Karnataka MLA’s Betting Firm Linked to Online Gaming Fraud Funds: Karnataka Congress MLA K.C. Veerendra has come under the spotlight in a growing investigation that’s sending shockwaves through India’s political and financial systems. The Enforcement Directorate (ED) has alleged that Veerendra’s betting firm received large sums of illicit money from online gaming fraud, rerouted through a network of shell companies and used to fund casinos, luxury cars, and offshore investments. This article breaks it all down: what happened, how it happened, and what it means for the online gaming industry, political accountability, fintech, cybersecurity, and everyday users like you. Whether you’re a working professional, parent, student, or digital entrepreneur—this one matters.

Karnataka MLA’s Betting Firm Linked to Online Gaming Fraud Funds

The case of K.C. Veerendra is more than a political headline—it’s a case study in the modern digital threat landscape, exposing how technology, finance, and crime can intertwine. For politicians, this is a call for transparency. For regulators, a push for policy reform. For users, a reminder to stay alert and informed. This story also underlines the need for a central gaming regulator, inter-agency coordination, and robust public education. Until then, stay smart—if an app promises easy money, it might just be playing you instead.

| Topic | Details |

|---|---|

| Main Accused | K.C. Veerendra, Congress MLA from Chitradurga |

| Investigation By | Enforcement Directorate (ED) |

| Allegations | Online gaming fraud, benami deals, money laundering |

| Total Value Seized | ₹12 crore in cash, ₹6 crore in gold, 10 kg silver, 4 luxury cars |

| Suspected Platforms | King567, Raja567 |

| Offshore Shell Companies | Based in Dubai, Georgia, Sri Lanka, and Nepal |

| Official Sources | enforcementdirectorate.gov.in, meity.gov.in, cybercrime.gov.in |

What Sparked the Investigation?

According to court filings and public records, the Enforcement Directorate began investigating Veerendra after suspicious transactions were flagged by the Financial Intelligence Unit (FIU). The ED traced these transactions back to online gaming platforms known for cheating users, manipulating digital payments, and rerouting earnings through benami accounts (assets held in someone else’s name to hide ownership).

The firm associated with Veerendra was allegedly the final beneficiary of these rerouted funds. Authorities have stated that the money was used to purchase high-end luxury cars, fund casino operations, and acquire real estate under fake identities.

Who Is K.C. Veerendra?

Known by his nickname “Puppy,” K.C. Veerendra is a sitting MLA from Chitradurga district. His name has cropped up in the past regarding suspected links to gambling, particularly in Goa and Sikkim, two Indian states where casino operations are legal under specific licenses.

He was arrested in August 2025 in Gangtok while allegedly exploring a casino investment. His arrest was part of a larger nationwide crackdown across six cities, including Bengaluru, Mumbai, Jodhpur, and Goa.

Seized assets include:

- ₹12 crore in cash (including foreign currency)

- Gold jewelry worth ₹6 crore

- Four high-end luxury vehicles

- 10 kg of silver articles

- 17 bank accounts and 2 lockers frozen

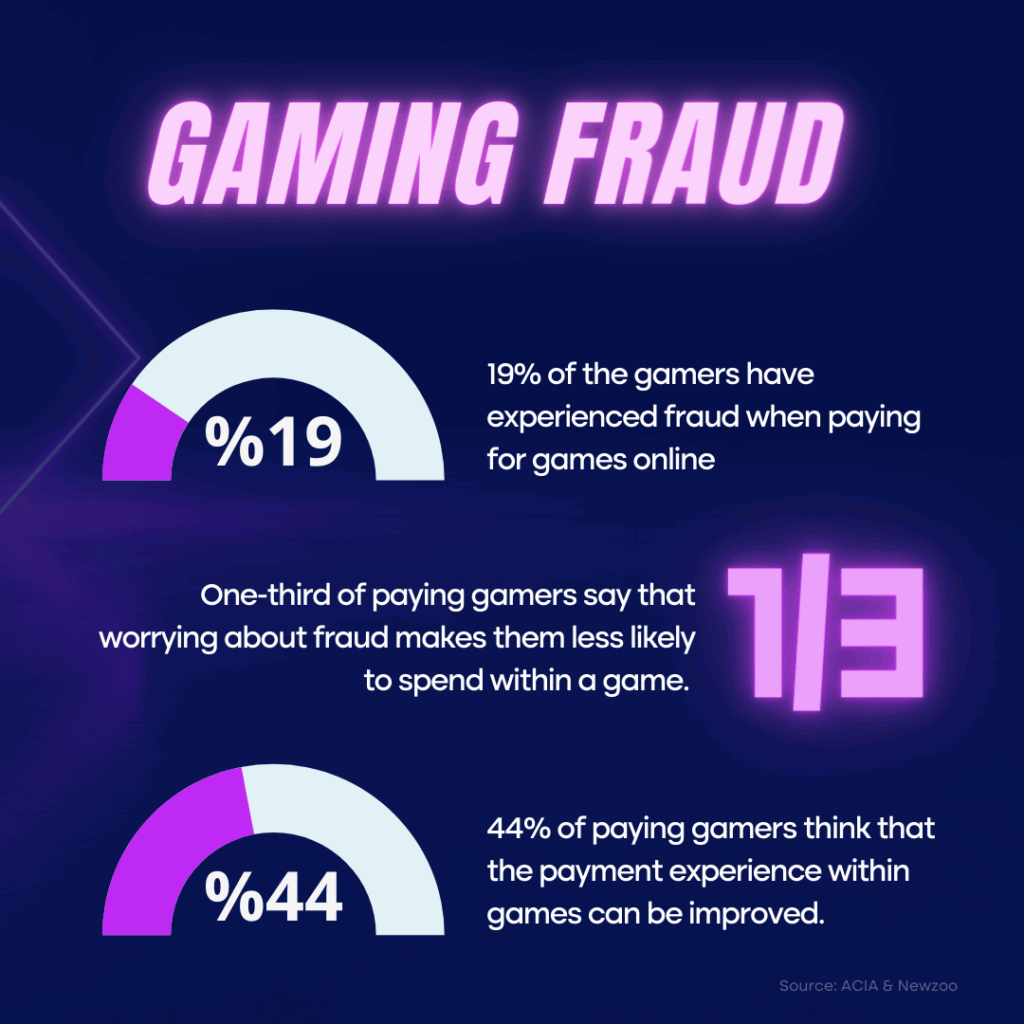

Understanding Online Gaming Fraud

Online gaming fraud involves rigging digital games to siphon funds from users, often disguised as “bonuses,” “membership fees,” or “entry points.” These platforms are designed to keep users spending while offering little to no chance of real return.

Here’s how it works:

- A user registers on a gaming platform like King567 or Raja567.

- They’re lured with signup bonuses and early wins.

- After continued play, they begin losing money but are encouraged to “top up” to win it back.

- Behind the scenes, winnings are pre-decided by algorithmic bots, not real chance or skill.

- The platform collects funds and disperses them through a maze of digital wallets and fake firms.

Such platforms often avoid regulatory oversight by operating through Telegram or WhatsApp, changing names frequently, and hiding IP addresses using proxy servers or virtual private networks (VPNs).

Legal Landscape: India vs USA

In India, gaming regulation is still catching up. While the Public Gambling Act of 1867 remains the primary law, it doesn’t address digital gaming. The Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules, 2021 attempts to fill the gap by mandating transparency and compliance.

States like Tamil Nadu, Andhra Pradesh, and Telangana have implemented stricter laws, but enforcement is inconsistent.

Key laws involved in this case:

- Prevention of Money Laundering Act (PMLA), 2002

- Foreign Exchange Management Act (FEMA), 1999

- Benami Transactions (Prohibition) Act, 1988

In the United States, comparable laws include:

- The Wire Act of 1961 (applied to betting across state lines)

- The Unlawful Internet Gambling Enforcement Act (UIGEA) of 2006

- FTC guidelines on deceptive gaming practices

Economic Impact of Karnataka MLA’s Betting Firm Linked to Online Gaming Fraud Funds on India’s Online Gaming Sector

India’s online gaming sector is projected to reach $5 billion by 2026, according to KPMG and NASSCOM. However, fraud cases like this shake investor confidence and raise questions about ethical governance.

Effects include:

- Increased due diligence from payment gateways

- Reluctance of foreign investors in RMG (Real Money Gaming)

- Demand for third-party compliance audits on platforms

Startups in the gaming ecosystem will now face stricter onboarding rules for users, enhanced KYC, and tighter advertising norms. In the long run, a central gaming authority may be formed to license and regulate such platforms.

How Authorities Traced the Money Trail?

This wasn’t just a routine raid. The ED conducted a forensic audit involving:

- IP address tracing from gaming servers

- Analysis of layered banking transactions across five states

- Call data records and device cloning

- Digital forensics to extract deleted WhatsApp chats and encrypted files

They discovered that:

- Veerendra’s firm was linked to more than 15 unregistered digital wallets

- Funds were moved in small chunks to avoid detection thresholds

- Multiple property deals were signed using forged IDs or proxy signatories

The ED also coordinated with financial intelligence units in Dubai and Georgia, tracing ownership of shell entities like Diamond Softech, TRS Technologies, and Prime9 Technologies, reportedly run by Veerendra’s relatives.

How to Identify and Avoid Fraudulent Gaming Platforms?

Whether you’re a parent watching your child play or a professional trying to vet investment apps, here’s how to protect yourself:

Checklist:

- Does the platform list its gaming license?

- Is the company registered with India’s MCA (Ministry of Corporate Affairs)?

- Are there real reviews from credible users or is it full of fake testimonials?

- Does it ask you to deposit large sums for “faster withdrawal” or “VIP access”?

- Can you find customer support info beyond WhatsApp?

Career Opportunities in Compliance and Cyber Law

Cases like this are boosting demand for:

- AML (Anti-Money Laundering) Compliance Officers

- Digital Forensics Analysts

- Gaming Regulation Experts

- Fraud Investigators in Fintech

In India, these roles are being hired across RegTech startups, law firms, and fintech firms. Certifications like CFCS, CFE (Certified Fraud Examiner), and ACAMS are seeing higher enrollments.

Educational Measures: How Families Can Stay Safe

Gaming fraud often affects children and teenagers first. Parents should:

- Use parental control apps to monitor online activity

- Discuss the risks of digital money and gaming

- Create a household rulebook for digital spending

- Regularly check bank statements and app purchases

Schools can also integrate cyber hygiene education under Digital Literacy initiatives. NGOs and EdTech firms can play a critical role in offering free workshops and content.

Political Fallout and What Comes Next

With the next round of elections looming, this case could trigger:

- Political distancing from Veerendra by party leadership

- Increased scrutiny into MLAs with business holdings

- A possible reshuffle in Karnataka’s legal or regulatory departments

Legal analysts suggest that if found guilty, Veerendra could face:

- Disqualification from the Legislative Assembly

- Confiscation of all benami and undisclosed assets

- Fines under FEMA and PMLA reaching several crores

- Up to 10 years of imprisonment under current money laundering laws

New Karnataka Law Hits NMDC – ₹13,975 Crore Tax Demand Raises Questions

Central GST Authorities Clarify No Notices Issued Based on UPI Transactions Amid Karnataka Row

Bidar Youth Arrested For ₹9.25 Crore GST Evasion Using Fake Bills