Massive GST Scam In Nepal Exports: If you’ve been following the financial news cycle, you’ve probably come across headlines about the Massive GST Scam in Nepal Exports. And here’s the twist: it doesn’t involve high-tech hacking or billion-dollar corporations, but something as ordinary as tiles and auto parts. Investigators allege that exporters fabricated paperwork, staged fake shipments, and walked away with tax refunds worth nearly ₹100 crore (around $12 million). It may sound like another case of financial fraud, but this scam highlights deeper issues in India’s tax and trade ecosystem. By understanding how this unfolded, we gain insight into how loopholes are exploited, what risks businesses face, and how governments can prevent such scams in the future.

Massive GST Scam In Nepal Exports

The Massive GST Scam in Nepal Exports shows how a carefully designed system can be exploited when loopholes meet corruption. From fake invoices worth ₹800 crore to refunds totaling ₹100 crore, it reveals the dark side of tax incentives. For governments, the solution lies in better digital monitoring, stronger enforcement, and accountability for officials. For businesses, the lesson is clear: integrity and compliance are not optional. And for citizens, awareness matters—because scams like this erode the public resources meant for everyone.

| Point | Details |

|---|---|

| Scam Value | Fake exports worth ₹800 crore (~$96M) |

| GST Refund Claimed | Around ₹100 crore (~$12M) |

| Industries Involved | Tiles and Automobile Parts |

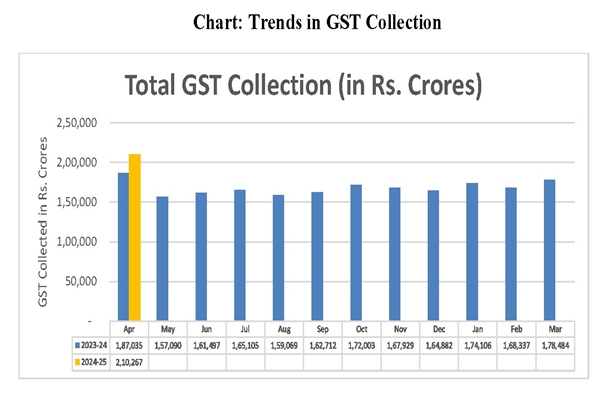

| Timeline | Fiscal Year 2022–23 |

| Accused | Around 30 exporters, customs officers, private agents |

| Seizures | 7 gold bars, incriminating documents, mobile devices |

| Investigating Agency | CBI – Central Bureau of Investigation |

| Locations Impacted | Patna, Purnea, Jamshedpur, Nalanda, Munger |

A Quick Refresher: What is GST and Why Refunds Exist

The Goods and Services Tax (GST), launched in India in 2017, replaced a confusing web of state and central taxes with one streamlined system. When businesses sell goods domestically, they collect GST from customers and pay it to the government.

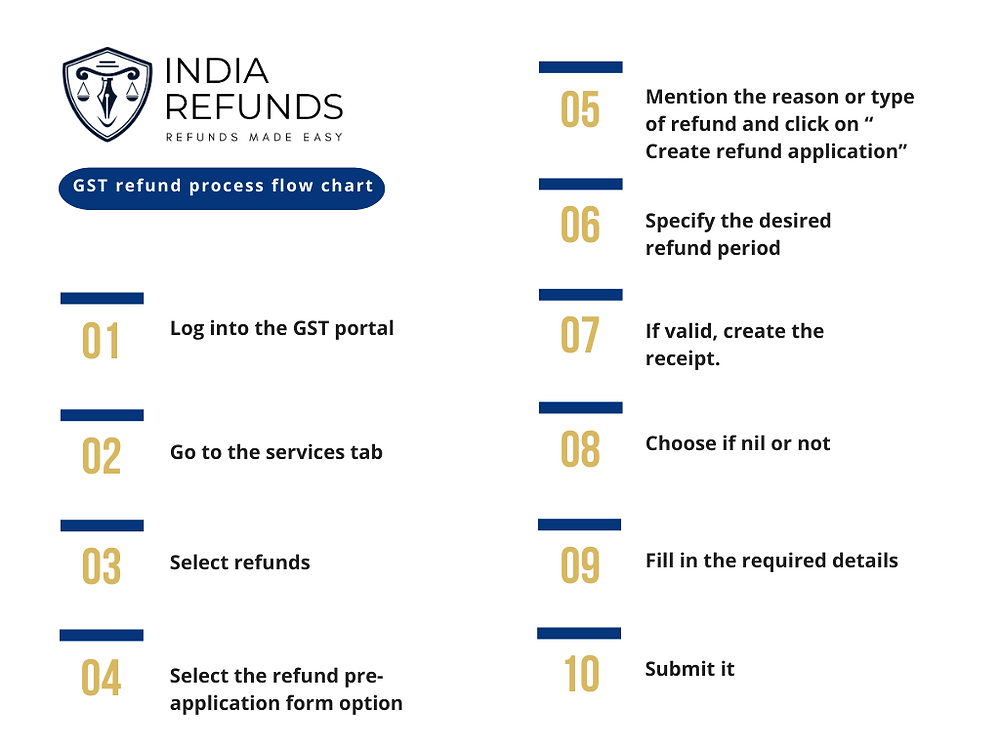

But when goods are exported, they are considered zero-rated supplies. Exporters do not pay GST on the final transaction but may pay it on inputs (raw materials, services, etc.). To remain competitive in global trade, they can claim GST refunds. In short, refunds ensure exporters are not penalized for taxes on products that leave the country. This refund mechanism is meant to help honest businesses. But in this case, it turned into a tool for fraudsters.

How the Massive GST Scam In Nepal Exports Worked?

Here’s the step-by-step breakdown of the scheme:

- Fake Export Bills – Exporters generated invoices for shipments of tiles and auto parts that never actually crossed the border.

- Customs Clearance – Using border posts such as Jaynagar, Bhimnagar, and Bhittamore, these documents were cleared as though the goods had left India.

- Invoice Structuring – Each invoice was kept under ₹10 lakh, making them look small enough to avoid triggering detailed customs checks.

- Refund Filing – The exporters then filed for GST refunds on the supposed exports, claiming back taxes they never paid.

- Cash Out – The government, relying on fraudulent paperwork, reimbursed these exporters, causing a loss of around ₹100 crore.

In total, investigators allege that fake exports worth ₹800 crore were recorded on paper.

The People Involved

The CBI FIR named a web of accused individuals, including:

- Around 30 exporters who filed fraudulent claims.

- Senior officials such as Ranvijay Kumar, Additional Commissioner of Customs (Patna), along with superintendents Neeraj Kumar, Manmohan Sharma, Tarun Kumar Sinha, and Rajeev Ranjan Sinha.

- A G-card holder, essentially a licensed clearing agent, suspected of orchestrating the paperwork between exporters and customs officers.

During searches across Bihar and Jharkhand, investigators seized seven gold bars of 100 grams each, mobile phones, and incriminating files. These raids in Patna, Purnea, Jamshedpur, Nalanda, and Munger suggest the scam had deep regional roots.

Why Tiles and Auto Parts?

Fraudsters don’t pick industries randomly. Tiles and auto parts were chosen for three key reasons:

- Common trade items: Both are widely imported and exported, making unusual activity harder to spot.

- Variable pricing: Market prices fluctuate, providing cover for inflated invoices.

- High tax brackets: GST slabs of 18% and 28% meant larger refunds, making the scam lucrative.

This combination made tiles and auto parts the perfect camouflage for large-scale tax fraud.

Why This Scam Matters?

At first glance, this might look like a financial story that affects only a few exporters and customs officers. But the ripple effects reach far beyond that.

- Taxpayer Losses – ₹100 crore is public money that could have been spent on roads, hospitals, or education.

- Strain on Honest Exporters – When fraud is detected, governments often tighten rules, making life harder for legitimate traders.

- Market Distortions – False export data inflates numbers, misleading policymakers and impacting trade statistics.

- Corruption Exposure – The involvement of senior customs officers shows how systemic collusion can undermine public trust.

A Look Back: Previous Export Frauds

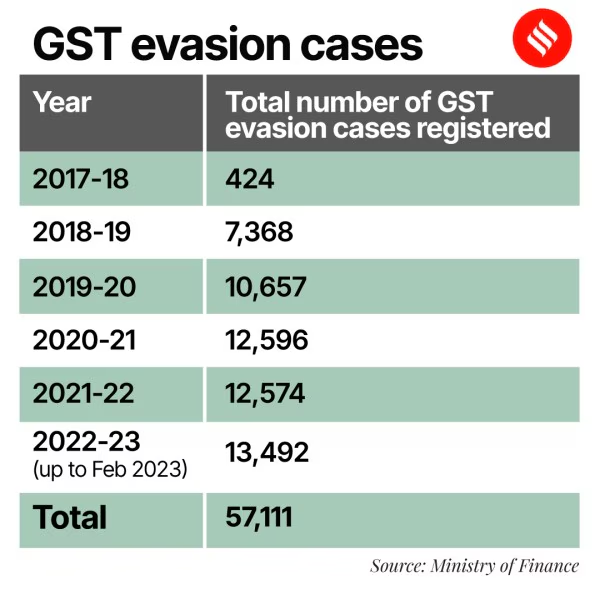

This isn’t the first time India has faced GST or export-related fraud.

- In 2021, the Directorate of Revenue Intelligence uncovered a textile export scam worth ₹1,800 crore, where refunds were claimed using fake shipping documents.

- Globally, the European Union has battled VAT frauds, with carousel fraud costing member states billions of euros every year.

- In the United States, sales tax refund fraud and Medicare billing frauds use similar loopholes: fake invoices, inflated claims, and collusion with insiders.

The playbook is consistent—only the industries and products change.

Expert Opinions

Experts believe that the fraud exposes structural weaknesses. A GST consultant interviewed by NDTV explained:

“Without real-time verification of exports and stronger digital oversight, these scams will continue. Physical checking of goods and AI-driven invoice matching are no longer optional—they’re necessary.”

Economists argue that this case demonstrates the need for a balance: preventing fraud without stifling legitimate trade. Too many restrictions can slow down exporters, hurting competitiveness.

Possible Policy Reforms

Cases like this often drive regulatory change. India may soon introduce:

- Stricter refund verification: More documentation and matching of invoices with actual shipping records.

- Digital audits: Linking GST data with customs clearance systems in real time.

- Customs accountability: Stronger disciplinary action against officers caught in collusion.

- Technology adoption: Blockchain-based supply chain verification could make tampering almost impossible.

These reforms are expected to reduce fraud but may also increase compliance costs for businesses.

Lessons for Businesses

This scam offers practical lessons for companies, regardless of size or sector:

- Maintain Transparent Records – Always keep export documentation accurate and verifiable.

- Vet Business Partners – Conduct due diligence on suppliers, agents, and clearing partners.

- Stay Compliant – Regularly update yourself on tax laws through resources such as the official GST portal.

- Audit Yourself – Conduct internal checks before authorities do.

- Invest in Technology – Digital invoicing and ERP systems help track errors and prevent fraud.

Shortcuts may bring quick profits but expose businesses to long-term risks like penalties, bans, or even imprisonment.

How Technology Could Help?

One of the strongest solutions lies in technology.

- Artificial Intelligence can detect unusual patterns in invoices, such as repetitive small-value bills just under inspection thresholds.

- Blockchain can create a tamper-proof trail of goods, from warehouses to border checkpoints.

- Data Sharing between GST authorities, customs, and banks can ensure that claimed exports are backed by actual financial transactions.

India has already started integrating e-invoicing and digital filing systems, but cases like this suggest more robust, interconnected solutions are needed.

India’s Aggressive Investment Reforms: GST Relief, PLI Tweaks, and a Simpler Future

High GST on Waste Is Bleeding ₹1.8 Lakh Crore From India’s Circular Economy

Supreme Court Flags Major Loopholes in GST Enforcement for Foreign Digital Giants in India