ITR Filing 2025: When it comes to ITR filing in 2025, one question has become a hot topic among salaried folks, small investors, and retirees: “Can I claim Section 87A rebate on capital gains if my income is below ₹7 lakh?” The short answer is: Yes, you can claim it for FY 2024–25 (AY 2025–26). But the story doesn’t end there—new rules kick in next year, and if you don’t pay attention, you might miss out on valuable tax savings. Let’s unpack everything step by step.

ITR Filing 2025

For ITR Filing 2025 (FY 2024–25, AY 2025–26), you can claim Section 87A rebate on capital gains if your total taxable income is ₹7 lakh or less. Courts have confirmed it, and the law only changes next year. So if you qualify, don’t leave money on the table. File carefully, claim the rebate manually, and keep your documents ready. From FY 2025–26 onward, this window will close, so 2025 is your last chance to save tax on capital gains under Section 87A.

| Topic | Details |

|---|---|

| Rebate Amount (Section 87A) | Up to ₹25,000 if total income ≤ ₹7 lakh (New Tax Regime, FY 2024–25) |

| Capital Gains Included? | Yes – STCG (u/s 111A) and LTCG for FY 2024–25 |

| Court Rulings | ITAT Ahmedabad (Aug 2025) → Allowed rebate on STCG; ITAT Chennai (Aug 2025) → Allowed rebate on LTCG |

| Finance Act 2025 Update | From FY 2025–26, capital gains excluded from rebate |

| ITR Utility Issue | Portal may not auto-apply rebate; manual claim required |

| Applies To | Resident individuals under the new tax regime |

| Reference | Income Tax Official Website |

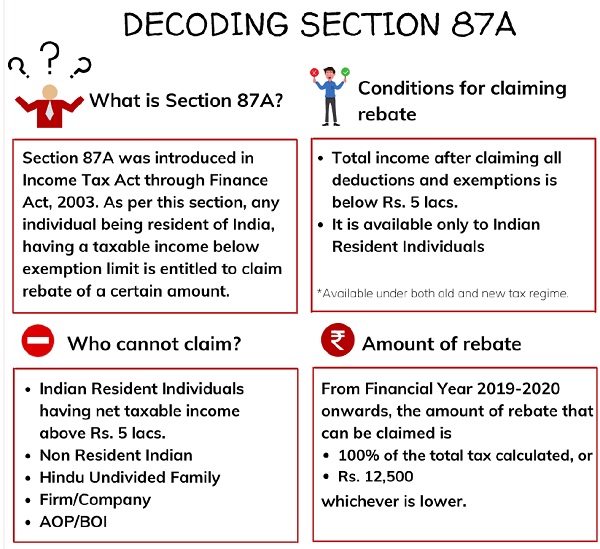

What Is Section 87A and Why Does It Matter?

Section 87A of the Income Tax Act is a rebate, not a deduction. That’s an important difference.

- Deductions (like 80C, 80D) reduce your taxable income.

- Rebate reduces your tax payable directly, after calculation.

Think of deductions as taking items out of your grocery cart to lower the bill, while rebate is like a coupon at checkout that wipes off the final amount.

For FY 2024–25 under the new regime, Section 87A allows taxpayers with income up to ₹7 lakh to reduce their tax liability to zero. That means if your total income, after all computations, is ₹7 lakh or less, you pay no income tax.

Where the Confusion Starts: Capital Gains

Capital gains are treated differently in tax law. Short-term capital gains (STCG) on listed equity are taxed at 15%, while long-term capital gains (LTCG) above ₹1 lakh are taxed at 10%.

Many believed since these are taxed separately, they wouldn’t qualify for the rebate. Even tax software wasn’t applying it automatically. That led to massive confusion.

But two major rulings in August 2025 cleared the fog:

- ITAT Ahmedabad Bench (August 12, 2025): Confirmed that STCG income can still qualify for Section 87A rebate.

- ITAT Chennai Bench (August 26, 2025): Extended the same principle to LTCG.

Their reasoning? Section 87A doesn’t exclude these incomes in FY 2024–25. Until the Finance Act explicitly changed it, the rebate must be allowed.

Example: How It Works

Say Priya earns ₹6 lakh salary and makes ₹70,000 in short-term stock gains.

- Total income = ₹6.7 lakh.

- Tax on ₹70,000 STCG = ₹10,500.

- Normally, she would owe tax.

- But since total income ≤ ₹7 lakh, she gets rebate up to ₹25,000 under Section 87A.

- Final tax = Zero.

This shows how small investors and salaried taxpayers can benefit for AY 2025–26.

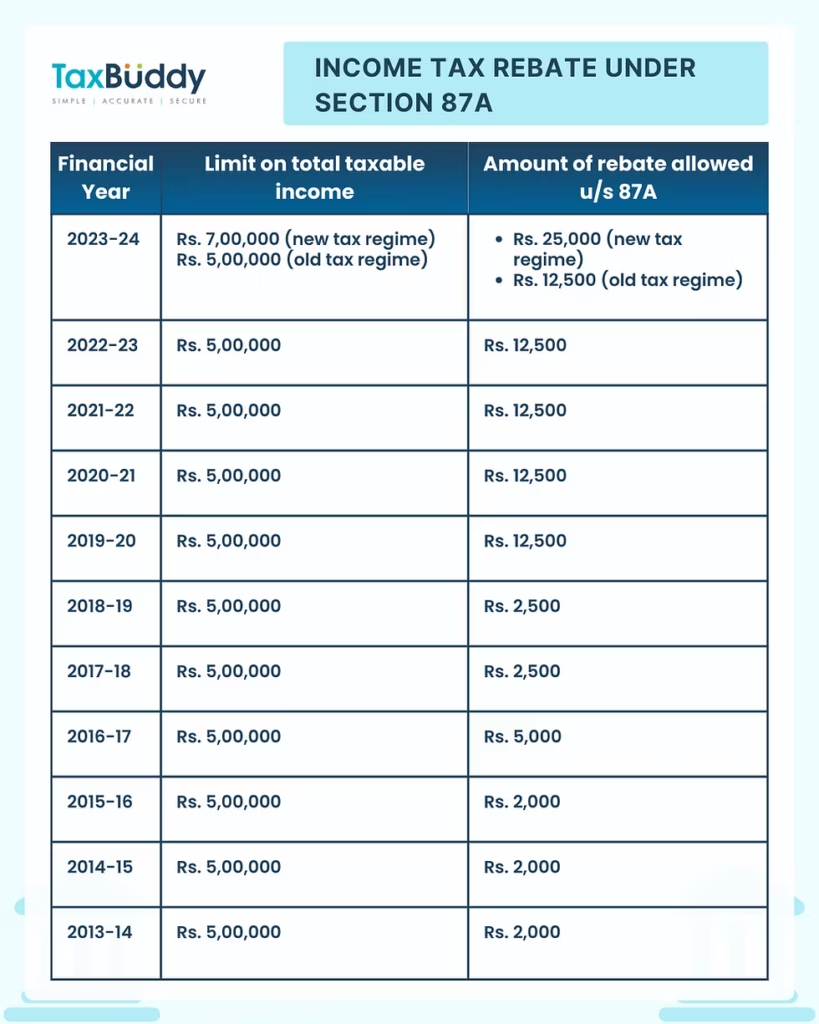

Old vs. New Tax Regime

This benefit is only available under the new tax regime. Here’s the difference:

- Old Regime: Rebate capped at ₹12,500, and only if income ≤ ₹5 lakh. More deductions allowed.

- New Regime: Rebate extended up to ₹25,000, with higher threshold of ₹7 lakh. Limited deductions, but lower slab rates.

For many middle-income earners who don’t have large deductions (like housing loan or 80C investments), the new regime with Section 87A rebate makes more sense.

What Changes in FY 2025–26?

Here’s the twist: the Finance Act 2025 amended Section 87A. Starting April 1, 2025, income taxed at special rates (STCG, LTCG, winnings from lotteries, etc.) will no longer qualify for the rebate.

That means:

- For FY 2024–25 → You can claim rebate on capital gains.

- From FY 2025–26 → Capital gains will be carved out, and you’ll pay tax even if your income is below ₹7 lakh.

So FY 2024–25 is a unique one-time window where capital gains still enjoy the rebate.

Professional Tip: Plan Ahead for FY 2025–26

While FY 2024–25 still allows you to claim the Section 87A rebate on capital gains, the writing is on the wall for next year. From FY 2025–26, capital gains will be carved out of rebate eligibility, meaning even if your income is under ₹7 lakh, you’ll still owe tax on STCG or LTCG.

So what’s the smart move? Start planning early. If you’re an investor, consider strategies like timing your gains, using the ₹1 lakh LTCG exemption limit, and balancing your portfolio with tax-efficient instruments like ELSS or NPS (if you choose the old regime). Salaried professionals should run a regime comparison each year to see which one actually reduces their tax bill.

By thinking one step ahead now, you’ll avoid surprises later and keep more money in your pocket.

Who Benefits the Most?

- Young salaried professionals with some stock investments.

- Small investors dabbling in mutual funds or equities.

- Senior citizens with limited pension plus some capital gains.

This group forms a large chunk of taxpayers. According to SEBI, India had over 8 crore demat accounts by 2025, many belonging to small investors. For them, Section 87A is a lifeline.

Step-by-Step ITR Filing 2025 Walkthrough

Filing your ITR can feel like assembling IKEA furniture—confusing until you break it down. Here’s how to do it for AY 2025–26.

Step 1: Collect Your Documents

- Form 16 (for salaried employees).

- Capital gains statement from your broker.

- Form 26AS and AIS (Annual Information Statement).

Step 2: Log In to the ITR Portal

Visit incometax.gov.in and start your return.

Step 3: Fill in Income Details

Include all sources—salary, interest, dividends, capital gains.

Step 4: Review Auto-Calculated Tax

The portal may show tax payable on capital gains. Don’t panic.

Step 5: Claim Section 87A Rebate

Manually apply rebate if total income ≤ ₹7 lakh.

Step 6: Validate, Preview, Submit

Cross-check everything before final submission.

Practical Mistakes to Avoid

- Assuming auto-calculation is always correct: Always check manually if rebate applies.

- Forgetting to verify AIS/TIS: Any mismatch can attract a notice.

- Switching regimes carelessly: Compare both old and new regimes before locking one.

- Waiting till the deadline: Late filing = penalties and interest.

Impact on Different Groups

Salaried Professionals

Employees earning ₹6–7 lakh can bring their tax to zero under Section 87A, even with capital gains.

Investors

Retail investors who booked modest gains this year stand to save thousands.

Senior Citizens

Pension plus investment income often totals under ₹7 lakh, so they too can benefit.

Data Snapshot

- Over 7.5 crore ITRs were filed in AY 2024–25 (CBDT).

- 8 crore+ demat accounts as of 2025 (SEBI).

- Most small investors fall under the ₹7 lakh income bracket.

Filing ITR This Year? – 4 Key Points Every Salaried Taxpayer Must Remember

ITR Filing 2025 Warning: 7 Common Issues Taxpayers Must Watch Out For

ITR-6 Excel Utility Released – Check If You Need to File This Year

Common Myths Busted

- Myth 1: Section 87A is an exemption.

Wrong. It’s a rebate after tax calculation. - Myth 2: It applies automatically to capital gains.

Wrong. You may need to apply it manually. - Myth 3: It applies in the old regime too.

Wrong. The higher ₹7 lakh rebate is only in the new regime.