Mandatory HSN Code Reporting in GSTR-1/1A: The world of Goods and Services Tax (GST) in India has seen some major updates recently. One of the most important changes that every business needs to get their head around is the mandatory HSN code reporting in GSTR-1 and GSTR-1A starting from May 2025. For those of you who aren’t quite sure what an HSN code is or how this new change affects your GST filing, don’t worry! This guide is here to break it all down. Whether you’re a business owner, an accountant, or simply someone looking to get up to speed on the latest updates, we’ve got you covered. The HSN (Harmonized System of Nomenclature) code is a globally recognized system for classifying goods and services. It’s a critical part of the GST system and helps in categorizing products for tax purposes. In 2025, the Indian government introduced mandatory reporting of HSN codes in the GST returns, specifically in GSTR-1 and GSTR-1A. This means that businesses will now need to specify the HSN codes of their goods and services when filing their returns. But why does this matter to you? And what do you need to do to stay compliant? Well, you’re about to find out!

Mandatory HSN Code Reporting in GSTR-1/1A

With the new mandatory HSN code reporting in GSTR-1 and GSTR-1A, businesses will have to be more vigilant about their GST filings starting from May 2025. While the changes might seem overwhelming at first, they are designed to enhance accuracy, reduce fraud, and improve the overall tax ecosystem. By ensuring that you report your HSN codes correctly, segregating your B2B and B2C supplies, and staying on top of document summaries, you’ll avoid potential penalties and ensure smooth filing for years to come. Always remember that compliance is key—and staying ahead of these changes will make your business operations that much smoother.

| Topic | Details |

|---|---|

| Mandatory HSN Code Reporting | Businesses must report HSN codes in GSTR-1 and GSTR-1A, effective May 2025 |

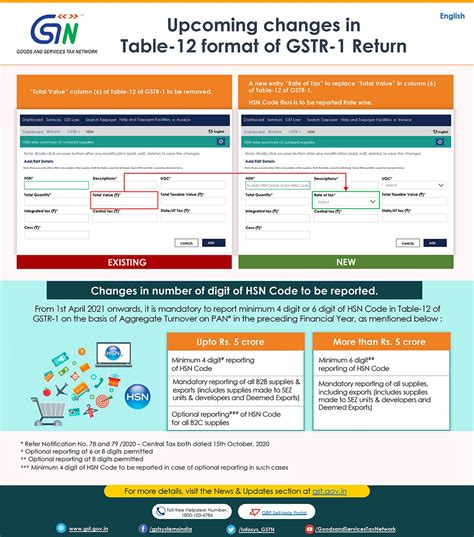

| HSN Reporting Threshold | Businesses with an annual turnover of up to ₹5 crore: 4-digit HSN; above ₹5 crore: 6-digit HSN |

| New Table Format | GSTR-1 and GSTR-1A have been updated to include mandatory HSN reporting |

| B2B and B2C Supplies | Separate reporting required for B2B (Business-to-Business) and B2C (Business-to-Consumer) supplies |

| Document Summary | New Table 13 will require a comprehensive summary of documents issued during the period |

| Validation Checks | GSTN introduces new validation checks to ensure data accuracy |

What Are HSN Codes, and Why Do They Matter?

Before we dive into the nuts and bolts of the new rules, let’s take a step back. You might be wondering: What exactly are HSN codes?

Simply put, HSN codes are numerical identifiers used to classify products and services under the GST system. These codes are globally recognized, making trade between countries more streamlined. For example, fruits might have one HSN code, while electronics have another. By using these codes, tax authorities can more easily identify and classify goods and services for taxation purposes.

So, when you file your GST return, you have to specify the HSN code for each of the products or services you’re selling. This ensures consistency, accuracy, and transparency in the tax process. But now, starting in 2025, the reporting of HSN codes will be more mandatory and precise.

New GST Filing Requirements Starting May 2025

Starting from the May 2025 return period, taxpayers will need to report their HSN codes in GSTR-1 and GSTR-1A, which are used to file outward supply details and corrections, respectively. HSN code reporting will be mandatory for businesses with an annual turnover (AATO) of ₹5 crores or more.

- For businesses with an AATO below ₹5 crore: You will have to report 4-digit HSN codes.

- For businesses with an AATO above ₹5 crore: You will have to report 6-digit HSN codes.

This change is part of an ongoing effort to improve the transparency and effectiveness of India’s tax system.

Breaking Mandatory HSN Code Reporting in GSTR-1/1A Down: What You Need to Do

The introduction of mandatory HSN code reporting means that businesses will need to be more meticulous with their GST filings. Here’s what you need to know:

1. Categorizing Your Sales: B2B vs. B2C

One of the significant changes in GSTR-1 and GSTR-1A is the segregation of sales into B2B (Business to Business) and B2C (Business to Consumer). Here’s how you can approach this:

- B2B Supplies: If you’re selling to registered businesses (with a GSTIN), you need to report the HSN codes for those sales under the B2B category.

- B2C Supplies: If you’re selling to individual consumers (who aren’t registered under GST), you need to report those sales under the B2C category.

2. Choosing the Correct HSN Code

You can no longer manually enter HSN codes in the return. You’ll now need to choose from a dropdown list of HSN codes available in the GST portal. This is designed to reduce errors and ensure uniformity across all returns. When you select an HSN code from the dropdown, its description will also auto-populate.

- Pro Tip: Always double-check the description of the code to ensure it matches the products you’re selling.

3. Summary of Documents in Table 13

From May 2025, Table 13 will be introduced as part of the GST filing process. This section requires you to provide a summary of all the documents you’ve issued during the period, including:

- Invoices

- Debit notes

- Credit notes

- Revised invoices

This is essential for making sure everything adds up correctly during the filing process.

4. Validation Mechanisms

The GST system will now incorporate automatic validation checks to verify the accuracy of the information you report. These checks will help ensure that the values you report for B2B and B2C supplies align correctly with other sections in your return.

For now, these validation checks will run in warning mode, which means you can still file your returns even if there are discrepancies. However, it’s important to resolve any warnings to avoid complications down the line.

Practical Advice for Businesses

As a business owner, here are some actionable tips to make your life easier with the new HSN reporting rules:

- Invest in GST Filing Software: If you haven’t already, investing in GST filing software can streamline the HSN reporting process. Software like Tally, ClearTax, or Zoho Books can make your filing process smoother and faster.

- Train Your Staff: Since this change involves a more technical process, training your accounting and finance staff on how to correctly report HSN codes is crucial. Make sure they understand the dropdown system and how to select the right code.

- Maintain an HSN Master List: Keeping a master list of all the HSN codes you frequently use can help speed up the filing process. This way, your team can quickly reference the list instead of hunting for codes during the filing process.

- Consult a GST Practitioner: If you’re unsure about the process, consult a GST practitioner or tax professional. They can help you navigate the complexities of HSN code reporting and ensure you stay compliant.

Massive ₹62 Crore GST Evasion Scam Uncovered in Ludhiana—Two Arrested in Major Tax Fraud Bust!

GST Collections for July 2025: You Won’t Believe Which State Tops the List!