Maryland’s Digital Ad Tax Crushed: If you’ve been following the buzz about Maryland’s Digital Advertising Tax, you’ve probably seen the headlines: “Maryland’s Digital Ad Tax Crushed – CCIA Scores Major Win.” This is a big one, folks. The Fourth U.S. Circuit Court of Appeals just ruled that a major piece of Maryland’s digital ad tax law was unconstitutional, handing a victory to the Computer & Communications Industry Association (CCIA), NetChoice, and other tech trade groups. In plain English? Maryland tried to silence companies from telling their customers about a tax hike, and the court said, “Nope, that’s not how America rolls.”

Maryland’s Digital Ad Tax Crushed

The Fourth Circuit’s ruling against Maryland’s Digital Ad Tax gag clause is a major victory for free speech, transparency, and digital business rights. While the tax itself still exists, the decision reaffirms that states cannot silence companies from explaining taxes to their customers. For businesses, the lesson is clear: stay transparent, communicate openly, and prepare for a future where states may continue experimenting with taxing Big Tech. For consumers, it means more clarity when bills go up—and a reminder that the right to complain about taxes is alive and well.

| Point | Details |

|---|---|

| Court Ruling | Fourth Circuit ruled part of Maryland’s Digital Ad Tax unconstitutional (Aug 15, 2025). |

| What Was Struck Down | The “pass-through” clause banning companies from itemizing or blaming the tax on invoices. |

| Why It Matters | Protects First Amendment rights and business transparency. |

| Who Won | CCIA, NetChoice, U.S. Chamber of Commerce. |

| Tax Details | 2.5% to 10% tax on global revenue from digital ads for companies making $1M+ in Maryland. |

| Next Step | Sent back to the lower court to decide remedies. |

| Official Source | CCIA Official Website |

The Backstory: Why Maryland’s Digital Ad Tax Crushed

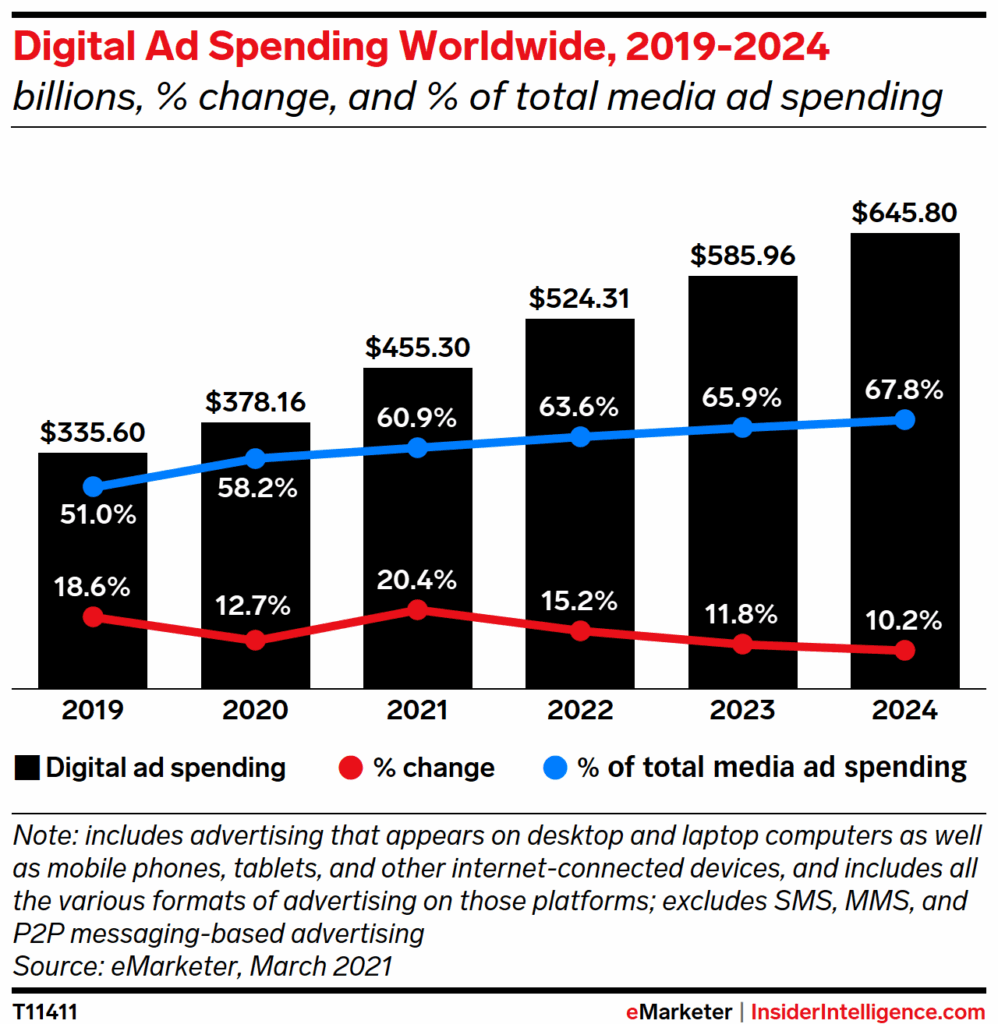

In 2021, Maryland broke new ground by becoming the first U.S. state to pass a tax on digital advertising revenues. State lawmakers argued that Big Tech companies like Google, Amazon, and Meta should contribute more to the local economy since they earn billions from Maryland residents without necessarily investing heavily in the state.

The tax revenue was earmarked to fund The Blueprint for Maryland’s Future, a sweeping education reform bill promising better teacher salaries, expanded pre-K programs, and improved student resources. State officials projected the tax could generate $250 million annually.

But from the start, critics warned of three main problems:

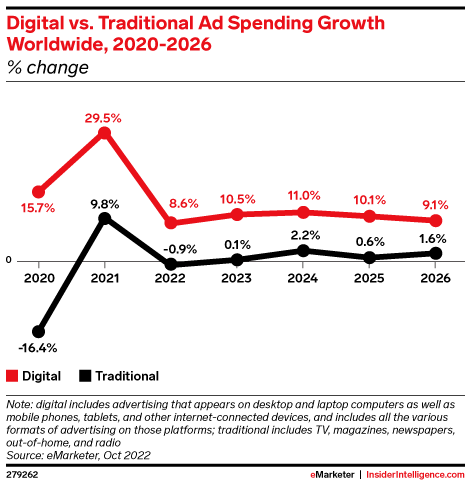

- It unfairly singled out digital platforms while exempting traditional media.

- The costs would likely trickle down to small businesses that rely on digital ads.

- The gag rule banning companies from disclosing the tax to customers crossed constitutional lines.

Why the “Pass-Through” Ban Was a Problem

The law’s most controversial element wasn’t the tax itself—it was the ban on transparency. Maryland prohibited companies from telling customers their higher bills were due to the tax. That meant no line-item surcharges, no invoice notes, no clear explanation.

Imagine if your internet provider raised rates but wasn’t allowed to say, “This increase is because Maryland taxed digital ads.” Customers would be left in the dark.

The appeals court didn’t mince words. Judge Julius Richardson wrote:

“The pass-through prevents companies from describing the tax in the one setting where the consumer is guaranteed to look: the invoice. Complaining about taxes remains a grand American political tradition.”

That statement gets to the heart of American values—you have the right to know why you’re paying more.

How Big Was the Tax?

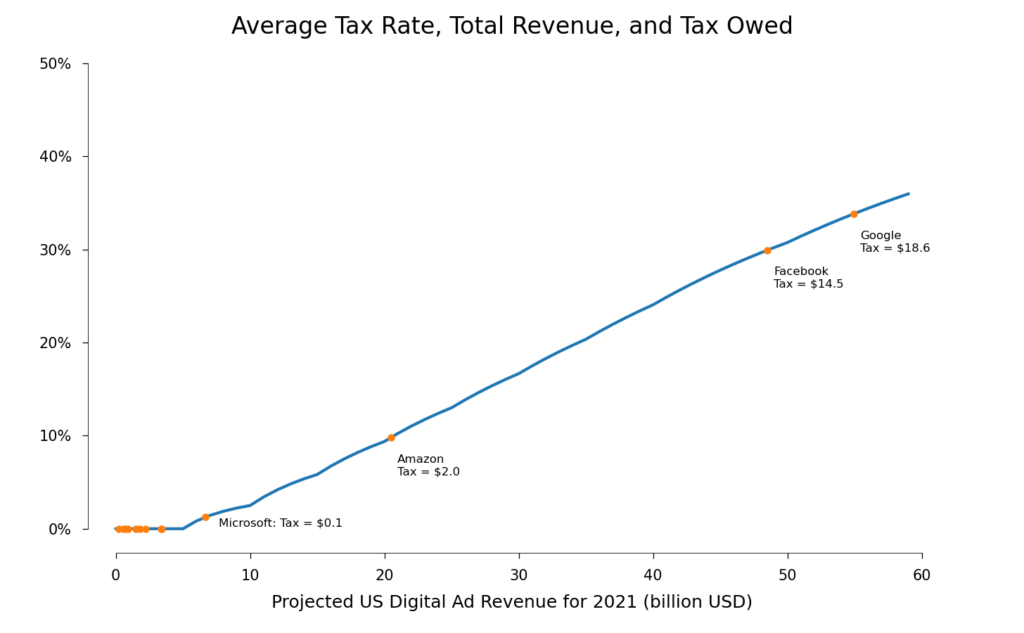

The tax applied only to companies with over $1 million in annual digital ad revenue in Maryland. But the rate depended on global revenue:

- 2.5% if global revenue was between $100 million–$1 billion

- 5% if $1 billion–$5 billion

- 7.5% if $5 billion–$15 billion

- 10% if more than $15 billion

To put that into perspective: Google Ads generated $307 billion in 2023. Even a fraction of that tied to Maryland could mean tens of millions in state taxes annually.

How CCIA and NetChoice Stepped In?

Two of the most influential digital trade groups, CCIA and NetChoice, immediately filed lawsuits challenging the tax. They argued:

- The gag rule violated the First Amendment by restricting truthful commercial speech.

- The law discriminated against digital advertising, leaving newspapers, radio, and TV untouched.

- If allowed to stand, the tax could inspire a patchwork of state-level digital ad taxes, complicating interstate commerce.

Stephanie Joyce, Senior VP at CCIA, celebrated the court’s ruling:

“Maryland tried to prevent criticism of its tax scheme, and the court recognized that tactic for what it was: censorship.”

NetChoice echoed the win, calling the gag clause “a blatant attempt to muzzle free speech.”

Timeline of the Legal Fight

- 2021 – Maryland passes the Digital Ad Tax; lawsuits follow immediately.

- 2022–2023 – Maryland courts argue over jurisdiction; cases bounce between state and federal courts.

- July 2024 – A federal judge dismissed CCIA’s First Amendment claims, calling them too broad.

- Jan 2025 – The Fourth Circuit revived the case, saying the claims deserved a full hearing.

- Aug 15, 2025 – Appeals court unanimously rules the gag clause unconstitutional.

Now, the case heads back to a lower court to decide whether to strike down the entire clause or narrow it further.

National and Global Perspective

Maryland’s law was the first of its kind in the U.S., but it didn’t emerge in a vacuum.

Globally:

- France introduced a 3% digital services tax in 2019 on large tech companies.

- The European Union has debated a bloc-wide tax to ensure Big Tech pays local governments.

Nationally:

- Connecticut, New York, and Indiana have considered similar digital ad tax bills.

- Economists warned these could raise ad costs for small businesses nationwide.

This ruling will likely discourage other states from copying Maryland’s approach, at least without serious revisions.

The Ripple Effect: Consumers and Businesses

This isn’t just a fight between Big Tech and state governments—it affects everyday businesses and consumers.

- Businesses: Digital ad agencies and local companies that buy ads on Google or Facebook may see surcharges appear on invoices. Transparency is now protected.

- Consumers: Higher advertising costs could indirectly lead to pricier products or services.

- Government Revenue: Maryland may collect less than projected if companies push back harder now that they can tell customers about the tax.

For example:

- A Maryland bakery running $10,000 in Facebook ads annually might see an extra 5% surcharge. Without transparency, they’d just pay more. With transparency, they can show it to clients—or even lobby against it.

Practical Guide: How Businesses Should Handle Digital Ad Taxes

Here’s a step-by-step checklist for businesses:

- Stay Informed – Follow updates from Maryland Comptroller’s Office.

- Itemize Clearly – Add “Maryland Digital Ad Tax” as a line item on invoices.

- Educate Clients – Send an FAQ explaining how state taxes impact ad pricing.

- Budget Wisely – Build in buffers for potential state-level taxes.

- Get Legal Help – Consult tax attorneys for compliance advice.

Expert Voices and Economic Data

According to the Tax Foundation, digital ad taxes often “distort markets” by raising costs that get passed down to small businesses. They also risk “double taxation” since tech companies already pay corporate income taxes.

Meanwhile, eMarketer reported U.S. digital ad spending hit $260 billion in 2024. Even a 2.5% levy on that would be over $6.5 billion—showing why states see digital ads as a tempting revenue source.

Legal scholars also argue this case could set precedent for how far states can go in regulating online commerce without crossing constitutional lines.

India’s Tax Reform Needs Economics, Not Politics — The Hard Truth

Borrowed Money From a Friend? You Might Be Hit With a Tax Penalty