IT Dept Busts Fake Claim Racket: The IT Department busts fake claim racket linked to the Jharkhand robbery case, and this gripping story is more than just a crime update—it’s a financial thriller that uncovers how fraudsters exploit legal loopholes to launder black money. At the heart of this case is a ₹5 crore robbery in Giridih, Jharkhand on June 21, 2023. What started as a straightforward robbery spiraled into a multi-state money-laundering investigation. The culprits, a Gujarat-based couple, set up a fake firm to claim the seized money. But thanks to sharp investigators and a strong legal system, their scheme was exposed.

IT Dept Busts Fake Claim Racket

The IT Department busts fake claim racket linked to Jharkhand robbery case is more than a courtroom drama. It’s a wake-up call on how fraudsters manipulate paperwork, exploit legal gaps, and attempt to turn black money into white. The verdict didn’t just reject one fake claim—it sent a message that vigilance, transparency, and compliance are the ultimate shields against fraud. For businesses, professionals, and ordinary citizens alike, the lesson is clear: shortcuts in money never end well.

| Point | Details |

|---|---|

| Case | IT Dept busts fake claim racket in Giridih (Jharkhand) robbery case |

| Date of Incident | June 21, 2023 (robbery); ruling on August 22, 2025 |

| Main Accused | Gujarat couple – Neena Shah & Kamlesh Rajnikant Shah |

| Shell Company Used | M/s MECTEC (fake sales of fruits, milk, animal feed) |

| Amount Involved | Around ₹5 crore robbery; ₹4.01 crore recovered |

| Court Ruling | Judge Hariom Kumar ruled money not linked to MECTEC |

| Official Source | Income Tax Department, India |

Timeline of Events

June 21, 2023 – Robbery in Giridih

A group of robbers intercepts a vehicle carrying cash worth ₹5 crore.

Late June 2023 – Recovery by Police

Authorities recover ₹4.01 crore and begin probing its origins.

July–August 2023 – Fake Claim Filed

Gujarat couple Neena and Kamlesh Shah appear, claiming the money as revenue from their firm, M/s MECTEC. They present paperwork showing sales of milk, fruits, and animal feed.

September 2023 – IT Dept Involvement

The Income Tax Department steps in, suspecting foul play. Early investigations reveal the company is a shell with no real business activity.

2024 – Court Hearings

Over several hearings, testimonies and evidence—including statements from driver Mayur Singh—expose the laundering model.

August 22, 2025 – Court Verdict

Judge Hariom Kumar rules the seized ₹4.01 crore has no connection to M/s MECTEC, rejecting the couple’s claim.

How the Fake Claim Racket Worked?

Think of it as a four-step hustle:

- Shell Firm Setup – M/s MECTEC was legally registered but operated only on paper. Fake invoices and tax returns made it look genuine.

- Fake Documentation – The Shahs produced bogus sales records showing revenue that matched the seized amount.

- Court Claim – They filed a claim in court asserting ownership, hoping the judicial system would release the money.

- Commission Model – Their plan was to take a hefty commission before funneling the remaining funds back to the actual black-money holders.

Driver Mayur Singh’s testimony sealed the case: the money was moved secretly in a car, routed through Patna, and an FIR was staged to cover the trail.

The Bigger Picture: IT Dept Busts Fake Claim Racket in Action

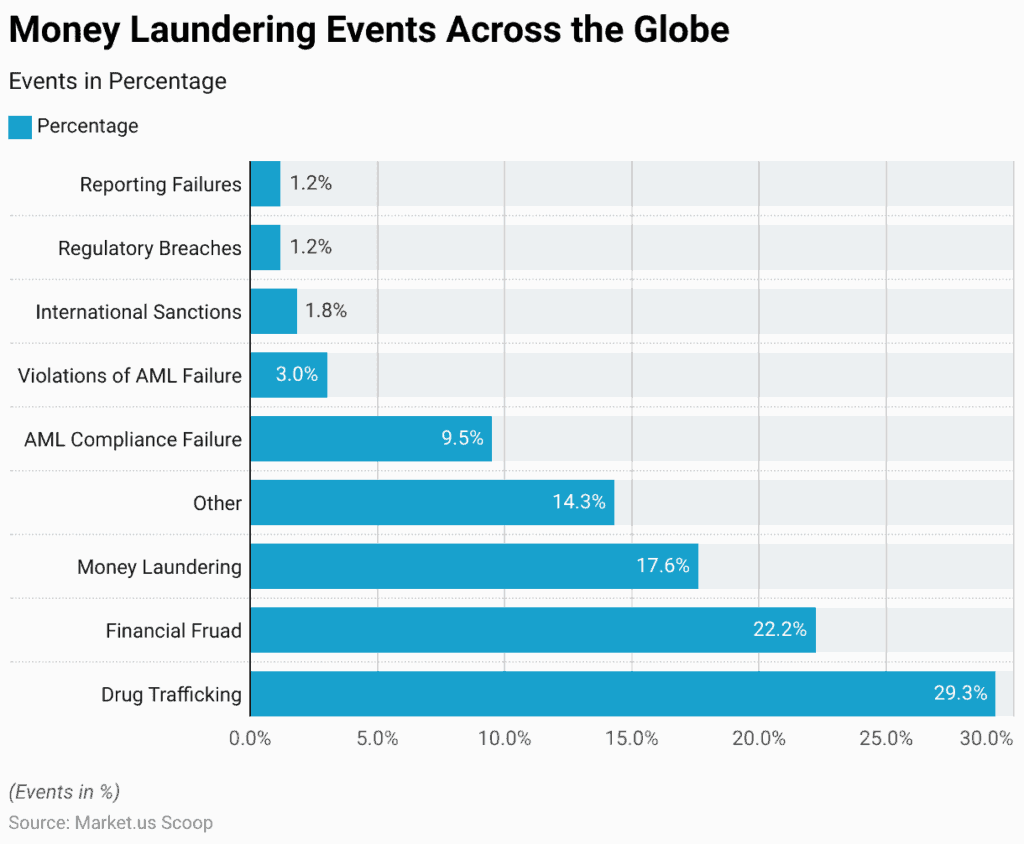

This case is a textbook example of money laundering—turning illegal money into “clean” income.

Common techniques include:

- Shell companies – Fake firms like M/s MECTEC.

- Layering – Moving money through multiple accounts to blur the trail.

- Trade-based laundering – Over- or under-invoicing goods to disguise illegal transactions.

- Hawala networks – Informal channels for moving cash outside the banking system.

Globally, the UN Office on Drugs and Crime estimates money laundering accounts for 2–5% of global GDP annually—between $800 billion and $2 trillion USD.

Legal Framework in India

Several laws and agencies address such scams:

- Indian Penal Code (IPC), 1860 – Charges of robbery, forgery, and conspiracy.

- Prevention of Money Laundering Act (PMLA), 2002 – Targeting illicit cash flows.

- Income Tax Act, 1961 – Powers the IT Dept to investigate unexplained income.

- Enforcement Directorate (ED) – Handles cases with international money trails.

- Reserve Bank of India (RBI) Regulations – Ensure financial transparency in banks.

For context, the PMLA has been used in high-profile cases such as the Yes Bank scam and Vijay Mallya’s loan default investigations.

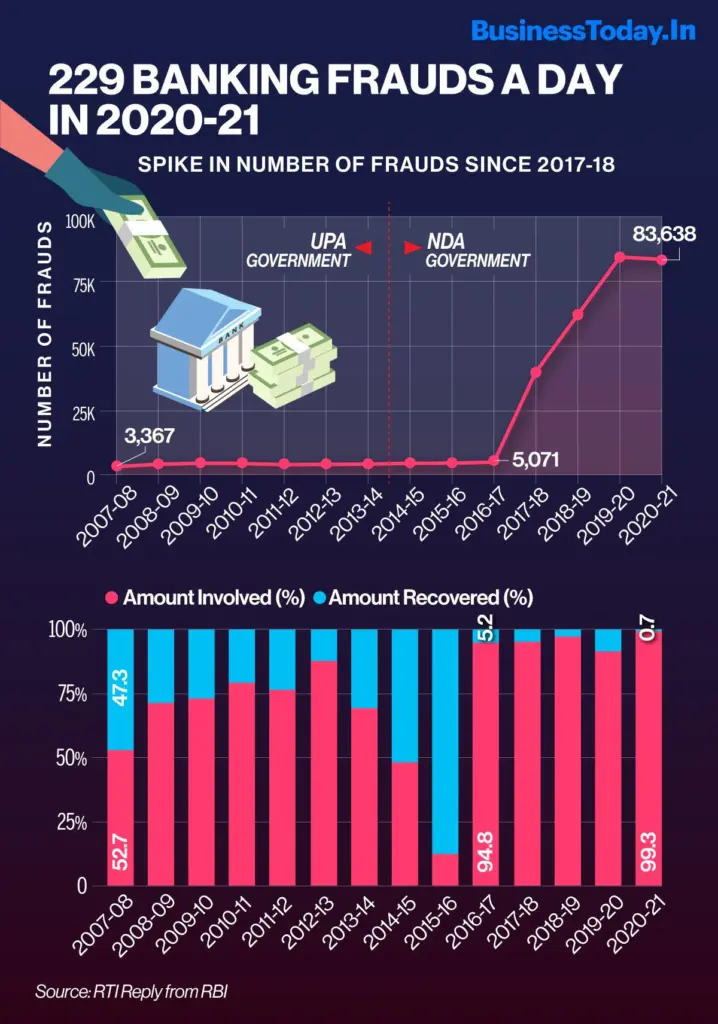

Economic Impact of Fraud

Financial scams don’t just hurt victims—they dent the economy:

- Loss of Tax Revenue – Black money weakens government finances.

- Lower Investor Confidence – Fraud cases discourage investment.

- Impact on Ordinary Citizens – When tax revenue is lost, governments have fewer resources for public welfare.

The World Bank has stated that countries with high fraud and corruption face slower GDP growth and higher inequality.

Role of Technology in Detecting and Preventing Financial Fraud

One of the biggest reasons this racket was eventually busted was the increasing use of technology in financial investigations. Today, regulators and enforcement agencies rely on advanced digital tools to catch fraudsters who think they’re smarter than the system.

Key Tech Tools in Action

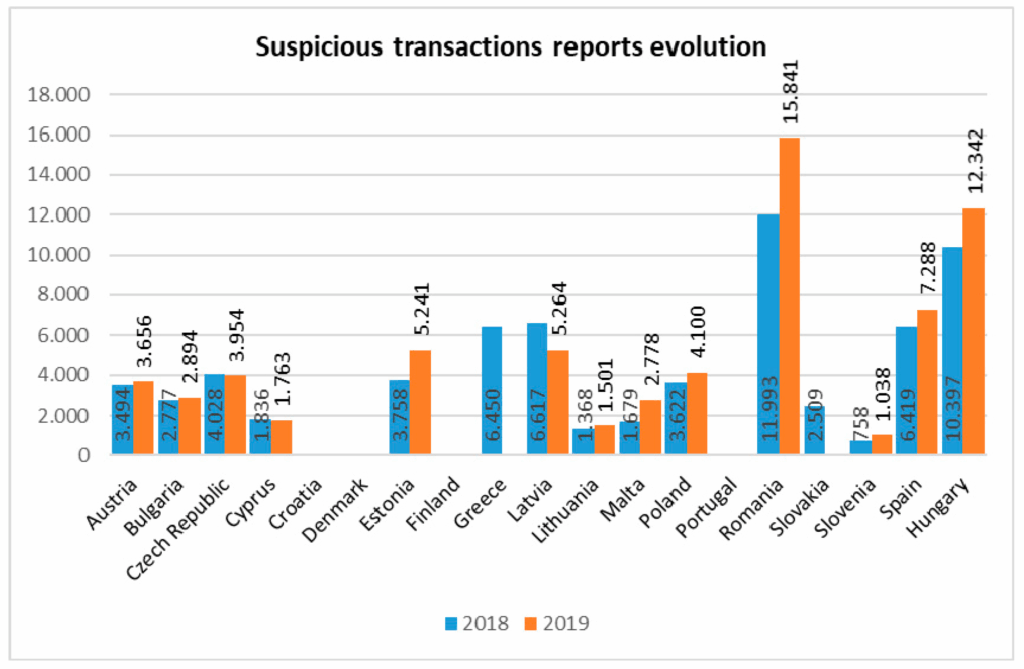

- Data Analytics & AI: Agencies now analyze suspicious transaction patterns using big data and artificial intelligence. For example, unusually large cash deposits or rapid fund transfers between unrelated entities can raise red flags instantly.

- Blockchain Monitoring: With the rise of cryptocurrencies, regulators use blockchain forensics to trace anonymous transactions that may hide illicit funds.

- KYC (Know Your Customer) Automation: Banks and NBFCs in India use AI-powered KYC checks to verify customers and flag shell accounts.

- Suspicious Transaction Reports (STRs): Banks are legally required to file STRs when transactions look shady. These are tracked by the Financial Intelligence Unit – India (FIU-IND).

Why This Matters?

The Giridih fake claim case may have used old-school tricks like fake invoices and staged FIRs, but in the modern financial world, digital footprints are nearly impossible to erase. From the U.S. FBI to India’s ED and IT Department, agencies are now leveraging machine learning, forensic accounting, and automated compliance systems to stay a step ahead.

Expert Opinions

- Former RBI Deputy Governor R. Gandhi once noted: “Shell companies are the most common vehicle for laundering black money in India.”

- PwC India’s 2022 survey shows that more than 57% of Indian businesses experienced fraud in just two years.

Experts agree that robust compliance, transparency, and digital monitoring are the only effective shields against such fraud.

Practical Guide: Protecting Yourself From Fraud

Here’s what businesses and individuals should do:

1. Verify Before Trusting

Check company details on MCA portal. Shell firms often lack actual operations.

2. Maintain Digital Trails

Use digital payments and keep invoices updated. Transparency is your best defense.

3. Identify Red Flags

- Excessive cash transactions.

- Fake or mismatched invoices.

- Offers of “easy recovery” of seized funds.

4. Hire Professionals

Consult chartered accountants and legal experts before engaging in big deals.

5. Report Suspicious Activity

File complaints at cybercrime.gov.in or call helpline 1930 in India.

Historical Parallels

This isn’t the first scam of its kind.

- Hawala Scams (1990s) – Parallel cash transfers across borders.

- 2G Spectrum Scam (2010) – Fake firms used to siphon billions.

- Enron Collapse (USA, 2001) – Fabricated accounting, $74 billion wiped out.

The common thread? Paperwork was manipulated to cover up fraud.

Courtroom Outcome

The August 2025 ruling by Judge Hariom Kumar set an important precedent:

- Fake documents can’t override evidence.

- Courts must carefully scrutinize financial claims involving seized money.

- Fraudsters may face prosecution under multiple laws, not just one.

This decision ensures that fraudsters think twice before filing fake claims in the future.

Income Tax Department Raids Over 10 Locations Across Tamil Nadu

India’s Oldest Citizens Now Contributing More To The Income Tax Kitty

Online Gaming Income FY25 – Tax Rate, TDS Rules And ITR Reporting Explained