Jaipur Land Scam: The Jaipur Land Scam has put India’s real estate sector under the spotlight again. The Enforcement Directorate (ED) recently raided 12 sites across Jaipur, uncovering evidence of black money laundering, benami deals, and links to shell companies abroad. This isn’t just another corruption story—it’s a reflection of how hidden wealth can distort markets, cheat governments out of revenue, and ultimately affect ordinary citizens. Whether you’re a homeowner, investor, or just curious, understanding the details of this case can help you make sense of the bigger picture.

Jaipur Land Scam

The Jaipur Land Scam isn’t just a local scandal—it’s a warning sign. It shows how corruption in real estate can distort entire economies, hurt honest buyers, and shake investor confidence. For India, this case highlights the urgent need for better enforcement, transparent real estate regulations, and stricter penalties. For everyday citizens, it’s a reminder: stay vigilant, demand transparency, and always double-check your deals. Black money may seem like someone else’s problem, but its impact—higher prices, fewer public services, weaker trust—hits everyone.

| Aspect | Details |

|---|---|

| Operation | ED raided 12 sites in Jaipur under the Prevention of Money Laundering Act (PMLA). |

| Main Accused | Gyan Chand Agarwal (200+ pending cases, 3 arrest warrants), with associates Jugal Kishor Derawala, Dalpat Singh, Govardhan Agarwal, and Anil Jain. |

| Seizures | ₹9 lakh cash, laptops, phones, and financial documents linked to foreign transactions. |

| Foreign Links | Shell companies in Dubai, Singapore, Cyprus, and Hong Kong. |

| Legal Framework | PMLA (2002), Benami Transactions (Prohibition) Act (1988, amended 2016). |

| Official Source | Enforcement Directorate (ED) |

What Happened in the Jaipur Land Scam?

On September 4, 2025, the ED carried out raids at 12 locations in Jaipur. The operation targeted real estate developers and businessmen accused of creating a web of fraudulent property transactions.

At the center of this is Gyan Chand Agarwal, a man infamous in Rajasthan’s business circles. With more than 200 legal cases pending against him—ranging from forgery to land grabbing—and three outstanding arrest warrants, Agarwal represents how unchecked fraud can fester for years.

The ED also listed names like Jugal Kishor Derawala, Dalpat Singh, Govardhan Agarwal, and Anil Jain as associates in the racket. Together, they allegedly laundered huge sums of money through benami properties and offshore accounts.

Black Money and Benami Deals Explained

What is Black Money?

Black money is income that is not reported to tax authorities. In the U.S., you’d call it unreported income—money that skips the IRS. In India, this often shows up in real estate deals, gold, or cash stashes.

Example: If a buyer pays $1 million for a property but records only $500,000 officially, the remaining $500,000 becomes black money.

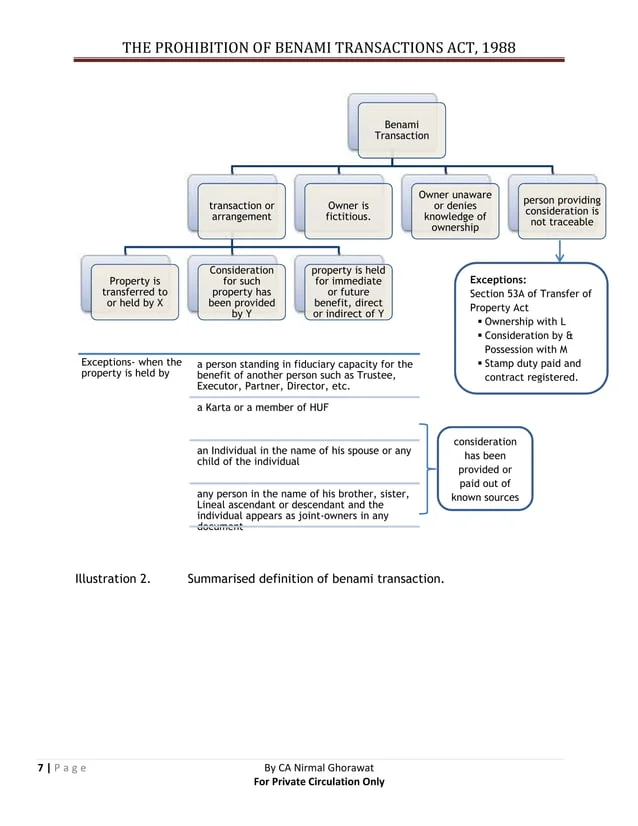

What are Benami Deals?

A benami deal means buying property in someone else’s name—like a driver, cousin, or even a fake identity—while the actual owner controls it secretly. The Benami Transactions (Prohibition) Act makes this illegal, but it’s still common.

In Jaipur’s case, the ED suspects benami land ownership tied to shell companies in Dubai, Singapore, Cyprus, and Hong Kong, a classic way to “round trip” money back into India as “foreign investment.”

What Did the ED Find?

The raids yielded:

- ₹9 lakh in cash (about $10,800 USD).

- Financial records linking Jaipur-based firms to overseas investments.

- Electronic evidence like laptops, phones, and USBs.

Investigators are analyzing these to trace money trails and expose networks of global money laundering.

Why This Jaipur Land Scam Matters for Everyone?

This isn’t a case limited to a few businessmen. It affects the wider economy and everyday lives.

- Housing Affordability – Illegal money inflates land prices, pushing homes beyond the reach of middle-class buyers.

- Lost Taxes – Billions siphoned away could fund hospitals, schools, or roads.

- Economic Reputation – Frequent scams hurt India’s image with global investors.

- Trust Deficit – When corruption dominates headlines, public faith in institutions erodes.

Globally, the UNODC estimates 2–5% of world GDP ($800 billion–$2 trillion) is laundered annually. India’s scams contribute significantly to this massive figure.

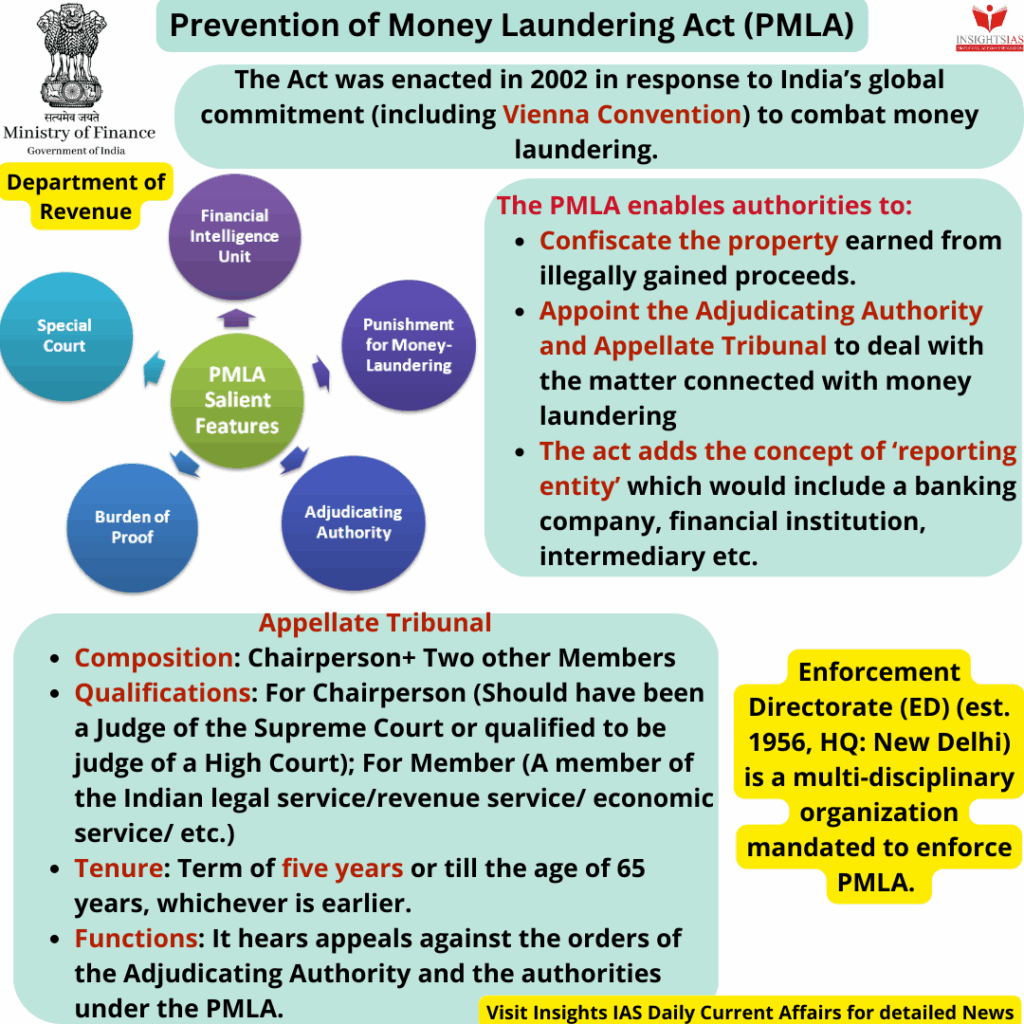

Legal Framework in India

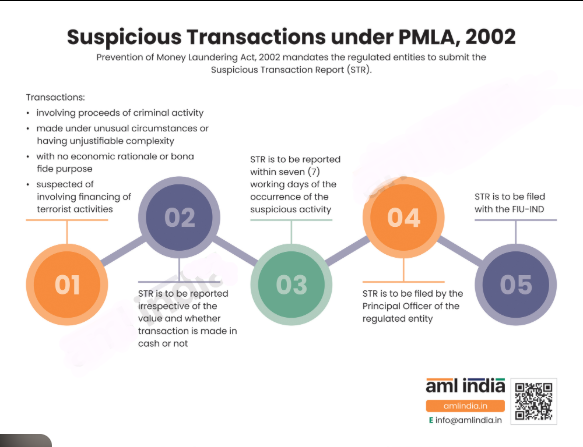

India uses a mix of strict laws to fight financial crimes:

- Prevention of Money Laundering Act (PMLA), 2002 – Empowers ED to seize assets, freeze accounts, and file charges.

- Benami Transactions (Prohibition) Act, 1988 (amended 2016) – Criminalizes hiding wealth under another’s name.

- Income Tax Act – Imposes heavy penalties on unreported assets.

These laws resemble frameworks in the U.S., where FinCEN monitors suspicious property deals and enforces anti-money laundering (AML) norms.

Past Scams and Global Connections

The Jaipur scam is part of a larger pattern. Some infamous cases include:

- Adarsh Housing Scam (India, 2010) – Flats meant for war widows were cornered by politicians and generals.

- Panama Papers (2016) – Revealed global offshore networks hiding billions.

- U.S. Real Estate Laundering – Reports show luxury condos in cities like Miami and New York being used to clean dirty foreign money.

The Jaipur case underlines how real estate remains the world’s favorite tool for hiding wealth.

How Money Laundering Through Real Estate Works?

To simplify, here’s the 5-step process:

- Dirty Cash – Earned through fraud or crime.

- Benami Buyer – Property registered under someone else’s name.

- Shell Companies – Overseas firms hold “ownership.”

- Round Tripping – Money comes back as “legit” foreign investment.

- Price Manipulation – Assets undervalued or inflated to conceal funds.

This makes dirty money look clean—until the authorities catch on.

Expert Opinions

Economists often warn that real estate scams are “double damage.” They not only launder illegal cash but also disrupt legitimate markets.

For instance, Transparency International highlights that property-related corruption is one of the hardest to detect because it hides in plain sight—land deeds, valuations, and registrations. The Financial Action Task Force (FATF), a global watchdog, has repeatedly flagged India’s need to tighten property regulations.

Practical Advice: How to Stay Safe

Whether you’re a buyer, seller, or professional:

- Verify Ownership – Cross-check property records on official portals.

- Insist on Transparency – Demand digital payments and legal receipts.

- Hire Legal Help – A good lawyer can catch loopholes.

- Check Market Value – If the price is way below market, that’s a red flag.

- Report Suspicious Deals – Use ED or IT Department reporting channels.

Impact on Citizens and Businesses

The ripple effect of scams like Jaipur’s is huge:

- Ordinary Citizens – Face inflated property costs.

- Small Businesses – Struggle to compete when big players use illegal funds.

- Banks – Risk bad loans if real estate bubbles burst.

- Government – Loses billions in taxes, straining public finances.

This is why strong enforcement isn’t just about punishment—it’s about protecting honest taxpayers.

Fake Invoice Scam: DGGI Detects ₹43 Crore GST Evasion

Admission Fraud Syndicate Busted, Two Arrested in Major Scam