Jefferies Predicts Stronger Growth for Two-Wheelers and Cars: When we talk about cars, bikes, and how much they cost, one thing that always plays a role is taxes. In India, the big player here is the Goods and Services Tax (GST). Now, Jefferies, one of the world’s top investment banking firms, predicts that if India goes ahead with expected GST rate cuts, two-wheelers and passenger cars will see stronger growth in the coming years. That may sound like financial jargon, but here’s the simple truth: if taxes fall, vehicles become cheaper. And when vehicles get cheaper, people buy more of them.

Jefferies Predicts Stronger Growth for Two-Wheelers and Cars

Jefferies’ prediction that two-wheelers and cars will see stronger growth from GST rate cuts highlights a turning point for India’s auto industry. If taxes drop, families could buy scooters, farmers could afford tractors, and middle-class households might finally step into cars. For investors, auto stocks could be the big winners. While challenges remain, the outlook is bright—and the road ahead looks smoother than it has in years.

| Category | Details / Impact |

|---|---|

| GST Cut Proposal | Cars, SUVs, and bikes GST may drop from 28% to 18%. Tractors from 12% to 5% (official GST Council). |

| Price Impact | Vehicles could become 6–8% cheaper, and if cuts go deeper, 8–10% cheaper. |

| Growth Outlook | Two-wheelers: 10% CAGR (FY25–28); Passenger vehicles: 8% CAGR; Tractors: 9% CAGR; Trucks: modest 3% CAGR. |

| Industry Upgrade | Hero MotoCorp upgraded by Jefferies; Price target raised from ₹3,800 to ₹5,200. |

| Winners in Focus | TVS Motor, Mahindra & Mahindra, Maruti Suzuki, Hero MotoCorp seen as top beneficiaries. |

| Professional Impact | Boost in auto jobs, supplier ecosystem, and dealership sales if demand rises. |

A Quick Refresher: What’s GST and Why Does It Matter?

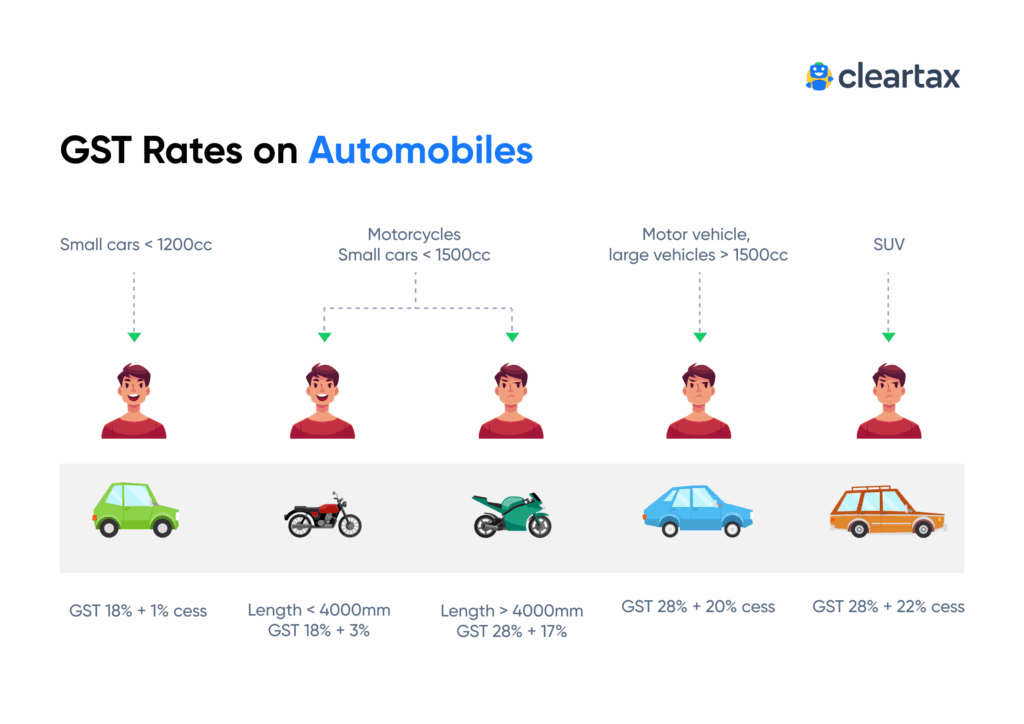

GST is like the sales tax in the U.S., only it’s nationwide and covers almost everything. Before GST was rolled out in 2017, India had a messy system with multiple state-level taxes. Automobiles, in particular, were burdened with excise duty, VAT, and other charges.

Since 2017, autos have been in the highest slab (28%), with some extra “cess” on SUVs. This made vehicles relatively pricey compared to income levels. Cutting GST now could be like giving the whole industry a shot of espresso—energizing it overnight.

India’s Auto Industry: Why This Matters

The auto industry isn’t just about cars and bikes—it’s the heartbeat of India’s economy. According to the Society of Indian Automobile Manufacturers (SIAM), the sector contributes about 7% of India’s GDP and supports over 37 million jobs.

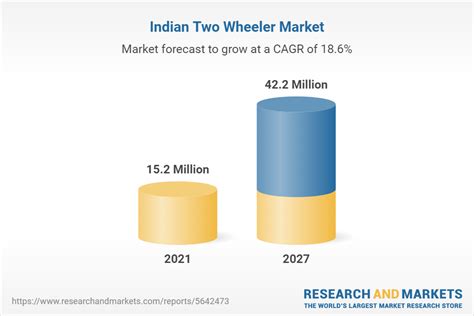

- India is the largest two-wheeler market in the world.

- It’s the fourth-largest car market, and growing fast.

- Tractors and commercial vehicles form a backbone for rural and logistics growth.

So, when GST cuts are proposed, it’s not just about cheaper scooters or SUVs. It’s about kickstarting an industry that powers jobs, manufacturing, and investment.

The Market Context: Auto Industry at a Crossroads

The past year has been bumpy for India’s auto sector:

- Two-wheeler sales grew only 2–3% year-on-year between April–July 2024.

- Passenger cars showed similar slow growth.

- Truck registrations fell 3%, signaling weakness in the commercial market.

- Tractors grew 7%, standing out thanks to resilient rural demand.

Jefferies argues that a GST cut could flip these numbers, with new buyers entering the market.

The Consumer Angle: What This Means for Everyday Buyers

Picture this:

- A middle-class family in Delhi thinking about buying a scooter for their daughter’s college commute. At today’s GST rate, the scooter costs ₹1,00,000. With an 8% GST cut, the price could drop by ₹8,000. That’s enough to cover a few months of gas.

- A farmer in Punjab looking at a tractor upgrade. A tractor priced at ₹8,00,000 could fall by ₹56,000 with the proposed GST cut. That’s like getting free equipment add-ons.

- A ride-hailing driver considering a compact car might finally see the math work out, lowering his monthly EMIs.

For millions of Indians, affordability is the make-or-break factor when buying a vehicle.

Festive Season: The Perfect Timing

India’s vehicle sales traditionally skyrocket during festivals like Diwali and Dussehra. Families see these times as lucky to make big purchases. If GST cuts kick in before or around the festive season, auto companies could witness a record-breaking sales run—similar to how Americans line up for Black Friday deals.

Who Stands to Win the Most?

Two-Wheelers: The Everyday Hero

Jefferies predicts a 10% CAGR for two-wheelers (FY25–28). Brands like Hero MotoCorp and TVS Motor dominate this space.

Passenger Cars: Middle-Class Aspirations

With an 8% CAGR, cars are expected to gain momentum. Jefferies highlights Maruti Suzuki and Mahindra & Mahindra as strong beneficiaries.

Tractors: Rural Lifeline

GST cuts could help farmers massively. Jefferies projects 9% CAGR for tractors. M&M is the clear leader here.

Stocks in Spotlight

- Hero MotoCorp upgraded; price target ₹5,200.

- TVS Motor projected 27% EPS CAGR.

- M&M forecast 19% EPS CAGR.

- Maruti Suzuki set for strong volume gains.

Stock Market Insights: How Investors Can Play This

For investors, GST cuts could mean a major sector rerating. Jefferies has already upgraded earnings estimates for key auto stocks. Historically, whenever auto affordability improves, stock valuations surge.

- Two-wheeler companies: best positioned for immediate demand jump.

- Passenger car makers: strong medium-term upside.

- Suppliers and component manufacturers: indirect beneficiaries from rising production.

Investors looking for exposure might consider auto ETFs, or directly track stocks like Maruti Suzuki, Hero MotoCorp, and M&M.

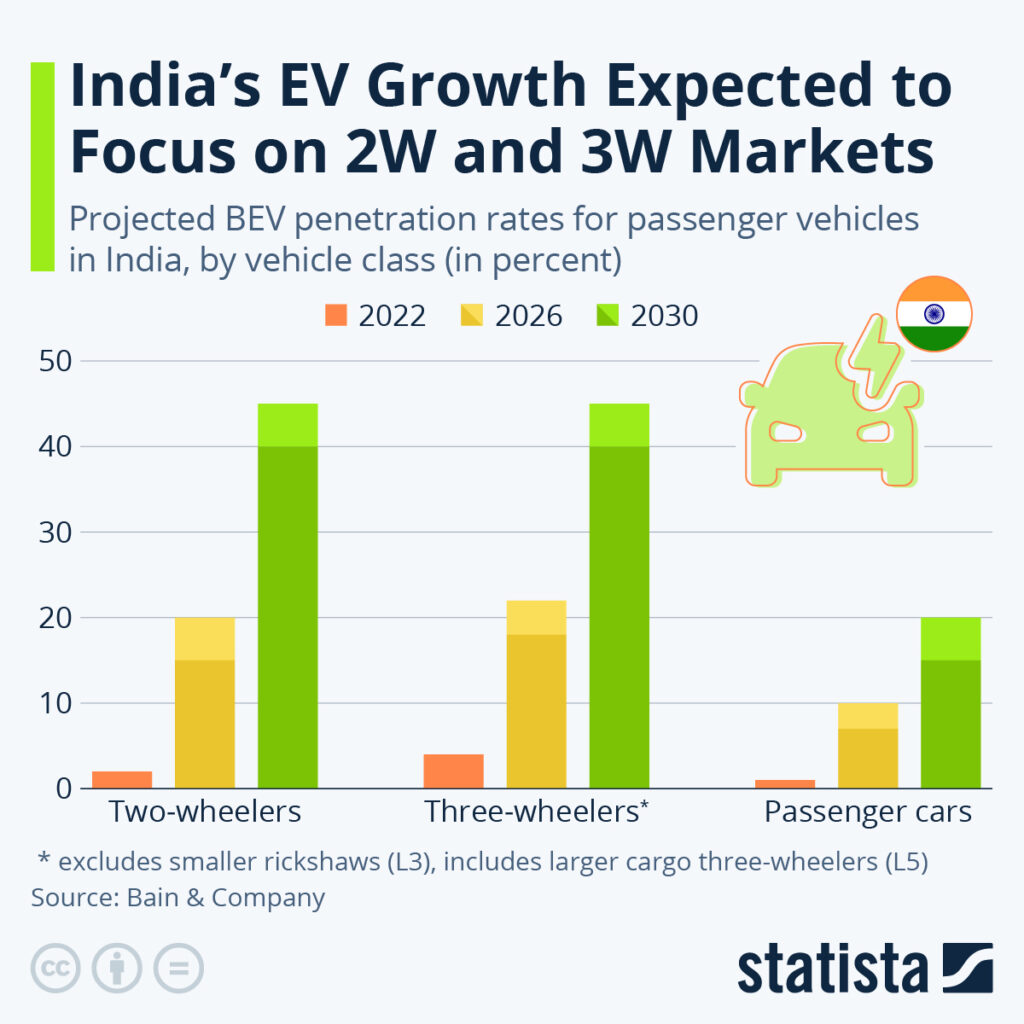

The EV Angle: Could GST Cuts Accelerate Electric Adoption?

India is pushing hard on electric vehicles (EVs), with subsidies under the FAME scheme. But EVs remain expensive upfront. If GST cuts also cover EVs, adoption could accelerate. Imagine electric scooters from Ola or Ather dropping further in price—suddenly EVs could compete directly with petrol bikes.

This could be a side benefit the government might not even have planned, but it could change the EV game in India.

Government’s Perspective: Why Now?

Why would the government cut GST now, when it earns revenue from high taxes?

- Demand slowdown: Auto sales have been sluggish, hurting GDP growth.

- Jobs pressure: More sales = more jobs in factories, dealerships, and logistics.

- Political timing: With elections never too far away, affordability measures are popular.

It’s a balancing act between tax revenue and economic stimulus, but Jefferies thinks the scale tips toward cuts.

Challenges & Risks: The Flip Side

Before we all rev up the engines, let’s not ignore the risks:

- Inflationary pressure: Lower taxes may not fully pass through to customers if input costs stay high.

- High interest rates: Car loans are pricier now; buyers might still hold back.

- Supply chain bottlenecks: Semiconductors, essential for modern cars, remain constrained.

- Policy delays: If the government drags its feet, momentum could fade.

So, while GST cuts could spark demand, the road may still have bumps.

Career and Professional Impact of Jefferies Predicts Stronger Growth for Two-Wheelers and Cars

Growth in the auto sector doesn’t just mean more shiny vehicles—it means jobs:

- Dealerships hiring sales and service staff.

- Suppliers ramping up production.

- Tech talent needed for electric vehicles (EVs) and connected car technologies.

- Logistics and after-market services like insurance and financing also benefit.

For professionals in engineering, sales, supply chain, or even fintech, GST cuts could indirectly open new doors.

GST Reform to Cut Rates on Vehicles – Will Two-Wheeler and Car Sales Finally Rebound?

Planning a Big Bike? Govt May Soon Slap 40% GST on 350cc+ Motorcycles

GST Overhaul Could Make Big Bikes Pricier While Smaller Ones Get Cheaper – Here’s the New Tax Twist

A Step-by-Step Guide: How GST Cuts Translate into Real Impact

- Government Approves GST Cut → Council revises tax slabs.

- Showroom Prices Drop → Cars and bikes become 6–10% cheaper.

- Consumers React → Families, farmers, and companies make new purchases.

- Dealers & Suppliers Benefit → More sales, bigger service revenues.

- Stocks Rally → Investors benefit from auto growth.

- Job Creation Multiplies → More hiring across auto value chains.