Israeli AI Startup Bags $60 Million to Help Governments Fight Fraud: When you hear that an Israeli AI startup bags $60 million to help governments fight fraud, you know this isn’t just another Silicon Valley headline. This is about IVIX, a Tel Aviv–founded company that’s quickly becoming the go-to tech partner for governments cracking down on shady money moves. Think tax evasion, money laundering, and those sneaky shell company schemes you hear about in the news. Founded in 2020, IVIX is already making waves worldwide. With its latest $60 million Series B funding round, the company is stepping up to help law enforcement and regulators fight fraud at scale—using the raw power of artificial intelligence. But this isn’t just big talk. IVIX’s technology has already helped uncover billions of dollars in hidden or illicit assets across the U.S., Europe, and Asia.

Israeli AI Startup Bags $60 Million to Help Governments Fight Fraud

IVIX’s $60 million Series B funding round isn’t just another tech headline—it’s a turning point in how governments fight financial crime. By arming agencies with AI-powered tools, IVIX is helping reclaim billions in lost tax revenue, protecting economies, and making the system fairer for everyone. The future of fraud detection is clear: AI isn’t just helpful, it’s essential. And with companies like IVIX leading the charge, the days of unchecked financial crime may finally be numbered.

| Topic | Details |

|---|---|

| Company | IVIX (Israeli AI startup) |

| Funding Raised | $60 million (Series B, 2025) |

| Total Capital Raised | $85 million since 2020 |

| Main Investors | O.G. Venture Partners, Insight Partners, Citi Ventures, Team8, Disruptive AI, Cardumen Capital, Cerca |

| Mission | Help governments detect and fight financial fraud with AI |

| Tech Focus | AI-powered data scanning (public data, blockchain, transactions, offshore activity) |

| Global Reach | U.S., Europe, Asia, South America |

| Team | ~60 employees, HQ in Tel Aviv |

| Impact | Detected billions in hidden assets |

Why This Matters: The Bigger Picture

Fraud isn’t just a Wall Street problem. It trickles down into everyday life. When wealthy individuals or corporations cheat the system, taxpayers like you and me end up footing the bill.

According to the IRS, the U.S. loses over $600 billion annually due to tax evasion and noncompliance. Globally, the OECD estimates trillions are lost in uncollected taxes and illicit financial flows. That’s money that could fund schools, healthcare, or infrastructure.

So when IVIX says it’s building an AI platform to track down fraudsters, it’s not just chasing headlines—it’s helping governments recover real cash that belongs to the people.

A Look Back: Fighting Fraud Before AI

Before AI, governments used:

- Audits: Manual, time-consuming, and only covered a fraction of taxpayers.

- Tip-offs & Whistleblowers: Helpful, but rare and unreliable.

- Pattern-based Software: Traditional fraud detection flagged obvious cases but missed sophisticated schemes.

The problem? These methods were slow, reactive, and outdated. Criminals could outsmart the rules, exploit loopholes, or simply overwhelm systems with complexity.

AI changes that by analyzing massive datasets in real time and spotting subtle, hidden patterns no human could find.

How IVIX Works: Breaking Down the Tech

Let’s get into the nuts and bolts of what makes IVIX unique.

1. Data Collection Across Borders

IVIX collects structured and unstructured data—everything from public company filings and property ownership records to blockchain transactions and trade flows.

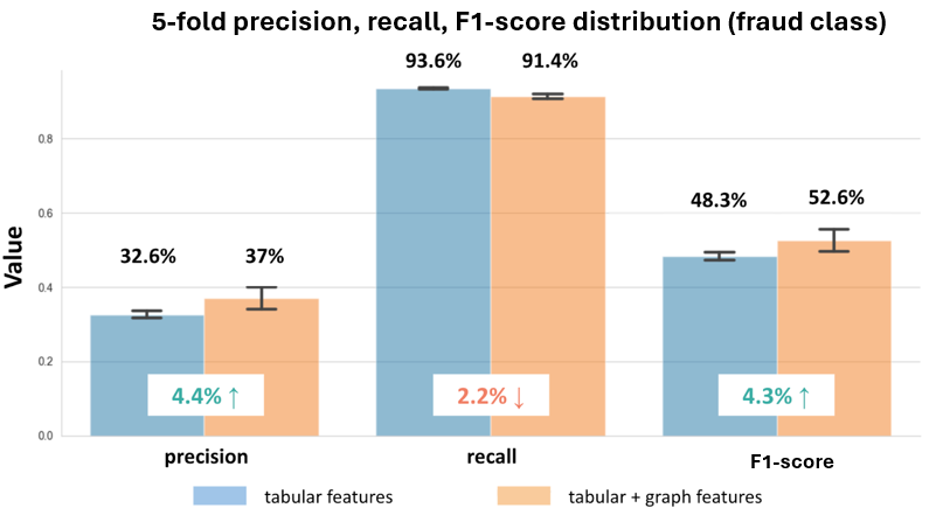

2. Machine Learning Models

The AI uses supervised and unsupervised learning to find anomalies. For example, supervised models learn from known cases of fraud, while unsupervised models scan for outliers that don’t fit typical behavior.

3. Predictive Analytics

Beyond spotting fraud after it happens, IVIX uses predictive analytics to forecast where fraud might occur next. That’s a game-changer for prevention.

4. Link Analysis

The software builds relationship maps connecting shell companies, accounts, and individuals across jurisdictions. This exposes networks that traditional audits miss.

Investor Confidence: Why Back IVIX?

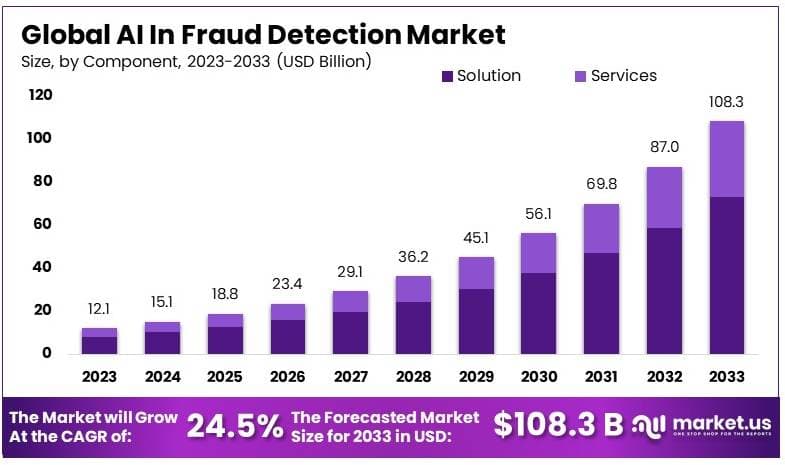

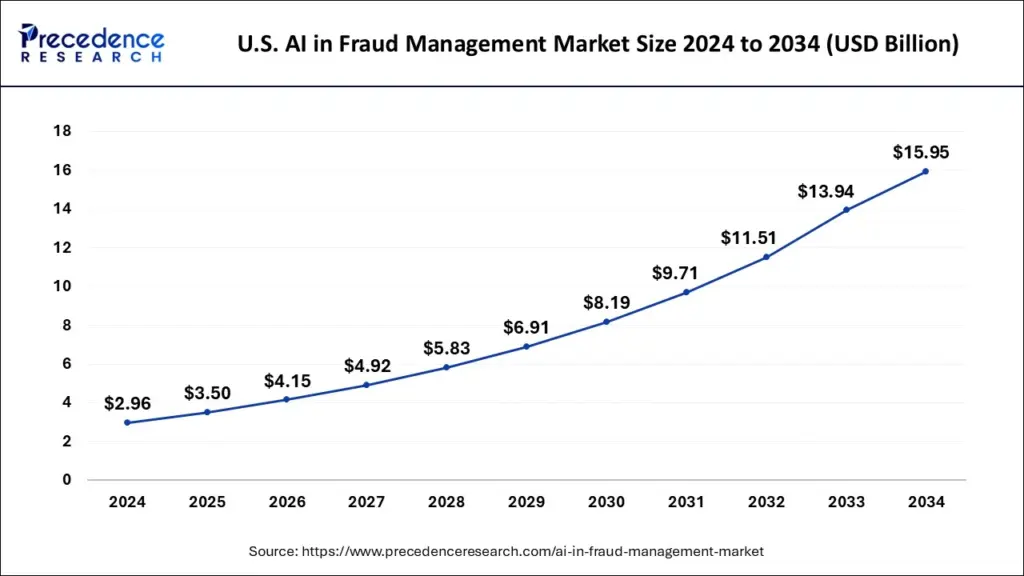

Big-name investors don’t just throw $60 million around for fun. Venture firms like Insight Partners and Citi Ventures see fraud detection as a massive growth market.

Why? Because governments worldwide are under pressure to recover lost revenue. According to the OECD, tax crime and illicit financial flows cost the world economy over $11 trillion annually. Even recovering a fraction is a huge win.

Investors also see long-term demand. Unlike consumer apps that come and go, governments will always need to enforce tax laws and stop fraud. That makes IVIX a stable, scalable bet.

Global Case Studies: What Could Have Been

AI fraud detection could have made a difference in several high-profile scandals:

- Panama Papers (2016): Exposed offshore tax evasion by the global elite. AI could have spotted the unusual offshore company connections earlier.

- Wirecard Collapse (2020): Billions went missing from the German payments company. AI anomaly detection might have flagged inconsistent accounting data sooner.

- Crypto Laundering by North Korea (2018–2022): Hackers laundered over $1 billion in crypto. AI could have tracked suspicious wallet transactions across blockchains.

These examples highlight the potential for IVIX to stop the next big scandal before it happens.

Why Governments Are All In?

Governments know they can’t out-staff or out-manual fraudsters anymore. Fraud is too complex, too global, and too digital. That’s why countries are eager to embrace AI-powered fraud detection.

IVIX is particularly attractive because it works at scale. Whether you’re tracking real estate transactions in Miami, crypto wallets in Singapore, or shell companies in Panama, the system unifies the data.

The result? Faster investigations, higher recovery rates, and a more fair tax system.

Challenges Ahead for IVIX

Of course, no solution is perfect. IVIX faces challenges like:

- Data Privacy Laws: Navigating rules like Europe’s GDPR when handling sensitive data.

- AI Bias: Making sure models don’t unfairly target specific groups or industries.

- Government Adoption: Some agencies may resist change or lack the technical skills to implement AI effectively.

- Fraudster Adaptation: Criminals will evolve new tactics to evade detection, creating an ongoing arms race.

How IVIX addresses these hurdles will determine its long-term success.

The Ethics: Power vs. Privacy

With great power comes great responsibility. AI in government must be carefully managed.

The risk is that powerful surveillance tools could overreach, infringing on privacy or being misused politically. The solution is transparency, legal safeguards, and third-party audits to ensure these tools are only used for genuine fraud detection.

IVIX has stated its focus is on publicly available and legally sourced data, not spying on ordinary citizens. But oversight will remain crucial.

What Israeli AI Startup Bags $60 Million to Help Governments Fight Fraud Means for Businesses?

For legitimate businesses, this is good news. Cracking down on fraud means fairer competition and more stable markets. But it also means:

- No Hiding: Businesses must ensure compliance, as AI tools will make it harder to cheat the system.

- Higher Scrutiny: Expect tighter oversight on cross-border deals, crypto transactions, and offshore entities.

- Opportunities: Companies offering compliance services, auditing, and cybersecurity can partner with government agencies riding the AI wave.

Career & Professional Insights

For professionals in finance, compliance, cybersecurity, and law, this is a golden opportunity. Careers in fraud detection and compliance tech are booming.

According to U.S. Bureau of Labor Statistics, jobs for information security analysts are projected to grow 32% from 2022 to 2032—much faster than the average across all industries.

If you’re building your career, focus on:

- Data Science & AI Training

- Forensic Accounting Certifications

- Blockchain Analytics

- RegTech (Regulatory Technology)

Step-by-Step: How Governments Can Leverage AI Against Fraud

- Data Integration – Collect and unify disparate datasets.

- AI Model Training – Use fraud patterns and anomalies to build smarter models.

- Continuous Monitoring – Run real-time scans for ongoing fraud attempts.

- Investigator Training – Equip human teams to act quickly when AI alerts them.

- Global Partnerships – Collaborate with banks, fintech firms, and international agencies.

Beyond Fraud: The Future of AI in Governance

Fraud detection is just the beginning. AI could help governments improve:

- Healthcare Fraud Prevention: Detecting fraudulent insurance claims.

- Social Security Oversight: Spotting fraudulent disability or unemployment claims.

- Procurement Transparency: Preventing corruption in government contracts.

The same tools that fight tax evasion could be applied across public services to improve efficiency and fairness.

Patna Man Arrested in ₹1 Crore Cyber Fraud Case in Lucknow

₹332 Crore Bogus Copper Supply Scam Uncovered in Telangana Tax Fraud Raid

₹50 Crore GST Fraud Busted In Mumbai – Two Directors Arrested In Mega Scam