India’s Tax Reform Needs Economics, Not Politics: When it comes to India’s tax reform, here’s the straight talk — the country’s big, bold attempt to overhaul its tax system and boost economic growth is still far from where it needs to be. And the main reason? There’s been too much political maneuvering and not enough economic problem-solving. This isn’t just a point you’d hear from an armchair critic. It’s echoed by economists, industry leaders, small business owners, and even international institutions. The Goods and Services Tax (GST), launched in July 2017, was supposed to be a landmark reform — a clean, unified way to tax goods and services across the entire nation. But for many, it’s felt like trading one complex system for another.

India’s Tax Reform Needs Economics, Not Politics

India’s tax reform journey is proof that economics should be in the driver’s seat, with politics as a passenger. GST was a bold, necessary step — but without simplification, automation, and expert-driven policy, it risks becoming a cautionary tale rather than a success story. The hard truth? If India wants to hit its ambitious growth targets, tax reform must focus on outcomes for real businesses and real people, not just political wins.

| Point | Details | Source |

|---|---|---|

| GST Launch | Introduced July 1, 2017, replacing multiple state & central taxes | GST Council Official Website |

| Core Challenge | Multiple tax slabs, high compliance load, political deadlock | Bloomberg Opinion, 2025 |

| Revenue Drop | 4% YoY decline in net direct tax collections (Apr–Aug 2025) | Reuters |

| Income Tax Overhaul | New draft Income Tax Bill 2025 to halve complexity | IndiaTimes |

| Ease of Doing Business Rank | India at 63rd globally (2020) | World Bank |

| Potential GDP Boost | Efficient GST could add 1–1.5% to GDP | IMF Report |

Why India’s Tax Reform Needs Economics, Not Politics Matters for Everyone — from Wall Street to Mumbai’s Markets

Taxes aren’t just some government paperwork problem. They directly shape:

- The price you pay for your groceries or your cup of coffee

- Whether your local store can survive in the long run

- How attractive a country looks to investors scouting for the next big growth market

When politics drives tax policy instead of economics, rules can change suddenly, filing requirements can become a burden, and investors — both local and foreign — lose confidence.

It’s like running a business where the rules of the game change in the middle of the season. You can’t plan, you can’t budget, and you certainly can’t grow without taking unnecessary risks.

GST: The Big Dream vs. The Reality Check

The Promise

When it was announced, GST was marketed as the ultimate “one nation, one tax” solution. The idea was simple in theory: scrap the jungle of state and central taxes and replace it with one streamlined system that would make trade easier, compliance simpler, and revenue collection more efficient.

Think of it like replacing a jumble of mismatched charging cables with one universal plug — less confusion, more convenience.

The Reality

On the ground, businesses face:

- Five tax slabs (0%, 5%, 12%, 18%, 28%) — each requiring its own classification rules and exceptions.

- Special exemptions that vary by state — making inter-state trade a nightmare for logistics and invoicing.

- Multiple returns every month — in some cases three per month, which drains time and resources.

Instead of being a single, predictable framework, GST has become something businesses must constantly monitor for updates and changes.

GST Timeline: 2017–2025

- 2017 – GST launches; initial rollout plagued by tech glitches and confusion.

- 2018 – Filing process is streamlined slightly, but businesses still face steep learning curves.

- 2019 – Some rate reductions implemented to spur consumption.

- 2020 – Pandemic prompts temporary relief measures, filing extensions, and deferred payments.

- 2021 – E-invoicing introduced for larger businesses, aiming to plug tax evasion but adding compliance load.

- 2022 – Discussions begin on rate rationalization, but political disagreements stall progress.

- 2023 – Proposal surfaces to cut slabs from five to three, but no consensus reached.

- 2025 – Home Minister Amit Shah takes over GST negotiations, signaling political prioritization over economic analysis.

How Politics Shapes the GST?

The GST Council — the body that sets rates and rules — is a mix of state finance ministers and the Union finance minister. While this structure ensures states have a voice, it also means decisions are subject to political bargaining.

For example:

- Cotton-producing states push for low GST on raw cotton to protect farmers.

- Textile-manufacturing states push for low GST on finished goods to help industries.

The result? Compromises that create complicated rate structures, with businesses caught in the middle. What should be a straightforward economic decision becomes a political chess match.

The Global Investor View

Institutions like the IMF and World Bank have praised India for attempting GST, but they’ve also warned that frequent changes, a confusing rate structure, and compliance uncertainty make it less effective than it could be.

Global investors value stability and clarity. Countries like Australia (with a flat 10% GST) and Singapore (with a single GST rate) offer predictability that makes investment decisions easier.

India’s GST, by contrast, often feels like it’s in “beta mode” — still being tested, still being tweaked, and still unpredictable.

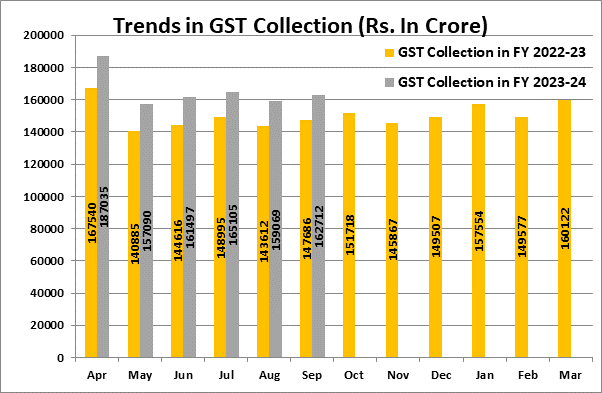

The Numbers Behind the Struggle

- 4% year-on-year decline in net direct tax collections between April and August 2025 — partly due to personal tax cuts and deferred deadlines.

- Businesses spend an estimated $20 billion/year in compliance costs — money that could otherwise be invested in growth and innovation.

- Over 300 GST-related court cases are pending, clogging up legal and financial resources.

These figures aren’t just abstract — they translate into slower job creation, higher consumer prices, and missed opportunities for foreign investment.

International Comparisons: Lessons for India

Australia

- Flat 10% GST across all states and territories.

- Simple list of exemptions (mainly fresh food, healthcare, and education).

- Quarterly filing for most small businesses.

United States

- Sales tax set at the state level, often in the single digits.

- Rates rarely change without significant public discussion.

- Online filing systems designed to be quick and inexpensive.

The takeaway? Simplicity, predictability, and limited exemptions help keep business costs low and investor confidence high.

Why Economics Needs to Lead?

For GST to work as intended, economic logic needs to come first. That means:

- Predictability — so businesses can plan budgets and investments years ahead.

- Simplicity — so compliance costs don’t eat into profits.

- Data-driven policymaking — using economic models and market data, not just political compromise.

Right now, India’s GST often falls short in all three areas.

An Action Plan for GST Reform

- Reduce to One or Two Slabs — Merge rates to cut classification disputes.

- Independent Expert Panel — Include economists, accountants, and industry representatives.

- Full Digital Automation — Pre-filled returns for SMEs, similar to how some U.S. states handle sales tax.

- Fast-Track Dispute Resolution — Special GST courts with mandatory 90-day resolution deadlines.

- Advance Notice for Changes — Rate or rule changes announced at least 6 months ahead.

Case Study: Rajesh in Gujarat vs. Susan in Ohio

Rajesh, a textile exporter in Gujarat, initially spent about 6 hours a week on GST filings in 2018. By 2024, thanks to new e-invoicing requirements and rate changes, that jumped to 14 hours a week — plus $500/month for a consultant.

Susan, in Ohio, runs a similar-sized textile business. She spends about 15 minutes filing sales tax online once a quarter. The difference is stark, and it’s not about effort — it’s about how the system is designed.

Income Tax Reform: A Sign of What’s Possible

India’s Income Tax Act of 1961 is being overhauled in the form of the Income Tax Bill 2025, aiming to:

- Halve the complexity of the code.

- Increase deductions for middle-class households and MSMEs.

- Streamline slabs for easier compliance.

If GST reform followed this economic-first model, India could create a more predictable, business-friendly tax environment.

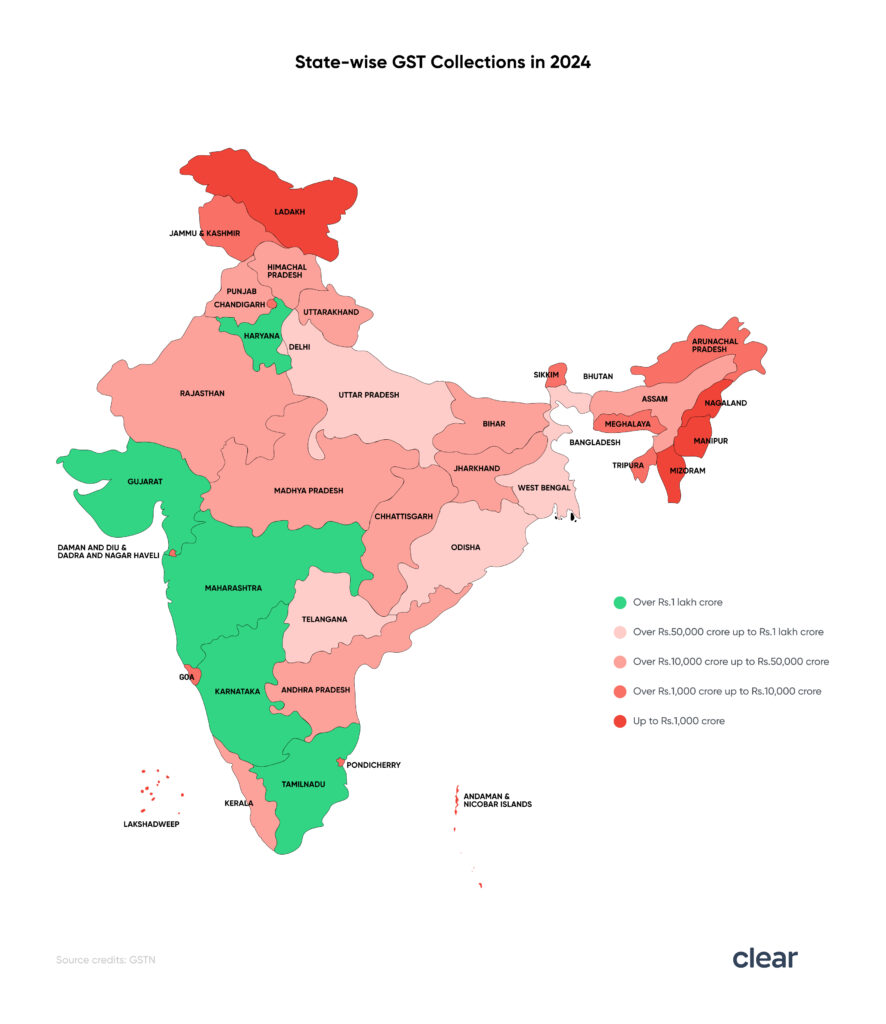

The Economic Stakes

India’s Ease of Doing Business rank is currently 63rd. An efficient GST could help push it into the top 50. More importantly, the IMF estimates that a well-functioning GST could boost GDP by 1–1.5% annually, creating jobs and increasing investment inflows.

The Balanced View: Why Politics Isn’t All Bad

Politics ensures that smaller or less wealthy states have a voice at the table. Without that balance, tax policy could favor the most industrialized regions. But when political compromise overshadows economic logic, the result is often a tax code that’s too complex to serve anyone well.

Practical Tips for Businesses in Today’s GST System

- Invest in automation — GST-compliant software can save hours each month.

- Join an industry body — Groups like FICCI and CII lobby for simpler rules.

- Follow official updates — Check GST Council regularly.

- Maintain detailed records — A lifesaver during audits.

- Use expert advice — A good tax consultant often pays for themselves.

India’s Tax Disputes Enter New Era as Govt Appoints Key Tribunal Members Nationwide

Half-Yearly Income Tax Digest 2025: Key ITAT Decisions Every Taxpayer Should Know