ITC Shares In Focus After GST 2.0: When it comes to stock market chatter in India, ITC shares in focus after GST 2.0 has been the headline lighting up every trading desk and retail investor group chat. Whether you’re a Wall Street-style trader glued to charts or a casual investor scrolling Groww or Zerodha, this tax shake-up is a big deal. So, what’s really going on with ITC and GST 2.0? Let’s unpack it in a way that’s clear enough for a 10-year-old yet sharp enough for a professional analyst.

ITC Shares In Focus After GST 2.0

The story of ITC shares in focus after GST 2.0 is one of balance. On one hand, FMCG and stationery businesses are set to shine under lower taxes. On the other, tobacco remains a wild card—but with potential long-term benefits from a cleaner tax structure. For investors, ITC remains a stable, dividend-paying giant with room for growth beyond cigarettes. Short-term swings will come, but the long-term story looks stronger than ever.

| Development | Impact on ITC | Data/Stats | Source/Reference |

|---|---|---|---|

| Simplified GST 2.0 | Lower tax rates for FMCG (biscuits, soaps, toothpaste, etc.) | GST slabs reduced to 5% & 18%; luxury/sin goods at 40% | Economic Times |

| Stationery Products Tax Relief | Boost to ITC’s Classmate & Paperkraft brands | GST reduced to Nil or 5% on notebooks, pencils, sharpeners | Upstox |

| Tobacco Taxation Shift | Short-term pain, long-term gain for cigarettes business | 28% GST + Cess continues; future 40% RSP-based slab | Economic Times |

| Market Reaction | ITC stock jumped 3.4% after GST relief clarity | Price at ₹425.70 on Sept 4, 2025 | Reuters |

GST: A Quick History Lesson

India rolled out GST 1.0 in 2017, combining multiple state and central taxes into one system. Back then, ITC shares tanked for a while because cigarette taxes shot up, and FMCG pricing confusion scared investors.

Fast forward to GST 2.0 in 2025, the government has learned a thing or two. Instead of confusing slabs like 12%, 18%, 28%, they now go with 5% and 18%—with a heavy 40% sin tax on cigarettes and luxury goods.

This time, the system is cleaner, easier for businesses, and better aligned with global practices.

1. FMCG Gets a Tax-Friendly Makeover

Everyday goods—like biscuits, atta, soaps, and toothpaste—are ITC’s bread and butter. Earlier, these items were slapped with 12–18% GST. Now, they’re down to 5%.

- Example: A ₹100 soap bar that earlier had ₹18 tax now has just ₹5 tax.

- Consumer Impact: More affordable essentials for millions of Indian households.

- Investor Impact: Higher demand, better margins, and stronger FMCG revenue share.

ITC’s FMCG segment already contributes over ₹20,000 crore annually in revenues. With lower taxes, the segment could see double-digit volume growth in the coming years, especially in rural markets where affordability drives consumption.

In plain English, ITC’s non-cigarette business just got turbocharged.

2. Stationery Gets a Lucky Break

If you’ve ever bought a Classmate notebook or a Paperkraft diary, you’ve supported ITC’s stationery division. Under GST 2.0, notebooks, pencils, and sharpeners now have Nil or 5% GST.

India has over 250 million school kids according to UNICEF. Even a ₹3–5 price cut per notebook means massive market potential. Parents who buy in bulk—especially during back-to-school season—will see visible savings.

For ITC, this means volume-led growth and a chance to dominate the education products space. The company already holds more than 25% market share in branded notebooks, and lower taxes could push that higher.

3. Cigarettes: Still a Tough Nut

Let’s face it—ITC = Cigarettes for most investors. The new 40% RSP-based slab on tobacco looks scary. But here’s the kicker:

- The old 28% GST + cess remains until states repay GST loans.

- Once the switch happens, analysts expect a 5% lower tax burden overall.

That’s like saying, “Hey, things may look bad now, but once the dust settles, ITC might actually pay less tax.”

Still, tobacco is always a regulatory risk. Governments can slap new levies like NCCD (National Calamity Duty) anytime. So, investors need to stay sharp.

Market Rollercoaster

Markets hate uncertainty but love clarity. ITC’s stock proved it:

- September 4, 2025: Up 3.4% (to ₹425.70) after GST clarity.

- September 5, 2025: Down 2% on worries about RSP taxation.

For long-term investors, volatility is just noise. The real game is in ITC’s diversification.

ITC Beyond Cigarettes: A Diversified Conglomerate

While cigarettes grab headlines, ITC is far more than a tobacco company.

- FMCG: Biscuits, noodles, personal care, household products.

- Hotels: ITC Hotels is one of India’s biggest luxury hospitality chains.

- Agri Business: ITC is a leading exporter of agri commodities like wheat, rice, and coffee.

- IT Services: Its subsidiary, ITC Infotech, provides global tech solutions.

This diversification is why investors often call ITC a “mini economy” in itself. Even if one sector struggles, others pick up the slack.

Global Perspective: How Does India Compare?

- USA: Cigarettes face state and federal excise taxes, sometimes exceeding 50% of retail price.

- EU: Average tobacco taxes exceed 60–70% of retail price.

- India (post-GST 2.0): Around 40% + cess/NCCD, aligning with global norms but still leaving ITC highly taxed.

On FMCG, India now competes better with low-tax nations, making ITC’s products more price-competitive.

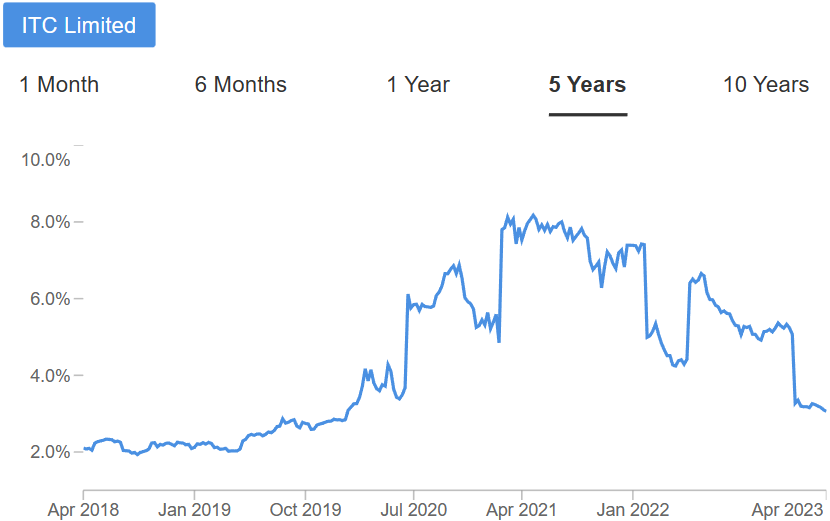

Historical Stock Performance

ITC has been one of India’s most debated stocks.

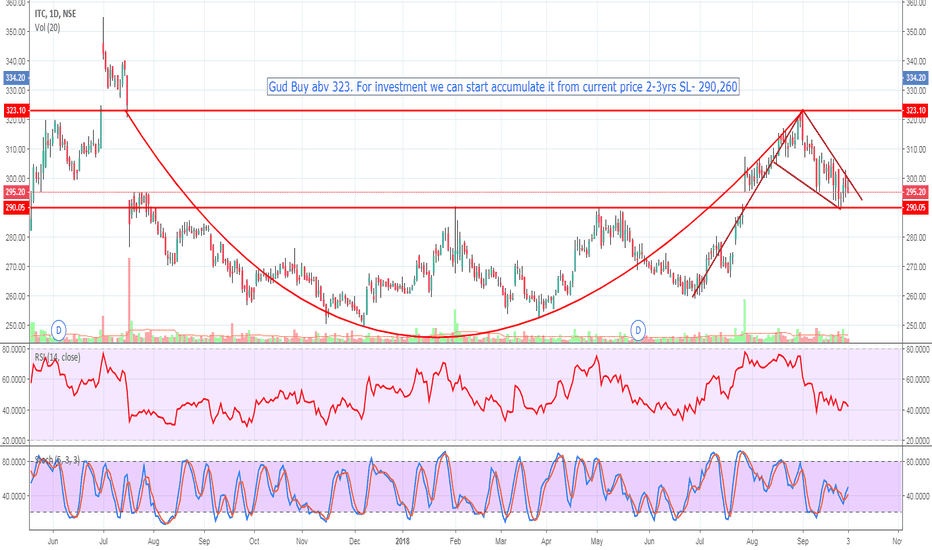

- 2017–2020: ITC’s stock stagnated around ₹200–230, as investors worried about cigarette taxes.

- 2021–2023: The stock rallied, crossing ₹400, fueled by FMCG growth and dividends.

- 2025: With GST 2.0, ITC finds itself again at the center of market debate.

Despite the ups and downs, ITC has delivered steady dividends, making it a safe haven for many.

Dividend Play: Why Investors Love ITC

ITC has been called the “dividend king of India.” It regularly pays 4–5% dividend yield, making it a sweet deal for long-term investors.

With FMCG and stationery margins improving under GST 2.0, ITC has more room to sustain or even increase dividends—a big plus for retirees and passive income seekers.

Investor Psychology: Why Retail Loves ITC

If you ask any Indian retail investor about ITC, chances are they hold it. Why?

- Safe, stable, dividend-paying.

- A stock you can “buy and forget.”

- Always in the news due to cigarette taxation, making it a conversation starter.

In behavioral finance terms, ITC represents a comfort stock—low-risk perception despite real risks.

Risks & Challenges

- Regulatory Risks: Any new tobacco levy could spook the market.

- ESG Pressure: Global funds often avoid tobacco-linked companies.

- Execution Risks: Can ITC scale biscuits and soaps fast enough to offset cigarette headwinds?

Step-by-Step Investor Guide

- Watch FMCG Growth: Check quarterly results for higher revenue share from non-cigarette businesses.

- Track Tobacco Taxation: Follow GST Council updates closely. Any relaxation = ITC stock bump.

- Dividend Check: If you’re income-focused, ITC’s dividend safety remains strong.

- Compare With Peers: Benchmark ITC against HUL, Nestlé, and Dabur for FMCG competitiveness.

Fake ITC & Duplicate GST Demand: Delhi HC Declines Writ, Orders Appeal Route

GST 2.0 Promises Consumption Boost – Can Lower Taxes Also Tame Inflation?

GST 2.0: How Modi’s Big Reform Could Boost Autos, FMCG, and Cement

Future Outlook

Analysts expect:

- FMCG growth of 12–15% CAGR over the next five years.

- Stationery business to benefit from rising literacy and education spend.

- Cigarettes to remain cash cows, but long-term ESG risks persist.

Put together, ITC could remain one of India’s most resilient conglomerates, balancing high-risk tobacco with high-growth FMCG.