ITR-U Explained: Filing taxes is like walking a tightrope—you prepare carefully, but sometimes you wobble. Maybe you forgot to include bank interest, maybe your employer reported TDS wrong, or maybe you realized months later that you missed disclosing that side hustle income. It happens to the best of us. That’s where ITR-U (Updated Income Tax Return) comes in. Introduced under Section 139(8A) of the Income Tax Act, ITR-U allows taxpayers to fix errors, disclose omitted income, or file missed returns—up to four years late. The Finance Act 2025 extended this window from two years to four, giving taxpayers more breathing space to come clean voluntarily.

ITR-U Explained

The ITR-U (Updated Income Tax Return) is India’s formal mechanism for taxpayers to correct mistakes, file missed returns, and disclose previously unreported income—up to four years late. While the flexibility is welcome, the cost of waiting increases steeply, with 25% to 70% extra tax depending on delay. For professionals, individuals, and businesses alike, the lesson is clear: use ITR-U wisely, file early, and stay compliant. It’s always better to fix things voluntarily than to wait for a tax notice to land in your inbox.

| Topic | Details |

|---|---|

| What is ITR-U? | A special return under Section 139(8A) to fix mistakes or omissions in previously filed tax returns. |

| Introduced | Union Budget 2022 (initially 2 years), extended to 4 years in Finance Act 2025. |

| Time Limit | File up to 4 years from the end of the relevant assessment year. |

| Extra Charges | Additional tax of 25%–70% of unpaid tax + interest, depending on delay. |

| Common Fixes | Missed freelance income, unreported bank interest, incorrect TDS, omitted rental or capital gains. |

| Who Can File? | Individuals, HUFs, firms, companies, LLPs, AOPs, BOIs—but not if under scrutiny or seeking refunds. |

| Refund Allowed? | No. ITR-U is only for disclosure of additional income and tax. |

| Official Resource | Income Tax Department Website |

Why Was ITR-U Introduced?

Before ITR-U, once the due date or revised return deadline passed, taxpayers had no formal mechanism to correct mistakes. Many ended up facing scrutiny, penalties, or even prosecution.

Recognizing this, the Union Budget 2022 introduced the concept of Updated Returns—a formal way for taxpayers to voluntarily correct themselves. The idea was simple: increase compliance by making it easier (and less scary) to fix mistakes, while boosting government revenue.

Initially, the window was 2 years. But professionals and businesses with complex accounts argued that wasn’t enough. With the Finance Act 2025, the government doubled it to 4 years.

The impact was immediate. In FY 2023-24, more than 1.3 crore taxpayers used ITR-U, resulting in thousands of crores of additional tax collection, according to reports in the Economic Times. This proves ITR-U has become a vital part of India’s tax ecosystem.

How ITR-U Compares Internationally

India isn’t the only country that lets taxpayers fix mistakes. But the timelines differ:

- USA (IRS): You can file an Amended Return (Form 1040X) within 3 years.

- UK (HMRC): Allows changes within 12 months; beyond that, special requests are needed.

- Canada (CRA): Offers up to 10 years to adjust returns.

India’s 4-year allowance places it in the middle range. It shows a balance—giving taxpayers enough time, but not unlimited freedom.

Who Can File ITR-U?

ITR-U is open to a wide range of taxpayers:

- Individuals and Salaried Employees – who may have missed side income, rental income, or interest.

- Businesses, Firms, and Companies – that discovered accounting errors or underreported turnover.

- NRIs (Non-Resident Indians) – with missed disclosures of Indian income.

Who Cannot File ITR-U?

- Taxpayers who want to reduce their tax liability or claim a refund.

- Those wanting to report a loss for carry-forward benefits.

- Cases already under search, seizure, or prosecution proceedings.

- Taxpayers who have already filed an ITR-U for the same year.

Real-Life Examples of ITR-U Use

- The Freelancer: Ramesh, a salaried IT professional, also earned ₹2 lakh freelancing. He forgot to report it. Two years later, he files ITR-U, pays tax plus 50% additional liability, and avoids future scrutiny.

- The Retiree: Mrs. Mehra forgot to include savings account interest and FD interest worth ₹40,000. She filed ITR-U within 12 months, paid 25% extra, and closed the matter.

- The Business Owner: A small manufacturer discovered an accounting mismatch for FY 2021-22. Using ITR-U in 2025, they corrected records and avoided penalties.

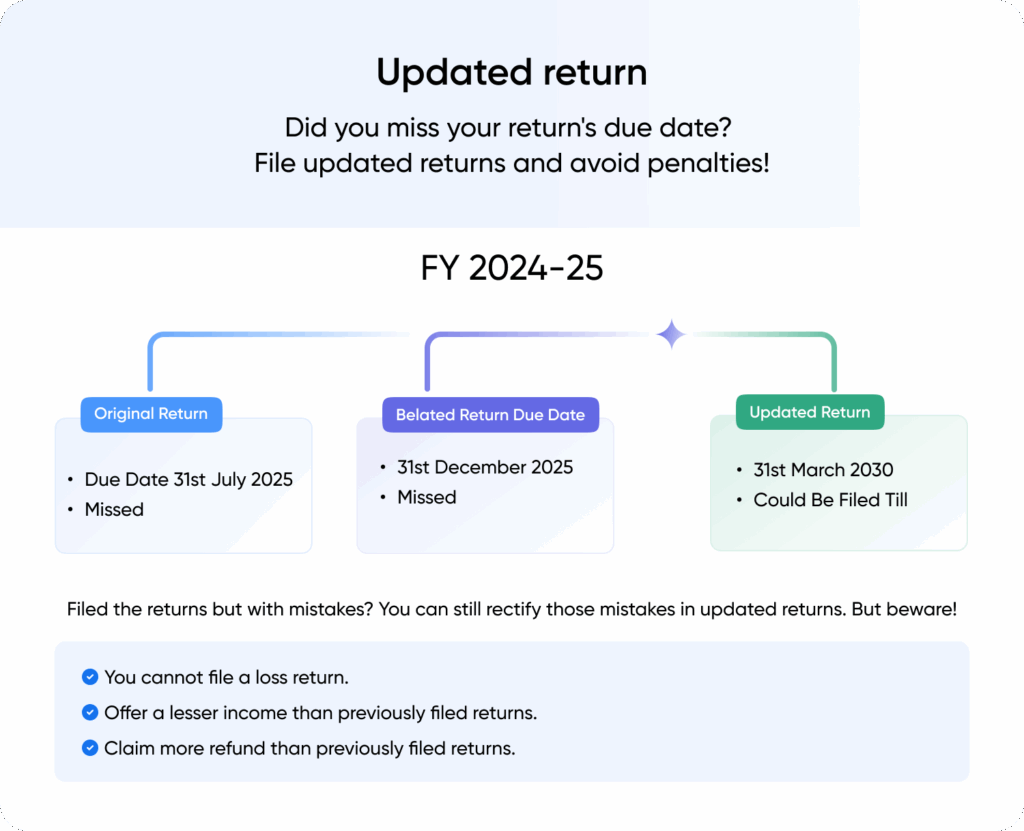

Filing Timeline and Deadlines

Here’s how the new 4-year limit works:

- AY 2022-23 (FY 2021-22): File until March 31, 2027.

- AY 2023-24 (FY 2022-23): File until March 31, 2028.

This means you can go back four years from the end of the relevant assessment year.

The Cost of Filing ITR-U: Additional Tax Liability

The government doesn’t let you off easy. Filing ITR-U means paying:

- The original tax due

- Interest on unpaid tax

- An additional tax penalty, based on delay:

- Within 12 months: 25% extra

- Within 24 months: 50% extra

- Within 36 months: 60% extra

- Within 48 months: 70% extra

This escalating scale encourages early disclosure. Waiting until year four makes it significantly more expensive.

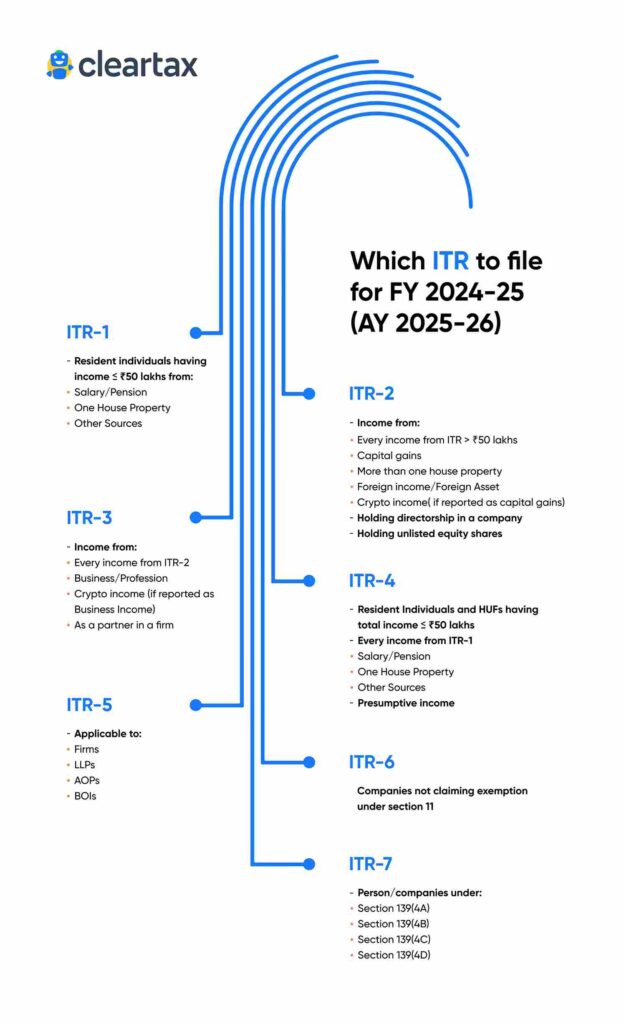

Step-by-Step Guide to Filing ITR-U Explained

- Log in to the Income Tax Portal.

- Select “File Income Tax Return.”

- Choose Assessment Year you want to update.

- Select ITR-U as the return type.

- Pick the Correct ITR Form (ITR-1, 2, 3, or 4).

- Fill in Updated Details – add missed income, correct errors.

- Pay Additional Tax + Interest – calculated automatically.

- Submit and Verify – using Aadhaar OTP, net banking, or digital signature.

Professional Advice: DIY vs. Hire an Expert

For simple cases—like missed savings interest or freelance income—most taxpayers can file ITR-U themselves using the online portal.

But for complex filings involving business income, overseas earnings, or capital gains, hiring a Chartered Accountant (CA) is wise. Professional advice ensures accuracy, reduces risk of errors, and provides peace of mind.

Common Mistakes Fixed with ITR-U

- Missed Freelance or Consulting Income

- Unreported Savings Bank or FD Interest

- Incorrect TDS Credits

- Forgotten Capital Gains on Stocks or Property

- Rental Income not included

- Incorrect classification of deductions

Quick Do’s and Don’ts Checklist

Do’s:

- File as early as possible to minimize penalties.

- Always cross-check Form 26AS and AIS before filing.

- Maintain income records, bank statements, and proof of earnings.

- Use official calculators and the tax portal to avoid mistakes.

Don’ts:

- Don’t use ITR-U to claim refunds—you can’t.

- Don’t file ITR-U more than once for the same year.

- Don’t wait until the last year unless absolutely necessary.

- Don’t underreport intentionally—misuse can lead to prosecution.

ITR-6 Excel Utility Released – Check If You Need to File This Year

ITR Refund Delayed? Here’s Why It’s Taking Longer and How You Can Track Your Status

Big Win for Taxpayers: Supreme Court Dismisses SLP Against GST Order on ECL Blocking