IT Raids Continue on Eastman Group and 10 Businesses: When the news broke that IT raids continue on Eastman Group and 10 businesses—ED entry likely next, it made headlines not only in India but also in communities abroad where Non-Resident Indians keep a close eye on home affairs. After all, an Income Tax raid is not something that happens every day. It’s a serious signal that the government suspects something major—whether it’s unpaid taxes, hidden income, or even links to money laundering. And now, with chatter that the Enforcement Directorate (ED) may step into the picture, the heat is turning up. The ED’s involvement means this is no longer just about missing tax returns; it could become a criminal probe with long-lasting consequences.

IT Raids Continue on Eastman Group and 10 Businesses

The ongoing story—IT raids continue on Eastman Group and 10 businesses, with ED entry likely next—isn’t just about one corporate group. It’s about the bigger shift in India’s financial ecosystem. The age of under-the-table deals, hidden income, and shell companies is coming to a close. For businesses, this is both a challenge and an opportunity. A challenge because compliance requires investment, discipline, and transparency. An opportunity because trust, ethics, and clean operations attract investors, employees, and customers. In the long run, playing fair is not only safer—it’s smarter.

| Aspect | Details |

|---|---|

| Subject | IT raids on Eastman Group and 10 businesses, possible ED involvement |

| Agencies Involved | Income Tax Department (current), Enforcement Directorate (expected) |

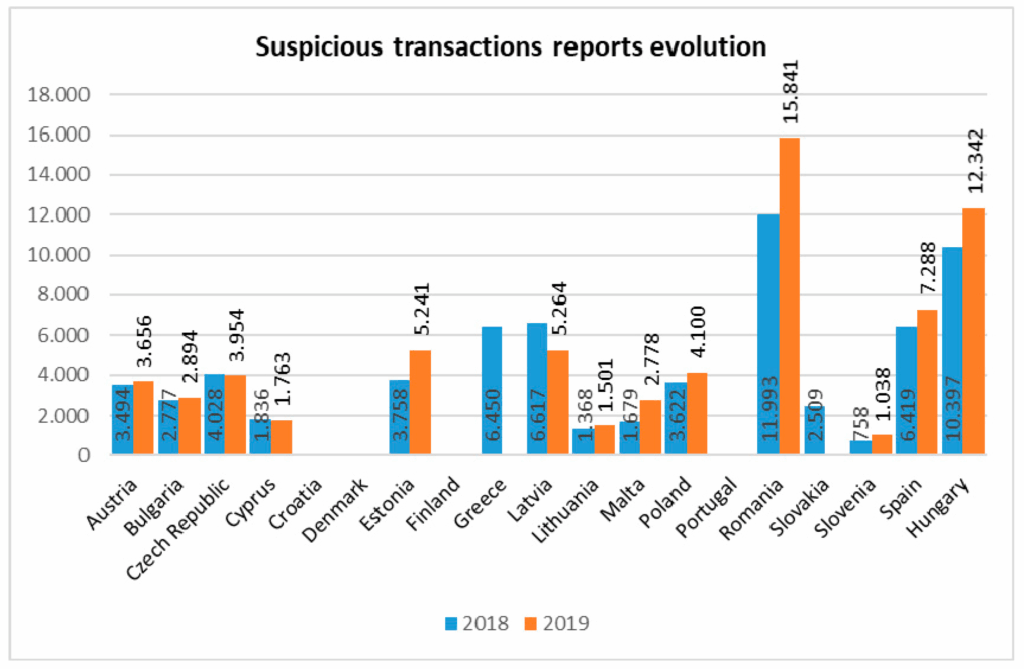

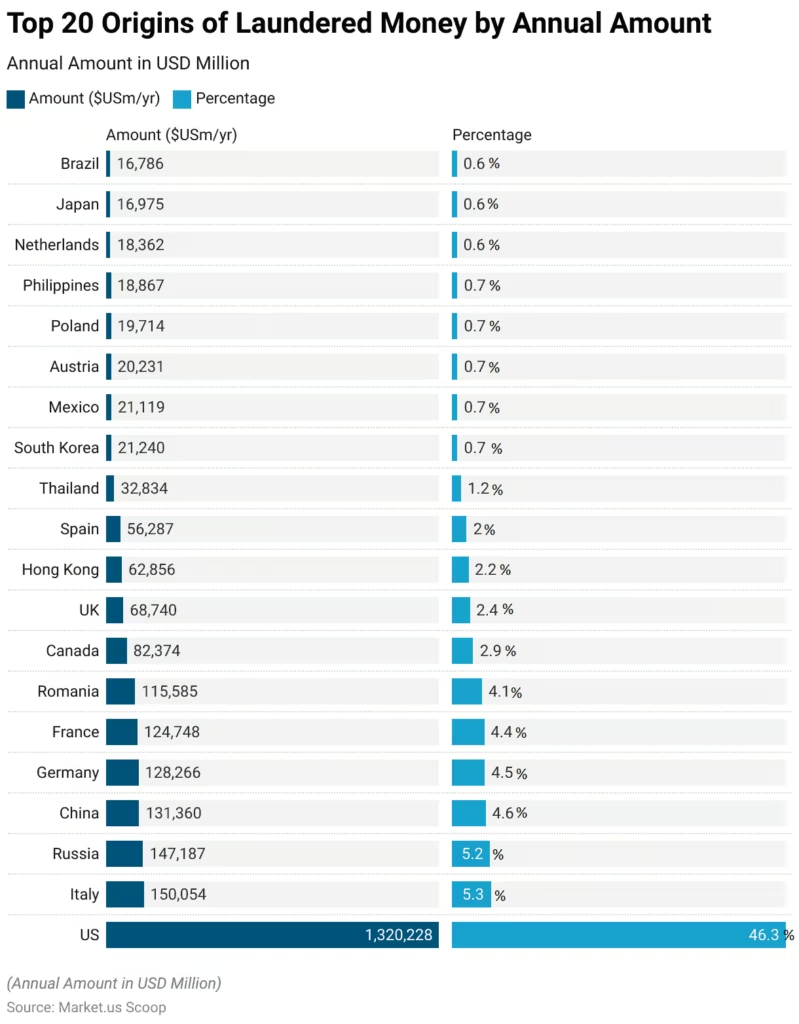

| Focus | Tax evasion, money laundering, suspicious transactions |

| Impact on Businesses | Asset seizures, frozen accounts, reputational damage, investor panic |

| Legal Framework | Income Tax Act, 1961 & Prevention of Money Laundering Act (PMLA), 2002 |

| Official Reference | Ministry of Finance, India |

What Exactly Is Happening?

The Income Tax Department has reportedly launched raids on the Eastman Group and 10 connected businesses. These raids usually begin at dawn, involve dozens of officers, and can last for days. Their purpose? To uncover black money, suspicious cash flows, or unaccounted transactions.

While the IT Department focuses on ensuring people and companies pay their fair share of taxes, the ED takes it much further. If ED enters, it means investigators believe there may be criminal activity like money laundering, hawala deals, or illegal overseas transactions. That’s why the mention of ED here has escalated interest.

Historical Context: Past Raids in India

India has witnessed several blockbuster raids in the last decade:

- Dainik Bhaskar (2021): Unaccounted income of more than ₹500 crore was found.

- Hero MotoCorp (2022): Authorities uncovered nearly ₹800 crore in alleged fake expenses and hidden funds.

- Delhi Liquor Policy Case (2023): ED and CBI both probed alleged irregularities worth thousands of crores.

- Real Estate Raids (2024): Multiple firms in Noida and Jaipur were raided for money laundering and tax evasion.

These examples show one thing clearly: Indian agencies are becoming more aggressive, more coordinated, and less forgiving.

How Many Raids Happen Every Year?

According to the Central Board of Direct Taxes (CBDT), over 2,400 search and seizure operations were conducted between 2014 and 2023, recovering over ₹50,000 crore in undisclosed income. In 2022-23 alone, the IT Department collected ₹16.61 lakh crore in direct taxes, marking a 17% rise from the previous year.

These numbers underline why businesses should pay attention. Raids are not isolated news—they’re part of a broader compliance crackdown.

Breaking Down the Agencies

The Income Tax Department (IT)

- Looks after income, corporate, and direct taxes.

- Powers include search, seizure, freezing assets, and issuing penalties.

- Primary goal: ensure taxes are properly filed and collected.

The Enforcement Directorate (ED)

- Functions under the Prevention of Money Laundering Act (PMLA), 2002.

- Tracks illicit money flows, cross-border scams, and foreign exchange violations.

- Can arrest individuals, attach properties, and prosecute in special courts.

Think of IT as the referee calling fouls in a game. The ED? They’re the federal investigators who bring the hammer down when rules are intentionally broken.

Impact of IT Raids Continue on Eastman Group and 10 Businesses on Businesses, Employees, and Sectors

1. Employees

Staff may face interrogations, long working hours during raids, and anxiety about job security. Morale usually takes a hit.

2. Investors

Markets dislike uncertainty. A raid can send stock prices tumbling and trigger panic among shareholders.

3. Suppliers and Vendors

Cash flow disruptions mean vendors may not get paid on time. This damages supply chain trust.

4. Sectors Hit the Hardest

- Real Estate: A favorite target due to heavy cash use.

- Manufacturing: Large firms with multiple vendors and cash-based deals face scrutiny.

- Startups: With foreign investors and rapid funding flows, startups risk falling under ED’s radar for compliance gaps.

Global Comparisons

United States (IRS)

The IRS Criminal Investigation Division collected over $5.7 billion from enforcement actions in 2022 alone. They aggressively target offshore accounts and unreported crypto holdings.

United Kingdom (HMRC)

HMRC’s fraud and tax evasion operations brought in £4 billion in 2022. Their focus has shifted to digital fraud and shell companies.

India’s Role

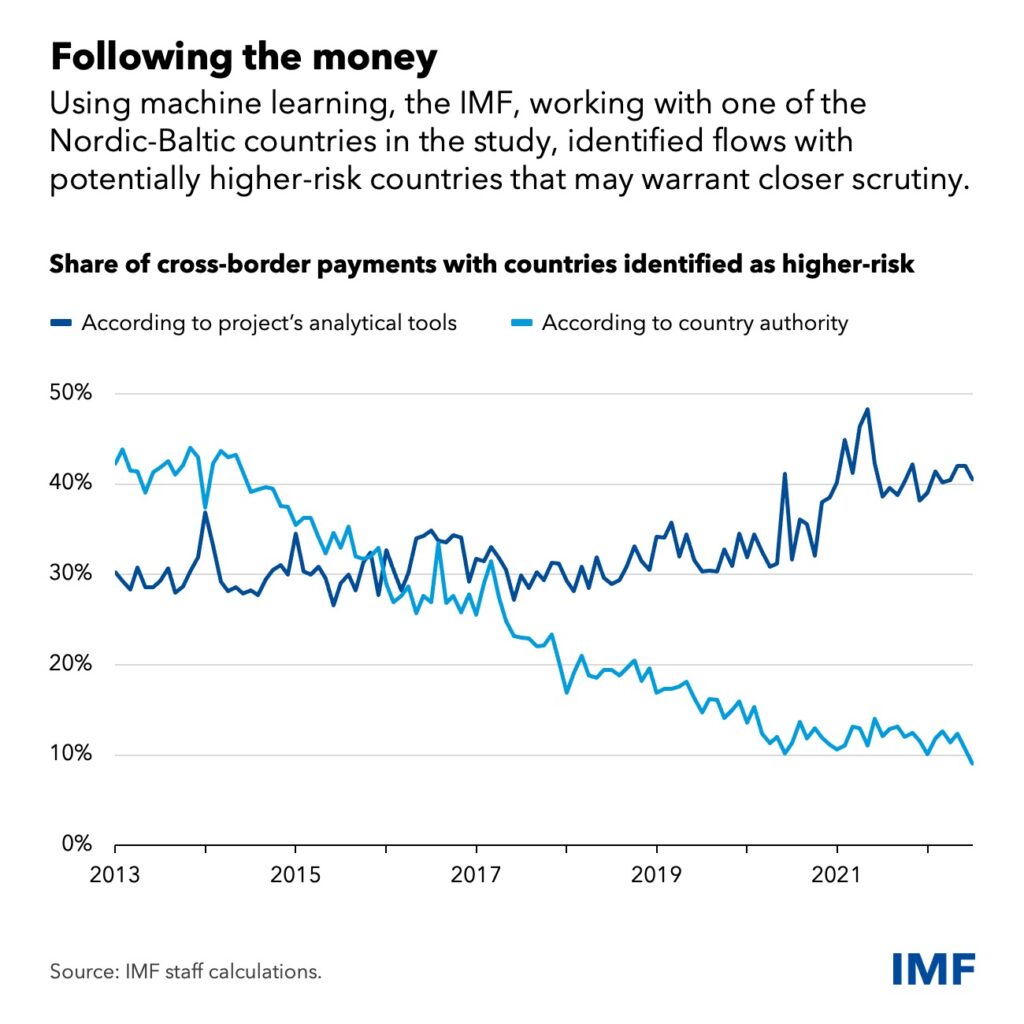

With OECD and FATF agreements, India now exchanges financial data globally, making it harder to hide money abroad.

The message worldwide? Transparency is the only safe bet.

Practical Advice for Professionals and Businesses

Keep Books Transparent

Messy books are like leaving food uncovered—trouble will find you. Reconcile accounts monthly and maintain digital records.

File Taxes Honestly

Avoid shortcuts. Legal deductions exist—claim them, but don’t cross into gray zones.

Document Deals

Every transaction should have a paper trail: contracts, invoices, receipts.

Train Your Staff

Employees handling finance should recognize red flags such as fake vendors or unusual fund transfers.

Legal Backup

Have a lawyer or compliance officer on standby. Waiting until the raid happens is too late.

Step-by-Step: What Happens During a Raid

- Surprise Entry: Teams arrive unannounced, often early morning.

- Premises Control: Phones, Wi-Fi, and movements may be restricted.

- Cash & Asset Check: Any large cash stash is noted and seized if unjustified.

- Seizure of Devices: Laptops, phones, USBs, and documents are collected.

- Employee Questioning: Accountants, CFOs, and key staff are interrogated.

- Follow-Up Proceedings: Show-cause notices and hearings follow.

- ED Involvement: If links to laundering surface, the ED escalates matters into criminal territory.

Case Study: Jaipur Real Estate Scam

In 2025, ED raided 17 locations in Jaipur, seizing ₹9 lakh in cash and multiple foreign investment documents. The probe revealed shell companies routing funds through overseas accounts. Lesson? Even medium-sized businesses are not safe if their funding trail looks suspicious.

Future Outlook: The Road Ahead

India is moving toward a zero-tolerance policy on tax evasion and money laundering. The combination of digital monitoring tools, AI-driven tax scrutiny, and global cooperation means businesses must rethink compliance.

The government is also pushing to expand its tax base, with direct tax collections expected to cross ₹20 lakh crore by 2026. For companies, this means clean practices are no longer optional—they’re survival tools.

Pro Tips Checklist for Business Leaders

- File income and corporate tax returns on time.

- Conduct yearly audits with independent firms.

- Avoid heavy cash transactions—use digital or bank channels.

- Keep contracts and invoices accessible for quick verification.

- Hire compliance officers if scaling beyond local markets.

₹332 Crore Bogus Copper Supply Scam Uncovered in Telangana Tax Fraud Raid

Former MP Ranjith Reddy Under IT Scanner After Tax Raids

Income Tax Department Raids Over 10 Locations Across Tamil Nadu