ITR Filing September 15 Deadline: The ITR filing September 15 deadline for FY 2024–25 (AY 2025–26) is fast approaching, and taxpayers are once again asking: Will the government extend it further? From salaried employees and pensioners to freelancers and small business owners, millions of Indians are hoping for clarity. Taxes aren’t anyone’s favorite subject (we’d all rather watch the Yankees game or plan a weekend BBQ), but ignoring deadlines can cost you money and peace of mind. Whether you’re filing for the first time or you’ve been doing this for years, staying updated matters. This article gives you the context, expert advice, and practical steps to file confidently before time runs out.

ITR Filing September 15 Deadline

The ITR filing September 15 deadline is likely the final date this year. While professional bodies have raised concerns and sought more time, the government hasn’t indicated a willingness to extend again. Missing the deadline can lead to late fees, interest, and loss of tax benefits. The smartest strategy is to file early, double-check your details, and stay compliant. Filing isn’t just about avoiding penalties—it’s about faster refunds, smoother financial planning, and building trust with lenders, investors, and the system.

| Point | Details |

|---|---|

| Extended Deadline | September 15, 2025 (non-audit taxpayers) |

| Possible Further Extension? | None announced yet; requests pending |

| Late Fees (234F) | ₹5,000 if income > ₹5 lakh; ₹1,000 if income < ₹5 lakh |

| Interest Rules | Section 234A (late filing), 234B & 234C (advance tax) |

| Returns Processed So Far | 2.6 crore+ returns by Aug 2025 |

| Official Portal | Income Tax Department |

Why the Deadline Was Extended to September 15?

The government extended the original due date of July 31, 2025 to September 15, 2025, citing multiple reasons:

- Portal Glitches: Many taxpayers reported login issues and delays in pre-filled form updates.

- AIS and 26AS mismatches: Annual Information Statement and tax credit data often didn’t sync.

- New Reporting Standards: ICAI introduced updated audit and compliance formats that slowed down preparers.

- Natural Disruptions: Floods in Assam and landslides in Himachal impacted timely compliance.

Think of it like your professor giving you extra time because the library printer broke down and half the class couldn’t finish their projects.

Will the Government Extend It Again?

This is the million-dollar question. As of early September, CBDT has not announced any further extension. However, professional associations like the Chandigarh Chartered Accountants Taxation Association (CCTAX) and regional tax councils have officially requested more time. Their arguments include:

- Many ITR forms were notified late.

- AIS mismatches forced repeated corrections.

- Small businesses and professionals are still catching up post-utility updates.

But policymakers remain cautious. In fact, senior finance ministry officials told media outlets that repeated extensions disrupt refund timelines and weaken compliance culture.

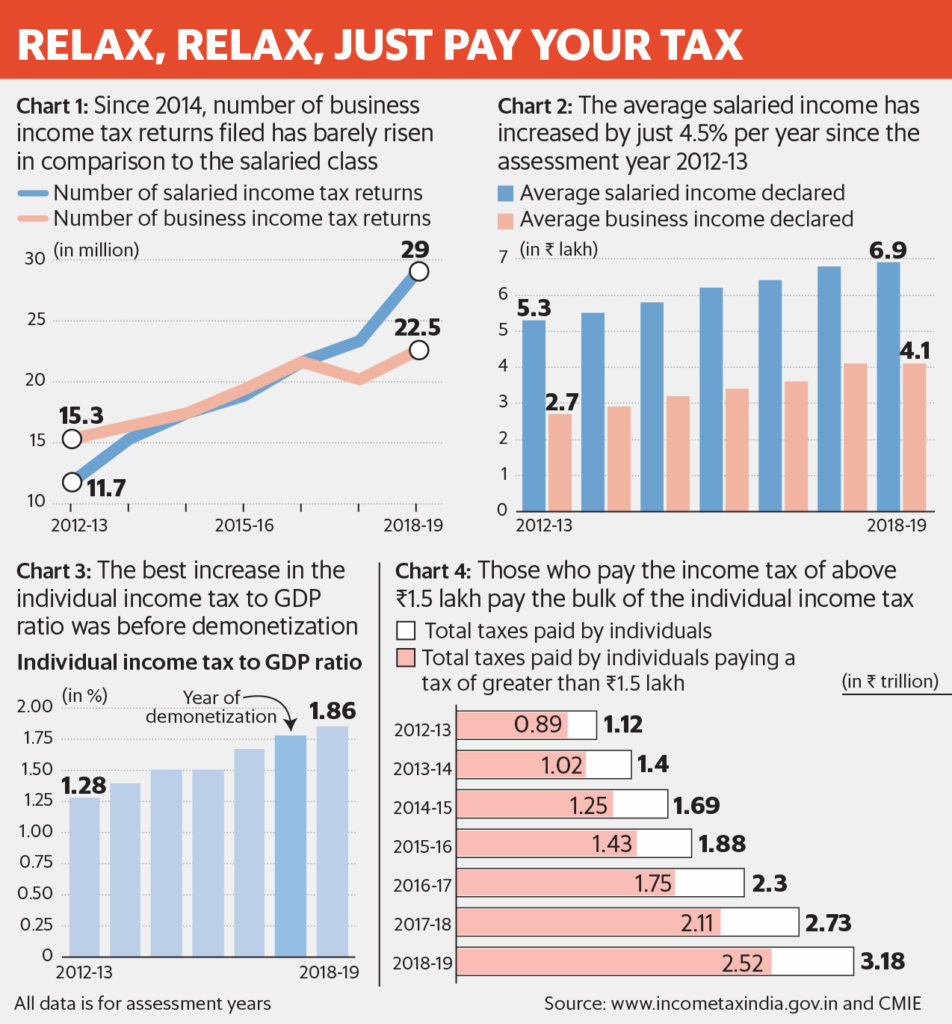

Historical Context

- 2020–21 (COVID years): Deadlines were extended multiple times due to lockdowns.

- 2022: Despite glitches, the government stuck to July 31 for most taxpayers.

- 2023 & 2024: Limited extensions were given, but primarily for technical categories, not for all taxpayers.

The trend suggests that unless there’s a major disruption, September 15 is likely the final date.

What If You Miss the ITR Filing September 15 Deadline?

Missing the date isn’t the end of the world, but it does have consequences:

- Late Filing Fees (Section 234F):

- ₹5,000 if total income exceeds ₹5 lakh.

- ₹1,000 if income is below ₹5 lakh.

- Interest under Section 234A:

- Charged at 1% per month (or part thereof) on unpaid tax.

- Example: If you owe ₹50,000 in tax and file one month late, you’ll pay an extra ₹500.

- Advance Tax Interest (Sections 234B & 234C):

- Applies if you didn’t pay 90% of your tax liability by March 15.

- Example: A consultant owing ₹2 lakh but paying only ₹50,000 as advance tax will face interest penalties.

- Loss Carry Forward Restriction:

- You cannot carry forward business or capital losses if you file late.

- For stock market investors, this can be a big hit.

Yes, you can still file a belated return until December 31, 2025, but the financial sting makes it less appealing.

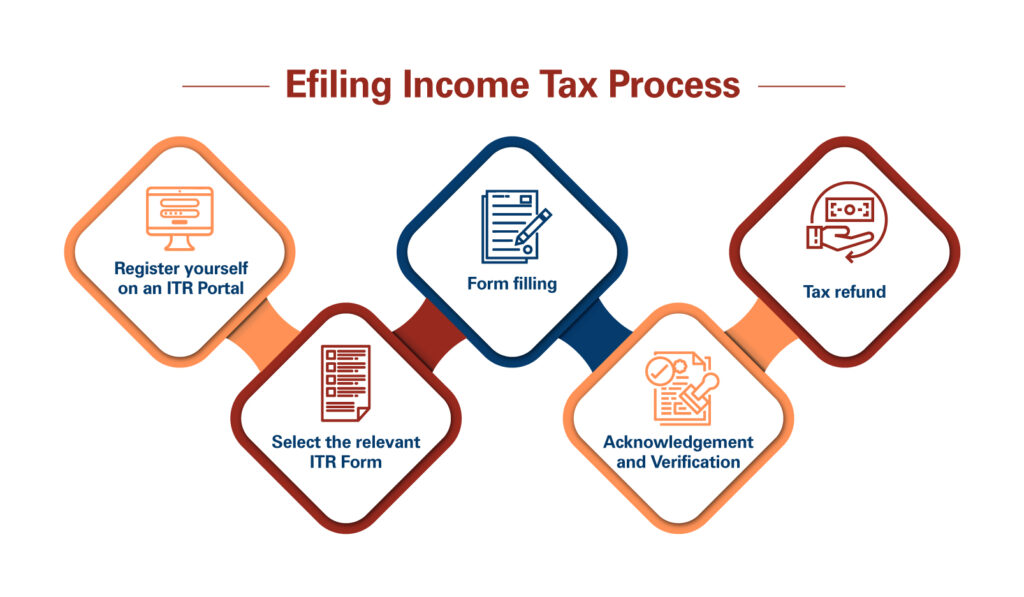

Step-by-Step Guide to Filing Before September 15

Step 1: Collect Your Documents

Form 16, AIS, Form 26AS, bank statements, investment proofs, rent receipts, and home loan certificates.

Step 2: Calculate Your Taxable Income

Add salary, business income, capital gains, and even small amounts like savings account interest.

Step 3: Apply Deductions & Exemptions

- Section 80C: PF, PPF, ELSS, insurance premiums

- Section 80D: Health insurance

- Section 24(b): Home loan interest

Step 4: Pay Self-Assessment Tax

Clear dues before filing. Use Challan 280 on the portal.

Step 5: File via the Portal

Visit the Income Tax e-filing website and file through pre-filled forms or upload JSON.

Step 6: E-Verify

Your return isn’t valid until verified via Aadhaar OTP, net banking, or Demat.

Why Filing Early Is a Smart Financial Habit?

tFiling your income tax return before the deadline isn’t just about dodging penalties—it’s a powerful financial habit. When you file early, your return gets processed faster, which means quicker refunds. That money can be redirected into investments, debt repayment, or even emergency savings. On the flip side, last-minute filers often run into portal slowdowns, form mismatches, and banking delays. Think of it like catching a morning flight: fewer crowds, smoother boarding, less stress.

Early filing also gives you time to fix mistakes. Maybe your Form 26AS doesn’t match your AIS, or your employer’s TDS entry is missing—filing early lets you raise corrections without racing against the clock. For professionals and small businesses, timely filing also builds credibility with banks and investors. Simply put, the earlier you file, the better control you have over your finances and peace of mind.

Real-World Scenarios

- Ravi (Salaried Employee): Files early, gets refund within 30 days, uses it to prepay part of his car loan.

- Ananya (Freelancer): Waits until the last day, portal glitches force her into late filing, and she ends up paying ₹6,000 extra in penalty + interest.

- Mr. Khan (Small Business Owner): Misses September 15, can’t carry forward his ₹5 lakh loss, loses out on saving future tax.

Lesson? Filing early isn’t just smart—it’s financially rewarding.

Practical Tips to Make Filing Easier

- Don’t wait until September 14 night—portal traffic skyrockets.

- Cross-check Form 26AS and AIS for mismatches.

- Keep proof of deductions ready for future scrutiny.

- Use professional help if you have multiple income streams.

Professional Insights

Chartered Accountants say that “most compliance challenges stem not from complexity, but from taxpayers waiting until the last minute.” The CBDT also encourages early filing, noting that refund processing is much faster for returns filed in August compared to September.

How Does India Compare Globally?

In the U.S., taxpayers face the April 15 deadline. Extensions to October are common, but interest accrues if tax isn’t prepaid. The message is universal: deadlines matter, and extensions aren’t freebies.

India’s September 15 deadline plays a similar role—miss it, and you risk penalties, slower refunds, and compliance headaches.

Before You File: Quick Checklist

- Confirm AIS and Form 26AS match.

- Pay pending self-assessment tax.

- Gather proof of deductions under Sections 80C, 80D, and 24(b).

- Choose the correct ITR form.

- Complete e-verification within 30 days of filing.

Kerala Claims Corruption Almost Nil As Most Taxpayers Stay Honest

GST Amnesty Scheme Alert — Must-Read Advisory for All Registered Taxpayers