Insurance Stocks Surge on GST Exemption Talk: and that’s not just trader chatter, it’s the real deal driving India’s stock market this week. From SBI Life to HDFC Life and the big daddy LIC, insurance names have jumped on news that a Group of Ministers (GoM) recommended removing the hefty 18% GST slapped on life and health insurance premiums. But here’s the million-dollar question: Should you jump in now, or wait until the dust settles? Let’s break it down with clarity, numbers, and some straight talk.

Insurance Stocks Surge on GST Exemption Talk

The surge in insurance stocks on GST exemption talk shows how sensitive markets are to policy moves. For households, it promises cheaper premiums. For insurers, it’s a balancing act between demand growth and margin pressure. For investors, it’s an opportunity—but with strings attached. If you’re risk-averse, wait for the GST Council’s decision. If you’re bold, enter selectively in leaders like HDFC Life or SBI Life. Either way, don’t forget—insurance is a marathon, not a sprint.

| Key Point | Details |

|---|---|

| Trigger | GoM proposal to exempt GST on health and life insurance premiums. |

| Current GST Rate | 18% on insurance premiums. |

| Market Reaction | Insurance stocks up: SBI Life (+2.5%), HDFC Life (+3.1%), LIC (+1.8%), ICICI Prudential (+2%). |

| Index Impact | Nifty 50 rose 0.28%, Sensex up 0.35%, led by financial stocks. |

| Consumer Angle | Could lower premiums upfront, but insurers risk losing Input Tax Credit (ITC), which may lead to higher base costs. |

| Timeline | GST Council to make final decision by Sept/Oct 2025. |

| Official Resource | GST Council – Government of India |

Why Did Insurance Stocks Surge on GST Exemption Talk?

The rally boils down to one thing: affordability. Right now, if you buy a ₹20,000 health insurance policy, you shell out an extra ₹3,600 in GST. That’s not pocket change for middle-class families.

The GoM’s suggestion of a GST exemption sent a strong signal that insurance might finally become more accessible. Investors loved it. Within hours of the news:

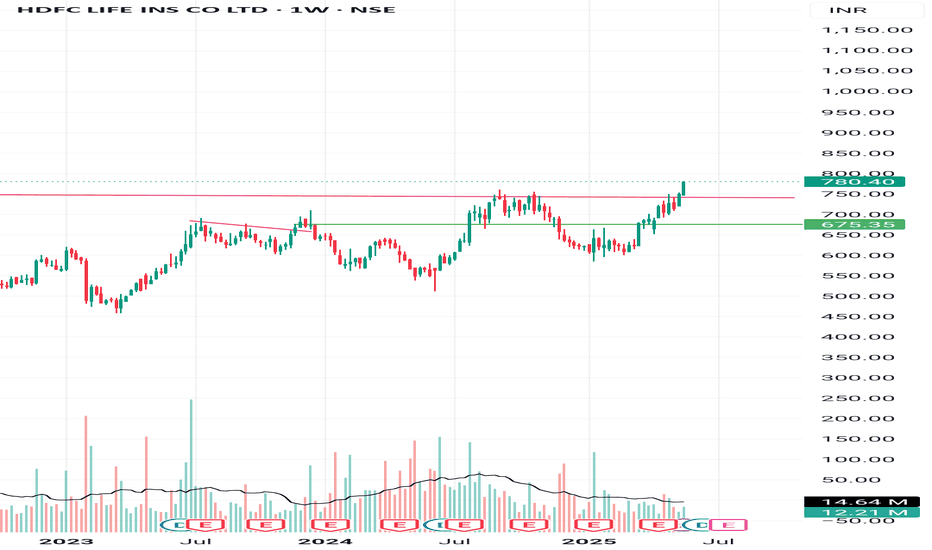

- HDFC Life spiked 3.1%, hitting a three-month high.

- SBI Life rose 2.5%, one of the top gainers on the Nifty.

- ICICI Prudential gained 2%.

- Even LIC, the giant often slow to move, ticked up 1.8%.

The optimism wasn’t just in insurance. The Nifty Financial Services Index jumped, and broader indices like the Sensex gained as Reliance and big banks joined the rally.

Historical Context: GST and Insurance in India

When the Goods and Services Tax (GST) rolled out in 2017, insurance got the short end of the stick. Premiums attracted 18% GST, one of the higher rates compared to many other services.

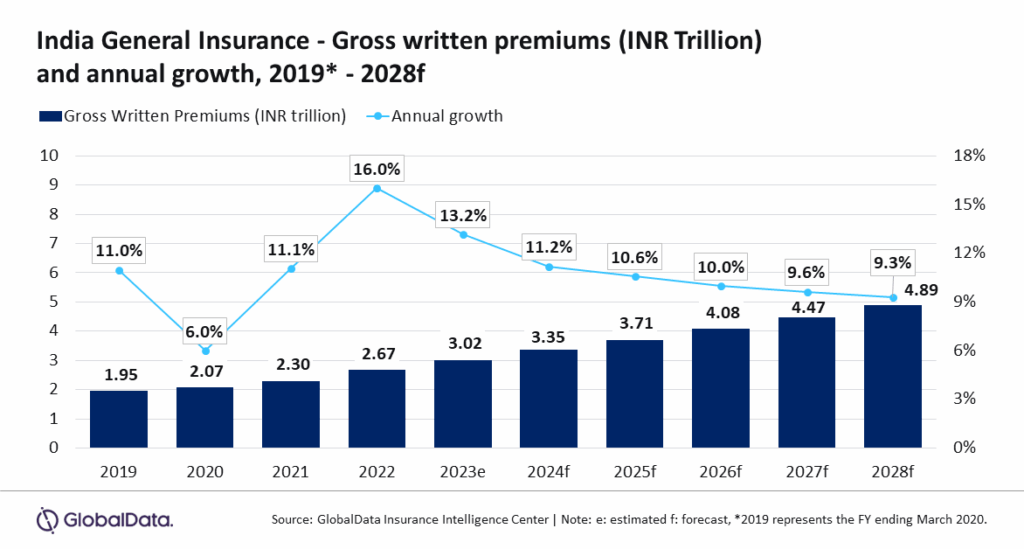

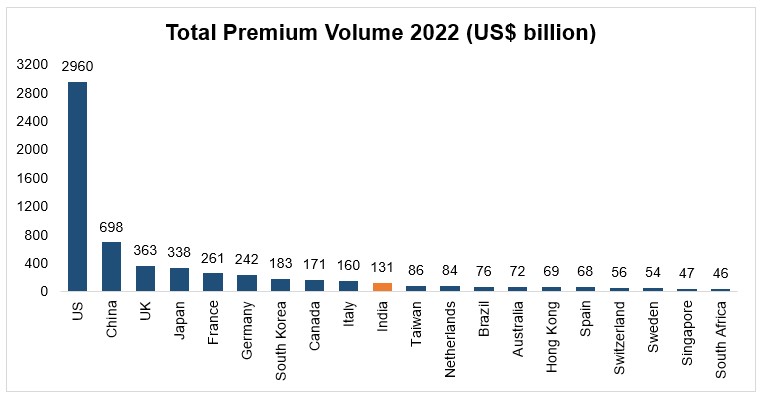

Industry watchdog IRDAI and insurers have repeatedly flagged that high GST is a barrier to financial protection in a country where penetration is already low. According to Swiss Re Institute, India’s insurance penetration in 2024 stood at 4.2% of GDP, compared to 11% in South Korea and 7% global average.

This GoM proposal is the closest India has come in eight years to revisiting that tax structure.

Global Comparison: How Other Countries Do It

- United States: Health insurance premiums are tax-deductible under specific rules, and life insurance isn’t taxed with GST/VAT equivalents. Obamacare expanded subsidies to make coverage cheaper.

- UK: Insurance Premium Tax (IPT) is applied but at a modest 12%.

- Singapore & Hong Kong: Life insurance is exempt from GST/VAT, and health insurance enjoys favorable treatment to boost adoption.

By comparison, India’s 18% GST looks like a financial hurdle that discourages households from getting insured.

What Does This Mean for Consumers?

For you and me—the policy buyers—the potential benefits are clear:

- Lower upfront premiums: If your life cover costs ₹30,000 annually, you save ₹5,400 immediately.

- Encourages first-time buyers: Young families often skip insurance citing cost. A GST exemption lowers the entry barrier.

- Business owners save big: Companies providing employee health plans stand to save lakhs.

But there’s a catch: if insurers lose Input Tax Credit (ITC)—their refund on GST paid for services like agent commissions—they may quietly increase the base premium. In that case, some or all of your “savings” vanish.

Case Studies: What Savings Look Like

- Middle-class family in Mumbai: Annual health cover of ₹25,000 saves ₹4,500 if GST goes. That’s an electricity bill for several months.

- Small business in Pune: Group insurance costing ₹3,00,000 for staff saves ₹54,000 annually. That’s enough to upgrade equipment or add another employee to coverage.

What Does It Mean for Insurance Companies?

- Upside: Demand could surge. India has 50% uninsured households, and cheaper premiums will draw in first-time buyers.

- Downside: Losing ITC means higher costs. Smaller insurers may struggle, while giants like HDFC Life and SBI Life absorb the hit better.

- Long-term: If penetration increases, insurers gain scale, offsetting short-term margin pressures.

Risks and Challenges Ahead

- Revenue Loss for States: GST from insurance is a solid revenue stream. States may push back against exemptions.

- Policy Execution: A “zero-rated” exemption preserves ITC; a plain “exempt” one doesn’t. The devil is in the detail.

- Market Volatility: If the Council delays or dilutes the proposal, expect sharp corrections.

- Insurer Lobbying: Larger insurers may favor reforms; smaller ones may lobby for subsidies to cover ITC losses.

Expert Views

- Nomura India: “Short-term gains for insurers may reverse if ITC is withdrawn. Watch for Council’s language.”

- Economic Times analysts: Note that insurance stocks added nearly ₹20,000 crore in market cap within a day of the news.

- Reuters reports: Emphasize the political angle—final decision may align with festive season to boost consumer sentiment.

Investor’s Checklist: Should You Buy Now?

Here’s how to decide:

- Company Fundamentals: Look at solvency ratios, new business premiums (NBP) growth, and persistency ratios.

- Policy Clarity: Wait for the Council’s decision. If it’s “zero-rated,” it’s bullish.

- Diversification: Don’t bet the house on insurance—balance with banks, IT, or even U.S. ETFs.

- Valuation Watch: Some insurance stocks already trade at high price-to-embedded-value ratios. Don’t overpay.

- Long-Term View: Insurance is a compounding game. Benefits play out over 5–10 years.

How U.S. Investors Can Relate

In the U.S., health insurance reforms like Obamacare showed how government policy directly drives sector growth. Subsidies and tax breaks boosted enrollment from 15% uninsured in 2010 to under 9% by 2023.

India’s GST exemption could mirror that effect. A nudge from the government may bring millions under coverage, just as Obamacare expanded health insurance in the U.S.

Detailed Investor Example

Let’s say you invest ₹2,00,000 in SBI Life now. If reforms spur 12% annual growth, in 10 years, that’s about ₹6,21,000.

If margins shrink and growth slows to 5%, you end up with ₹3,25,000. The difference shows why clarity on ITC and Council’s decision is critical before you invest big.

GST Collections Unveil Shocking Cultural Shifts Across Indian Districts

Maruti Suzuki Subsidiary Slammed With ₹86 Crore GST Penalty in Appellate Ruling

GST Council Considers Amnesty That Could Save Small Businesses Lakhs in Penalties