GST on Handbags Slashed to Just 5%: When it comes to fashion and accessories, nothing says “style” quite like a handbag. Whether you’re heading to work, going on a weekend trip, or just running errands, a good bag is more than a storage solution—it’s a statement. And here’s the latest buzz: the GST (Goods and Services Tax) on handbags has been slashed to just 5%. Yes, you read that right—shopping just got a whole lot sweeter. This change isn’t just about cheaper purses at the mall. It’s part of a major GST reform in India, where the government has restructured tax rates to boost consumer demand and support local artisans. Even though the reform is happening in India, the news has global ripples because fashion supply chains, imports, and exports are deeply interconnected. For U.S. fashion lovers, business owners, and professionals in the retail sector, this update means exciting opportunities and lessons to learn.

GST on Handbags Slashed to Just 5%

The GST slash on handbags to 5% is more than a fashion headline—it’s an economic move that empowers consumers, artisans, and businesses alike. For everyday shoppers, it means cheaper prices. For artisans, it’s validation of their craft. For professionals, it’s a chance to rethink sourcing strategies. At the end of the day, a handbag is never just a handbag—it’s culture, livelihood, and style rolled into one. And now, thanks to this tax reform, it’s also a little lighter on the wallet.

| Topic | Details |

|---|---|

| GST on handbags | Reduced from 12% to 5% (effective Sept 22, 2025) |

| Who benefits? | Consumers, artisans, small businesses, eco-friendly brands |

| Why it matters | Boosts affordability, supports cottage industries, fuels demand |

| New GST structure | 5% (essentials), 18% (standard), 40% (luxury/sin goods) |

| Official Source | GST Council India |

A Quick Look Back: The GST Story

When GST was rolled out in India back in 2017, it replaced a tangled web of state and central taxes. Handbags initially sat in the 12–18% bracket, which meant they were considered more of a “semi-luxury” item than an everyday good.

Over the years, fashion associations and artisan groups lobbied the government to bring rates down. Why? Because high taxes discouraged local sales and exports, especially of handmade products. Now, after eight years, the government finally responded with GST 2.0, creating just three slabs—5%, 18%, and 40%—and handbags got their long-awaited tax relief.

Why Should Fashion Lovers Care About GST on Handbags Slashed to Just 5%?

Handbags aren’t just accessories—they’re emotional purchases. That Coach tote or handmade jute bag you’ve been eyeing feels less like a splurge when the tax is lower.

Before: A bag priced at $100 (₹8,000 approx.) under the old tax system would cost $112 with GST.

Now: With just 5% GST, it’ll cost $105.

Savings: $7 on every $100 spent.

That may sound small, but think about holiday sales, weddings, and bulk shopping. For middle-class families, every dollar counts. For businesses, lower taxes equal higher volume sales.

The Psychology of Spending

In the United States, we see the same trend during Black Friday or Memorial Day sales. Even small discounts drive people to shop more because the perception of savings is powerful. That’s exactly what India is banking on here: make fashion affordable, and people will spend more, stimulating the economy.

According to a report by McKinsey, consumer spending in emerging economies like India grows by up to 15% when indirect taxes are lowered on lifestyle products. This move taps into that consumer psychology.

Boost for Small Businesses and Artisans

Here’s the part that warms my heart: this reform isn’t just for the fashionistas shopping at luxury malls. The real winners are artisans, rural weavers, and small cottage industries.

Take Meera Handlooms, a small family business in Odisha weaving jute handbags. At 12% GST, their bags were priced higher than machine-made imports. Now at 5%, they can compete fairly, boosting sales domestically and abroad.

Another example is a women’s cooperative in Rajasthan producing leather purses. With the new GST cut, they estimate a 20% increase in orders this festive season.

In the U.S., this is similar to when states reduce taxes for small organic farms—it gives them a fighting chance against big-box corporations.

Impact on the Global Fashion Industry

Fashion is a global supply chain. Lower GST in India means:

- Cheaper exports: U.S. and European boutiques importing Indian eco-friendly handbags will see lower costs.

- Sustainability trend boost: Cotton and jute bags align with the global shift to green fashion.

- Competition for big brands: Affordable artisan-made bags could pressure mid-tier luxury brands to adjust pricing.

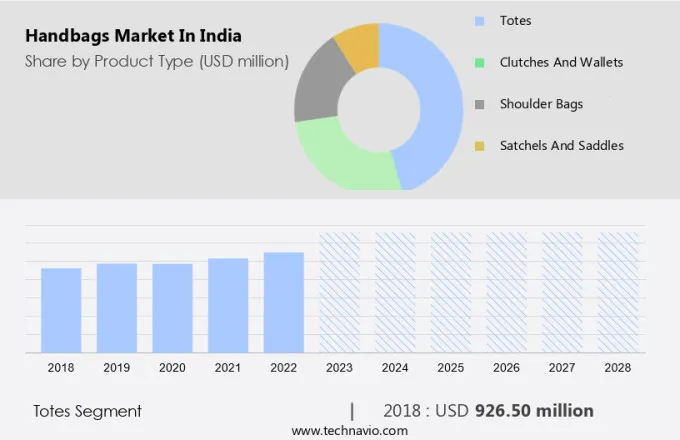

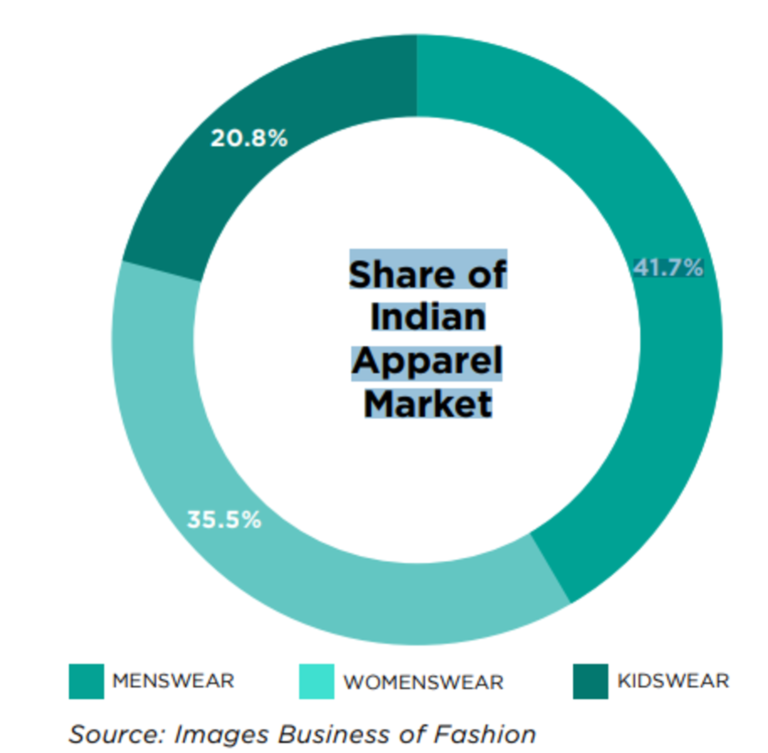

According to Statista, the Indian fashion retail market is expected to hit $115 billion by 2026. With this reform, handbags will surely play a bigger role in exports.

Step-by-Step Guide: How Businesses Can Leverage This

If you’re a U.S. importer or fashion entrepreneur, here’s how to make the most of this change:

- Identify suppliers – Focus on Indian brands producing eco-friendly or handcrafted bags.

- Negotiate pricing – With 7% tax savings, suppliers may be open to better deals.

- Highlight sustainability – Market handbags as green, handcrafted, and fair-trade.

- Track exchange rates – The U.S.–India dollar-rupee balance affects final margins.

- Watch for tariffs – Ensure U.S. import duties don’t offset savings from GST cuts.

- Market storytelling – Consumers love to know the origin of their products; use artisan stories in branding.

Consumer Tips: How to Shop Smarter

Look for tags: “Handicraft” or “eco-friendly” bags get the biggest price cuts.

Stack discounts: Combine the GST benefit with seasonal sales for maximum savings.

Support small brands: Buying artisan-made handbags helps rural families thrive.

Think resale value: Eco-friendly and handcrafted bags often have longer lifespans and can be resold at good prices.

Professional Insight: Economic and Social Ripple Effects

Economists argue that tax reforms like this do more than boost sales—they create employment opportunities. India’s handicraft sector employs nearly 7 million artisans, many of them women. Lower taxes mean higher demand, which in turn creates more jobs.

Socially, this also supports rural empowerment. For women in small towns and villages, making handbags isn’t just about art; it’s about financial independence.

Cement Stocks Could Boom as Analysts Eye a Possible GST Slash

New GST Slash May Slash Car Prices—See How Much You Could Save on Your Dream Ride