Luxury EV Dream Just Got Pricier: The hottest debate in India’s auto sector right now centers on GST on luxury electric vehicles (EVs). Reports suggest the government is preparing to raise Goods and Services Tax (GST) for high-end EVs from the current 5% to a steep 18%. For anyone dreaming of owning a Tesla, BMW iX, or Mercedes EQC, this sounds like a rude awakening. But is it truly a death blow to India’s luxury EV dream—or just a tax correction aimed at fairness? Let’s break down the facts, the numbers, and what it means for buyers, the industry, and India’s clean energy goals.

Luxury EV Dream Just Got Pricier

The government’s proposed GST hike on luxury EVs from 5% to 18% is a balancing act. It keeps subsidies intact for budget buyers while asking the wealthy to shoulder more tax. But the move risks cooling momentum in the premium EV segment, which plays a vital role in making EVs aspirational. With India chasing its 2030 EV adoption targets, every policy shift matters. For now, one thing is clear: if you’ve been eyeing a luxury EV, buy it before the taxman knocks.

| Point | Details |

|---|---|

| Current GST on EVs | 5% across all categories (official GST site) |

| Proposed GST on premium EVs (₹20–40 lakh) | 18% |

| Budget EVs | Stay at 5% |

| Small ICE cars | Likely reduction from 28% to 18% |

| Luxury ICE SUVs | Flat 40% slab proposed |

| Next Steps | GST Council meet on September 3–4, 2025 |

| Impact | Premium EVs to cost more; affordable EVs remain unaffected |

How GST on EVs Has Evolved?

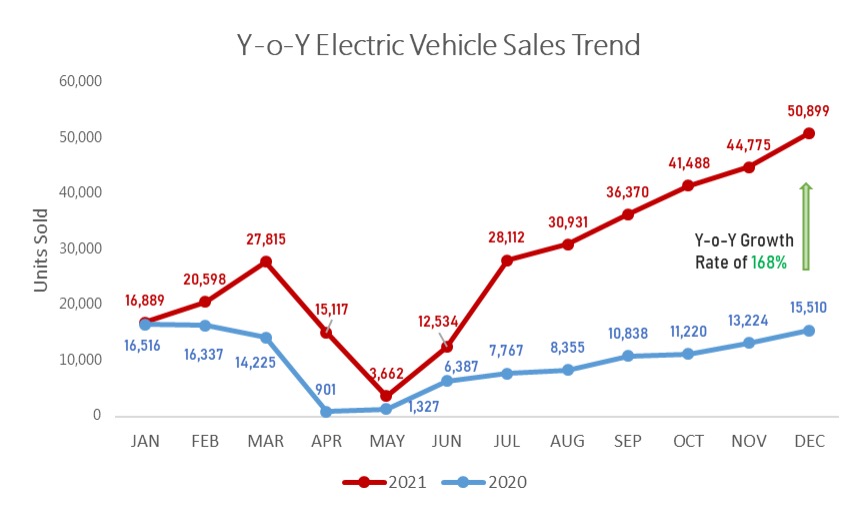

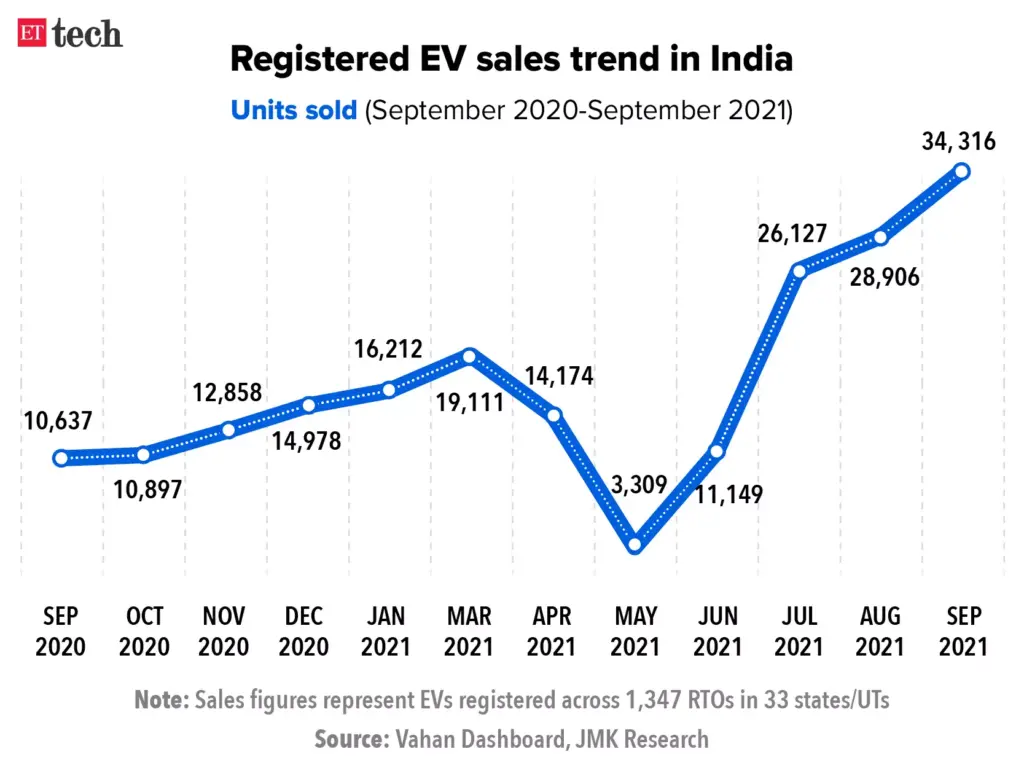

When GST was first rolled out in 2017, EVs were taxed at 12%. That was lower than petrol and diesel cars (28% plus cess), but still a burden on early adopters.

Then came the big change in 2019, when the government slashed GST on EVs to 5%. Combined with road tax waivers in states like Delhi and subsidies under the FAME-II scheme, this gave EVs a massive push.

Tata Nexon EV, priced at around ₹15 lakh, became a breakout success. By 2024, EVs made up nearly 2% of India’s total car sales—a small share, but a big jump from near zero just five years earlier.

Now, policymakers believe that blanket tax incentives for all EVs no longer make sense. Luxury EVs bought by the wealthy don’t need taxpayer-funded support.

Why Target Luxury EVs?

Think of it this way: imagine the government offering the same food subsidy coupon to both a billionaire shopping at Whole Foods and a single mom at Walmart. Doesn’t feel right, does it?

That’s exactly the argument policymakers are making. A flat 5% GST means both a Tata Tiago EV and a ₹40 lakh BMW iX get the same benefit. The government believes this isn’t equitable.

The solution on the table: keep 5% GST for budget EVs that middle-class families buy, but raise GST to 18% for premium EVs priced between ₹20–40 lakh.

How Will Prices Change?

Let’s run the math with two popular examples.

- Tesla Model Y (₹30 lakh estimate)

- 5% GST = ₹1.5 lakh

- 18% GST = ₹5.4 lakh

- Price hike = ₹3.9 lakh

- Mercedes EQC (₹40 lakh)

- 5% GST = ₹2 lakh

- 18% GST = ₹7.2 lakh

- Price hike = ₹5.2 lakh

For buyers in the luxury segment, this is real money. That said, budget EVs like the Tata Tiago EV (~₹8.5 lakh) and MG Comet (~₹7.9 lakh) remain unchanged. So if you’re shopping in the affordable category, you’re safe.

Broader GST Overhaul Beyond EVs

This is part of a larger plan to simplify India’s GST regime. Right now, we have four slabs: 5%, 12%, 18%, and 28% (plus cesses). The government is considering streamlining it into just two slabs: 5% and 18%, plus a 40% slab for luxury goods and sin items.

- Small ICE Cars: Expected to drop from 28% to 18%. That could make a Maruti Swift or Hyundai Grand i10 cheaper by ₹50,000–70,000.

- Luxury SUVs: Taxed at a flat 40%, slightly less than the current effective 43–50%.

- Insurance & Financial Services: Likely capped at 18%, reducing household costs.

So, while luxury EVs go up in price, small ICE cars may get cheaper—a move that could shift buyer sentiment.

EV Policy and India’s 2030 Targets

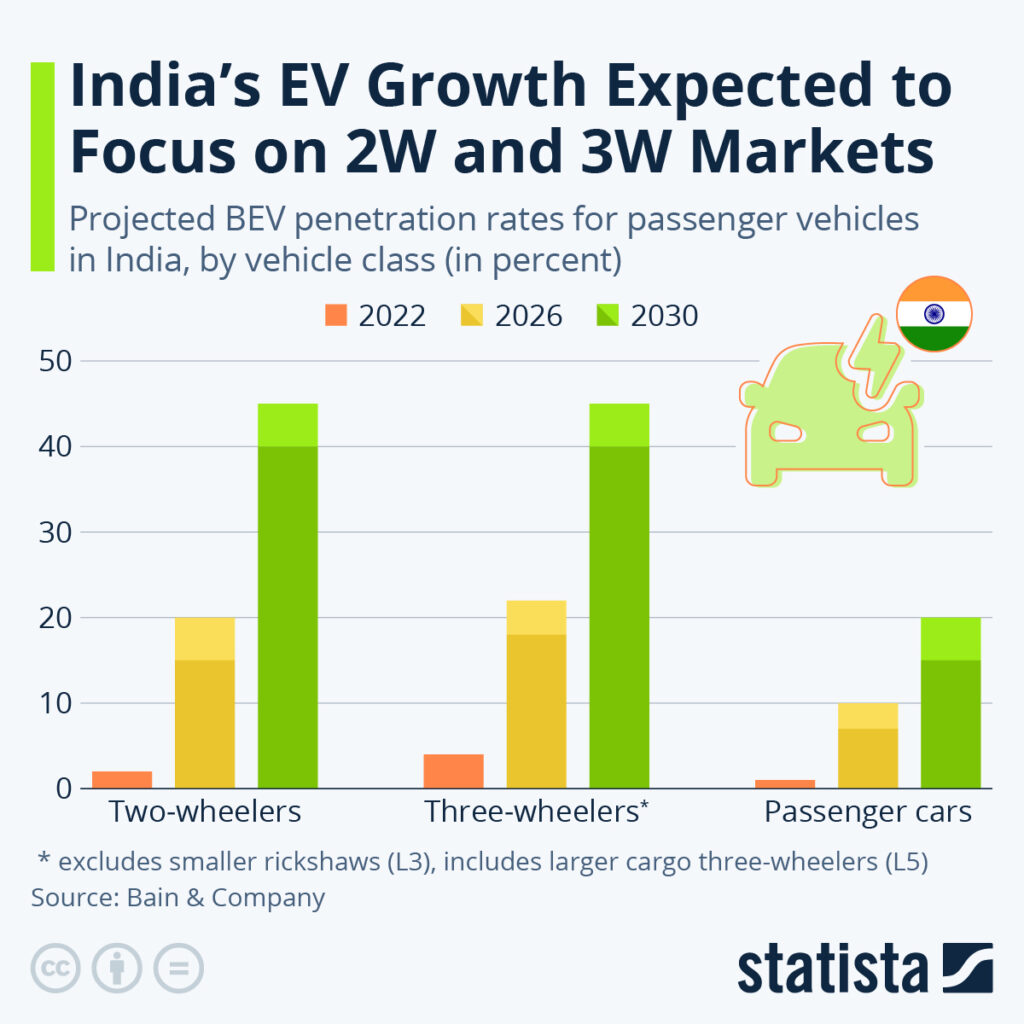

India has set a bold goal: 30% of car sales should be electric by 2030. Achieving this requires incentives, investment in charging infrastructure, and consumer trust.

- FAME-II Scheme: Offers subsidies on EVs, but mostly for two-wheelers and buses.

- State Incentives: Delhi offers up to ₹10,000 per kWh subsidy for EVs, while Maharashtra waives road tax.

- Charging Infra Push: The government aims for 1 charging station every 25 km on highways by 2030.

But here’s the challenge: if luxury EVs get too expensive, India risks losing the “aspiration effect.” Cars like Tesla or BMW bring glamour and attention to the EV segment. Without them, the narrative may weaken.

Environmental Angle

India’s cities are among the most polluted in the world. According to the World Air Quality Report 2024, Delhi ranked as the most polluted capital globally. Road transport contributes nearly 12% of India’s CO2 emissions.

Encouraging EV adoption isn’t just about economics—it’s about saving lives, reducing healthcare costs, and cleaning the air kids breathe. If higher GST slows EV adoption, it may undermine environmental goals.

Consumer Psychology: Will Indians Still Buy?

Indian buyers are famously price-sensitive. A jump of ₹3–5 lakh in the luxury segment might push many buyers back toward ICE SUVs or hybrids.

For middle-class buyers, stable 5% GST on budget EVs is good news. But cheaper small petrol cars (due to GST cuts) could tempt families away from EVs.

It’s a tug of war: environmental goals vs. affordability vs. consumer mindset.

Impact of Luxury EV Dream Just Got Pricier on Industry and Jobs

- Startups: Premium EV startups could face slower growth. Budget-focused players like Tata and Mahindra may benefit.

- Dealerships: Luxury dealers may see lower footfall, while budget EV demand could hold steady.

- Jobs: India’s auto industry employs nearly 37 million people. Any disruption—positive or negative—ripples across supply chains, R&D, and manufacturing.

Global Comparison: How Others Tax EVs

- United States: Offers up to $7,500 in federal tax credits for EV buyers.

- European Union: Countries like Germany and France offer subsidies up to €6,000 per EV.

- China: Has aggressively subsidized EVs for years, fueling its dominance in the global EV market with over 60% share.

India’s approach is unique: instead of giving subsidies to all, it selectively pulls back benefits for the wealthy while protecting middle-class buyers.

Practical Advice for Buyers

- Buy Premium Now: If you’re serious about a Tesla, BMW, or Mercedes EV, act before September 2025.

- Stick to Budget EVs: Nexon EV, Tiago EV, and XUV400 remain at 5%.

- Watch Festive Season Deals: Dealers may offer discounts before GST hikes.

- Consider Total Cost of Ownership: Even if upfront cost rises, EVs still save thousands annually in fuel and maintenance.

- Check State Perks: States like Delhi, Gujarat, and Maharashtra continue to offer incentives.

Expert Opinions

- R C Bhargava, Maruti Suzuki Chairman: “Rational GST is critical, but EV growth shouldn’t be discouraged.”

- Society of Indian Automobile Manufacturers (SIAM): Warns that the hike on luxury EVs could hurt momentum in adoption.

- Economists: See this as a “wealth targeting tax,” where the rich bear more of the load.

Possible Scenarios

- If GST Hike Passes

- Luxury EV prices rise sharply.

- Budget EVs stay strong.

- ICE cars may get cheaper, pulling buyers back.

- If GST Hike Stalls

- Luxury EVs retain tax perks.

- Government loses potential revenue.

- EV adoption in premium space continues without disruption.

Lower GST On ICE Vehicles Could Impact EV Growth – HSBC Report

GST Reform to Cut Rates on Vehicles – Will Two-Wheeler and Car Sales Finally Rebound?