Is Your Alimony Taxable? Whether you’re paying it or receiving it, alimony can be confusing—especially when taxes get involved. You might be thinking, “I just settled a divorce. Isn’t that enough to deal with? Now taxes too?” We get it. But the truth is, not understanding how alimony is taxed in India could cost you thousands in penalties, missed filings, or incorrect returns. So whether you’re trying to protect your finances, file your taxes right, or just stay out of trouble with the Income Tax Department—this article has everything you need to know about alimony and taxation in India. Let’s break it down in plain English—with examples, official sources, real-life stories, and expert advice.

Is Your Alimony Taxable?

Divorce is hard enough—don’t let taxes make it worse. If you’re receiving or paying alimony in India, it’s critical to understand the difference between taxable and non-taxable payments.

Lump-sum = Good for tax savings.

Recurring payments = Must be reported as income.

Asset transfers = Should be court-documented.

Child support = Always tax-free.

The golden rule? When in doubt, consult a tax professional. The upfront cost is worth avoiding years of notices and headaches.

| Aspect | Details |

|---|---|

| Lump-Sum Alimony | Not taxable for the recipient (capital receipt). |

| Monthly (Recurring) Alimony | Taxable for the recipient under “Income from Other Sources.” |

| Payer Deduction (All Types) | No deduction allowed for payer—considered personal expense. |

| Asset Transfers as Alimony | Tax-exempt if made during marriage. Post-divorce, may be taxable. |

| Child Support | Completely tax-free for the recipient. |

| Court-Ordered Settlements | Generally safer for avoiding tax disputes. |

| Official Reference | Income Tax Department of India |

What is Alimony in India?

Alimony, often referred to as maintenance, is a legal obligation where one spouse pays financial support to the other after divorce or separation. The idea is to help the financially weaker partner maintain a reasonable lifestyle similar to the one during the marriage.

It’s governed by various laws in India, including:

- Section 125 of the CrPC

- Hindu Marriage Act

- Special Marriage Act

- Muslim Women (Protection of Rights on Divorce) Act

And yes—how it’s taxed depends on how it’s structured.

Types of Alimony: Lump Sum vs. Recurring

Before we jump into tax rules, let’s get clear on what kind of alimony you’re dealing with:

1. Lump-Sum Alimony: A one-time payment made by one spouse to the other, usually at the time of or shortly after the divorce.

2. Recurring Alimony: Payments made monthly or quarterly for a specific period, often years.

Each has its own tax implications, and choosing the wrong format without advice can leave you with a bigger tax bill.

How Different Types of Alimony Are Taxed?

Lump-Sum Alimony: Tax-Free for the Recipient

When a spouse receives a one-time alimony amount, Indian courts have repeatedly ruled that it is a capital receipt, not income.

This means:

- Recipient pays zero tax

- Payer cannot claim deduction

This ruling stems from landmark cases like:

- Princess Maheshwari Devi of Pratapgarh v. Commissioner of Income Tax

- CIT v. M. Ramalaxmi (1994)

Example: Anjali receives ₹20 lakh from her ex-husband as a one-time settlement. She doesn’t have to include it in her income tax return.

Monthly Alimony: Taxable Under ‘Other Sources’

On the flip side, if the payment is recurring, it is considered income in the hands of the recipient.

Key points:

- Taxed as “Income from Other Sources” under Section 56 of the Income Tax Act

- Must be declared in the recipient’s ITR

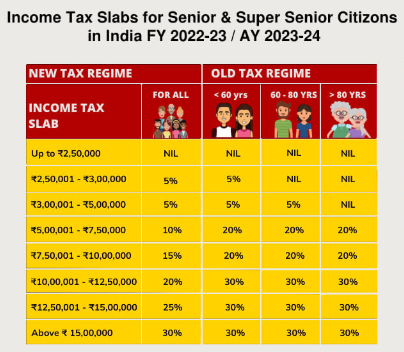

- Taxed as per the applicable slab rate

Example: If Meera receives ₹50,000 per month, she must include ₹6,00,000 annually as part of her income. Depending on her total income, she may fall into the 5%, 10%, or 20% tax bracket.

Again, the payer gets no tax benefit. It’s not deductible, no matter how regular or large the payments are.

Are Asset Transfers in Divorce Tax-Free?

Another common way to settle alimony is through property, jewelry, stocks, or other asset transfers.

The taxability depends on timing and documentation:

If transfer is made before divorce is finalized:

- It qualifies as a gift between relatives

- Tax-free under Section 56(2)

If transfer is made after divorce:

- If it’s not part of a court order, and value exceeds ₹50,000, it may be considered a taxable gift

- But if it’s part of a documented divorce settlement, it may still be exempt

The recipient is also liable for tax on future income from the asset, like:

- Rent from real estate

- Interest from fixed deposits

- Capital gains from sale of shares

Example: Raj transfers a flat worth ₹60 lakh to his ex-wife Nisha as part of the divorce settlement. If properly documented, Nisha pays no tax on the transfer—but must declare future rent as income.

Is Child Support Taxable in India?

No. Child support is not taxable in India.

Regardless of how it’s paid (monthly or one-time), child maintenance is for the child, not the spouse. Hence:

- The recipient parent doesn’t pay tax

- The payer gets no deduction either

However, it’s essential to clearly mention in the divorce decree what portion of the payment is for child support.

Legal Backing: Tax Laws and Judgments

- Income Tax Act, 1961: Section 56 (income from other sources)

- Transfer of Property Act, 1882

- Section 125 of CrPC: Deals with maintenance

- Key Judgments:

- CIT v. M. Ramalaxmi (Madras High Court)

- Princess Maheshwari Devi case (Allahabad High Court)

All these legal frameworks support the view that taxability depends on the form and purpose of the payment.

Real-Life Scenarios That Show How It Plays Out

Scenario 1 – No Tax on Lump Sum

Rekha received ₹30 lakh in one go. She didn’t report it as income—and she was right. Her CA confirmed it was a capital receipt, and no tax was due.

Scenario 2 – Tax Notice on Monthly Alimony

Sunita received ₹75,000 per month but didn’t report it in her ITR for two years. She got an IT notice, paid penalty and interest. If she had known, she could’ve avoided this by declaring it annually.

Is Your Alimony Taxable: Common Mistakes to Avoid

- Assuming all alimony is tax-free

- Mixing up child support and spousal support in documentation

- Not documenting asset transfers properly

- Using cash for alimony transactions

- Failing to report periodic alimony in ITR

Expert Advice from the Field

“Many people make the mistake of accepting monthly alimony without thinking of the tax angle. A large one-time settlement is often more tax-efficient, especially for non-working spouses.”

— Neha Bansal, Chartered Accountant

“Make sure every clause of your settlement is tax-compliant. One mistake can lead to years of tax notices and penalties.”

— Advocate Manish Tripathi, Family Law Specialist

Checklist for Divorced Couples (Alimony & Taxes)

| Task | Completed (Yes/No) |

|---|---|

| Clarify lump-sum or recurring payment | |

| Mention payment terms in divorce decree | |

| Separate child support from alimony clearly | |

| Ensure asset transfers are court-ordered | |

| Keep records of bank transactions | |

| Declare income in ITR, if taxable | |

| Consult a CA or lawyer for filing support |

How Indian Alimony Rules Compare with the U.S.

| Feature | India | USA (Post-TCJA 2019) |

|---|---|---|

| Lump-Sum Alimony | Not taxable for recipient | Not taxable |

| Recurring Alimony (Recipient) | Taxable | Not taxable |

| Recurring Alimony (Payer) | Not deductible | Not deductible |

| Child Support | Not taxable | Not taxable |

Half-Yearly Income Tax Digest 2025: Key ITAT Decisions Every Taxpayer Should Know

Major Corporate Default: NCLT Admits Insolvency Petition Due to ₹98 Crore Loan Non-Payment

No GST on UPI Payments — Government Clears the Air in Rajya Sabha