Los Angeles Lab Owner Admits $11.2 Million Tax Evasion: If you’ve been following health care and tax fraud stories, you’ve probably heard about the Los Angeles lab owner who admitted to a massive $11.2 million tax evasion scheme tied to Medicare payments. This shocking case shows how one person used loopholes, lies, and a fake owner to cheat both the health care system and American taxpayers. But this isn’t just another crime headline. It’s a reminder that Medicare fraud costs the country billions each year and that tax evasion isn’t a victimless crime—it’s money stolen from seniors, families, and communities. Let’s unpack the details, explain why it matters, and see what lessons professionals and regular folks can take away.

Los Angeles Lab Owner Admits $11.2 Million Tax Evasion

The Los Angeles lab owner who admitted to $11.2 million tax evasion and Medicare fraud shows how greed and deception can cause massive damage. Fraud doesn’t just steal from the government—it steals from communities, taxpayers, and patients who rely on Medicare. The lesson is clear: honesty and compliance aren’t optional—they’re the foundation of trust in our system. Whether you’re running a business or filing your taxes, shortcuts may seem tempting, but they can lead to devastating consequences.

| Aspect | Details |

|---|---|

| Who | Armen Muradyan, owner of Genex Laboratories in Burbank, CA |

| What | Admitted to $11.2M federal tax evasion and Medicare fraud |

| How | Used a friend as a “shill” owner to funnel $23M in Medicare reimbursements |

| Other Crimes | Fraudulent COVID-19 loan application (~$100K) |

| Tax Years | 2015–2020 (no returns filed 2021–2023) |

| Charges | Health care fraud conspiracy, wire fraud, tax evasion |

| Max Penalties | 20 years (wire fraud), 10 years (health care fraud), 5 years (tax evasion) |

| Sentencing Date | December 11, 2025 |

| Official Source | U.S. Department of Justice |

The Scam Unfolded

Here’s how the scheme played out:

- The mastermind: Armen Muradyan, 60 years old, ran Genex Laboratories, a blood-testing company in Burbank.

- The cover-up: Since Medicare had barred him from submitting claims, he recruited a friend—identified as “L.S.”—to act as the fake owner of the lab.

- The money flow: Over $23 million in Medicare reimbursements went into accounts under L.S.’s name but controlled by Muradyan.

- The tax dodge: Instead of reporting the income, Muradyan filed returns showing only about $40,000 annually, a fraction of the truth. His accomplice also filed misleading returns.

- The pandemic twist: He even filed a fraudulent COVID-19 EIDL loan application, claiming $800,000 in 2019 revenue and multiple employees. Reality? No income. No staff. Yet he secured nearly $100,000, which he spent on himself.

This wasn’t sloppy bookkeeping—it was a calculated fraud.

Why Los Angeles Lab Owner Admits $11.2 Million Tax Evasion Case Matters?

Fraud like this hurts everyone, not just the government:

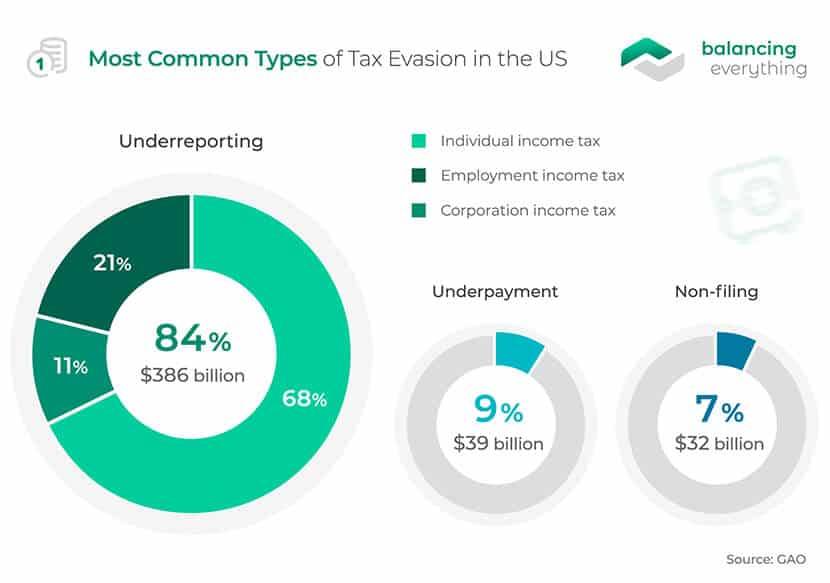

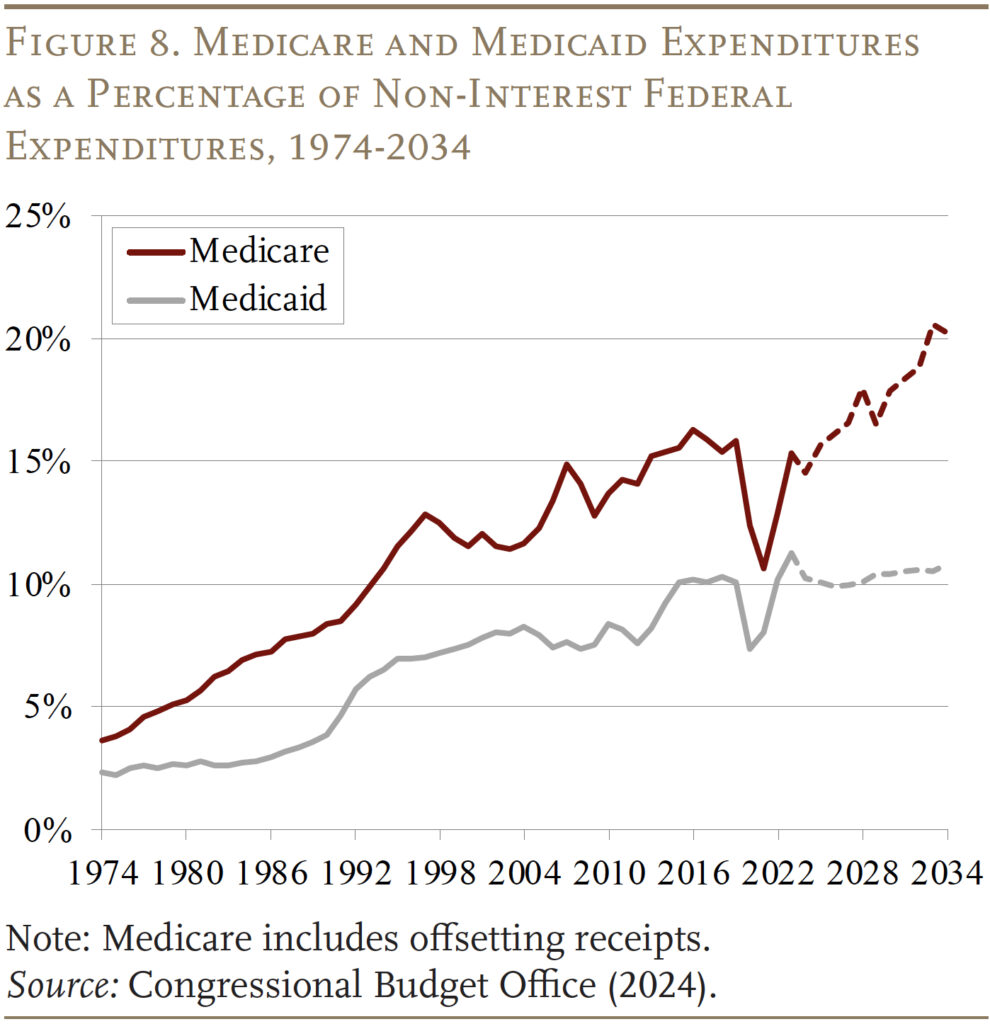

- Taxpayers pay more. Medicare fraud drains tens of billions annually, money that could go toward seniors, people with disabilities, and legitimate medical providers.

- Trust in the system collapses. Honest labs and clinics face tighter regulations and delays because scams like this poison the well.

- Health care costs rise. Fraud forces Medicare and insurers to raise premiums, increase oversight, and pass costs to the public.

Medicare Fraud in the U.S.: A Bigger Problem

Muradyan’s case is part of a much larger issue. The National Health Care Anti-Fraud Association estimates that at least 3% of total health care spending—tens of billions of dollars—goes to fraud every year.

Recent examples include:

- A Miami clinic owner convicted for a $45 million kickback scheme involving unnecessary treatments.

- A Detroit-area physician sentenced for orchestrating a $122 million fraud, billing Medicare for services never provided.

- Multiple COVID-era fraud cases, where businesses falsely applied for aid programs like EIDL and PPP loans.

In 2022, the Department of Justice reported recovering $1.7 billion through health care fraud settlements and judgments.

Breaking Down the Charges

Legal language can be confusing, so here’s what Muradyan admitted to:

- Health care fraud conspiracy (up to 10 years): Agreeing with others to trick Medicare into paying false claims.

- Wire fraud (up to 20 years): Using electronic communications—like bank transfers, emails, or phone calls—to commit fraud.

- Tax evasion (up to 5 years): Willfully hiding income or lying on tax returns to avoid paying.

Together, the maximum penalty is 35 years in federal prison. While sentences are often lighter with plea deals, the charges highlight the seriousness of the crimes.

How the IRS and FBI Catch Tax Evasion?

Ever wonder how people like Muradyan get caught? It’s usually not luck—it’s auditing and data tracking.

- Bank records: The IRS and FBI subpoena accounts to trace money flows. Hidden income usually leaves a trail.

- Whistleblowers: Employees, competitors, or even friends may tip off investigators.

- Computer matching: The IRS compares W-2s, 1099s, and bank data against tax returns. Big gaps trigger audits.

- Lifestyle audits: If you claim $40,000 a year but live in a mansion, red flags go up fast.

Muradyan’s case involved multiple agencies, including IRS Criminal Investigation, FBI, and HHS-OIG, working together to uncover the fraud.

Human Impact: The Real Victims

Fraud isn’t just about numbers—it has real consequences:

- Patients may be billed for services they never received or have their identities used in fake claims.

- Taxpayers lose billions that could fund schools, infrastructure, or medical programs.

- Communities see higher insurance premiums and strained Medicare budgets.

This is why the government aggressively prosecutes health care fraud cases—it’s not just about money, it’s about protecting trust.

A Step-by-Step Guide for Professionals: Staying Compliant

Running a business, especially in health care, comes with strict rules. Here’s how to avoid mistakes that could ruin your career:

Step 1: Keep Clean Records

Maintain organized, accurate books. Software like QuickBooks or Xero helps ensure nothing slips through the cracks.

Step 2: Report All Income

Don’t fudge numbers. Even side hustle income from Venmo or PayPal is reported to the IRS.

Step 3: Follow Medicare Regulations

If you’re barred from billing Medicare, that’s the end of the road. Using a “front man” is a serious crime.

Step 4: Apply Honestly for Loans

COVID-19 showed us that loan fraud will be uncovered. Only apply if you qualify.

Step 5: Get Professional Guidance

Hire a tax professional or compliance attorney. Their fee is nothing compared to fines or prison time.

Everyday Advice: How Citizens Can Protect Themselves

- Check Medicare statements. Look for services you didn’t receive and report suspicious charges.

- File taxes correctly. Even if you earn cash from odd jobs, report it. The IRS is cracking down on hidden side income.

- Stay alert to scams. If someone offers a “shortcut” to avoid taxes or regulations, it’s probably illegal.

Israeli AI Startup Bags $60 Million to Help Governments Fight Fraud

Tampa OnlyFans Star Who Made $5.4 Million Now Charged With Tax Evasion

Legal Process: What Happens Next

Muradyan has pleaded guilty, which means:

- Sentencing date: December 11, 2025.

- Possible prison time: Up to 35 years, though plea deals often reduce time served.

- Restitution: Courts may order him to pay back taxes and fraudulent Medicare payments.

- Supervised release: Even after prison, he could face years of monitoring.

This case also serves as a warning—federal agencies have increased focus on COVID-related fraud and health care scams.