Kerala Claims Corruption Almost Nil: When people talk about corruption in India, the conversation usually spirals into complaints about bribes, delays in government offices, or big-ticket scams involving politicians. That’s why Kerala’s recent claim feels almost unbelievable: Kerala says corruption is “almost nil” because most taxpayers are honest. This bold statement came from Shaik Khader Rahman, Chief Commissioner of CGST & Customs in Kerala, who revealed that about 85% of taxpayers comply with rules and pay honestly. At a time when countries across the globe are bleeding revenue due to tax evasion, Kerala’s claim isn’t just good news for the state—it’s a model worth studying for anyone interested in governance, business, or finance.

Kerala Claims Corruption Almost Nil

Kerala’s declaration that corruption is “almost nil” is more than just a headline—it’s a lesson in how trust, technology, and culture can reshape governance. With 85% of taxpayers staying honest, quick dispute resolution, and a transparent system, Kerala is punching above its weight in compliance. Yes, scandals in institutions show cracks in the system, but the bigger picture is clear: Kerala has built a foundation others can learn from. For professionals, the key takeaway is simple: honesty isn’t just the right choice—it’s the profitable one.

| Point | Details |

|---|---|

| Main Claim | Kerala’s CGST Chief says corruption is “almost nil.” |

| Taxpayer Honesty | Around 85% of taxpayers comply with rules. |

| Revenue Stats | GST collections: ₹18,000 crore (~$2.1B); 75% from services, 25% from goods. |

| Growth | Revenue growth FY 2023–24 to 2024–25: about 5%. |

| Efficiency | Tax disputes resolved within 3–4 months. |

| Reference | New Indian Express |

Why This Matters?

At its heart, corruption boils down to trust and opportunity. If the system is too complex, people look for shortcuts. If officials exploit loopholes, citizens lose faith and start evading. Kerala seems to have balanced the equation by making compliance easier, enforcement smarter, and honesty more culturally accepted.

Think of it like paying your utility bill online. When the system is fast, transparent, and simple, you’re less likely to delay or dodge payments. The same principle applies here—Kerala has made paying taxes straightforward and culturally “normal.”

For professionals and global investors, this means fewer hidden costs. Every dollar (or rupee) spent is less likely to leak into bribes or delays. That improves Kerala’s reputation as a place to do business. In U.S. terms, it’s like comparing the simplicity of filing taxes in a state with good e-filing systems versus getting tangled in paperwork where errors are common and audits drag on.

Historical Context: Why Kerala Stands Out

Kerala didn’t get here overnight. Several unique factors created the foundation for this achievement:

- Education First: With a literacy rate above 96%, Kerala has one of the most educated populations in India. People understand the importance of compliance and can navigate digital systems better than in many other regions.

- Global Exposure: Millions of Keralites live and work abroad, especially in the Middle East and North America. They experience transparent tax systems overseas and often bring those values home.

- Remittance-Driven Economy: A significant chunk of Kerala’s GDP comes from remittances. This reduces dependency on shady industries where corruption thrives, like mining or heavy manufacturing.

- Strong Social Development: Decades of investment in healthcare, education, and social equality fostered a collective culture. Paying taxes is seen not just as an obligation but as a contribution to the community.

This context makes Kerala different from states where low literacy, cash-driven economies, or large unregulated sectors create fertile ground for corruption.

The Numbers Behind the Kerala Claims Corruption Almost Nil

Taxpayer Honesty

The claim that 85% of taxpayers comply with rules is striking. To put this into perspective, the IRS estimates that U.S. taxpayers underreport income by hundreds of billions each year, leaving a “tax gap” of nearly $600 billion annually. Compared globally, Kerala’s compliance is extraordinary.

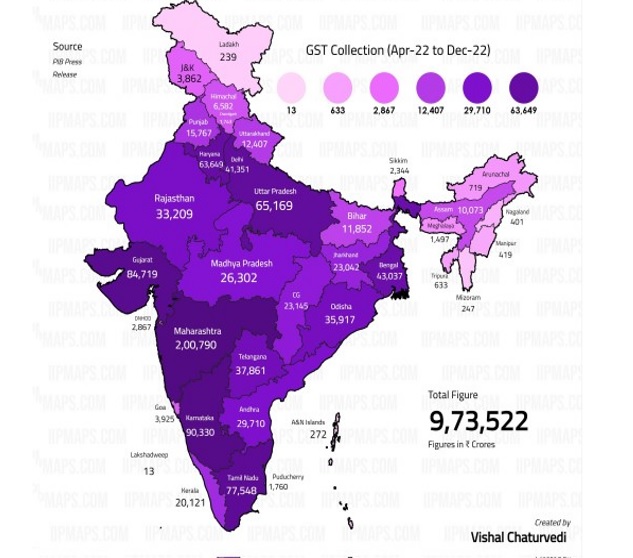

GST Collections

Kerala’s GST collection in FY 2024–25 was ₹18,000 crore (~$2.1B). Here’s the breakdown:

- 75% from services: Tourism, IT, healthcare, education, logistics, and financial services dominate.

- 25% from goods: With fewer large factories compared to states like Maharashtra or Gujarat, manufacturing plays a smaller role.

This heavy tilt toward services means Kerala’s economy is less prone to industrial tax manipulation but also more vulnerable to fluctuations in tourism or remittance-driven consumption.

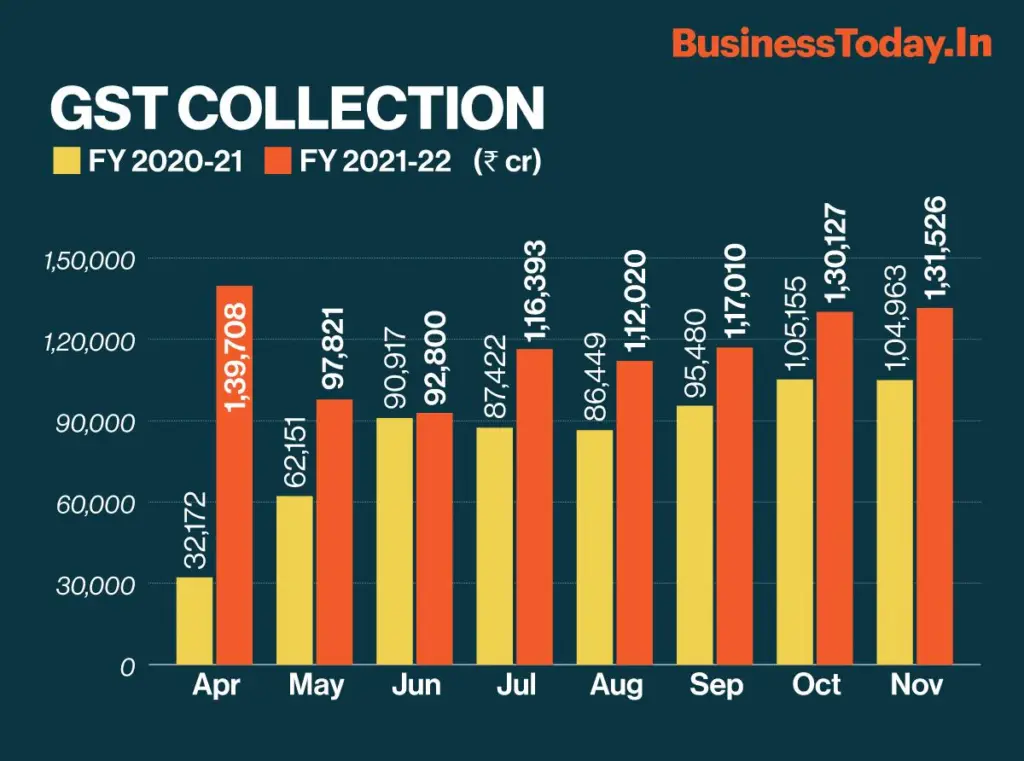

Growth Rate

Revenue grew about 5% year-on-year from FY 2023–24 to 2024–25. Nationally, India’s GST revenue grew 10–12%, so Kerala lags behind. But slow growth isn’t always bad—it could also signal high compliance and fewer “hidden” gains from evasion.

Fast Dispute Resolution

Tax disputes are resolved in 3–4 months in Kerala, while in many parts of India, cases drag on for years. This is a big deal for businesses. Imagine if the IRS resolved disputes within months instead of dragging audits and court cases for years—companies would save millions in legal fees and uncertainty.

Real-Life Stories

Consider Meera, a boutique owner in Kochi. She files taxes online in under an hour. Instead of dreading inspections, she receives digital alerts that guide her through compliance. That saves her time and builds her credibility with banks.

Or Arjun, a hotelier in Munnar, who once struggled with paperwork. Now, with online systems, his transparent records helped him secure a loan for expansion. His honesty didn’t just keep him out of trouble—it fueled growth.

These examples show how a culture of transparency reduces stress, builds trust, and encourages entrepreneurship.

How Kerala Pulled This Off?

- Digital Transformation

Kerala invested heavily in IT infrastructure for tax filing. Online portals reduced human interaction, which in turn reduced the chance of bribery. It’s similar to how mobile banking reduced fraud in the U.S.—digital systems leave less room for manipulation. - Smuggling Control

By tightening border checks and implementing e-way bills, Kerala made it harder for businesses to move goods without paying taxes. Smuggling, once a big leakage, became riskier. - Efficient Legal Framework

With faster courts and dispute mechanisms, Kerala removed the incentive for taxpayers to stall. Businesses now see resolution as achievable, not endless. - Trust-Building

Instead of intimidating taxpayers, Kerala emphasized education and guidance. Officers act more like advisors than adversaries, which encourages voluntary compliance.

Comparing Kerala Locally and Globally

- Other Indian States: Maharashtra, Delhi, and Gujarat collect higher revenues due to industrial bases, but they also face higher evasion. Kerala’s smaller economy shows disproportionately higher compliance.

- United States: Even with advanced IRS systems, tax evasion remains rampant. Kerala proves that cultural trust, not just tech, drives compliance.

- Scandinavia: Countries like Sweden and Norway enjoy high compliance because citizens trust the government to use taxes wisely. Kerala mirrors this by investing tax money back into healthcare and education, building trust loops.

Challenges and Contradictions

Kerala isn’t flawless. Institutional corruption cases continue to pop up.

- The Kerala Financial Corporation lost ₹101 crore (~$12M) in questionable investments.

- The ANERT scandal exposed irregularities in the state’s renewable energy agency.

So while taxpayer honesty is high, public institutions still face credibility issues.

Global Lessons

Kerala’s example provides universal lessons:

- Simplify Compliance: The easier it is, the less people cheat.

- Speed Matters: Fast dispute resolution encourages cooperation.

- Trust is Key: Technology can’t replace cultural values—honesty has to be normalized.

- Show Results: People pay taxes more willingly when they see roads, schools, and hospitals improve.

Future Outlook

Kerala can’t rest on its laurels. To sustain progress, it must:

- Expand AI use to detect evasion early.

- Improve transparency in public institutions.

- Diversify its economy with industries while preserving compliance culture.

- Educate small businesses on compliance through workshops and digital campaigns.

If Kerala succeeds, it could become a global case study in tax governance.

Practical Advice for Professionals

Whether you’re in Dallas or Delhi, here’s how Kerala’s lessons apply to you:

- Leverage digital tools: Use QuickBooks, Zoho Books, or Tally for clean records.

- Stay proactive: File early and avoid last-minute errors.

- Think long-term: Reputation matters more than short-term savings.

- Build a compliance culture: Train staff, set standards, and reward transparency.

GST Collections Unveil Shocking Cultural Shifts Across Indian Districts

New DDP Indicators and GST Collections Reveal Economic and Cultural Shifts in Districts

How Local Trade Helped July GST Collections Reach an Impressive Rs 1.96 Lakh Crore—The Inside Story