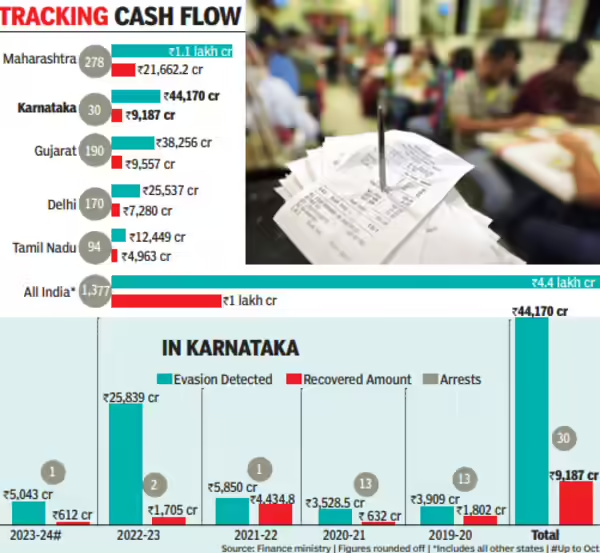

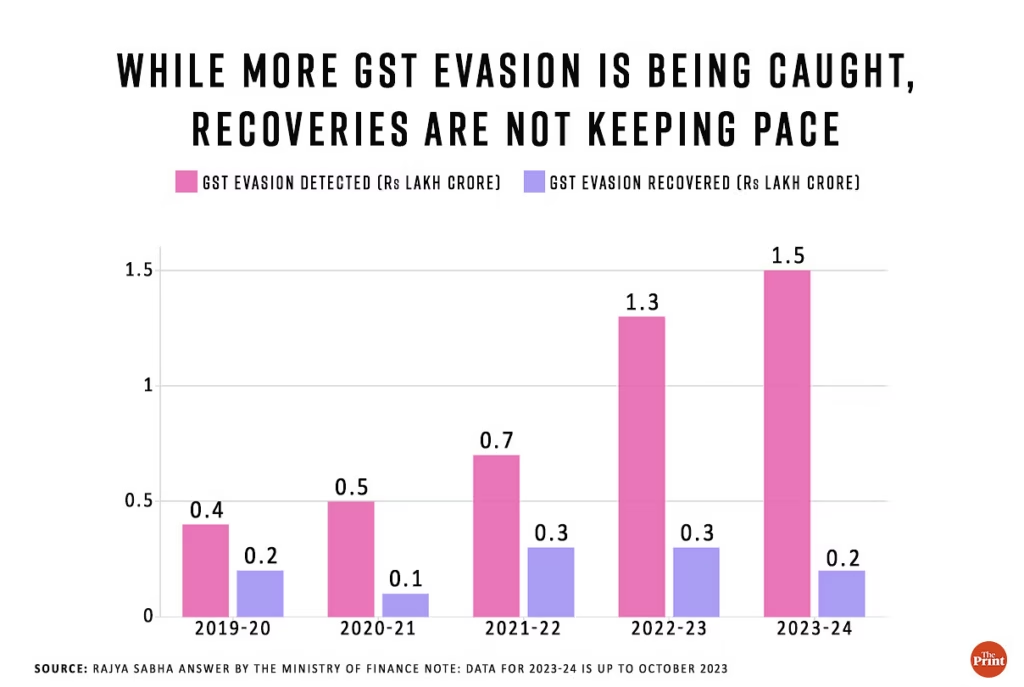

Karnataka Records Fivefold Rise in GST Evasion to ₹39,577 Crore: If you thought tax fraud was something you only heard about in major corporate scandals, think again. The Indian state of Karnataka just reported a staggering figure to the Lok Sabha: Goods and Services Tax (GST) evasion worth ₹39,577 crore in the 2024–25 fiscal year (FY25). That’s a fivefold increase compared to the ₹7,202 crore detected the year before. In U.S. dollars, that’s over $4.75 billion slipping through the tax net in just one year. This isn’t just a line item in a budget report. That amount of money could fund thousands of schools, repair roads across the state, provide better public healthcare, and support infrastructure projects for years. Whether you’re a small trader, a large corporation, or a curious observer, understanding what led to this spike — and what it means — is important.

Karnataka Records Fivefold Rise in GST Evasion to ₹39,577 Crore

Karnataka’s fivefold increase in GST evasion is more than just a headline — it’s a warning to every business. The combination of digital payment data, improved analytics, and stricter enforcement means it’s harder than ever to hide from tax authorities. For honest traders, that’s a positive step toward a level playing field. For others, it’s a signal that the old ways of avoiding taxes are ending. In a rapidly digitizing economy, compliance isn’t just about following the law; it’s about building credibility and staying competitive. If your business operates in India, this is the moment to review your records, understand your obligations, and take action before the tax department does it for you.

| Point | Details |

|---|---|

| Total GST Evasion Detected in FY25 | ₹39,577 crore (~$4.75B USD) |

| Increase Over FY24 | 5× higher (from ₹7,202 crore in FY24) |

| Number of Cases | 1,254 cases in FY25 |

| Arrests Made | 9 individuals |

| Money Recovered | ₹1,623 crore voluntarily paid |

| Previous Years | FY23: ₹25,839 crore; FY24: ₹7,202 crore |

| Key Trigger for Public Debate | UPI-based GST notices sent to traders |

| Official Source | Lok Sabha |

| Finance Minister’s Note | Notices based on UPI data issued by state GST offices, not central GST authorities |

What Happened and Why It’s Big News?

The Goods and Services Tax is India’s nationwide indirect tax system, much like the sales tax in the United States. GST is collected on the sale of goods and services, and the revenue is split between the central and state governments.

In FY25, Central GST (CGST) officers in Karnataka uncovered a record ₹39,577 crore in evasion. This is more than just a jump — it’s a leap from the previous year’s ₹7,202 crore and even surpasses FY23’s ₹25,839 crore. That’s a swing that reflects not just changes in economic activity but also how enforcement strategies have evolved.

The spike gained national attention when traders began receiving notices from the Karnataka state GST offices based on their UPI (Unified Payments Interface) transaction data. For small businesses used to operating partly in cash, this felt like a sudden and invasive crackdown.

Why Karnataka Records Fivefold Rise in GST Evasion to ₹39,577 Crore?

Multiple factors appear to be behind this sharp rise:

- Enhanced Detection Methods – Authorities have started analyzing UPI payment data alongside bank transactions, invoices, and e-way bills, making it much harder to hide sales.

- Post-Pandemic Economic Surge – As business activity picked up after the COVID slump, taxable transactions rose — and so did opportunities for evasion.

- Aggressive Field Enforcement – More officers, more audits, and more random inspections have increased detection rates.

- Public Protests Drawing Focus – The backlash against UPI notices put a spotlight on potential non-compliance, prompting more thorough investigations.

The UPI Factor: Digital Trails and Tax Compliance

UPI is India’s digital payment powerhouse. It processes billions of transactions each month, and its convenience has transformed how people pay for goods and services. But with that convenience comes a digital trail that’s gold for tax enforcement.

Karnataka’s tax department cross-referenced UPI records with GST registrations. Traders whose combined turnover (cash plus digital) exceeded ₹40 lakh annually for goods or ₹20 lakh for services — without GST registration — received notices.

The result was swift backlash:

- Many Bengaluru traders displayed “No UPI, Only Cash” signs.

- Milk vendors, market sellers, and shop owners organized a statewide shutdown on July 25.

- The state government rolled back certain notices, waived older dues for exempt items, and began holding awareness sessions to educate traders on GST compliance.

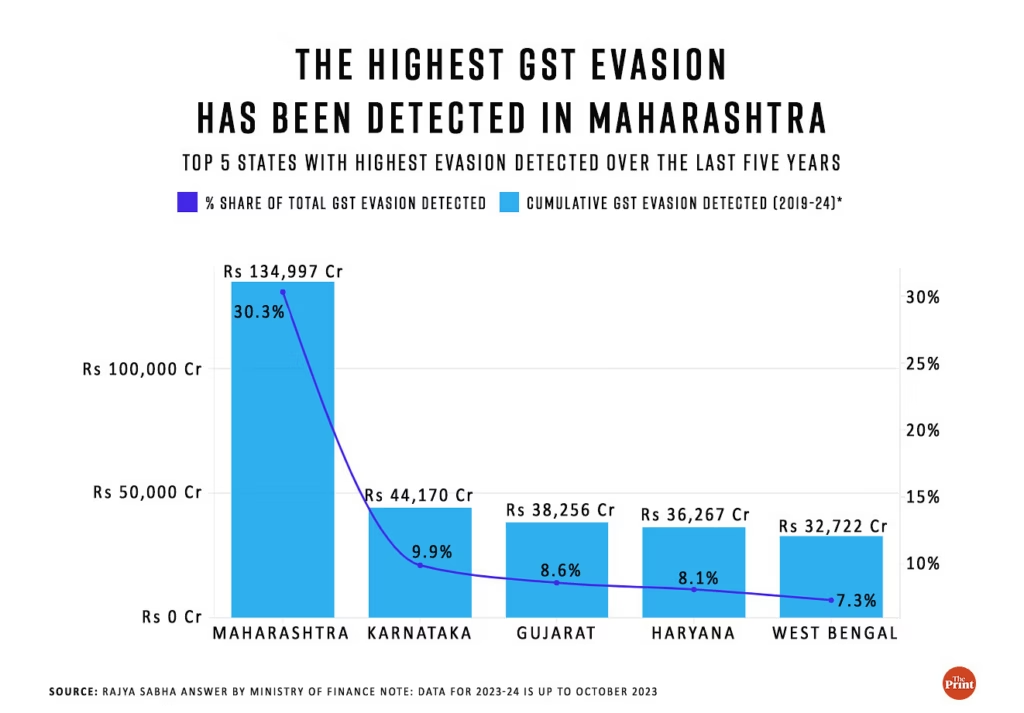

Karnataka vs. Other States

Karnataka’s numbers stand out. While GST evasion exists in every state, most haven’t seen a jump of this magnitude in a single year. Maharashtra and Tamil Nadu reported increases in detected evasion, but not on the same scale.

This raises an interesting point — Karnataka may have a bigger compliance problem, or its detection methods could simply be more advanced, allowing it to uncover evasion other states are missing.

Sector-Wise Patterns in GST Evasion

Data from enforcement officials suggests certain sectors were more prone to GST evasion in FY25:

- Textiles and Apparel – Frequent underbilling and fake invoices.

- Construction and Real Estate – Cash-based deals and misreporting of contract values.

- Electronics – Mismatch between import/export records and sales.

- Food and Beverages – Undeclared high-volume sales.

These industries tend to have high transaction volumes and sometimes operate in fragmented supply chains, making it easier to hide taxable income.

How Evasion Hurts the Economy and Honest Businesses?

The loss of ₹39,577 crore in GST revenue has direct and indirect effects:

- Public Services Take a Hit – Less money for infrastructure, healthcare, and education.

- Job Losses – Government-funded projects slow down without funding, cutting jobs in construction, manufacturing, and related sectors.

- Competitive Disadvantage for Honest Traders – Those who pay their taxes face unfair competition from those who undercut prices by avoiding GST.

It’s like everyone contributing to a neighborhood improvement fund — except a few skip paying, and now the park renovation has to be canceled.

Government Action Plan Going Forward

Officials have already signaled a stronger stance:

- Increased Use of AI and Analytics – Automated systems will flag discrepancies faster.

- Closer Central-State Coordination – To prevent jurisdictional loopholes.

- Expanded Trader Education Programs – Simplifying GST rules to encourage voluntary compliance.

- Harsher Penalties – Repeat offenders could see steeper fines and longer jail terms.

The Finance Minister has also clarified that central GST authorities didn’t issue UPI-based notices; these came from state GST offices.

A Real-World Example of Detection

Consider a Bengaluru electronics retailer who reported ₹18 lakh in annual sales — under the ₹40 lakh threshold. Upon reviewing UPI transactions, authorities found ₹28 lakh in digital sales plus another estimated ₹15 lakh in cash transactions. That brought the total to ₹43 lakh, triggering mandatory GST registration. The business was liable for back taxes, penalties, and temporary closure until compliance was achieved.

Compliance Guide for Traders

To avoid trouble, traders should:

- Know the Thresholds – ₹40 lakh for goods, ₹20 lakh for services.

- Register Before You’re Required – This avoids penalties and interest.

- Track All Sales – Cash and digital sales both count toward the limit.

- File Returns On Time – Delays lead to fines and interest.

- Stay Updated – GST rules can change mid-year; follow updates on the official GST portal.

Lessons from the U.S.

The IRS in the U.S. uses payment processors’ reports, such as PayPal and Venmo 1099-K forms, to track business income. When reporting thresholds were lowered, many small businesses and gig workers faced unexpected tax liabilities. The lesson is clear: digital transactions leave an audit trail, and trying to hide them rarely works out well in the long run.

7,000 Vendors Without Registration Now Targeted in Karnataka—Here’s How to Avoid Penalties

Banks Propose New GST Slab of ₹1 Crore to Prevent Merchants from Avoiding Digital Payments

GST Council Considers Amnesty That Could Save Small Businesses Lakhs in Penalties