Luxury Salons Raided in Chandigarh: If you’ve been dropping serious cash at a high-end salon in Chandigarh, you might want to take a second look at your bill. In early August 2025, government tax teams raided some of the city’s most luxurious beauty spots, suspecting they weren’t collecting — or paying — the Goods and Services Tax (GST) the right way. Think of it like buying a fancy burger in New York: you expect the sales tax to be added to your bill, and you trust the restaurant to pass it on to the government. If they skip that step, it’s not only illegal — it also cheats the system and could get you tangled up if you’re not careful.

Luxury Salons Raided in Chandigarh

The luxury salon raids in Chandigarh aren’t just a headline-grabbing story — they’re a warning to both consumers and businesses. Tax compliance is not an optional courtesy; it’s a legal requirement that protects public resources and fair competition. Whether you’re getting a haircut or a luxury spa treatment, your receipt is more than a slip of paper — it’s your proof, your protection, and your contribution to a fair marketplace.

| Topic | Details |

|---|---|

| What Happened | Raids on luxury salons in Chandigarh for alleged GST evasion. |

| When | August 8–9, 2025. |

| Who’s Involved | Excise Department & Central GST officials; 12+ high-end salons targeted. |

| Main Allegations | Not charging GST, taking cash without bills, misreporting services as product sales. |

| Tax Rate in Question | 18% GST on salon services (CBIC official site). |

| Why It Matters | Customers may unknowingly be part of tax evasion if they don’t request bills. |

| Pro Tip | Always ask for an official invoice — it protects your rights and supports fair taxation. |

What Went Down in Chandigarh’s Salon Scene?

According to reports from The Tribune and Hindustan Times, enforcement teams targeted premium salons in upscale areas like Sectors 8, 9, 26, and 35. These are not your neighborhood hairdressers — they cater to celebrity clients, charge lakhs for bridal makeovers, and offer spa services that could rival the cost of a weekend in Las Vegas.

Authorities suspect these salons were accepting large cash payments without issuing receipts, and reclassifying high-value services as “product sales” to dodge GST. GST on salon services in India is 18%, similar to how some U.S. states levy combined state and local sales taxes above 8%.

GST vs. Sales Tax: A Quick Comparison

For readers outside India, here’s a quick analogy: GST in India is a nationwide tax applied to most goods and services, replacing multiple state and federal indirect taxes. In the U.S., sales tax varies by state and locality, but the principle is the same — fund public infrastructure, healthcare, and education.

The difference is in implementation:

- India’s GST is collected at multiple stages in the supply chain but credited back through input tax credit.

- U.S. sales tax is generally collected at the final point of sale and doesn’t have an input credit mechanism for consumers.

Both systems rely on businesses to collect and remit taxes honestly. If they don’t, the system breaks.

Why Customers Should Care?

If a salon isn’t charging or paying GST properly, you might think you’re saving a little money. But the reality is different:

- You lose consumer protection rights.

- You indirectly support tax evasion.

- You risk paying hidden costs that don’t benefit the community.

It’s like buying a designer bag from a street vendor — you might save upfront, but you lose the guarantee, the authenticity, and the right to complain if something goes wrong.

Case Study 1: The ₹50,000 Bridal Package

Imagine Ria, a bride-to-be, books a ₹50,000 bridal package. The salon offers her an “exclusive” ₹9,000 discount for paying cash.

- GST on ₹50,000 should be ₹9,000.

- The discount is essentially the GST they’re not remitting.

- If her appointment is mishandled or canceled, she has no paper trail.

That’s not a bargain — it’s a business shifting tax liability away from themselves and onto the system.

Case Study 2: The Missing GSTIN

A professional makeup artist offers packages above ₹25,000 but doesn’t list a GSTIN (Goods and Services Tax Identification Number) on any invoice. This is a clear violation if the annual turnover exceeds ₹20 lakh, and customers accepting such invoices are part of a transaction that’s off the official books.

How GST on Salon Services Works?

If your haircut costs ₹2,000:

- GST = ₹2,000 × 18% = ₹360

- Final bill = ₹2,360

The GST component should be shown separately, not hidden within the total price. If it’s missing but the price seems inflated, there’s a good chance the tax is being pocketed.

Red Flags Your Salon Might Be Playing It Shady

- No printed invoice — even small cafés in the U.S. print receipts.

- Cash-only for large services — a common tax evasion tactic.

- GST not shown separately — it should be itemized.

- Discounts that exactly match GST percentage — often a tax avoidance disguise.

- No GSTIN on bill — every registered business must display it.

Expert Insights

Tax consultant Ajay Mehra told Hindustan Times:

“Consumers often overlook GST compliance, thinking it’s the business’s responsibility. But every invoice you demand helps ensure that the money you pay in taxes actually reaches the government, not someone’s pocket.”

The Economic Ripple Effect

When salons skip GST:

- The government loses revenue for public works, schools, and healthcare.

- Honest competitors are forced into an unfair playing field.

- Workers in these businesses may be paid off the books, losing social security benefits.

The World Bank notes that tax evasion in emerging markets can reduce GDP growth by 1–2% annually — a significant loss for public welfare.

The Legal Side

Under India’s GST Act, businesses with turnover above ₹20 lakh must register for GST, collect it, and remit it to the government. Penalties for non-compliance include:

- Fines up to 100% of the unpaid tax.

- Interest charges on late payments.

- Prosecution in severe cases.

How Businesses File GST?

For professionals curious about compliance:

- Businesses file monthly or quarterly GST returns (GSTR-1 for sales, GSTR-3B for summary returns).

- Input tax credit offsets GST paid on business purchases.

- Late filing attracts interest at 18% per annum and daily penalties.

Skipping this process not only risks raids but also closes the door to legitimate tax benefits.

Steps for Customers to Protect Themselves

- Always request a bill — verbal pricing is not protection.

- Check for GSTIN — validate on the GST portal.

- Prefer digital payments — they leave a transaction trail.

- Report violations — use the CBIC grievance portal.

- Understand your rights — under Indian consumer law, you can demand transparent pricing.

Consumer Rights You Should Know

The Consumer Protection Act ensures:

- Right to be informed about the quality, quantity, and price of services.

- Right to seek redressal if services are deficient.

- Right to a tax invoice for purchases above ₹200.

Luxury Salons Raided in Chandigarh: What Happens Next in Chandigarh?

Authorities are auditing three years of financial records from raided salons. Additional inspections are planned for other luxury service sectors — including spas, gyms, and high-end event planners. Officials have publicly warned that repeat offenders will face not only fines but possible criminal cases.

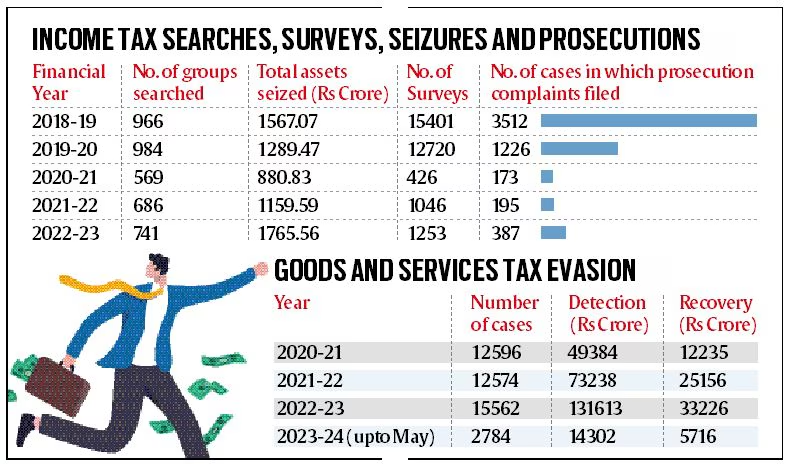

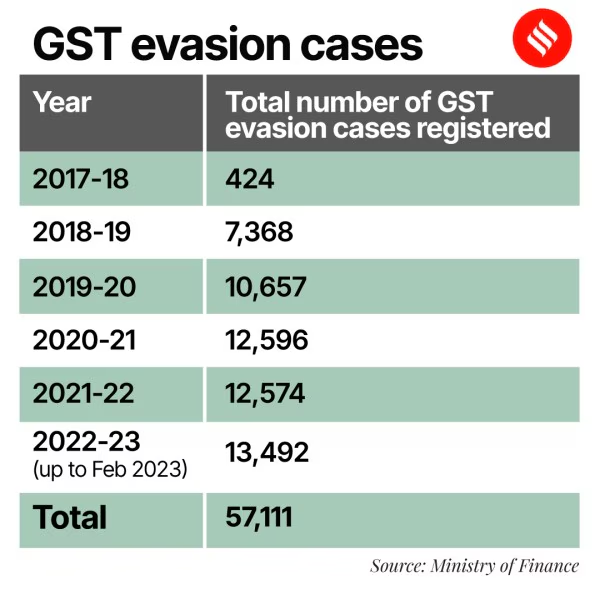

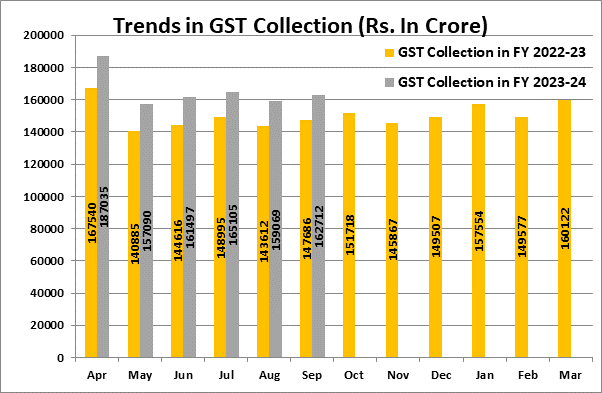

How This Fits into India’s Larger Tax Compliance Push?

Over the past five years, India’s tax authorities have stepped up digital monitoring. Linking GST returns to income tax filings and bank transactions has made it harder for large-scale evasion to go unnoticed. The luxury service industry is now firmly on the radar, given its high-value transactions and history of under-reporting.

“No More Mysterious Justice”: Jharkhand HC Strikes Down GST Order, Demands Clarity

Supreme Court Sides with Businesses: GST Refund Rejection Overturned in Landmark Ruling

Is Using UPI Data to Track GST Evaders a Game-Changer? Experts Weigh In