Maruti Suzuki Subsidiary Slammed With ₹86 Crore GST Penalty: In a recent headline-making case, Suzuki Motor Gujarat Pvt Ltd (SMG)—a wholly owned subsidiary of Maruti Suzuki India Ltd (MSIL)—has found itself in hot water with tax authorities. The Gujarat CGST Appellate Authority has confirmed a ₹86.1 crore GST demand, along with an additional ₹8.6 crore in interest and penalties, under the reverse-charge mechanism (RCM). This massive tax blow has become a cautionary tale for companies across India and beyond, especially in sectors that deal with cross-border or service-based transactions. If you’re a tax professional, finance leader, or even just someone who wants to understand how this happened, this detailed guide breaks it all down—clearly, simply, and with real-world relevance.

Maruti Suzuki Subsidiary Slammed With ₹86 Crore GST Penalty

The ₹86 crore GST penalty slapped on Suzuki Motor Gujarat shows that no company is too big to fall short on compliance. Even though SMG paid the tax, incorrect or delayed reporting under the reverse-charge mechanism resulted in penalties and a very public financial blemish. This ruling is more than just a fine—it’s a compliance signal. From startups to conglomerates, businesses must treat RCM as a real liability, track it diligently, and avoid assumptions that voluntary payment alone is enough. Remember, under GST, what you file matters just as much as what you pay.

| Topic | Details |

|---|---|

| Company Involved | Suzuki Motor Gujarat Pvt Ltd (SMG) |

| Parent Company | Maruti Suzuki India Ltd |

| Total Penalty | ₹86.1 crore (tax) + ₹8.6 crore (interest & penalty) |

| Period Under Review | April 2020 – August 2022 |

| Core Issue | Reverse-charge mechanism (RCM) misreporting |

| Regulator | CGST Appellate Authority, Gujarat |

| Tax Status | Tax already deposited by SMG before show-cause notice |

| Legal Status | SMG is appealing to GST Tribunal |

| Amnesty Used | Yes – for July 2017 to March 2020 period under Section 128A |

| Financial Impact | Declared as “non-material” by Maruti Suzuki India Ltd |

Who Are Maruti Suzuki and Suzuki Motor Gujarat?

Maruti Suzuki India Ltd (MSIL) is the country’s largest carmaker, producing over 1.7 million vehicles per year and holding more than 40% of the passenger vehicle market share.

To meet growing demand, Maruti’s parent company, Suzuki Motor Corporation (Japan), set up Suzuki Motor Gujarat (SMG) in 2014 as a 100% subsidiary. SMG handles the actual manufacturing of cars, which are then purchased and marketed by MSIL.

SMG operates state-of-the-art production plants in Gujarat and plays a crucial role in Maruti’s supply chain, especially for popular models like the Baleno, Swift, Dzire, and Fronx.

What Is the Reverse-Charge Mechanism (RCM) Under GST?

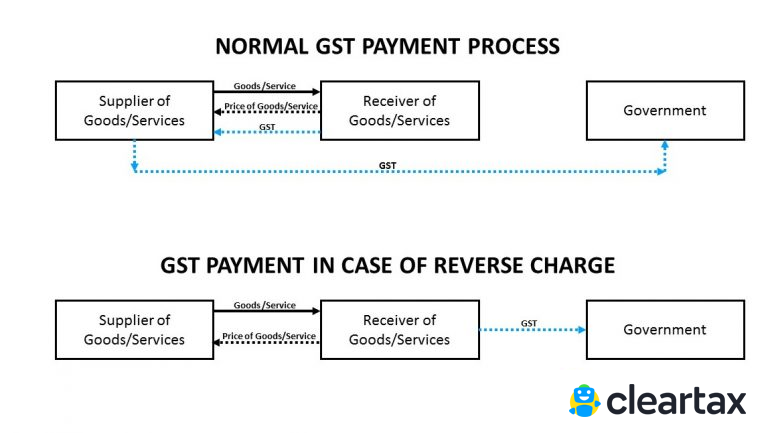

In normal business transactions, the supplier of goods or services charges GST and deposits it with the government. But under Reverse-Charge Mechanism (RCM), the recipient of the service pays the GST instead.

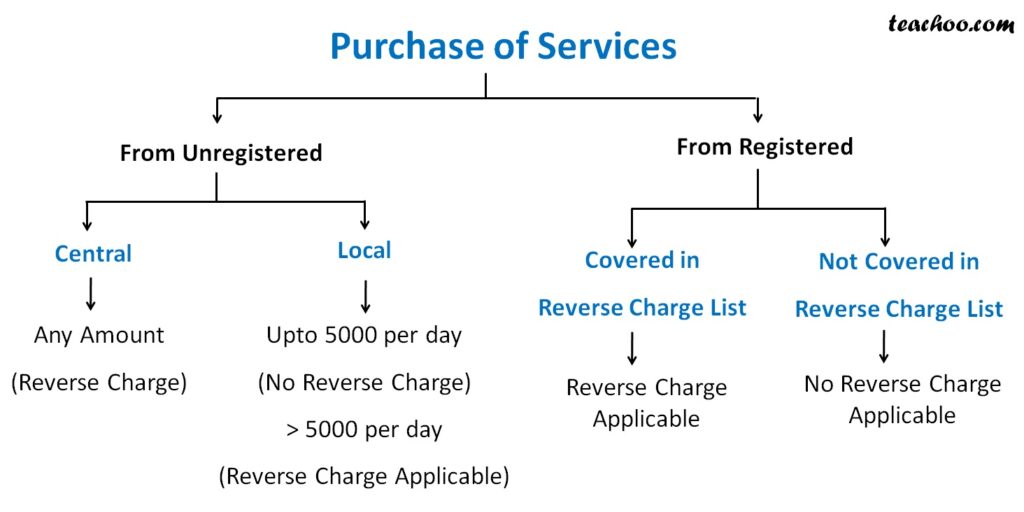

RCM is applicable when:

- The supplier is unregistered under GST.

- The supply is from outside India (like import of services).

- The supply falls under specific RCM-notified categories (legal, security, transportation, etc.).

In SMG’s case, the issue revolved around imported technical services and other transactions that fell under RCM. While SMG did pay the tax voluntarily, it missed timely reporting or correct compliance, triggering interest and penalty under the law.

How Did SMG End Up With an ₹86 Crore GST Demand?

Here’s a simplified breakdown of what happened:

- SMG received technical and consulting services between April 2020 and August 2022, likely from overseas or unregistered vendors.

- Under reverse-charge, SMG was liable to pay GST directly to the government.

- Although SMG voluntarily paid the ₹86.1 crore before any show-cause notice, authorities noted delays and errors in return filings.

- Based on that, the Gujarat CGST Appellate Authority imposed an ₹8.6 crore penalty, citing improper compliance under Sections 73 and 50 of the CGST Act.

How GST Penalties Are Calculated in India?

When there is a delay in paying GST, the following charges can be levied:

| Charge Type | Explanation | Rate/Amount |

|---|---|---|

| Interest | On late payment of tax | 18% per annum |

| Penalty | For incorrect reporting or delay | 10% of tax due or ₹10,000, whichever is higher |

| Late Fees | For delayed GSTR-3B filings | ₹50 – ₹200 per day depending on nature |

This structure is what led to the ₹8.6 crore additional liability for SMG.

What Is the CGST Appellate Authority?

The Central Goods and Services Tax (CGST) Appellate Authority is the second level of redressal in GST disputes.

When a taxpayer disagrees with an adjudication order from a GST officer, they can appeal to the Commissioner (Appeals). If the order from that level is still unsatisfactory, the matter goes to the Appellate Authority.

SMG’s appeal at this level was unsuccessful, prompting them to now move to the GST Tribunal.

What’s the GST Tribunal, and What Happens Next?

The GST Appellate Tribunal (GSTAT) is the next legal platform where SMG will be fighting its case. This is a quasi-judicial authority that examines:

- Legal validity of the order

- Procedural correctness

- Whether interest and penalties were fair under GST law

As of 2025, the Tribunal benches are now operational, following years of delays due to appointments and legal reforms.

If SMG loses here, it can appeal to the High Court, and then to the Supreme Court, if needed.

Maruti Suzuki’s Response: No Big Deal?

In a regulatory filing, MSIL clarified that this penalty will have no material impact on its operations or financials. Given that Maruti’s quarterly revenue exceeds ₹30,000 crore, a ₹94.7 crore hit (including penalties) represents just 0.3% of revenue.

Still, the case has compliance lessons for the broader business community.

What Is Section 128A: The GST Amnesty Scheme?

Section 128A of the CGST Act, introduced in 2024, allowed businesses to settle past GST disputes for periods between July 2017 and March 2021 by:

- Paying the principal tax only

- Waiving off interest and penalties

SMG used this provision to withdraw part of its earlier appeal for the 2017–2020 period, significantly reducing its past tax burden.

Businesses have until September 30, 2025, to avail this scheme.

You can read more about the amnesty scheme on the CBIC website.

Practical Compliance Tips for Businesses As Maruti Suzuki Subsidiary Slammed With ₹86 Crore GST Penalty

1. Identify All RCM-Triggered Transactions

- Import of services

- Legal fees

- Transport via GTA

- Unregistered vendor services

2. Keep a Dedicated RCM Register

This should include:

- Date of invoice

- Vendor registration status

- GST rate applied

- Tax paid date

- Filing status in GSTR-3B

3. Automate GST Compliance

Tools like TallyPrime, Zoho Books, SAP GST module, and ClearTax offer RCM-specific accounting features.

4. Review Your GST Returns Monthly

Late reporting—even if the tax is paid—can lead to interest and penalty. Internal audits can prevent that.

Expert Commentary: What Industry Insiders Are Saying

“RCM is one of the most misunderstood parts of GST. Even large enterprises often fail to reconcile payments with return filings, which is where penalties creep in.”

— N. Sharma, Partner, PwC India

“SMG’s case is a reminder that self-compliance is not just about paying the amount due. It’s also about declaring and documenting everything correctly.”

— Manisha Iyer, Independent GST Consultant

GST Portal to Be Down August 2–3 — Check Exact Hours Before Filing

Cabinet Greenlights Major GST Act Amendments—What These Changes Mean for Businesses and Consumers

Punjab Achieves Staggering 32% GST Growth in July—Finance Minister Harpal Singh Cheema Reveals