Madras HC Strikes Down GST Order Issued Just Before Hearing: In a landmark ruling, the Madras High Court recently struck down a Goods and Services Tax GST order that was issued just one day before a scheduled personal hearing. The case has highlighted a serious violation of natural justice principles, underlining the need for fairness in the tax adjudication process. This article delves deep into the details of this case, offering insights into the legal implications, the impact on the GST system, and practical advice for both taxpayers and professionals navigating the tax landscape.

Madras HC Strikes Down GST Order Issued Just Before Hearing

The Madras High Court’s decision in this case is a powerful reminder of the importance of natural justice in the tax system. It reinforces the idea that everyone, whether an individual or a business, deserves a fair hearing before an adverse decision is made. Tax professionals and businesses should take this ruling to heart and ensure that they are always advocating for due process in their dealings with tax authorities. This case also highlights the continuing evolution of the Indian GST system and its ongoing efforts to balance efficiency with fairness. As tax professionals, understanding these principles can help you better navigate the system and protect your clients’ interests. By adhering to the principles of natural justice, we can foster a more transparent and equitable tax system that benefits everyone involved.

| Topic | Details |

|---|---|

| Case Name | Tvl. Shri Bharathi Weaves vs. GST Authorities |

| Date of Incident | Assessment order issued on February 10, 2025, one day before scheduled hearing |

| Court Ruling | The Madras High Court quashed the GST assessment order due to violation of natural justice. |

| Legal Reference | Section 75(4) of the GST Act requires a personal hearing before issuing an adverse order. |

| Court’s Directive | Tax authorities are instructed to allow a fresh reply with supporting documents, schedule a personal hearing with a 14-day notice, and pass a reasoned order. |

| Impact on Taxpayers | The ruling strengthens the taxpayer’s right to a fair hearing and promotes procedural fairness in GST assessments. |

| Impact on Tax Professionals | Tax professionals must ensure that clients are aware of their right to personal hearings and the importance of adhering to due process in GST cases. |

Introduction: What Happened?

In early February 2025, the Madras High Court stepped in to rectify a troubling situation where a GST order was issued just one day before the scheduled personal hearing of the taxpayer. This case, involving Tvl. Shri Bharathi Weaves, serves as a stark reminder of the importance of maintaining procedural fairness in the tax system. The court found that by issuing the order prematurely, the authorities had deprived the taxpayer of their right to a fair hearing, a principle that is core to the Indian judicial system.

The issue at hand was not only about a tax assessment but also about ensuring that individuals and businesses have their day in court, so to speak, and can present their side before any adverse decisions are made.

Let’s dive deeper into what happened, the implications of this ruling, and what taxpayers and professionals should learn from it.

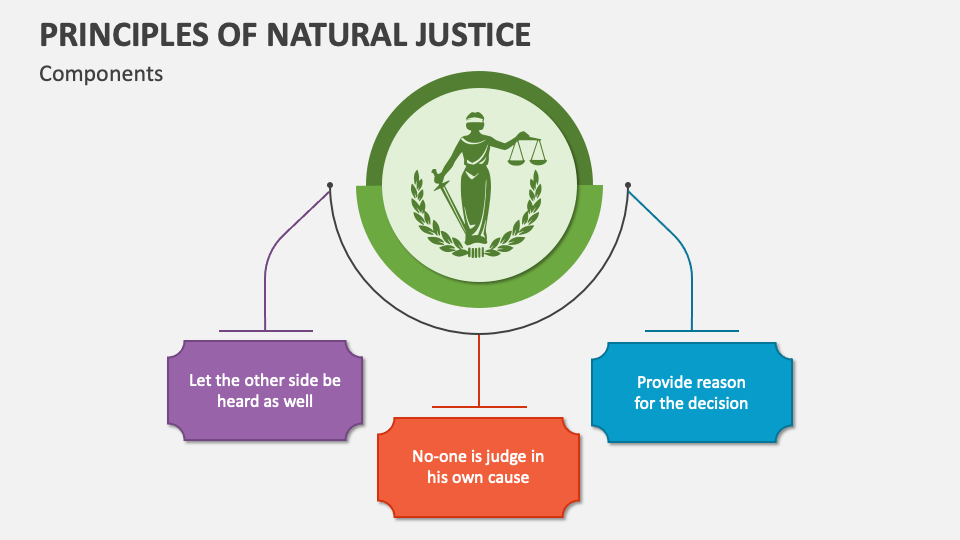

What is Natural Justice and Why Does It Matter?

At the heart of the Madras High Court’s decision is the concept of natural justice. This legal principle guarantees fairness in decision-making processes. It ensures that individuals affected by any decision have the right to be heard and that the decision is made impartially.

In this context, natural justice mandates that before any adverse decision—like a tax assessment—is made, the concerned party must be given a reasonable chance to present their case. In this case, the taxpayer, Tvl. Shri Bharathi Weaves, was scheduled to have a hearing on February 11, 2025, but the authorities rushed to pass an assessment order on February 10, violating this very principle.

Why Is Natural Justice So Important in Tax Law?

For businesses, tax assessments can be a make-or-break situation. If the government wrongly imposes taxes, it can lead to financial strain. By adhering to natural justice, the tax system helps avoid unjust penal actions that could cripple small businesses. Moreover, this ruling serves as an essential reminder to both tax authorities and taxpayers about the importance of respecting procedural fairness.

Key Details of the Case: Madras HC Strikes Down GST Order Issued Just Before Hearing

Here’s a breakdown of the events that led to the court’s intervention:

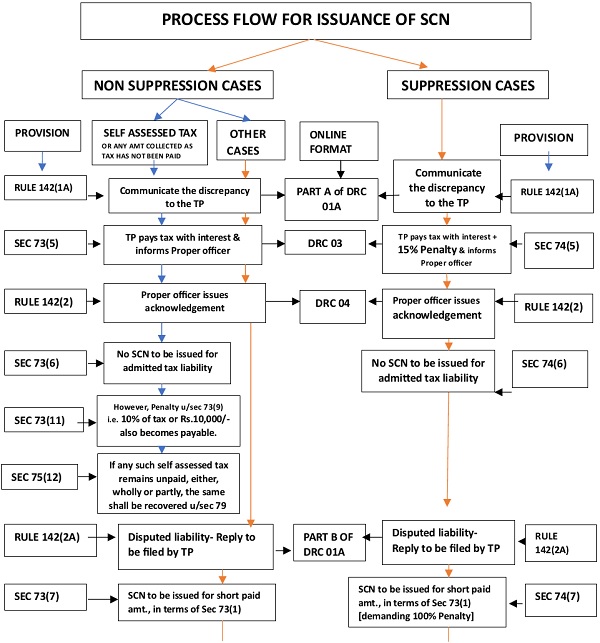

- Show Cause Notice: Tvl. Shri Bharathi Weaves, a business, received a show-cause notice on November 23, 2024. This notice alleged discrepancies in their tax filings for the year 2020-21. The business requested a 15-day extension to submit the supporting documents, which the authorities granted.

- Personal Hearing Scheduled: A personal hearing was scheduled for February 11, 2025, giving the business ample time to prepare and present its case.

- Premature Order Issuance: Just a day before the scheduled hearing, on February 10, 2025, the authorities issued a GST assessment order, essentially denying the taxpayer the opportunity to present their case.

- Court’s Intervention: Justice Krishnan Ramasamy of the Madras High Court observed that issuing the GST order one day before the hearing undermined the entire purpose of the hearing. In a clear violation of the principles of natural justice, the taxpayer had been denied a fair opportunity to be heard.

The Court’s Ruling: A Lesson for Tax Authorities

The Madras High Court’s ruling serves as a crucial lesson for both tax professionals and taxpayers. The court emphasized that it was mandatory for the authorities to allow the taxpayer to file their response and have a personal hearing before issuing any assessment order that could have a negative impact.

Key Directives from the Court:

- Fresh Opportunity for Reply: The court directed that the taxpayer be given three weeks to file their reply, along with the necessary supporting documents.

- Personal Hearing with Adequate Notice: The authorities were instructed to provide the taxpayer with a 14-day notice before scheduling a personal hearing.

- Reasoned and Speaking Order: The final assessment order should be based on the taxpayer’s submissions, and the authorities must provide clear reasoning for their decision.

The Legal Implications: A Strong Stand on Procedural Fairness

This ruling aligns with several previous decisions by the Madras High Court, which has consistently emphasized the need for a personal hearing under Section 75(4) of the GST Act. This section mandates that before issuing any adverse orders, tax authorities must give the taxpayer an opportunity to present their case. Failing to do so compromises the taxpayer’s right to a fair process.

The court’s decision strengthens the legal framework for ensuring that businesses and individuals are protected from arbitrary decisions by tax authorities. It sends a strong message that the rule of law will prevail in tax matters, and those in charge must follow the due process.

Background on the GST System: What is GST and Why Is It Important?

Before diving into the details of this case, it’s important to understand the Goods and Services Tax (GST) system itself. GST is a single, unified indirect tax introduced in India on July 1, 2017, to replace multiple indirect taxes such as VAT, excise duty, and service tax. It is designed to streamline the tax process, making it easier for businesses to comply with tax laws.

Under the GST system, businesses are required to file returns periodically. If the authorities find discrepancies or errors in the filings, they issue a show-cause notice, to which the taxpayer must respond. If the taxpayer is unable to justify the discrepancies, an assessment order may be issued.

Why is the GST System Controversial?

The implementation of GST has had both positive and negative impacts on the Indian economy. While it has simplified the tax structure and improved tax compliance, many businesses, especially smaller ones, have struggled to meet the complex compliance requirements. Issues such as mismatched invoices, delays in refund processing, and cumbersome paperwork have made it a challenge for many.

The Tvl. Shri Bharathi Weaves case illustrates how the GST system’s complexity can sometimes result in procedural oversights, which ultimately affect the fairness of the tax assessment process.

Why Tax Professionals Should Pay Attention?

This case isn’t just for the legal experts—tax professionals and consultants working with businesses need to take notes. If you’re advising clients on tax matters, it’s essential to keep the following in mind:

- Personal Hearing: Make sure your clients know their rights to a personal hearing under Section 75(4) of the GST Act.

- Prepare for Delays: If a hearing is scheduled, ensure that all documentation is ready well in advance and that the timeline for submission is met.

- Adhere to Procedural Norms: Always encourage your clients to push for fairness. If there’s any indication that a decision might be rushed, they should ask for an extension to ensure their case is properly heard.

Say Goodbye to In-Person GST Hearings: ‘Faceless Adjudication’ System to Be Tested from Friday

Massive ₹62 Crore GST Evasion Scam Uncovered in Ludhiana—Two Arrested in Major Tax Fraud Bust!

7,000 Vendors Without Registration Now Targeted in Karnataka—Here’s How to Avoid Penalties