 Judicial Members and 33 Technical Members.

How It Will Help Taxpayers and Businesses?

The tribunal is not just a legal setup. It’s a game-changer for businesses and professionals who’ve been trapped in red tape.

Key Benefits:

- Faster Case Resolution: Average time for GST appeal resolution in High Courts is 2–4 years. GSTAT aims to cut that down to 6–12 months.

- Digital Filing: E-filing via a centralized portal makes it accessible to all taxpayers, including those in Tier-2 and Tier-3 cities.

- Lower Legal Costs: Compared to High Court litigation, tribunal proceedings are faster, cheaper, and more streamlined.

- Specialized Expertise: Tribunal members are experts in tax law, ensuring fair and informed decisions.

For small and medium enterprises (SMEs), this is a major step toward ease of doing business.

India’s Tax Disputes Enter New Era: Step-by-Step Guide to Filing a GST Appeal

Filing a case with GSTAT is designed to be user-friendly and fully digital.

Step 1: Prepare the Appeal

Gather essential documents:

- Copy of the original order

- Grounds of appeal

- Details of tax, interest, penalty involved

- PAN, GSTIN, contact details

Step 2: Login to the GSTAT Portal

Access the portal (expected to go live in late 2025) via gst.gov.in and verify using DSC or Aadhaar OTP.

Step 3: Pay Appeal Fee

Fees depend on the disputed amount and must be paid via NEFT, UPI, or debit/credit card.

Step 4: Upload Documents

Upload all supporting documents in PDF format as per portal instructions.

Step 5: Attend Hearing

The tribunal allows hybrid-mode hearings — you can join online or appear physically. Decisions and orders will be delivered digitally.

Legal Framework: The GSTAT (Procedure) Rules, 2025

Notified on April 24, 2025, these rules lay the groundwork for how the tribunal functions. Key highlights include:

- Time limits for filing and disposing of appeals

- E-summons and notices

- Real-time case tracking

- Digital storage of rulings for legal referencing

These rules bring clarity, accountability, and modern infrastructure to India’s tax justice system.

Global Comparison: How India Matches Up

Many developed countries already operate similar tax tribunals:

- Canada: Tax Court of Canada for GST/HST appeals

- Australia: Administrative Appeals Tribunal (AAT)

- United Kingdom: First-tier Tribunal (Tax)

India’s move to establish GSTAT mirrors these systems and brings Indian tax litigation in line with global best practices.

Opportunities for Professionals

This reform opens career and consulting opportunities for:

- Chartered Accountants (CAs)

- Company Secretaries (CS)

- Tax Lawyers

- GST Practitioners

GSTAT will become a new litigation practice area, encouraging specialization in indirect tax law and dispute resolution. Law schools and commerce institutions are likely to integrate these rules into their curriculum.

Half-Yearly Income Tax Digest 2025: Key ITAT Decisions Every Taxpayer Should Know

Major Corporate Default: NCLT Admits Insolvency Petition Due to ₹98 Crore Loan Non-Payment

Massive ₹62 Crore GST Evasion Scam Uncovered in Ludhiana—Two Arrested in Major Tax Fraud Bust!

What to Expect Next?

The government has laid out an aggressive timeline for full tribunal rollout:

- August–September 2025: Training of tribunal staff, set up of regional offices

- September 2025: GSTAT Portal goes live

- October 2025 onwards: Hearings expected to commence across India

The Centre has also urged states to expedite infrastructure for physical benches and courtrooms. Meanwhile, the Ministry of Finance is working with the GST Council to ensure that pending legacy cases are prioritized for disposal.

Expert Opinions

Industry experts are welcoming the move:

“This is a landmark reform. A specialized body like GSTAT will reduce litigation load and speed up resolution,” says Rajesh Mehta, Partner, Indirect Tax, Deloitte India.

“Tax certainty is a big deal for foreign investors. This tribunal could improve India’s ease of doing business ranking,” notes Prerna Suri, former tax counsel at the World Bank.

Even the Parliamentary Standing Committee on Finance has applauded the tribunal formation as a long-overdue and much-needed institution.