Kerala HC Rules KVAT Not Leviable on Hoardings: In a landmark decision, the Kerala High Court has clarified a crucial aspect of the Kerala Value Added Tax (KVAT) Act. The court ruled that KVAT is not applicable on hoardings when there is no transfer of the right to use the hoardings to third parties. This decision provides clarity for businesses engaged in outdoor advertising and resolves years of confusion surrounding the taxability of hoardings in Kerala. While this ruling is a significant win for advertisers in Kerala, it also raises important questions about the structuring of advertising contracts and their tax implications. Understanding the details of this ruling can help advertisers, businesses, and legal professionals navigate the often-complex world of tax regulations and outdoor advertising.

Kerala HC Rules KVAT Not Leviable on Hoardings

The Kerala High Court’s ruling on KVAT and hoardings is a significant development for the outdoor advertising industry in Kerala. By clarifying that KVAT does not apply when use rights are not transferred, the ruling provides clarity and relief for businesses in the advertising sector. To ensure compliance with this ruling, businesses must carefully draft their contracts and avoid transferring control over the hoardings. Legal counsel and continuous updates on tax regulations will help businesses stay on the right side of the law.

| Key Data & Insights | Details |

|---|---|

| Court Ruling | Kerala High Court ruled KVAT not applicable on hoardings when no transfer of use rights occurs. |

| Main Consideration | The right to use hoardings is not transferred to the advertiser. |

| Key Implication | Advertisers should ensure that contracts do not transfer use rights to third parties. |

| Tax Impact | Quashes previous assessments for hoarding displays under KVAT. |

| Official Source | Kerala High Court Judgement on Hoardings |

The Case at a Glance: Understanding the Ruling

The Kerala High Court’s decision focuses on a key issue regarding outdoor advertising. Specifically, the court examined whether KVAT applies to hoardings when the right to use the hoardings is not transferred to third parties. The case arose when the tax authorities attempted to levy KVAT on transactions related to hoardings.

However, the court ruled that, in this case, there was no transfer of control over the hoardings to the advertiser. The agreement merely allowed advertisers to display their advertisements without the ability to control or sublet the hoarding. This distinction was pivotal: the KVAT is applicable only if there is a transfer of the right to use goods, which the court determined did not occur in this case.

This ruling brings much-needed clarity for outdoor advertising companies, especially in the context of KVAT’s application to hoardings and other similar advertising spaces.

Why Kerala HC Rules KVAT Not Leviable on Hoardings Matters?

For advertisers and businesses in Kerala, the Kerala High Court’s ruling is a major development. The KVAT had been a point of contention in the outdoor advertising industry, with confusion around whether hoardings were subject to the tax. By confirming that KVAT does not apply when the right to use hoardings is not transferred, the court’s decision provides a clear roadmap for businesses involved in advertising.

Practical Implications for Advertisers

This ruling provides a much-needed sense of relief for companies that rely on outdoor advertising. If you are in the business of selling or leasing hoardings for advertising purposes, this judgment means you may no longer be required to pay KVAT for displaying ads, as long as your contract doesn’t transfer use rights to the advertiser.

For instance, if you lease out a hoarding space to an advertiser with a contract that allows them to display their advertisement for a specific period (without granting them control over the hoarding itself), then no KVAT should apply.

However, there is a catch. If the contract allows the advertiser to sublet, reassign, or control the use of the hoarding, KVAT may apply. Advertisers need to ensure that their agreements are properly structured to avoid triggering taxable events.

Step-by-Step Guide: How to Stay Compliant with KVAT in Outdoor Advertising

Step 1: Understand the Concept of Transfer of Use Rights

The transfer of use rights refers to a situation where the advertiser gains control over the hoarding space. This includes the ability to sublet, transfer, or decide how the hoarding is used. If such rights are granted, then the transaction could be considered taxable under KVAT. In contrast, if the advertiser simply displays ads without control over the hoarding, no VAT applies.

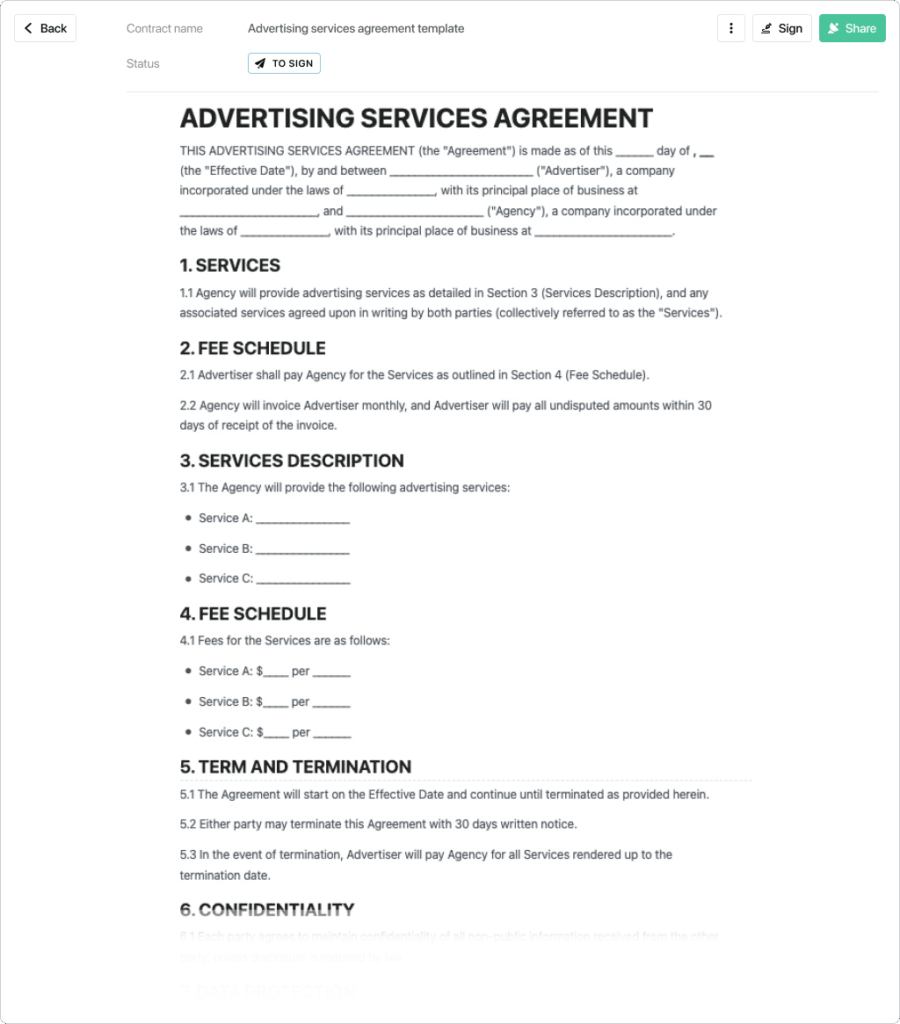

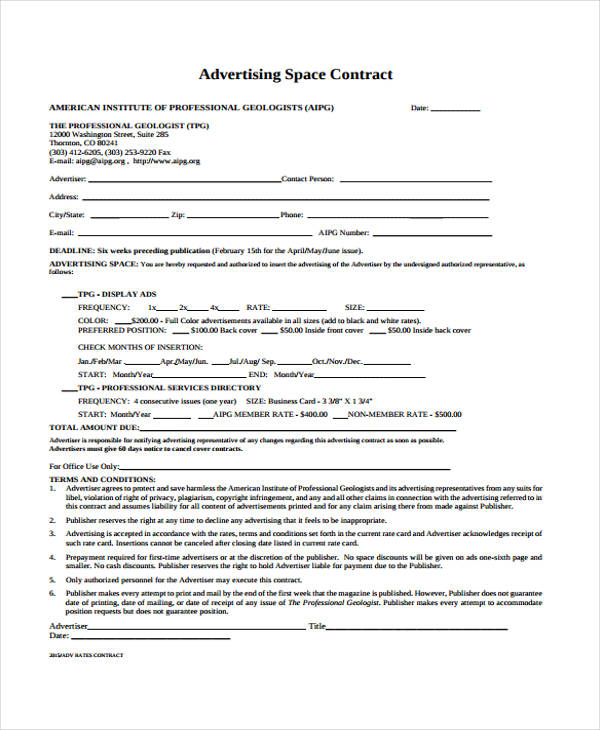

Step 2: Draft Clear Contracts

Make sure that your contracts explicitly specify that ownership and control of the hoarding remain with you, the service provider. Advertisers should be given the right to display ads but not the right to control the space.

Step 3: Provide Documentation of Ownership and Control

Keep thorough records showing your control over the hoardings. This can include maintenance logs, advertising schedules, and visual proof that you retain ownership and are managing the space throughout the contract duration.

Step 4: Seek Legal Advice

Given the legal nuances surrounding KVAT, it’s important to consult with legal and tax experts to ensure your contracts comply with all relevant laws. A legal professional specializing in tax law can help you identify any potential pitfalls and avoid inadvertent tax liability.

Step 5: Stay Updated on Legal Changes

Tax laws are not static, and they may evolve over time. To avoid compliance issues, keep up with updates on tax regulations, especially as they pertain to outdoor advertising. Subscribing to legal newsletters or consulting local tax experts can help you stay on top of changes.

A Comparison with Other States

Kerala is not the only state in India where outdoor advertising is governed by local tax laws. In fact, several states have their own variations of VAT or sales tax applicable to hoarding contracts.

For instance, in Maharashtra, outdoor advertising is subject to a luxury tax rather than VAT, while in Tamil Nadu, similar outdoor advertising services may also be subjected to service tax. Advertisers in these states need to tailor their contracts according to local tax laws and should consult with legal professionals to avoid potential issues.

Challenges in Implementing the Ruling

While the Kerala High Court’s ruling provides clarity, businesses may face challenges in its implementation. One challenge is ensuring that contracts are properly drafted and do not unintentionally transfer rights to third parties. Moreover, if a business fails to maintain clear documentation of its ongoing control over the hoardings, they may be at risk of facing tax assessments.

Further, the application of KVAT can vary in different contexts, depending on the specifics of the contract. Thus, businesses must stay vigilant and proactive to ensure that they remain tax-compliant.

Half-Yearly Income Tax Digest 2025: Key ITAT Decisions Every Taxpayer Should Know

Massive ₹62 Crore GST Evasion Scam Uncovered in Ludhiana—Two Arrested in Major Tax Fraud Bust!