Jamaicans Vote Amid Promises of Tax Cuts: When Jamaicans vote amid promises of tax cuts and fears of deep-rooted corruption, the world listens. Jamaica isn’t just a sun-soaked island—it’s a country of resilience, history, and global influence. With nearly three million citizens at home and another three million living abroad, Jamaica’s choices ripple far beyond the Caribbean Sea. On September 3, 2025, voters faced a tough decision: keep Andrew Holness and his Jamaica Labour Party (JLP) in power, or give Mark Golding and the People’s National Party (PNP) a chance to reshape the country. Both men brought bold promises, but trust in leadership was the real issue. Jamaicans weren’t just choosing tax policies—they were voting on whether their government could finally beat back the shadow of corruption.

Jamaicans Vote Amid Promises of Tax Cuts

The 2025 Jamaican election wasn’t just about numbers—it was about trust, fairness, and leadership credibility. While Holness delivered results on jobs and crime, corruption questions remain a thorn in his side. For Jamaicans, the stakes are high. Tax relief could transform daily lives, but only if governance stays clean. For Americans, Jamaica’s story mirrors familiar debates over fairness, accountability, and economic opportunity. Democracy thrives when people demand more than promises—they demand proof.

| Category | Details |

|---|---|

| Election Date | September 3, 2025 |

| Main Candidates | Andrew Holness (JLP), Mark Golding (PNP) |

| Economic Promises | Holness: Slash tax rate from 25% → 15%, double minimum wage. Golding: Raise income tax threshold. |

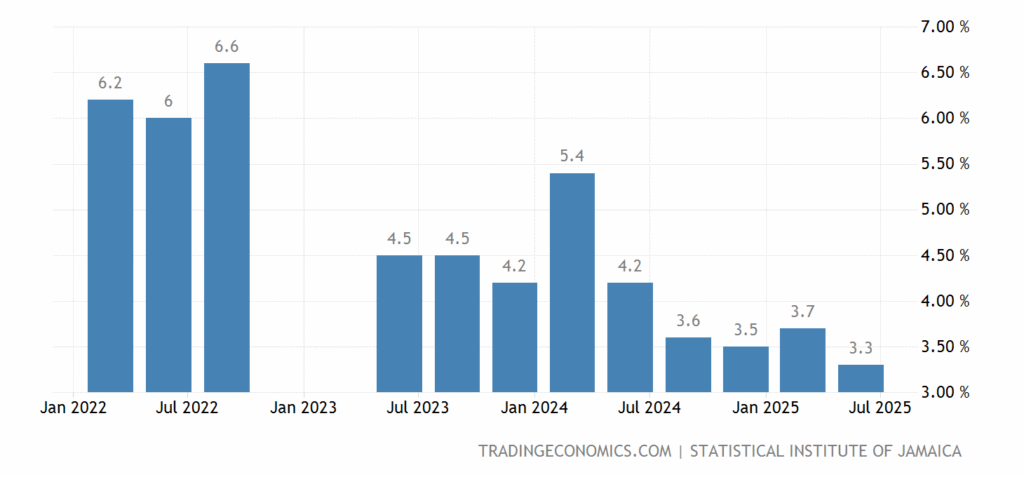

| Unemployment Rate | 3.3% (record low) |

| Poverty Reduction | From 16.7% in 2021 to 8.2% in 2023 |

| Crime Reduction | 43% drop in killings, up to 70% in some tourist areas |

| Voter Turnout | 38.8% (slightly up from 2020) |

| Election Outcome | JLP won 34 seats, PNP secured 29 seats |

| Official Resource | Government of Jamaica |

Why This Election Was Historic?

Jamaica’s democracy is young compared to the United States but deeply resilient. Since independence in 1962, the country has alternated between the JLP and the PNP. Both parties promise prosperity, but voters often feel shortchanged.

This election highlighted a crossroads:

- Would Jamaica double down on economic growth under Holness?

- Or would citizens demand a clean slate with Golding, betting on transparency and fair taxation?

Low turnout—just 38.8%—shows skepticism still rules the day. Many Jamaicans stayed home, convinced politics won’t change their lives.

Holness’s Game Plan: Jobs, Wages, and Tax Cuts

Prime Minister Andrew Holness ran on results, not just promises. He showcased:

- Record-low unemployment at 3.3%.

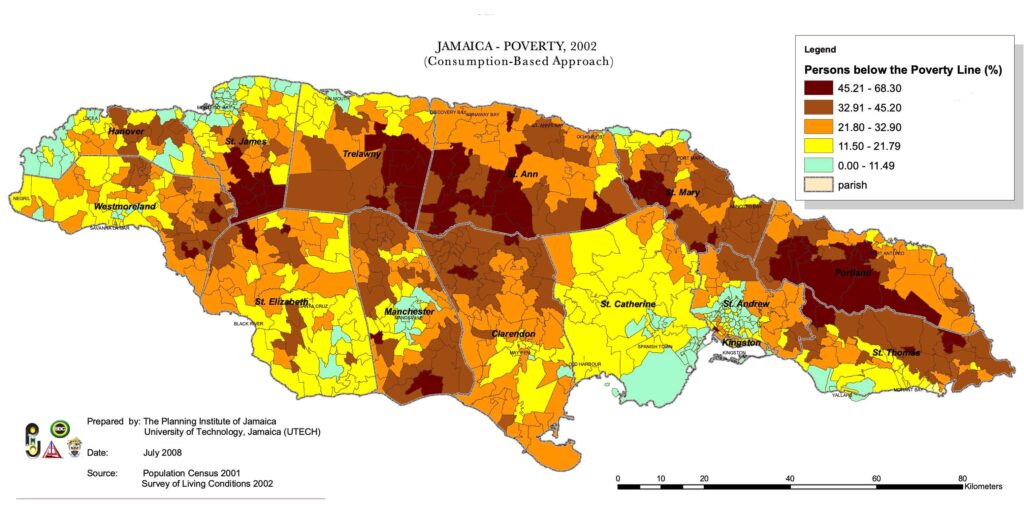

- Poverty reduction from 16.7% in 2021 to just 8.2% in 2023.

- Crime reduction of 43% nationwide, with up to 70% drops in tourist zones.

Holness added bold pledges:

- Cut income tax rates from 25% to 15%.

- Double the minimum wage.

For a Jamaican worker earning J$60,000 a month (~USD 390), doubling wages to J$120,000 (~USD 780) could mean affording school fees, better housing, or even saving for the first time.

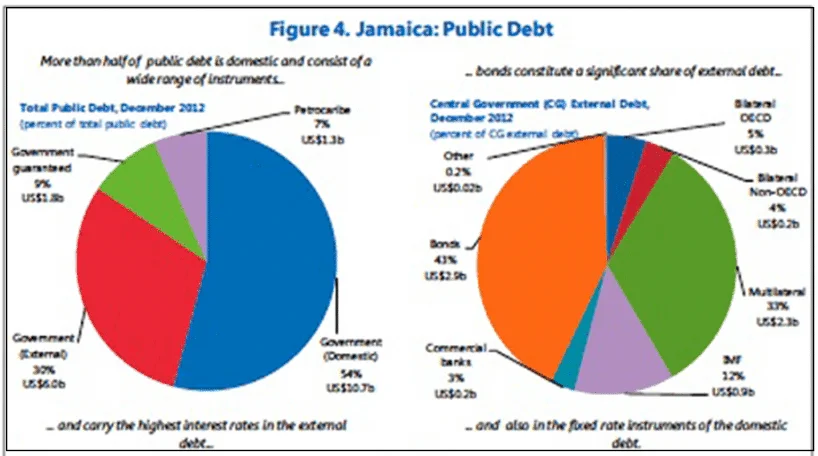

Yet, critics warn such drastic tax cuts could blow holes in Jamaica’s budget. Public services—already stretched thin—depend heavily on income tax revenue.

Golding’s Counter: Fairness and Clean Governance

Mark Golding, leader of the PNP, focused less on slashing rates and more on fairness. He promised to raise the tax-free income threshold from J$1.8M to J$3.5M (~USD 22,000). That would exempt more Jamaicans from paying income tax entirely.

Golding also leaned on corruption as his main talking point. With the Integrity Commission questioning Holness’s asset declarations, Golding vowed to restore transparency and accountability.

His message resonated with professionals and the middle class, but some doubted whether any politician could truly root out corruption in Jamaica.

The Everyday Impact of Jamaicans Vote Amid Promises of Tax Cuts: Real Numbers for Real Families

Let’s break it down for everyday Jamaicans:

- Holness Plan (15% flat tax):

If you earn J$2,000,000/year (~USD 12,900), your tax bill drops from J$500,000 to J$300,000. That’s J$200,000 saved—like a bonus without working extra hours. - Golding Plan (raise threshold):

If you earn J$3,000,000/year (~USD 19,300), you currently pay tax on J$1.2M. Under Golding’s plan, you’d pay nothing. That’s a full tax break for middle-income families.

Both sound sweet, but here’s the catch: Holness’s plan risks cutting government revenue. Golding’s plan risks inflation if too much cash floods the economy.

Corruption: The Shadow Over Jamaican Politics

Jamaica’s politics have long been dogged by corruption allegations—contracts, government spending, and even campaign financing are often viewed with suspicion.

A 2024 Transparency International survey ranked Jamaica 69th out of 180 countries in corruption perception—better than some, but still worrying for investors and citizens.

For voters, the fear isn’t abstract. It’s real: whether hospitals get medicine, schools get funding, or roads get repaired depends on how honestly leaders spend money.

Voices From the Ground

During the campaign, citizens expressed mixed feelings:

- Sandra, a nurse in Kingston: “Holness gave us jobs and peace on the streets. But if corruption is real, what good are those numbers?”

- Dwayne, a taxi driver in Montego Bay: “Golding talks nice, but can he really fight corruption? We’ve heard that story before.”

- Akeem, a university student in Spanish Town: “We need leaders who think about young people. Tax breaks are nice, but what about scholarships and jobs for graduates?”

Global Implications: Why the U.S. Cares

Jamaica may be small, but its influence runs deep:

- Tourism: Over 2 million Americans visit Jamaica yearly. Safer streets mean safer vacations.

- Trade: Jamaica exports bauxite, rum, and coffee—industries that connect to U.S. supply chains.

- Migration: Economic hardship in Jamaica fuels immigration to the U.S., particularly in Florida and New York.

- Security: Corruption and organized crime spill over borders, impacting U.S. policy in the Caribbean.

Historical Echoes: From Manley to Holness

This isn’t the first time Jamaicans debated big promises. Back in the 1970s, Prime Minister Michael Manley of the PNP promised sweeping social reforms. By the 1980s, economic struggles shifted power back to the JLP.

The tug-of-war between bold promises and harsh realities has defined Jamaican politics for decades. Today’s election continues that legacy, but with a sharper focus on transparency.

The Diaspora Factor

Over 3 million Jamaicans live abroad, especially in the U.S., Canada, and the U.K. While they can’t vote, they send home billions in remittances—roughly 17% of Jamaica’s GDP.

Many diaspora Jamaicans expressed frustration that they couldn’t cast ballots, despite contributing so much to the island’s economy. Political pressure may grow for future reforms that allow diaspora participation.

What Comes Next?

With Holness’s JLP securing 34 seats to the PNP’s 29, expect:

- Aggressive tax reform—to prove campaign promises weren’t empty.

- Increased scrutiny from watchdogs like the Integrity Commission.

- International monitoring of Jamaica’s anti-corruption efforts.

- Pressure from the diaspora to play a bigger role in national politics.

For Jamaica’s young professionals, the key question is whether opportunities will grow at home—or if they’ll need to migrate for success.

Whistleblower Punished? Pension Agency Suspends Manager After He Flags R21m Payment

Israeli AI Startup Bags $60 Million to Help Governments Fight Fraud

Tampa OnlyFans Star Who Made $5.4 Million Now Charged With Tax Evasion