Jefferies Sees Auto Boom Ahead: When Jefferies, one of the world’s leading investment firms, predicts an auto boom ahead, it’s not just idle talk. Their latest analysis points to a potential shakeup in India’s auto industry, thanks to proposed Goods and Services Tax (GST) cuts. If implemented, these reforms could make vehicles cheaper, boost consumer demand, and drive growth for auto giants like Mahindra & Mahindra (M&M), Maruti Suzuki, and Hero MotoCorp. This story isn’t just for economists or stock market analysts. It affects everyday consumers, businesses, and even the global auto landscape. Whether you’re a professional investor, a car enthusiast, or just a curious reader wondering why everyone is suddenly buzzing about India’s car market, this breakdown will explain what’s happening, why it matters, and what comes next.

Jefferies Sees Auto Boom Ahead

If these GST cuts roll out as expected, India’s auto sector could witness one of its biggest booms in decades. Buyers would enjoy cheaper prices, companies like M&M, Maruti, Hero, and TVS would ride strong growth, and the Indian economy would gain a powerful demand push. Like we say in the U.S.: “When opportunity knocks, don’t leave it waiting on the porch.” For India’s auto sector, the knock is loud, and the door is wide open.

| Point | Details |

|---|---|

| Main Story | Jefferies projects a massive auto boom if India slashes GST rates. |

| Top Winners | M&M, Maruti Suzuki, TVS Motor, Hero MotoCorp expected to benefit most. |

| Savings for Buyers | Car and bike prices could drop by 6–8% on-road. |

| Industry Impact | Vehicle demand may rise by 2–6% FY26–28, EPS gains 2–8%. |

| Economic Impact | A potential ₹2.4 lakh crore ($288B) boost to India’s economy and 0.5–0.7% GDP lift. |

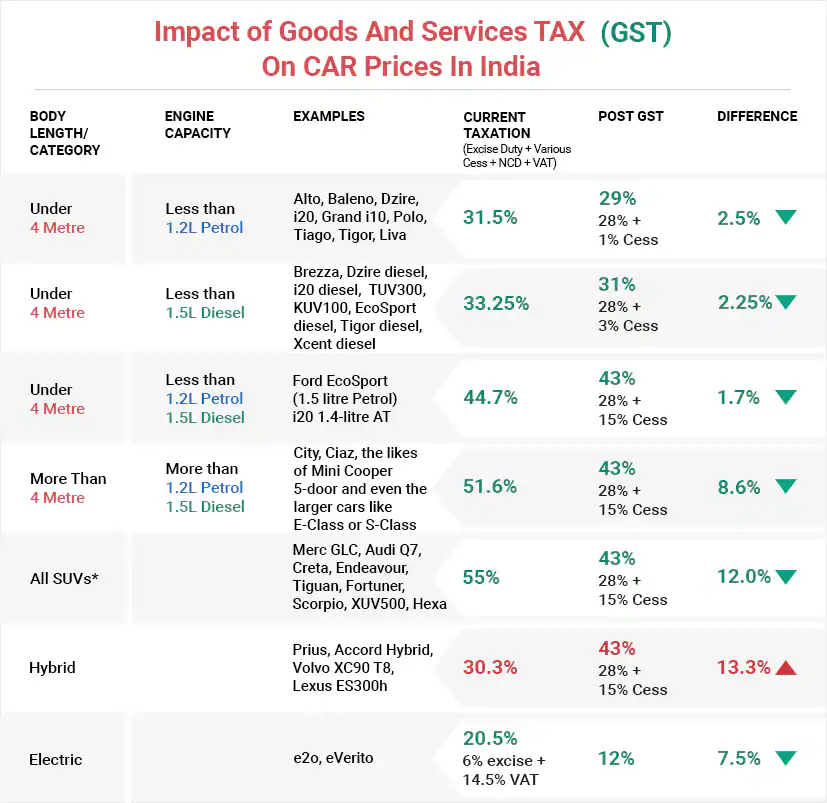

| Historical Context | GST in 2017 initially raised auto prices. Cuts now reverse that pressure. |

| Global Examples | U.S. “Cash for Clunkers” and EU VAT cuts boosted auto sales in similar ways. |

| Official Resource | Government of India GST Portal |

GST Cuts: Breaking Down the Reform

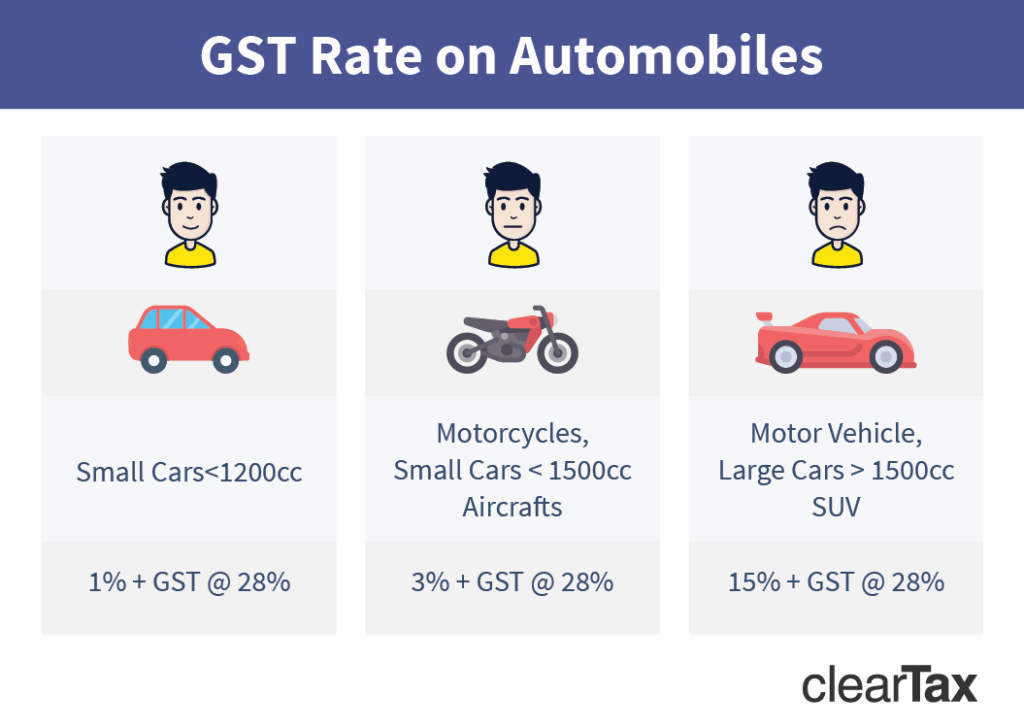

At present, cars and two-wheelers in India fall under one of the highest GST slabs—28%, often with an added cess for SUVs and luxury cars. The government’s proposal seeks to simplify and rationalize this structure into just three key categories:

- 18% GST: Applies to two-wheelers, small passenger cars, and most mainstream vehicles.

- 5% GST: For tractors and essential vehicles serving agriculture and rural transport.

- 40% (including cess): For luxury SUVs and gas-guzzling premium cars.

This isn’t just tax theory. It translates to real-world savings for consumers. On-road vehicle prices could drop by 6–8% overnight, making both cars and bikes more affordable. Imagine shopping for a new Ford in the U.S. and finding out that a $30,000 SUV now costs $27,500 simply because Uncle Sam changed tax rules. That’s the scale of impact we’re talking about.

Why Jefferies Sees Auto Boom Ahead?

Jefferies’ optimism is backed by hard data:

- Sales boost: Vehicle demand could jump 2–6% over FY26–28.

- Earnings growth: Key auto players may see 2–8% EPS upgrades.

- Festive timing: The reforms could hit right before Diwali 2025, India’s equivalent of the holiday shopping season, when auto sales already peak.

Top Picks by Jefferies:

- TVS Motor → Projected 27% EPS CAGR from FY25–28.

- Mahindra & Mahindra → Strong growth with 19% EPS CAGR.

- Maruti Suzuki → Mass-market affordability makes it a big winner.

- Hero MotoCorp → Outlook upgraded from “Underperform” to “Hold.”

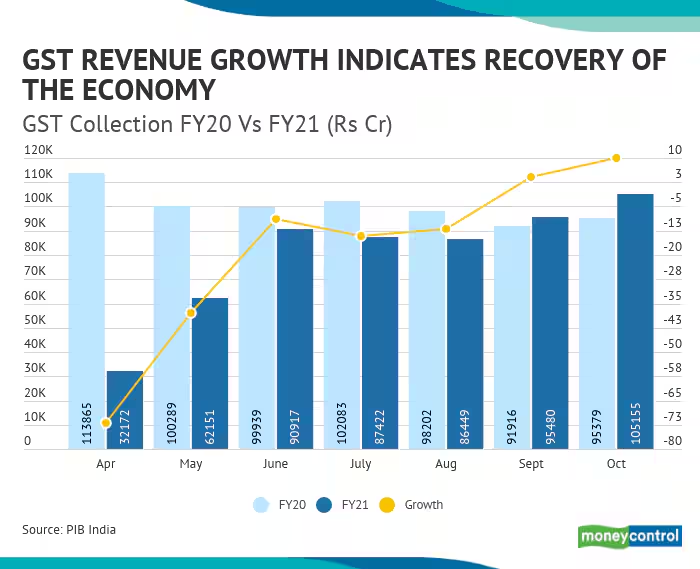

Historical Context: From 2017 GST to 2025 Reforms

When India rolled out GST in 2017, many car prices went up because the 28% slab was higher than the earlier excise duty structure. Demand slowed, and the industry had to adjust.

Fast forward to today, and the government is looking to undo some of that burden. Instead of dampening sales, GST could now stimulate demand. This policy shift is almost a course correction, turning taxation into a growth engine.

Global Lessons: What the World Tells Us

Tax policy has long been used worldwide to stimulate auto demand:

- United States (2009 – Cash for Clunkers): Consumers were offered rebates to trade old cars for fuel-efficient models. The program sold nearly 700,000 cars in a few months, helping companies like Ford and GM recover after the financial crisis.

- Germany (2009 Auto Bailout): The government subsidized car purchases, sparking a surge in demand that supported its famed auto industry.

- European Union (2020 COVID Stimulus): VAT reductions helped maintain car sales during the pandemic.

India’s potential GST cuts could replicate these outcomes, particularly in its massive two-wheeler market, where affordability drives volumes.

Which Companies Win the Most?

Mahindra & Mahindra (M&M)

M&M is like the Ford of India—producing SUVs, tractors, and utility vehicles. Lower GST means both farmers and city families can access M&M’s popular models at better prices. Jefferies estimates 19% earnings growth here.

Maruti Suzuki

Think of Maruti as India’s Toyota—dominant, reliable, and everywhere. Small cars are Maruti’s bread and butter, and with an 18% GST rate, demand could skyrocket.

Hero MotoCorp

The go-to brand for motorcycles and scooters. Hero’s fortunes are tied to India’s middle and lower-income families. With a tax cut, bikes become more affordable, fueling sales growth.

TVS Motor

The surprise outperformer. Projected 27% EPS CAGR puts TVS in the spotlight as a rising star, similar to how Tesla scaled in its early years.

Beyond Autos: Economic Ripple Effects

Jefferies and Morgan Stanley expect these reforms to trigger:

- ₹2.4 lakh crore ($288 billion) demand boost.

- 0.5–0.7% lift in GDP.

- Ripple effects in cement, steel, finance, and real estate as auto demand spills over.

Think about it—more car sales mean more financing through banks, higher demand for cement and steel (factories and dealerships), and more disposable income flowing across sectors.

Consumer Psychology: Why Buyers Are Waiting

Showrooms across India have seen buyers delaying purchases. Why? Everyone’s waiting for GST cuts to kick in before they commit. This is classic psychology: if tomorrow promises a discount, no one wants to buy today.

Once cuts roll out, analysts expect a flood of demand, similar to Black Friday shopping lines in the U.S.

Risks and Challenges

Even with optimism, challenges exist:

- State Revenues: State governments may resist GST cuts, fearing revenue losses.

- Luxury Auto Makers: Companies like Mercedes and BMW might oppose the steep 40% “sin tax.”

- Environment Impact: Cheaper vehicles mean more cars on roads, adding pressure on pollution and traffic unless EV adoption keeps pace.

- Execution Risks: If the reforms face political or legal delays, buyers’ patience could wear thin.

Expert Voices

Industry veterans are already weighing in:

- R.C. Bhargava (Chairman, Maruti Suzuki India) has hinted that tax rationalization would “support small car demand, which has slowed due to affordability issues.”

- Pawan Goenka (former M&M executive) noted that “lower taxation on tractors could directly benefit rural India, where affordability remains key.”

- Analysts at Morgan Stanley echoed Jefferies’ view, calling the reforms “a catalyst for cyclical recovery.”

India Proposes Tax Cuts on Small Cars – Modi Reforms Send Auto Stocks Soaring

Small Cars May Get Cheaper Under New GST Reform – But Luxury Cars to Stay Costly

India’s GDP to Get Smarter? MoSPI Eyes GST, UPI, and Vehicle Data for Accuracy Boost

Practical Advice

For Consumers

- Hold off on big purchases until reforms are finalized, likely by late 2025.

- Look for festive offers post-GST cuts for maximum savings.

- Use the opportunity to negotiate better financing terms—banks often compete aggressively during booms.

For Investors

- Focus on Jefferies’ picks: M&M, Maruti, TVS, Hero.

- Avoid luxury-heavy firms flagged as underperform (Hyundai, Tata Motors).

- Think beyond autos—consider cement, steel, and banking stocks tied to demand growth.

Step-by-Step Timeline

- Government finalizes GST rationalization.

- Announcement expected ahead of Diwali 2025.

- New rates roll out.

- On-road prices fall by 6–8%.

- Buyers rush dealerships; record sales logged.

- Stock markets react positively, with auto and allied industries rallying.