Jharkhand HC Strikes Down GST Order: The Jharkhand High Court recently made waves by striking down a Goods and Services Tax (GST) demand order, highlighting the growing importance of fairness, transparency, and clarity in the tax system. In this significant case involving Rahman Sales, the court emphasized the need for tax authorities to follow proper procedures, ensure clear communication, and respect taxpayer rights. This case is not just another legal dispute but a critical reminder for businesses and individuals navigating India’s complex GST system. As taxation systems evolve, the court’s intervention sheds light on the potential pitfalls that taxpayers could face, especially in a situation where the GST order wasn’t properly uploaded to the portal or communicated to the taxpayer. The decision, with its emphasis on due process, highlights how courts can ensure fairness in the system.

Jharkhand HC Strikes Down GST Order

The Jharkhand High Court’s ruling in the Rahman Sales GST case underscores the importance of transparency, fairness, and clarity in India’s GST system. With this landmark decision, the Court not only protected the rights of the taxpayer but also sent a clear message to GST authorities that they must adhere to procedural fairness. This ruling is a significant step towards improving the GST framework and ensuring businesses are not caught in the crossfire of administrative errors. For businesses, the case serves as a reminder to stay vigilant and proactive when dealing with taxes. Stay informed, keep your records updated, and seek professional guidance if needed. It’s always better to be safe than sorry, especially when dealing with complex systems like GST.

| Topic | Details |

|---|---|

| Case | Rahman Sales GST dispute |

| Court Decision | Jharkhand High Court quashed the GST demand order |

| Issue | Violation of natural justice principles, improper communication |

| GST Portal Issue | Order not uploaded to the GST portal |

| Court’s Stance | Calls for transparency, clarity, and due process in GST orders |

| Impact on Taxpayers | Ensures fair treatment and communication of tax matters |

| Source | Taxguru |

What Happened in the Jharkhand HC Case?

The case revolved around Rahman Sales, a business that had a GST demand order for the financial year 2017-18. However, the Jharkhand High Court quashed the order due to a significant procedural flaw: the tax authorities had failed to upload the GST demand to the official portal, and the business was not properly informed of the order.

According to the Court, taxpayers are entitled to clear communication and easy access to their GST orders. In this instance, the non-uploading of the order on the GST portal and improper communication created an atmosphere of confusion, violating the principles of natural justice—a legal concept that ensures that individuals are treated fairly and given a chance to be heard. The court took a stand that this wasn’t just a technical error but one that significantly impacted the taxpayer’s ability to understand, challenge, or comply with the demand. As a result, the Court decided to quash the GST order, underlining the need for tax authorities to be more diligent in their approach.

Why Is This Ruling Important?

This ruling serves multiple purposes and provides valuable lessons for businesses, tax professionals, and even the broader taxation system in India. Let’s break it down:

- A Wake-Up Call for Tax Authorities: The ruling is a reminder that taxpayers need to be able to easily access GST orders and notices. The failure to upload such notices on the portal causes confusion and might prevent timely responses from taxpayers. This affects the overall trust in the system.

- Ensuring Fairness in Taxation: Natural justice principles require that any order affecting a person’s rights must be made after proper notice, and this applies to GST. With the court’s decision, taxpayers are more likely to be protected from arbitrary or unfair tax assessments.

- Improved Transparency and Communication: The decision reflects an increasing push for transparency in tax matters. The court’s stance will likely lead to better communication from GST authorities in the future, reducing errors and misunderstandings that can often lead to costly legal battles.

- A Precedent for Future Cases: This case could become a reference for future disputes regarding improper GST communication. Businesses that face similar issues may now have more legal leverage to challenge GST demands based on improper procedures.

Understanding GST and Natural Justice

What Is GST?

GST stands for Goods and Services Tax, which is a consumption-based tax applied to goods and services sold in India. The aim of GST was to replace multiple indirect taxes with a single, more efficient tax system, reducing the burden on businesses and simplifying compliance.

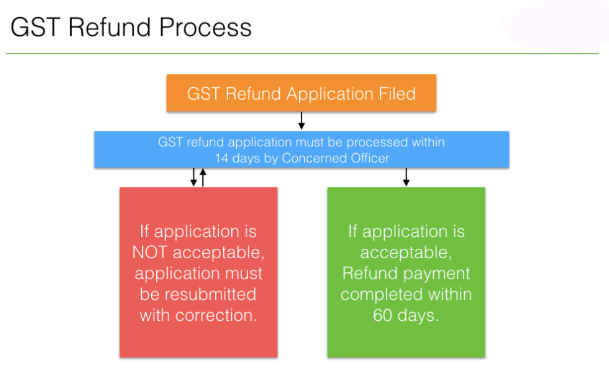

The tax has multiple slabs, and businesses are required to file their returns accordingly. Compliance includes regular filing of returns, paying the tax, and keeping track of all invoices and payments. One of the challenges of GST is ensuring that businesses understand and comply with the various provisions, including GST registration, refunds, and invoicing.

What Is Natural Justice?

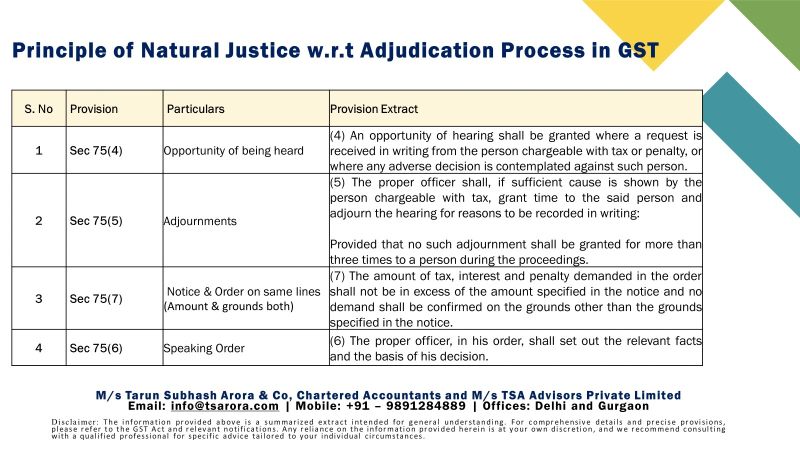

The principle of natural justice is fundamental to ensuring fairness in legal and administrative proceedings. It ensures that a person’s rights are respected, providing a fair opportunity to present their case. Natural justice typically consists of two elements:

- The Right to Be Heard: Individuals must be given notice of any actions that may affect their interests and must have an opportunity to present their side.

- The Right to an Unbiased Decision: The decision-maker must be impartial and must not have any conflicts of interest.

In the case of Rahman Sales, the tax authorities’ failure to notify the business about the GST order, coupled with improper communication, led the court to quash the demand, as it violated these principles of fairness and transparency.

Practical Advice for Businesses Affected by GST Issues

If you run a business, you need to stay proactive in your dealings with GST. Here are a few practical tips to help you avoid issues similar to the one faced by Rahman Sales:

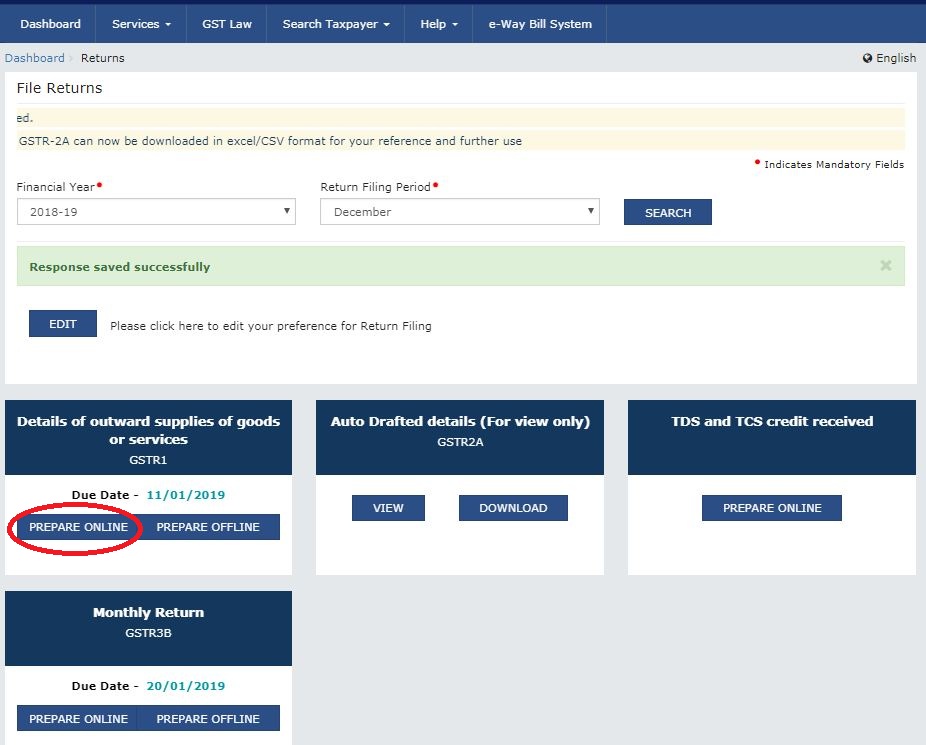

- Stay Up to Date on the GST Portal: Regularly check the GST portal for any updates, notices, or demands. GST-related communications are supposed to be uploaded here, and if you fail to check, you might miss important information that could lead to penalties or legal action.

- Ensure Your Contact Information Is Correct: Your contact details should be current on the GST portal. This ensures that you receive all notices in time and can act on them appropriately.

- Consult Professionals When Needed: GST can be complex. If you are unsure about any aspect of your GST filing or receive an unclear order, consult with a tax professional. They can guide you through the proper steps and help you avoid mistakes.

- Keep Documentation Organized: Keep a thorough record of all your business transactions, GST returns, and communications with the authorities. This will help you in case of disputes and will make the audit process smoother.

- Use the Right Channels for Appeal: If you receive an incorrect GST order or notice, don’t hesitate to appeal. You can request a hearing or challenge the order through the proper legal channels. Ensure that your appeal is well-documented and based on solid grounds.

How Jharkhand HC Strikes Down GST Order Affects Future GST Cases?

This ruling by the Jharkhand High Court sends a strong message to both taxpayers and the government alike. The court has set a legal precedent that calls for clear, well-documented, and timely communication between GST authorities and taxpayers.

For businesses across India, this means more accountable and transparent GST processes in the future. The decision also gives taxpayers more confidence to challenge unfair or unclear GST orders, knowing that the legal system is willing to protect their rights.

Additionally, businesses will now have more clarity about what steps they can take when faced with improper communication from the authorities. This might lead to more careful scrutiny of GST orders by tax professionals and legal experts, ensuring that companies can avoid any errors in their compliance.

How to Add or Edit Bank Details on GST Portal Without Errors—Full Process Explained

Maruti Suzuki Subsidiary Slammed With ₹86 Crore GST Penalty in Appellate Ruling

No GST on UPI Payments — Government Clears the Air in Rajya Sabha