Major Corporate Default: In a landmark move that underscores the seriousness of financial discipline, the National Company Law Tribunal (NCLT) has recently admitted an insolvency petition against A.N. Enterprises Infrastructure Services Pvt Ltd for a loan default of ₹98 crore. The petition was filed by DSM Projects Pvt Ltd, a creditor that lent money to A.N. Enterprises under a legally binding agreement. The company failed to meet its repayment obligations, triggering the insolvency process. This article takes a deep dive into the circumstances surrounding the insolvency petition, how it affects businesses, and what measures companies can take to avoid such scenarios in the future. The Insolvency and Bankruptcy Code (IBC), which governs such cases, offers a detailed procedure for addressing corporate defaults, including the initiation of the Corporate Insolvency Resolution Process (CIRP) by the NCLT. By examining this case closely, we will also explore practical advice for businesses, highlight the role of financial experts, and offer guidance on what to do when facing similar situations.

Major Corporate Default

Insolvency petitions like the one filed against A.N. Enterprises highlight the critical importance of financial discipline for businesses. The NCLT’s role in these proceedings underscores the significance of adhering to repayment schedules and enforcing creditor rights. By understanding the process and taking proactive measures, businesses can mitigate the risk of insolvency and avoid the costly consequences of defaults.

| Key Point | Details |

|---|---|

| What Happened | NCLT admitted an insolvency petition for ₹98 crore default on a loan. |

| Parties Involved | DSM Projects Pvt Ltd (Petitioner) vs. A.N. Enterprises Infrastructure Pvt Ltd (Respondent). |

| Amount Involved | ₹98 Crore |

| Loan Agreement Date | September 6, 2017 |

| Repayment Tenure | 4 years 6 months, due by March 13, 2022 |

| Relevant Law | Insolvency and Bankruptcy Code (IBC) |

| Key Focus | Enforcing creditor rights and financial discipline. |

| Official Reference | Taxscan Article |

The Role of NCLT in Corporate Insolvency Cases

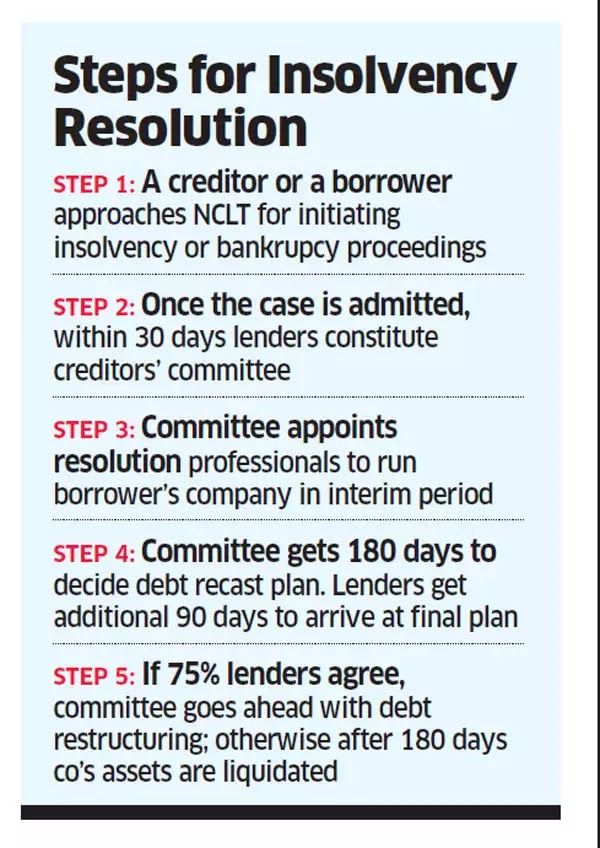

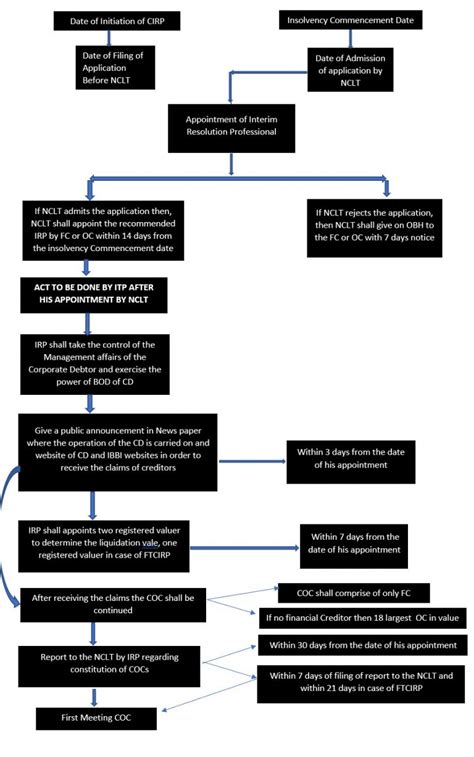

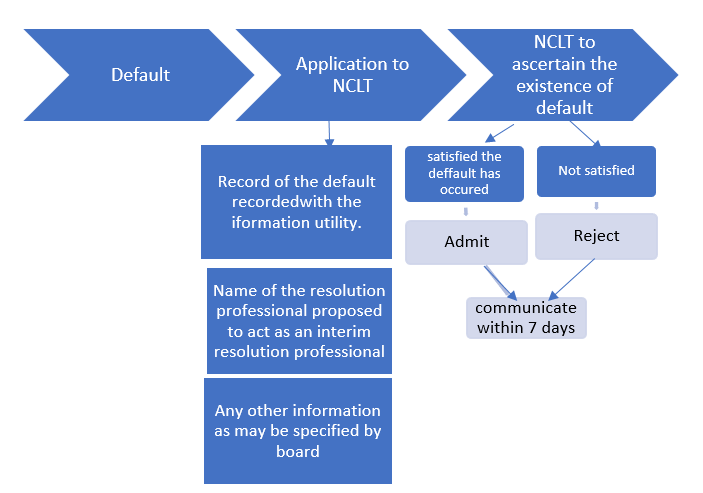

The National Company Law Tribunal (NCLT) is the primary judicial body responsible for adjudicating corporate insolvency cases in India. It plays an essential role in upholding the Insolvency and Bankruptcy Code (IBC), which aims to simplify and streamline the bankruptcy process. The tribunal is empowered to hear insolvency petitions filed by creditors and, if necessary, appoint an Interim Resolution Professional (IRP) to oversee the company’s financial restructuring or liquidation.

In this particular case, DSM Projects Pvt Ltd filed the insolvency petition against A.N. Enterprises for a default in an inter-corporate loan agreement. Despite the arbitration clause included in the loan agreement, the NCLT proceeded with the insolvency petition, demonstrating its determination to enforce financial obligations.

What Led to the Insolvency Petition?

The default occurred when A.N. Enterprises failed to repay the ₹63 crore loan extended to it by DSM Projects. The loan was supposed to be repaid over a period of 4 years and 6 months, but by the due date of March 13, 2022, the repayment was not made, leading to the insolvency petition. This is a typical scenario in the corporate world where companies sometimes fail to meet their financial commitments, either due to cash flow issues, poor management, or external economic factors.

When this happens, creditors are left with little choice but to take legal action. The IBC provides a framework for creditors to recover their dues and ensures that businesses fulfill their financial obligations.

The Importance of Enforcing Credit Rights

By admitting the petition, the NCLT is sending a clear message: creditors’ rights are paramount. The IBC protects these rights, enabling creditors to recover their dues either through business restructuring or asset liquidation. This also emphasizes the broader importance of adhering to repayment schedules, as failure to do so can lead to significant legal and financial consequences.

Broader Impact of Major Corporate Default on Businesses

1. Impact on Employees and Stakeholders

Insolvency petitions have far-reaching consequences, not just for the company involved but also for its employees, customers, and other stakeholders. Employees may face uncertainty about their jobs, while suppliers and customers might experience delays or disruptions in service. A company’s reputation could take a major hit, making it difficult to secure future contracts or partnerships.

2. Impact on Investors

Investors are often the hardest-hit by corporate defaults. They may lose the money they invested or see a drastic reduction in the value of their investments. For public companies, stock prices could plunge, affecting shareholders. Moreover, investor confidence can be shaken, potentially leading to a loss of capital in the broader market.

3. Legal Repercussions for the Defaulting Company

When a company goes into insolvency, the legal repercussions can be severe. Besides the financial burden of liquidation, the company may face penalties or reputational damage that could linger long after the insolvency is resolved.

Steps to Avoid Corporate Defaults and Insolvency

1. Thorough Financial Planning and Management

Before taking on any large loans, companies must perform detailed financial planning. This includes cash flow forecasts, cost-cutting measures, and risk assessments. Proactive financial management can help avoid potential defaults by keeping track of revenue streams and liabilities.

2. Timely Repayment and Communication with Creditors

Companies should prioritize timely repayment of loans. If you find yourself unable to meet deadlines, communicate early with your creditors to renegotiate terms or explore options like debt restructuring. Open lines of communication can often prevent defaults from escalating into insolvency petitions.

3. Seek Professional Financial Advice

Engaging financial advisors and legal experts early on can prevent defaults. These professionals can help create repayment plans, manage debt, and guide businesses through financial crises. Legal teams are also essential in navigating the IBC process if insolvency petitions are filed.

4. Business Restructuring and Asset Management

In some cases, businesses facing severe defaults may consider restructuring. This may involve selling off non-core assets, cutting down on overheads, or finding new investors to stabilize operations.

Case Study: Gstaad Hotels Pvt Ltd and the JW Marriott Bengaluru

A recent example of insolvency proceedings is Gstaad Hotels Pvt Ltd, which owned the JW Marriott Bengaluru. The company faced a default of ₹665.74 crore, prompting the NCLT to initiate the Corporate Insolvency Resolution Process (CIRP). In this case, the NCLT’s intervention highlighted the importance of corporate discipline in maintaining financial commitments.

The hotel faced severe financial pressure due to the pandemic and other operational challenges. The case illustrates how large enterprises, particularly in the hospitality industry, can face bankruptcy proceedings if they default on loans. It also reinforces the need for businesses to maintain financial health during challenging periods.

The Role of Financial Advisors and Legal Teams

Having the right financial advisors and legal counsel on board can make a significant difference when navigating corporate insolvency issues. Financial advisors can assist in debt management, assessing financial risks, and devising strategies for debt repayment. On the other hand, legal teams ensure that businesses follow the proper legal channels when dealing with creditors, including negotiating loan restructuring, defending against insolvency petitions, or representing the company during CIRP.

Massive ₹62 Crore GST Evasion Scam Uncovered in Ludhiana—Two Arrested in Major Tax Fraud Bust!

August 2025 GST Compliance Calendar: Everything You Need to Know to Stay Ahead of Deadlines

Cabinet Greenlights Major GST Act Amendments—What These Changes Mean for Businesses and Consumers