Last Date to File ITR: If you’ve been putting off filing your taxes this year, here’s the deal: the September 15 deadline is the last date to file your Income Tax Return (ITR) and pay self-assessment tax without penalty in India. The Central Board of Direct Taxes (CBDT) has officially extended the filing date for non-audit taxpayers, giving millions of individuals, professionals, and small businesses a chance to breathe. Still, this isn’t a free pass to slack off. Miss the September 15 date, and penalties plus interest charges will start kicking in. In other words, think of this as your final warning before the government begins applying late fees like interest on a forgotten credit card bill.

Last Date to File ITR

The September 15, 2025 deadline is more than just a date on the calendar. It’s the final opportunity for non-audit taxpayers to file their ITR and pay self-assessment tax without penalty. Missing it means extra costs, delayed refunds, and lost benefits. Whether you’re a salaried employee, a freelancer, or a small business owner, taking action now ensures compliance and peace of mind. So, don’t wait until the servers crash on September 14. Get your paperwork in order, file your return, and pay your dues today. Future you will be grateful.

| Point | Details |

|---|---|

| Deadline Extended | From July 31, 2025 to September 15, 2025 (Assessment Year 2025–26) |

| Who’s Covered | Non-audit taxpayers – salaried individuals, pensioners, NRIs, Hindu Undivided Families (HUFs), Associations of Persons (AOPs) |

| Penalty-Free Zone | File ITR and pay self-assessment tax by September 15 = no Section 234A interest |

| After September 15 | Late filing fee + interest charges apply |

| Official Notification | CBDT Circular No. 6/2025 |

Why Did the Government Extend the Last Date to File ITR?

The tax deadline for non-audit cases is usually July 31 every year. Over the last several years, however, CBDT has repeatedly extended due dates, especially during the COVID-19 pandemic. While those extensions were linked to disruptions, this year’s shift to September 15 is largely to ease compliance pressure on taxpayers and reduce server overloads on the Income Tax e-filing system.

Historically, many taxpayers wait until the last week of July to file, which often leads to technical snags. By extending the date, CBDT is encouraging smoother compliance and ensuring the system can handle the load.

What Is Self-Assessment Tax and Why It Matters?

Self-assessment tax is the balance tax you pay after considering advance tax and TDS (Tax Deducted at Source). It’s basically your way of squaring up with the government before closing your tax books.

For example, if your total tax liability is ₹1,50,000 and TDS has already covered ₹1,20,000, the remaining ₹30,000 is self-assessment tax. If you pay it on or before September 15, you avoid interest under Section 234A. But if you delay, interest at 1% per month or part of a month applies.

This interest may sound small, but it stacks up quickly, especially if you’re dealing with large sums.

Step-by-Step Guide to File ITR Before the Last Date to File ITR and Pay Self-Assessment Tax

Step 1: Gather Your Documents

- Form 16 from your employer

- Form 26AS or Annual Information Statement (AIS)

- Bank account statements

- Proof of investments (life insurance, ELSS, PPF, etc.)

- Rent receipts, if claiming HRA

Step 2: Log in to the E-Filing Portal

Go to www.incometax.gov.in and log in using your PAN and password.

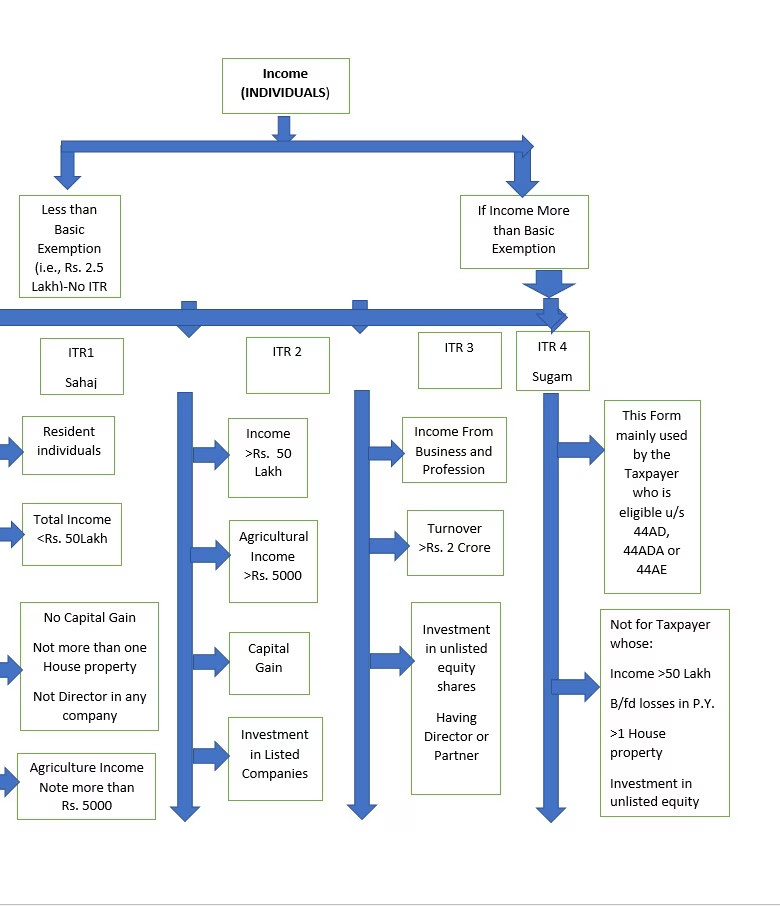

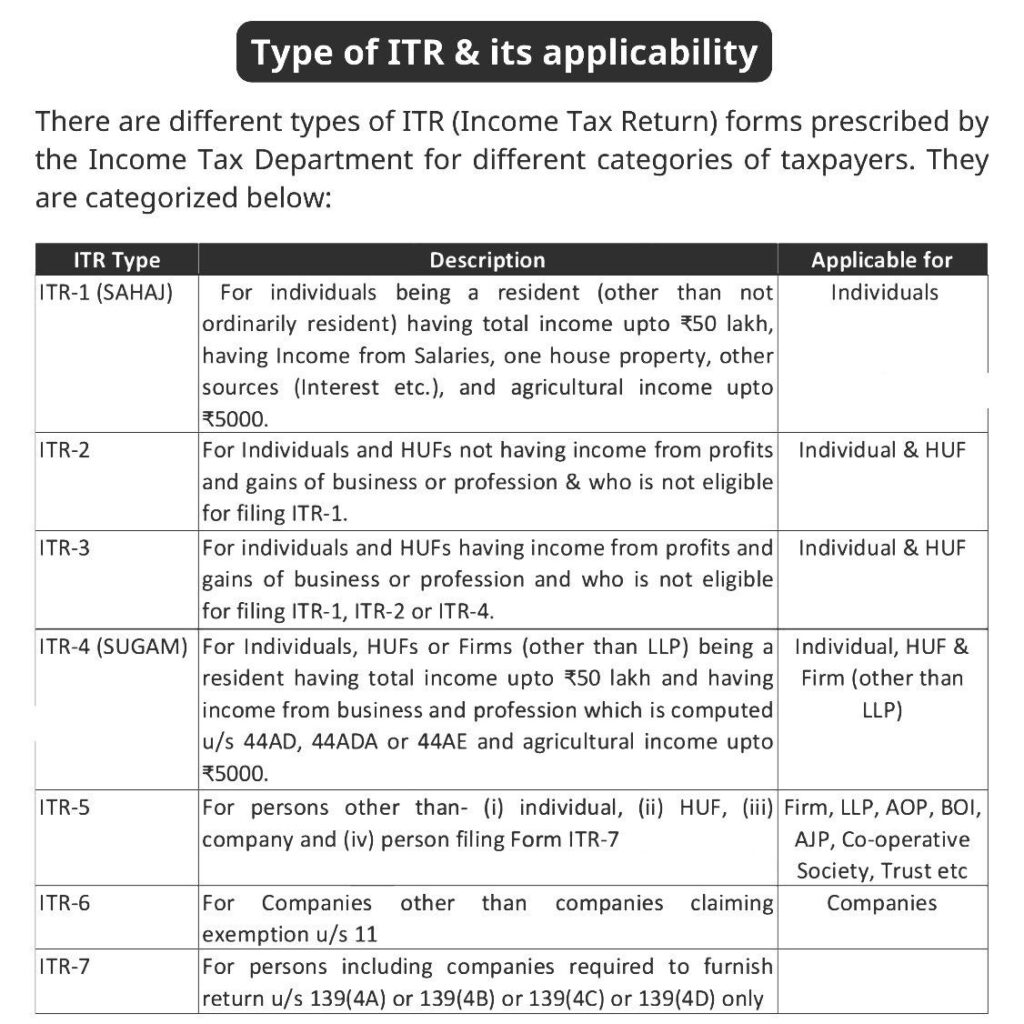

Step 3: Choose the Correct ITR Form

- ITR-1 for salaried individuals

- ITR-2 for those with capital gains or multiple properties

- ITR-3/ITR-4 for business owners and freelancers

Step 4: Calculate Your Liability

The system will auto-fill much of your data. Review carefully, especially deductions and exemptions.

Step 5: Pay Self-Assessment Tax

Use the “e-Pay Tax” option or Challan 280 via net banking. Ensure you select the right assessment year (2025–26).

Step 6: Submit and E-Verify

Once paid, submit your return and e-verify using Aadhaar OTP, net banking, or Digital Signature.

Checklist Before Hitting Submit

- Verify TDS in Form 26AS

- Match entries in AIS with your income sources

- Double-check deductions under Section 80C, 80D, 80G, and others

- Ensure correct residential status (especially important for NRIs)

- Calculate and pay any balance tax before September 15

- Always e-verify after filing; without this, your return isn’t considered valid

What Happens If You Miss the Last Date to File ITR?

Here’s where things get expensive:

- Interest under Section 234A

Charged at 1% per month or part of a month on the unpaid self-assessment tax. Example: If you owe ₹40,000 and delay filing for 3 months, interest = ₹40,000 × 1% × 3 = ₹1,200. - Late Filing Fee (Section 234F)

- ₹5,000 if total income exceeds ₹5 lakh

- ₹1,000 if income is below ₹5 lakh

- Loss of Benefits

Certain losses (business or capital gains) cannot be carried forward if returns are filed late. - Refund Delays

Filing late often pushes refund processing back by months.

How India’s Deadline Compares with the U.S.?

In the United States, the IRS deadline is April 15. Taxpayers can apply for an extension to October 15, but the catch is that any tax due must be paid by April 15 to avoid penalties.

India’s system this year is more forgiving since both filing and payment of self-assessment tax align on September 15. For Non-Resident Indians (NRIs) with exposure to both systems, the Indian extension feels like a grace period, but with penalties lurking if ignored.

Why This Deadline Matters for Different Taxpayers?

Salaried Employees

Usually straightforward, but late filing can still trigger penalties and refund delays.

Freelancers and Gig Workers

Often have multiple income streams (consulting, side hustles) that don’t get covered under TDS. Self-assessment tax is common here.

Small Business Owners

Cash flow can get squeezed if returns are delayed, as penalties eat into profits.

NRIs

Many NRIs with property or investment income in India need to reconcile multiple income sources. Filing late can complicate future visa or financial applications.

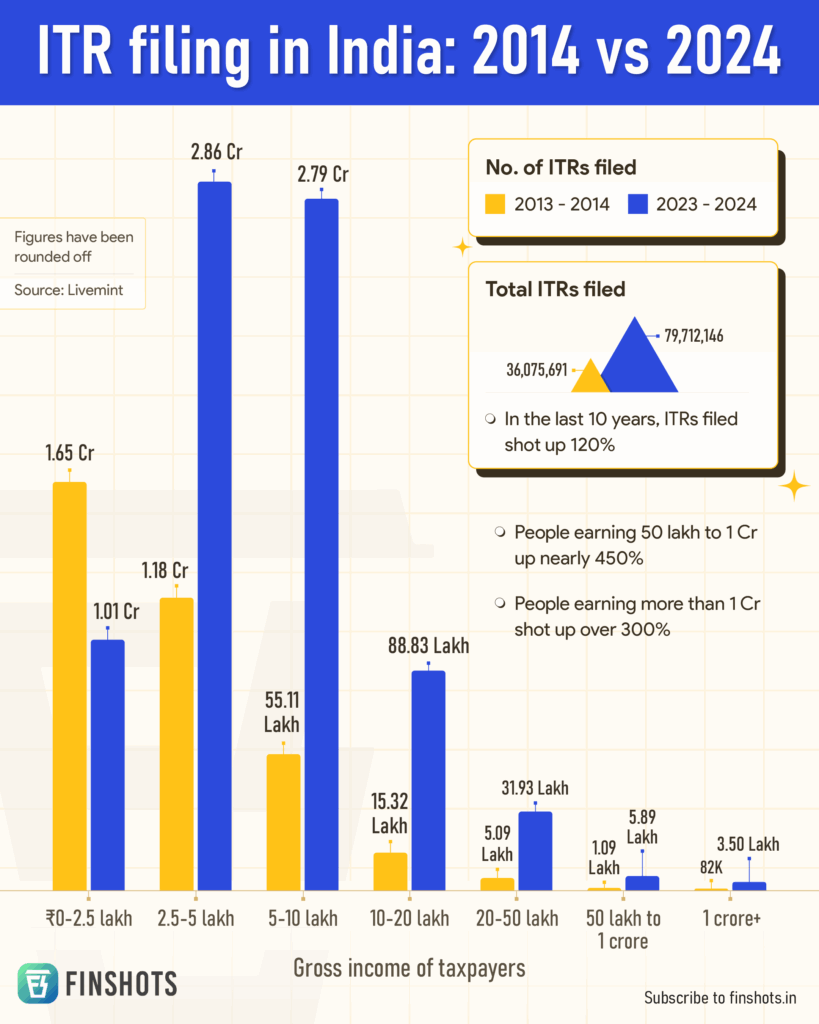

Historical Trends in Tax Filings

- In FY 2022–23, over 7.8 crore returns were filed, a record at that time.

- In FY 2023–24, the number crossed 8.2 crore, with nearly 6.6 crore filed by the July deadline.

- Data shows more than 90% of returns were e-verified within 24 hours of filing.

This demonstrates both the scale of compliance and the tendency of taxpayers to wait until the very last moment.

Penalty Calculations in Detail

Let’s assume two taxpayers:

- Raj owes ₹25,000 in self-assessment tax but pays on October 20 (1 month late).

- Interest = ₹25,000 × 1% × 1 = ₹250

- Late fee = ₹5,000 (since his income > ₹5 lakh)

- Total extra = ₹5,250

- Meera owes ₹10,000 and files on December 5 (almost 3 months late).

- Interest = ₹10,000 × 1% × 3 = ₹300

- Late fee = ₹1,000 (since her income < ₹5 lakh)

- Total extra = ₹1,300

These numbers may look small, but scale them to lakhs or crores for businesses, and the impact becomes significant.

Expert Insights

- Tarun Garg (Deloitte India): “With the deadline extended, September 15 should be treated as the final due date under Section 234A, meaning no penal interest if tax dues are cleared by then.”

- Tarun Kumar Madaan (CA): “Unlike previous extensions, Circular No. 6/2025 has no caveats. That means taxpayers can be confident they won’t face additional interest if payments are made by the new date.”

- Shubham Jain (Nangia Andersen India): “Use this window wisely. Don’t wait for September 14—plan ahead.”

Stats and Insights You Should Know

- Over 25% of taxpayers in India end up paying some form of self-assessment tax every year.

- Refund delays often stretch 3–6 months for late filers.

- Around 70% of salaried taxpayers file their returns only in the last 10 days before the deadline.

These patterns highlight why extensions are often necessary, but also why last-minute filing is risky.

Filing ITR This Year? – 4 Key Points Every Salaried Taxpayer Must Remember

ITR Filing 2025 Warning: 7 Common Issues Taxpayers Must Watch Out For

ITR 2025 Filing Guide – Why Students and Unemployed Must Not Skip It