JPMorgan Targets German Consumers With 2026 Digital Bank Launch: JPMorgan Chase is officially targeting German consumers with a major digital bank launch planned for 2026. This move has the potential to shake up Germany’s already crowded financial landscape, making waves not just in Berlin but across Europe. For anyone keeping an eye on banking trends, this is huge—and it might just change the way Germans save, spend, and trust their banks. If you’re wondering why this matters, think about how you felt the first time you ditched CDs for Spotify or switched from Blockbuster to Netflix. That’s the kind of digital-first disruption JPMorgan is bringing to a market that’s still heavily dominated by traditional banks, co-ops, and local savings institutions.

JPMorgan Targets German Consumers With 2026 Digital Bank Launch

JPMorgan’s entry into Germany in 2026 isn’t just another expansion—it’s a strategic play that could transform European banking. By launching Chase digital bank from Berlin, JPMorgan is betting big on tech-driven financial services in a market that values savings, security, and trust. For consumers, it means more competition, better rates, and smarter digital tools. For German banks, it’s a warning shot. For Europe, it could mark the start of a new digital era in finance.

| Aspect | Details |

|---|---|

| Launch Date | Q2 2026 |

| Market Entry | JPMorgan’s Chase brand entering Germany (after the UK) |

| Initial Product | Savings accounts tailored to German consumers |

| Local HQ | Berlin, opening by end of 2025 |

| Competition | Deutsche Bank, Commerzbank, fintechs like N26, Trade Republic |

| Why It Matters | Digital-first approach could reshape German retail banking |

| Official Source | JPMorgan Chase |

Why JPMorgan Is Betting Big on Germany?

Germany is Europe’s largest economy, home to more than 83 million people and one of the world’s strongest consumer markets. Germans are known for being financially cautious—preferring savings accounts, certificates of deposit, and insurance products to high-risk investments.

According to Deutsche Bundesbank, German households had over €7.5 trillion in financial assets by 2023, with around 40% sitting in savings and deposits. That’s a massive pile of cash just waiting for better digital solutions.

Jamie Dimon, JPMorgan’s long-time CEO, has been blunt about the bank’s global ambitions. In his words, digital banking is the future of customer engagement, and Europe—with its fragmented markets and tech-savvy younger generations—is ripe for disruption.

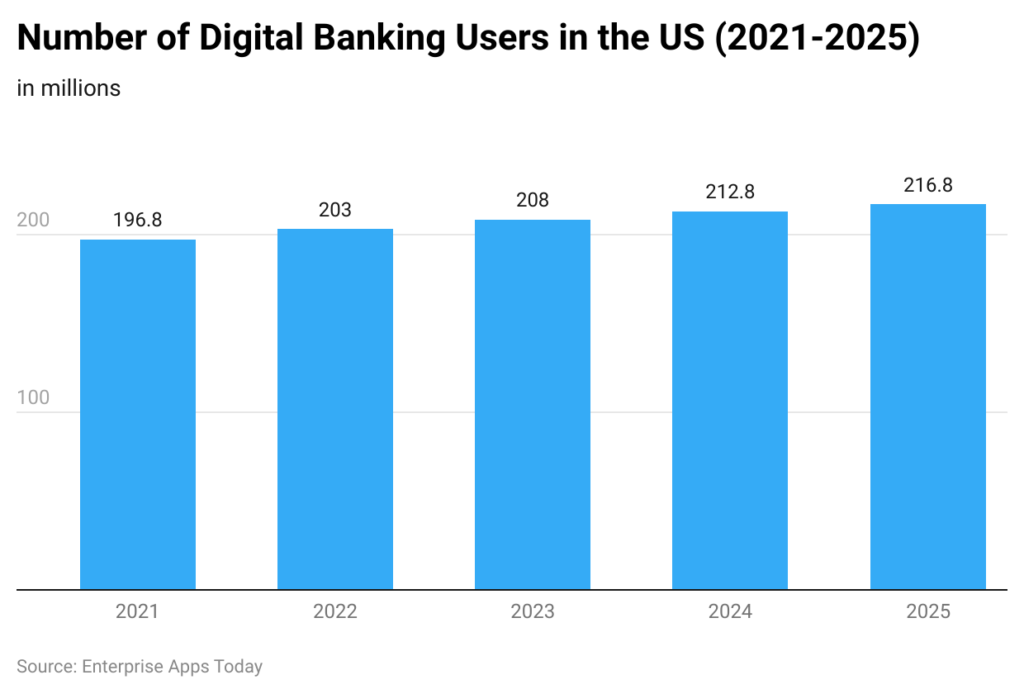

JPMorgan already proved the model works in the UK. Launched in 2021, Chase UK gained more than 2 million customers in under three years. Germany is the next logical move.

Historical Context: JPMorgan’s European Journey

JPMorgan isn’t some new kid on the block. The bank has been operating in Europe for decades, primarily serving corporations, governments, and wealthy individuals.

- In the 1970s, it established a strong presence in Frankfurt.

- During the 2008 financial crisis, JPMorgan’s relative stability strengthened its global reputation.

- By 2021, it boldly entered consumer retail banking in the UK with Chase.

The Germany launch is different—it’s not about business-to-business but about tapping into everyday consumers. That’s a huge cultural and operational shift.

How the Digital Bank Will Work?

JPMorgan is going digital-only. Forget branches, long lines, and outdated paperwork. The plan is simple:

- Download the Chase app and open an account in minutes.

- Start with a savings product—clear, transparent, and designed for trust.

- Expand gradually into credit cards, loans, and investing products once the foundation is built.

This mirrors Chase’s UK rollout, which began with current accounts and then expanded into credit cards and rewards.

The Competitive Landscape

Germany’s retail banking market isn’t easy. It’s fragmented, overbanked, and fiercely competitive.

- Traditional players like Deutsche Bank, Commerzbank, and regional Sparkassen dominate the market.

- Cooperatives and savings banks enjoy long-standing consumer trust, especially in smaller towns.

- Fintechs like N26 (Berlin-based) and Trade Republic have attracted younger, digital-native consumers.

So why does JPMorgan think it has a shot? Three reasons:

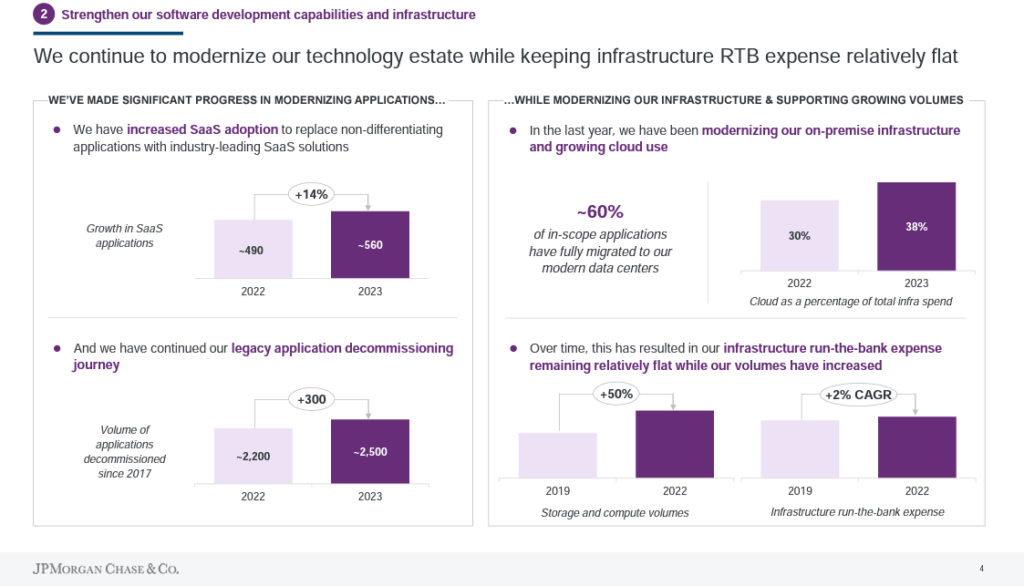

- Deep pockets – Spending $17–18 billion annually on technology gives Chase an edge.

- Global brand power – Chase is one of the most trusted names in U.S. banking.

- Lessons learned – The UK launch gave JPMorgan insights it can apply to Germany.

JPMorgan Targets German Consumers With 2026 Digital Bank Launch: Opportunities for Consumers

For everyday Germans, this move could be a game-changer:

- Higher savings rates – Chase may offer more competitive returns than legacy banks.

- Mobile-first experience – Easy-to-use apps, fast account setup, and real-time tools.

- Zero or low fees – To win customers, Chase will likely keep fees minimal.

- Global trust factor – JPMorgan’s financial stability reassures cautious savers.

Think of it like when Uber entered Germany—suddenly, consumers had a slick, global option compared to traditional services.

Real-Life Scenarios

- Berlin Student: Opens a Chase account in minutes, enjoys higher savings returns, and avoids hidden fees.

- Munich Family: Switches to Chase for better mortgage savings and easy budgeting tools.

- Hamburg Startup Owner: Leverages Chase’s app for both personal and potential business-related products.

The Challenges Ahead

Of course, JPMorgan won’t have it easy.

- Regulation – Germany’s BaFin regulator is strict on compliance, security, and data.

- Customer loyalty – Germans often stick with the same bank for decades.

- Profitability – Chase UK isn’t expected to break even until 2025. In Germany, margins are thinner.

- Cultural habits – Germans value stability, and many prefer in-person interactions with local banks.

Comparing Chase With Competitors

- N26: Known for sleek design and low fees, but has struggled with customer service issues.

- Deutsche Bank: Legacy infrastructure, but trusted brand.

- Trade Republic: Focuses on investing, not banking basics.

- Sparkassen: Deeply rooted in local communities but slow on digital adoption.

Chase’s advantage is being able to combine tech innovation with financial muscle.

Global Implications

If JPMorgan’s German expansion succeeds, it could set off a chain reaction across Europe:

- Entry into France, Spain, and Italy.

- Pressure on European banks to modernize faster.

- Opportunities for cross-border banking with one digital app.

This isn’t just about Germany—it’s about reshaping banking across the continent.

Practical Advice: What This Means for You

If you’re in Germany—or do business there—here’s how to prepare:

- Stay open: Chase might bring products worth switching for.

- Compare offers: Don’t assume your current bank is giving the best deal.

- Check regulation: Make sure your money is protected under German deposit insurance.

- Start small: Test Chase with a savings account before moving everything.

Step-by-Step Guide: Preparing for Digital Banking

- Learn how digital-only banks work.

- Assess your needs—just savings, or also credit and investing?

- Test Chase with a small account first.

- Track interest rates across banks.

- Monitor compliance updates from BaFin.

Europe Blocks U.S.-Bound Parcels – Tax Rule Change Behind The Move

New Cyber Fraud Trick Lets Hackers Empty Bank Accounts Without OTP or Debit Card

GST Shake-Up May Cushion Trump’s Tariff Blow, Report Suggests