Massive ₹62 Crore GST Evasion Scam: In one of the largest GST evasion cases to be uncovered in India, a massive ₹62 crore scam has been exposed in Ludhiana, Punjab. The investigation has revealed a highly sophisticated tax fraud scheme where a group of individuals created fake businesses, filed false tax returns, and evaded GST payments, causing a huge financial loss to the government. The raid has led to two arrests, and authorities are continuing their search for others involved in this complex operation.

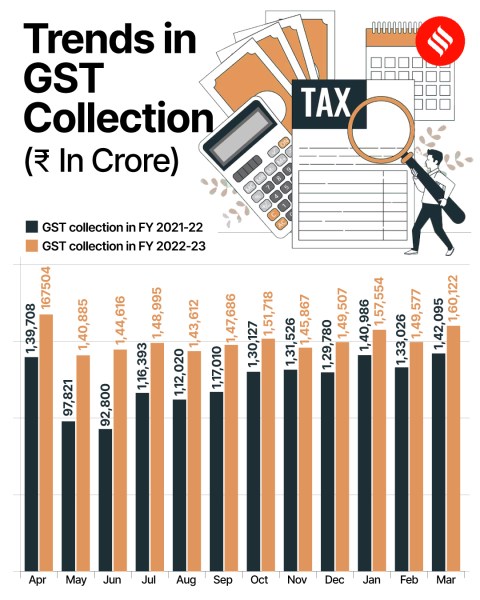

This scam underscores the growing issue of Goods and Services Tax (GST) evasion in India, a nation that introduced GST to streamline its taxation system but continues to face challenges with fraudulent activities. In this article, we’ll break down the details of the Ludhiana GST scam, how these frauds typically operate, the impact on the economy, and what businesses can do to protect themselves from falling victim to similar schemes. Whether you’re a tax professional, a business owner, or just someone curious about the intricacies of taxation, this article will walk you through the key points of the case and offer practical advice on how to avoid falling into the trap of tax fraud.

Massive ₹62 Crore GST Evasion Scam

The ₹62 crore GST evasion scam uncovered in Ludhiana serves as a wake-up call for businesses across India to stay vigilant and follow proper tax procedures. By understanding how these frauds operate and implementing strict compliance measures, businesses can protect themselves from falling victim to such schemes. Always remember, in the world of taxation, transparency, and diligence are your best defense.

| Topic | Details |

|---|---|

| Scam Amount | ₹62 Crore |

| Location | Ludhiana, Punjab |

| Key Individuals Arrested | Two people arrested, mastermind still on the run |

| Fraudulent Businesses | Fake companies created using the identities of unemployed youth |

| Total Fake Transactions | ₹866.67 Crore in bogus transactions (2023-2025) |

| Input Tax Credit (ITC) | ₹157.22 Crore claimed fraudulently |

| Recovered Evidence | Cheques, NEFT forms, fake invoices, ₹40 lakh in cash |

| Link to Government Website | GST India |

Understanding the Massive ₹62 Crore GST Evasion Scam

Ludhiana, a bustling industrial hub in Punjab, has recently become the epicenter of a major tax fraud investigation. The scam, which involved the creation of multiple fake firms, was orchestrated by a local accountant named Sarabjit Singh. Singh and his associates exploited the GST system by registering fictitious companies that appeared to conduct large-scale transactions. These bogus firms were used to claim input tax credits (ITC) for goods and services they never actually received.

Key Details of the Scam:

- Fake Firms Creation: Over 20 fake firms were set up using the personal details of unsuspecting individuals, including unemployed youth and daily-wage laborers. These individuals were promised a daily wage of ₹800 in exchange for allowing the use of their bank accounts and Aadhaar details.

- Bogus Transactions: Between 2023 and 2025, these companies conducted false transactions worth ₹866.67 crore, with fraudulent claims of ₹157.22 crore in GST refunds.

- Evidence Recovered: During the investigation, authorities found unsigned cheque books, pre-filled NEFT forms, fake invoices, and a substantial amount of unaccounted cash (₹40 lakh). These findings suggest a highly organized operation designed to siphon money from the government’s coffers.

This massive scheme highlights just how sophisticated GST frauds can become, with individuals using digital tools, fake documentation, and manipulated identities to carry out their illegal activities.

How Does GST Evasion Work? A Step-by-Step Guide

To understand how such a large-scale scam can unfold, let’s break down the typical steps involved in a GST evasion scheme:

Step 1: Creation of Fake Businesses

Fraudsters usually start by creating shell companies that appear to be legitimate. These businesses may have fake addresses, fake GST registration numbers, and fabricated records. They often recruit unsuspecting individuals to serve as the front for these companies, offering them small financial incentives in return for using their identities.

Step 2: Fake Transactions

Once these shell companies are set up, fraudsters engage in fake transactions. They issue invoices for goods or services that were never delivered. These invoices allow them to claim input tax credit (ITC), which reduces their tax liability.

Step 3: Claiming ITC

Using the false invoices, these businesses file GST returns claiming ITC for purchases that never took place. The government, believing these claims to be legitimate, refunds the money, allowing the fraudsters to pocket the excess funds.

Step 4: Laundering the Money

To cover their tracks, fraudsters often launder the ill-gotten gains through various means. This can include moving funds across multiple bank accounts, converting the money into assets like real estate, or simply withdrawing large sums in cash.

Step 5: Selling Fake Goods

Sometimes, fraudsters may even create fake invoices for goods that are either never manufactured or are sold at inflated prices to make the transaction look real.

The Role of Technology in Massive ₹62 Crore GST Evasion Scam

As technology advances, so do the methods used by fraudsters to evade taxes. The Ludhiana GST scam involved digital tools that made it easier for fraudsters to create fake invoices, register fake businesses online, and move money across multiple bank accounts. Using advanced software, they could easily fabricate documents and manipulate records without leaving a trace.

How Technology Helps Combat Fraud:

- Blockchain for Transparency: Governments are exploring blockchain technology to create tamper-proof systems for tracking goods and services, which can reduce fraudulent claims.

- AI for Pattern Recognition: Artificial intelligence is being used to detect irregular patterns in transactions, flagging suspicious activities before they become widespread.

- E-Invoicing: E-invoicing systems, where invoices are automatically uploaded to government servers, have made it harder to manipulate invoices.

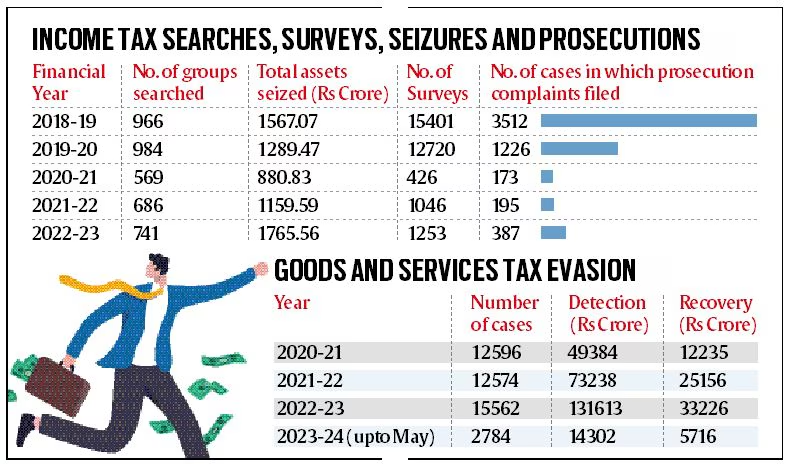

How the Government is Tackling GST Fraud?

The government of India is taking significant steps to curb GST fraud. Various government agencies, such as the Directorate General of GST Intelligence (DGGI) and the GST authorities, are working to increase surveillance and improve enforcement.

Recent Measures Include:

- E-Invoicing Mandate: By mandating the generation of invoices through a centralized system, the government is tightening the process and making it harder for fraudsters to falsify transactions.

- Increased Scrutiny of Returns: The government has introduced a more aggressive approach to auditing returns, flagging discrepancies and conducting detailed investigations when necessary.

- Taxpayer Awareness Campaigns: The government is also running awareness programs to help businesses recognize fraudulent activities and report them.

Real-Life Examples of GST Fraud in India

India has seen several large-scale GST frauds in recent years. Some of the most notable ones include:

- The ₹350 Crore Scam in Delhi: A group of businessmen in Delhi was found to have created fake companies to fraudulently claim ₹350 crore in GST refunds. Their operations were shut down after an extensive investigation, which led to multiple arrests.

- ₹130 Crore Scam in Tamil Nadu: In this case, fraudsters used fake invoices to claim refunds for goods that never existed. The scheme was busted when the authorities noticed discrepancies in the reported transactions.

The Importance of GST Audits and Regular Inspections

Regular audits are crucial for ensuring compliance with tax regulations. GST audits help businesses verify the authenticity of their tax returns, invoices, and other financial documents. If conducted properly, audits can also detect fraud before it spirals out of control.

Why Audits Matter:

- Prevent Fraud: Regular audits help identify discrepancies early, preventing large-scale fraudulent activities.

- Improve Financial Management: Through audits, businesses can ensure their financial records are accurate and compliant.

- Increase Trust: A company that regularly audits its financials enhances its reputation with stakeholders, partners, and customers.

International Comparison: How Other Countries Tackle GST Fraud

While India’s GST system is still evolving, other countries have adopted various strategies to combat GST fraud:

- Australia: Australia’s tax authority, the ATO, uses sophisticated data analytics and real-time reporting to prevent fraudulent claims. The introduction of a single-touch payroll system has also helped streamline tax collection.

- United Kingdom: The UK’s HMRC uses machine learning to identify unusual transaction patterns that may indicate tax evasion.

By learning from international best practices, India can improve its efforts to combat tax fraud and make the GST system more efficient.

What Can Businesses Do to Protect Themselves?

If you’re a business owner, tax professional, or anyone involved in the GST system, it’s crucial to take steps to protect yourself from falling victim to similar fraud schemes. Here’s a practical guide to safeguarding your business:

1. Conduct Due Diligence

Before entering into any business transactions, especially with new suppliers or partners, always verify their GST registration status. Check for the authenticity of their business by examining their financial records and past transactions.

2. Implement Strong Internal Controls

Make sure your business maintains detailed records of all transactions, including invoices and receipts. Internal audits should be conducted regularly to identify any inconsistencies or irregularities in your financials.

3. Stay Updated on GST Rules

GST rules can be complex and subject to change. Keep your business compliant by staying up to date with any revisions or new developments in GST laws. Official resources like the GST India website provide valuable information for businesses.

4. Train Employees

Ensure that your team is aware of the importance of following proper accounting practices and understanding GST requirements. Providing regular training on tax compliance can help prevent errors and reduce the risk of falling into fraudulent schemes.

5. Report Suspicious Activities

If you notice any suspicious activities, such as receiving fake invoices or dealing with suppliers who don’t appear legitimate, don’t hesitate to report them to the authorities. The earlier the authorities are alerted, the easier it will be to prevent further damage.