Major Relief for NRSC in GST Dispute: In a significant legal development, the Telangana High Court has provided interim relief to the National Remote Sensing Centre (NRSC), an institution under the Indian Department of Space, in a Goods and Services Tax (GST) dispute. The court’s ruling has brought attention to the complexities of GST law, especially as it pertains to government entities, and how such institutions can navigate legal challenges against tax authorities. This decision marks a turning point for how the GST law could be applied to scientific research institutions and government agencies, raising questions about the fairness of tax regulations for public sector entities.

The case brings to light the evolving relationship between government organizations and taxation authorities, especially in industries where research and public service are the primary objectives. The NRSC is one of the most prominent players in India’s space research community, and this dispute has caught the attention of both tax experts and those within the scientific community.

Major Relief for NRSC in GST Dispute

The Telangana High Court’s interim relief to NRSC not only provides a temporary reprieve for the organization but also raises critical questions about how GST law should apply to public sector entities. It signals that government agencies can and should challenge tax demands if they believe they are unfair. As this case moves forward, it will likely shape the future of GST law in India, especially as it pertains to government agencies and research institutions. This decision also serves as a reminder that taxation law is a dynamic field where precedent can set the stage for broader changes. NRSC’s victory in this case could pave the way for other public sector entities to contest unjust tax demands, especially in the context of government-funded scientific research.

| Aspect | Details |

|---|---|

| Institution Involved | National Remote Sensing Centre (NRSC), under the Indian Department of Space |

| Disputed Tax Order | GST order issued on January 22, 2025, by tax authorities |

| Court’s Interim Order | NRSC directed to deposit 10% of the assessed tax liability; no coercive action to be taken until tribunal’s decision |

| Tribunal’s Role | NRSC allowed to challenge the tax order before the relevant tribunal within three months of its formation |

| Legal Precedent | Decision aligns with a previous high court ruling in a similar case |

| Official Reference | Times of India Report |

Understanding the NRSC and the GST Dispute

What is the NRSC?

The National Remote Sensing Centre (NRSC) is one of the key institutions under the Indian Department of Space, primarily responsible for acquiring and processing satellite data. This data has various uses, including in agriculture, urban planning, disaster management, and environmental monitoring. The center plays a crucial role in utilizing satellite technology to support governmental and developmental activities. Its work is integral to India’s space technology program, assisting other governmental departments and organizations with data related to land management, climate change, and infrastructure development.

NRSC is a key contributor to initiatives like the Indian Remote Sensing Satellite (IRS) series, which provides critical data to support national development programs. The center has a unique position within the Indian government, providing technical expertise and data critical for policy decisions and disaster response. Its role is highly specialized, and its core function is not aligned with traditional commercial activities, making it distinct from private sector entities.

The GST Dispute

In January 2025, the NRSC received a GST order from tax authorities demanding a substantial amount in taxes. The tax authorities argued that the NRSC, despite being a government organization, should be subject to GST on certain services provided, especially considering the commercial nature of some of their operations.

The tax order was based on the notion that the NRSC’s satellite data services, such as providing imagery and mapping to external parties, could be seen as a taxable service. However, the NRSC contested this order, arguing that their primary objective is public service and scientific research, not profit generation. The agency asserted that the tax demand was unfair, given its role as a government-backed institution focused on national development.

The NRSC’s legal team contended that the application of GST to such scientific and governmental services contradicted both the spirit of the tax law and the institution’s non-commercial character. The agency also pointed out that their activities were aligned with national policies and directly supported public welfare, which should exempt them from GST obligations.

Court’s Interim Major Relief for NRSC in GST Dispute and Its Implications

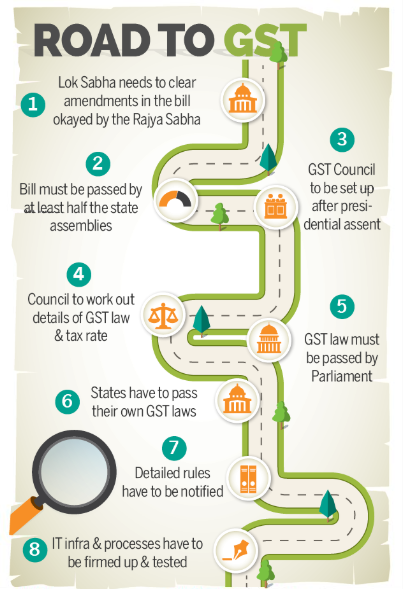

The Telangana High Court granted interim relief to the NRSC, which could have long-term implications for government agencies and public sector undertakings involved in similar disputes. Here’s what the court’s ruling involved:

1. Deposit Requirement

The court directed the NRSC to deposit 10% of the assessed tax liability. This amount is a fraction of the total tax demand, and while it doesn’t necessarily mean the NRSC owes that full amount, it ensures that the organization contributes to the tax pool during the legal process. This move is often seen in legal gst disputes to balance the interests of both the institution and the government during the proceedings.

For NRSC, the interim order is a compromise, ensuring that the institution continues to function while still participating in the GST dispute process. This is a strategic legal tool often used in cases where the court wants to ensure that the organization is not entirely exempted from the taxation process but also shields them from undue burden until the case is decided.

2. No Coercive Action

The most crucial part of the ruling is that the court prevented tax authorities from taking any coercive measures, such as freezing accounts or seizing assets, while the case is under legal review. This is a major relief for NRSC, as it allows them to continue their operations without the risk of disruption from tax authorities.

This protection is vital for public sector organizations like NRSC, which often rely on continuous operations to fulfill their mission. Coercive actions could severely impact their ability to deliver crucial services, which is why the court’s intervention is so significant.

3. Tribunal’s Role

The court also allowed the NRSC to challenge the tax order before the relevant tribunal. This gives the NRSC the opportunity to present its case at a higher legal level. They have three months to approach the tribunal once it is formally established.

This provision provides the NRSC with a clear legal avenue to challenge the decision at a later stage. The tribunal, a specialized body in handling gst disputes related to taxation, will have the final say in determining whether the GST order should be upheld or overturned. The tribunal’s decision could provide much-needed clarity on how GST applies to research and government agencies.

This decision is seen as a precedent for similar cases involving public sector organizations, emphasizing that they should not be unduly burdened by arbitrary tax demands.

Practical Advice for Organizations Facing Similar GST Disputes

While NRSC’s situation is specific, other organizations, especially government agencies, non-profits, and public sector undertakings, may find themselves in similar GST disputes. Here are some practical steps organizations should take if they find themselves in a similar situation:

1. Review the Tax Order Carefully

The first step is always to thoroughly understand the tax order. Organizations should look for inconsistencies or errors in the way the order has been issued. If the demand seems excessive or unwarranted, it is crucial to consult with legal experts.

A careful review will allow organizations to identify whether the tax authority has considered the organization’s unique status or operations. In NRSC’s case, the fact that the center is a government-backed, research-focused organization was a critical point of contention.

2. Seek Expert Legal Counsel

Engage a tax lawyer or legal team with expertise in GST law. They will assess the legal grounds for challenging the tax demand. In the case of government organizations like the NRSC, special considerations may apply, making expert legal advice even more critical.

Tax laws can be complex, especially when applied to institutions that do not operate like traditional businesses. Legal experts specializing in GST can guide organizations through the intricacies of the law and help determine the best course of action.

3. File an Appeal

If the order is deemed unjust, file an appeal with the GST Tribunal or High Court. Just like NRSC, organizations should aim to prevent any coercive actions by the tax authorities while the legal process is ongoing.

Filing an appeal is often a crucial step in obtaining relief from tax demands. It is essential to follow the prescribed legal steps to ensure that the organization’s rights are protected.

4. Stay Compliant with Interim Orders

If a court or tribunal issues an interim order, like depositing a percentage of the tax amount, organizations must comply. Failing to do so can result in the court or tribunal losing its leverage over the case.

Compliance with interim orders is critical. These orders are often put in place to ensure that the dispute does not escalate while the matter is being legally evaluated. Non-compliance could lead to the dismissal of the appeal.

5. Document Everything

Maintain detailed records of all correspondence, tax filings, and court proceedings. Good documentation can be critical when presenting a case to a tribunal or higher court.

Proper documentation provides a clear record of the legal journey and supports the organization’s position in any future hearings. This can be helpful in both the short and long term.

Broader Implications of the Court’s Decision

GST Law and Government Entities

The decision is important because it highlights an ongoing issue with GST law as it applies to government organizations and research institutions. GST is designed to be a comprehensive taxation system that includes most goods and services. However, government agencies, especially those involved in research and public welfare, often argue that the law should provide exemptions or special treatment for them.

This case may encourage more government institutions to challenge GST demands they feel are inappropriate or burdensome. The court’s interim order also suggests that there may be greater scrutiny of GST regulations for public sector organizations in the future.

The NRSC’s case is only one of many that may arise, as other government entities may also find themselves facing unexpected tax assessments. This case could ultimately lead to changes in how the GST law is applied to non-commercial public sector entities in India.

Expert Opinions on GST Disputes

According to Ravi Kumar, a tax expert at TaxSutra, “The NRSC case highlights a critical issue where scientific research institutions and government agencies must be allowed to operate without the constant fear of bureaucratic encumbrances, especially when it comes to taxes. The interim relief granted by the court is a good sign for institutions in similar positions.”

Another expert, Anita Sharma, a legal consultant with LegalEagle, adds, “It is clear that the court wants to balance the interests of tax collection with the unique needs of public sector entities. This could lead to more clarity on how the law applies to such entities.”

GST Collections for July 2025: You Won’t Believe Which State Tops the List!

Supreme Court Takes Action: Issues Notice to IMA in Ongoing GST Dispute—What’s Next for the Case?

Say Goodbye to In-Person GST Hearings: ‘Faceless Adjudication’ System to Be Tested from Friday