ITR Refund Delayed: If you’re one of the millions of taxpayers who filed your Income Tax Return (ITR) expecting a refund, but find yourself waiting much longer than anticipated, you’re likely wondering: Why is it taking so long? And how can you track the status of your refund? In this guide, we’ll explore the reasons behind these delays, offer practical advice for tracking your refund, and provide helpful tips to ensure smoother experiences in the future.

ITR Refund Delayed

ITR refunds are an essential part of the tax filing process, and delays can be frustrating. However, understanding the common reasons for delays, how to track your refund, and steps to avoid future issues can help make the process smoother. Stay on top of your verification, ensure accurate details, and don’t hesitate to reach out for assistance if necessary.

| Key Point | Details |

|---|---|

| Why Refunds Are Delayed | Increased scrutiny by tax departments, technical issues with ITR forms, pending verifications, and bank account mismatches are the main causes of delays. |

| Tracking Your Refund | Use the official Income Tax e-Filing Portal to track the status, including ‘Refund Paid’, ‘Refund Failed’, ‘Refund Adjusted’, and ‘Refund Pending’. |

| Steps to Avoid Delays | Ensure ITR verification, pre-validate your bank account, fix technical issues in your forms, and promptly respond to notices from the Income Tax Department. |

| Interest on Delayed Refunds | Taxpayers are entitled to interest under Section 244A if their refund is delayed beyond the prescribed time. |

| Official Resources | Visit the Income Tax Department’s website for more details and tracking your refund. |

| Common Reasons for Refund Delays | Pending ITR verification, increased scrutiny, mismatch of bank details, and outstanding tax liabilities. |

Why Is My ITR Refund Delayed?

Filing your ITR is a crucial task each year, and once it’s done, most taxpayers look forward to their refund. Ideally, it should take around 4-5 weeks after submission for the tax department to process and issue the refund. But, in reality, many people face delays. Here are some of the most common reasons:

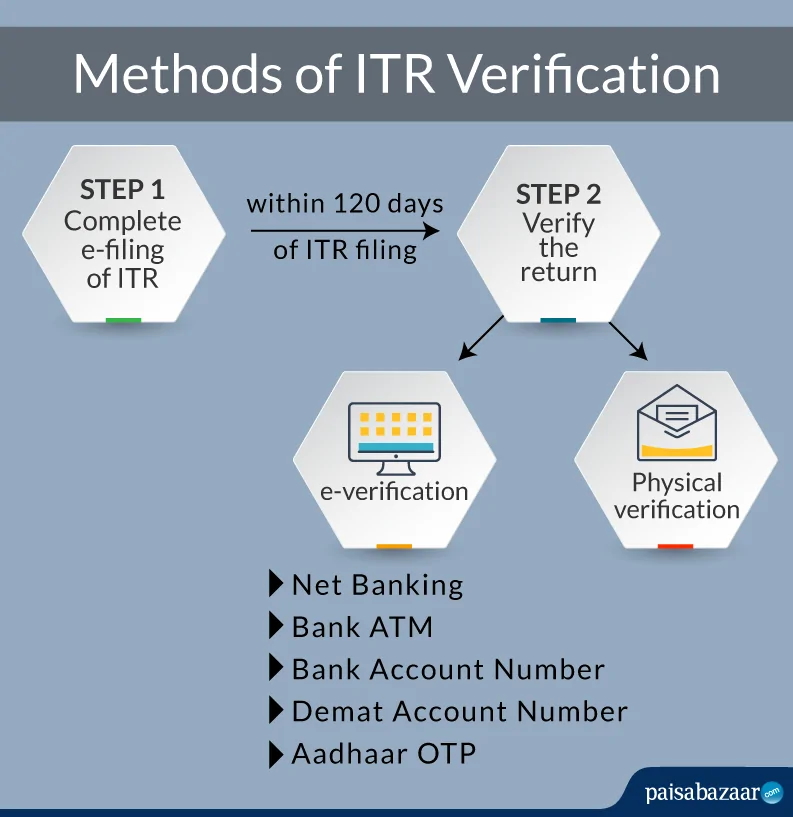

1. Pending ITR Verification

You might think that filing your return is the last step in the process, but there’s one more thing to do: verify it. If you haven’t verified your ITR within 30 days of filing, the return is considered invalid, and the refund process is halted. You can verify your return through various methods like Aadhaar OTP, EVC (Electronic Verification Code), or by physically sending a signed ITR-V form to the Centralized Processing Centre in Bengaluru.

If you’ve missed this crucial step, your refund won’t be processed until verification is completed. Check your email for reminders from the Income Tax Department to verify your return!

2. Increased Scrutiny by the Tax Department

In recent years, the Income Tax Department has stepped up its efforts to ensure that returns are filed accurately and comply with all the rules. As a result, returns are being subjected to more scrutiny, which can cause delays in processing. If your ITR has been flagged for any potential discrepancies, or if there’s a need for additional documents or clarifications, your refund may be delayed.

3. Outstanding Tax Liabilities

If you have any pending tax liabilities from previous years, your refund might be withheld until those dues are cleared. The tax department can adjust your refund against outstanding dues under Section 245(2) of the Income Tax Act. So, if you haven’t cleared your dues or have pending assessments, it’s worth checking your history with the department to see if any adjustments are being made.

4. Technical Issues with ITR Forms

Sometimes, it’s the little things that cause the biggest delays. If there are discrepancies or errors in your ITR form, such as mismatched values in the Schedule Brought Forward Loss Adjustment (BFLA) or Schedule Carry Forward Loss (CFL), this can lead to rejection or further scrutiny of your return. It’s always a good idea to double-check your details before filing and ensure there are no errors that could lead to delays or complications.

5. Bank Account Details Mismatch

When you provide your bank account details for the refund, make sure that the information is accurate and the account is pre-validated on the e-filing portal. If your account details are incorrect or don’t match the name on your PAN card, your refund might fail. To avoid this, ensure your bank account is linked to your PAN and double-check all information before submitting your ITR.

Understanding the Refund Processing Timeline

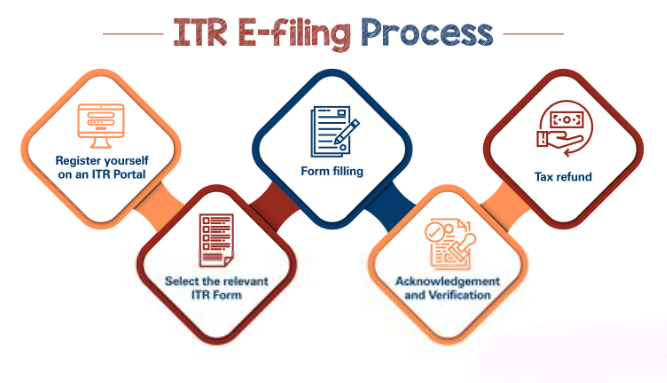

The refund process isn’t immediate, and it’s important to understand the timeline. Here’s a simple breakdown of the steps involved:

- Filing Your Return: Once you file your ITR, the first step is for the tax department to acknowledge your return. If you’ve filed electronically, this should happen almost immediately.

- ITR Verification: After filing, you must verify your ITR. If this is done online, it’s usually instant, but if you’re sending an ITR-V form by mail, it might take a few days to process.

- Processing by CPC Bengaluru: After verification, your return is sent for processing to the Centralized Processing Centre (CPC) in Bengaluru. This is where the tax department checks your return for any errors, inconsistencies, or discrepancies.

- Issuance of Refund: Once the processing is complete, and if everything checks out, your refund is issued. This usually happens within 4-5 weeks after processing, provided there are no issues.

- Bank Processing: After the refund is issued, it usually takes 2-3 business days for the bank to process and credit the amount to your account. Make sure your bank account details are accurate to avoid any delays at this stage.

How to Track Your ITR Refund Status?

Tracking your refund status is easy, and it’s something you can do right from your phone or computer. Here’s a simple guide to tracking the status of your ITR refund:

1. Log into the Income Tax e-Filing Portal

Go to the official Income Tax website www.incometax.gov.in. Log in with your credentials.

2. Navigate to the ‘View Filed Returns’ Section

Once you’re logged in, go to the ‘e-File’ tab and click on ‘Income Tax Returns.’ Under this section, you’ll find the option to view the details of the returns you’ve filed.

3. Select the Relevant Assessment Year

Choose the assessment year for which you want to check the refund status. You’ll be able to see the status of your refund there.

4. Check the Refund Status

You’ll see one of the following statuses:

- Refund Paid: Your refund has been issued.

- Refund Failed: The refund could not be credited, typically due to incorrect bank details or an inactive account.

- Refund Adjusted: The refund was adjusted against outstanding dues.

- Refund Pending: Your refund is still being processed.

If your refund is listed as “Refund Pending,” keep an eye on your email for any updates or notifications. You can also check back on the portal after a few days for updates.

Real-Life Examples of Common Refund-Related Mistakes

Sometimes, real-life examples can help you avoid common pitfalls. Here are a few stories of people who experienced delays due to mistakes that could have been avoided:

1. Missed ITR Verification

Sarah filed her ITR and assumed the process was done. However, she forgot to verify her return. Two months later, she found out her refund was delayed because her return was invalid without verification. After verifying her return, it took an additional 2 weeks to process her refund.

2. Bank Account Mismatch

John, who had recently switched banks, entered his old bank details in his ITR form. The result? His refund was marked as “Refund Failed.” He had to update his account details and wait another week before receiving his refund.

3. Mismatched Data

Amit didn’t match his income details properly in his ITR, which led to the tax department flagging his return for discrepancies. It took him weeks to respond to notices and provide clarification, causing a significant delay in his refund.

Checklist for a Smooth ITR Filing and Refund Process

- Verify Your ITR Immediately After Filing: Don’t wait! Make sure you verify your return within 30 days of filing.

- Double-Check Your Bank Account Details: Ensure that the bank account information is correct and pre-validated.

- Review Your ITR Form for Accuracy: Before submitting, go through your ITR form to ensure there are no mistakes.

- Respond to Notices Promptly: If you receive any notices from the Income Tax Department, respond as soon as possible to avoid delays.

- Keep Track of Your Refund Status: Use the e-filing portal regularly to check the status and ensure there are no issues.

Half-Yearly Income Tax Digest 2025: Key ITAT Decisions Every Taxpayer Should Know

Big Win for Bus Services: CESTAT Grants Service Tax Exemption for Employee & School Transport

2025’s Most Important ITAT Rulings: Half-Yearly Income Tax Case Digest Reveals Critical Insights