Media And Advertising Sector Seeks Urgent GST Relief: The media and advertising sector seeks urgent GST relief from the government, and the call is louder than ever. With rising costs, shrinking ad revenues, and delayed payments, industry bodies are pushing for reforms that could ease the burden and inject fresh life into a struggling industry. From news broadcasters to outdoor advertisers, from magazine publishers to cable operators, every corner of the industry is raising the same concern: The current tax regime is choking us—we need relief, and we need it fast.

Media And Advertising Sector Seeks Urgent GST Relief

The media and advertising sector’s plea for urgent GST relief is about survival, not luxury. From news broadcasters battling delayed payments to publishers fighting digital unfairness, the industry is united in demanding reforms. The GST Council now faces a tough choice: protect short-term tax revenue or secure the long-term health of a critical sector. With GST 2.0 around the corner, the decision could reshape India’s media landscape for years to come.

| Aspect | Details |

|---|---|

| Main Demand | Reduction of GST from 18% to 5% for outdoor ads, cable, and other segments |

| NBDA Request | Levy GST on payment receipt, not invoice issue, to reduce cash flow pressure |

| Publishers’ Ask | Exempt digital editions of newspapers/magazines from GST (like print) |

| Outdoor Advertising | Exempt GST for PPP-driven infrastructure projects |

| Cable Operators | Cut GST from 18% to 5% to remain competitive with OTT platforms |

| Market Impact | India’s ad market worth ₹1.3 trillion ($16B), slowed to 5% growth in 2024 |

| Upcoming Decision | GST Council meeting on September 3–4, 2025 |

| Official Source | GST Council Website |

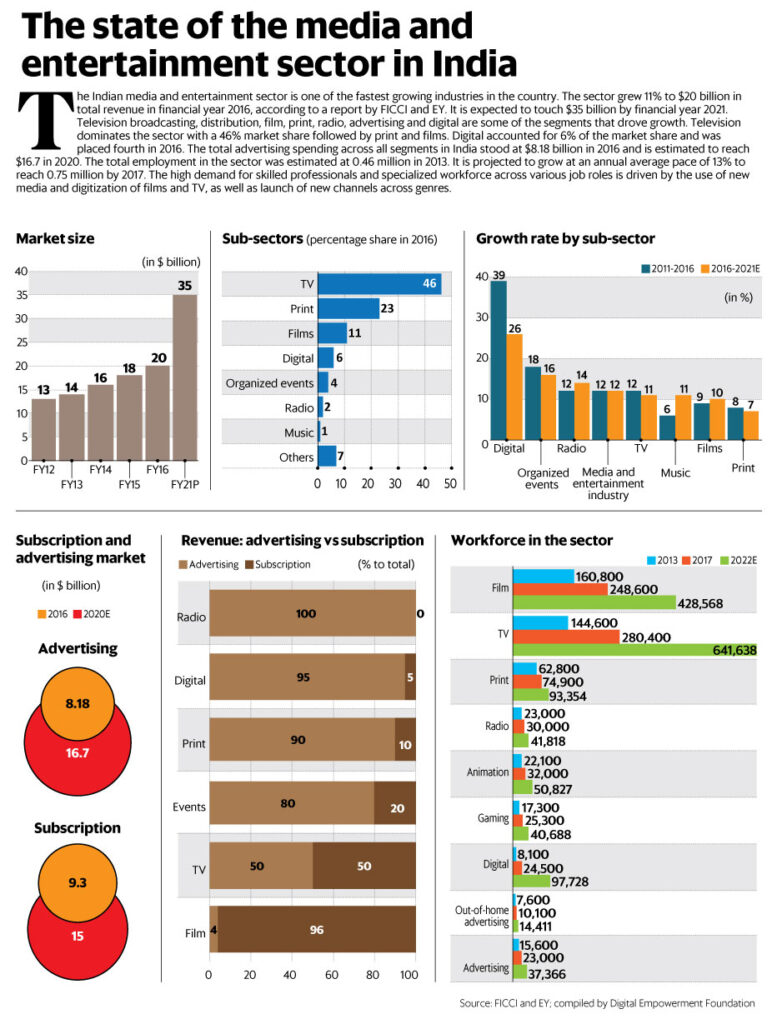

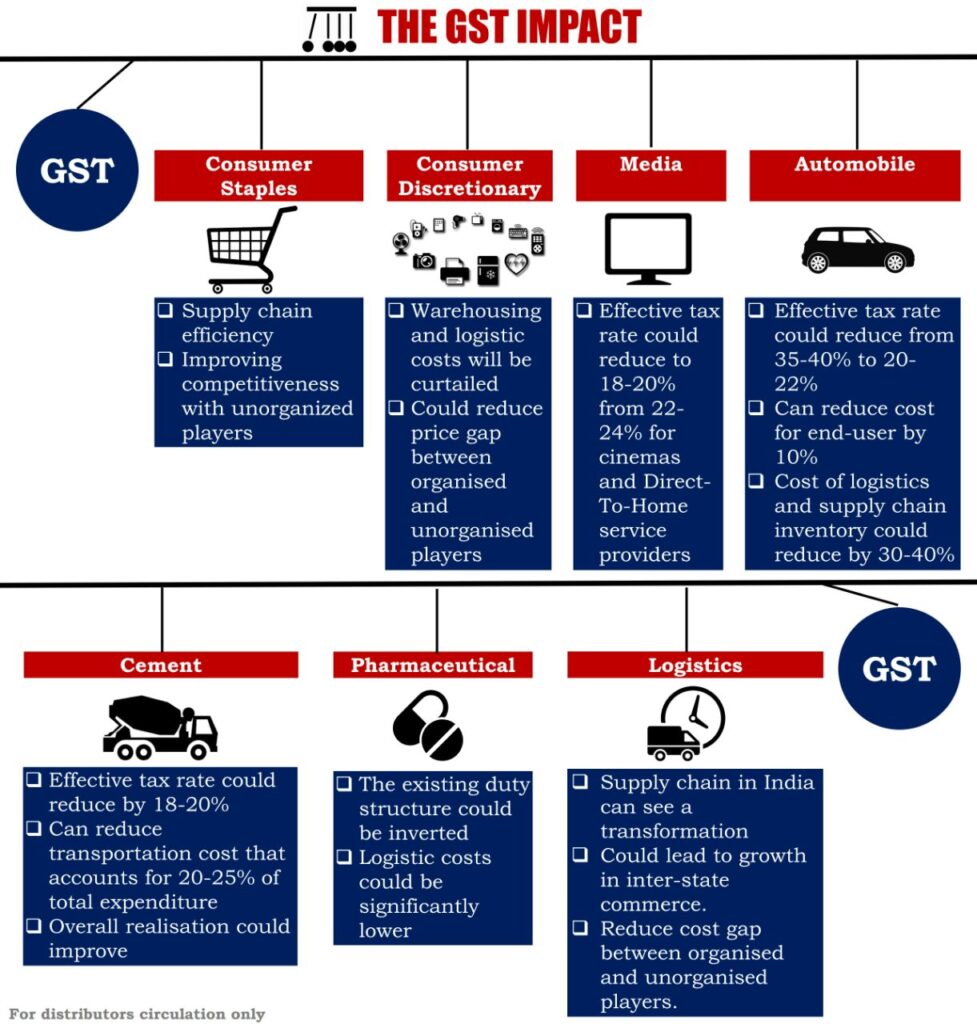

Historical Context: How GST Changed the Game

When GST (Goods and Services Tax) rolled out in 2017, it promised a unified tax system. But for the media and advertising world, the 18% slab was a heavy burden. Before GST, advertising attracted a service tax of 12–15%. The sudden jump to 18% added millions in additional costs for broadcasters, publishers, and ad agencies.

COVID-19 made things worse. Ad spending fell sharply in 2020 and 2021, and although recovery is underway, the sector hasn’t returned to pre-pandemic growth. With ad revenues already under pressure, the high GST rate feels like salt on a fresh wound.

News Broadcasters’ Struggle (NBDA)

The News Broadcasters & Digital Association (NBDA) is one of the loudest voices in this debate. They argue that GST should be collected only when payment is actually received. Today, GST is due the moment an invoice is raised—even if the payment comes six months later.

For TV news channels that rely heavily on government advertising, this is crippling. Payments from government agencies and PSUs can take 120–180 days. During that time, broadcasters are forced to borrow money just to pay taxes on revenue they haven’t seen yet.

NBDA also wants Input Tax Credit (ITC) restored for business essentials like:

- Vehicle rentals for news crews.

- Catering during 24/7 live coverage.

- Insurance for employees working in high-risk environments.

Currently, these fall under blocked credits in Section 17(5) of the CGST Act. For an industry where mobility and staff safety are non-negotiable, this exclusion feels unfair.

Magazines and Digital Publishers (AIM)

The Association of Indian Magazines (AIM) is demanding equal treatment for digital and print editions. Print is GST-exempt, but digital magazines pay 18%. That’s like charging sales tax on a Kindle edition but not the paperback.

AIM’s key proposals include:

- GST exemption for digital editions, just like print.

- Reduction of GST on paper imports (especially lightweight coated paper under 70 gsm) from 18% to 5%.

- Full ITC eligibility for printing services, ink, logistics, and distribution.

- Tax clarity on digital syndication and licensing, which often get taxed inconsistently.

If these reforms aren’t made, AIM warns many smaller magazines will fold. This could narrow India’s media diversity, concentrating power in the hands of a few big players.

Outdoor Advertising (IOAA)

The Indian Outdoor Advertising Association (IOAA) says the 18% GST is killing local advertising. For small businesses—a restaurant, a local coaching center, or a new clothing brand—billboards and posters are effective. But the high tax makes even modest campaigns unaffordable.

IOAA is calling for:

- A reduced GST rate of 5% for outdoor ads.

- Exemption of GST on PPP-based projects, like ad-funded bus stops, parks, and toilets.

Globally, outdoor advertising is often treated differently. In the US, most states don’t levy sales tax on billboards. In the UK, advertising services are zero-rated for VAT. India’s 18% rate makes outdoor campaigns unusually expensive.

Cable Operators (AIDCF)

Cable operators, represented by the All India Digital Cable Federation (AIDCF), face a double squeeze. On one side, they’re competing with OTT giants like Netflix and Amazon Prime. On the other, they’re weighed down by the 18% GST on cable subscriptions.

The result? Millions of subscribers have cut the cord in favor of streaming. Between 2021 and 2024, India lost nearly 8 million cable subscribers, while OTT subscriptions grew 25%.

AIDCF argues that reducing GST on cable services to 5% would:

- Make subscriptions more affordable.

- Slow the exodus to OTT.

- Protect jobs in the cable and broadcasting sector.

Global Comparison: What Other Countries Do

- United States: No federal tax on advertising. Some states impose small levies, usually below 5%.

- United Kingdom: Advertising services are zero-rated under VAT.

- European Union: Many EU countries apply reduced or zero VAT for cultural and media services.

India’s 18% GST looks punitive by comparison. If India wants its media and advertising industry to stay competitive globally, aligning with international norms could be crucial.

Expert Insights on Media And Advertising Sector Seeks Urgent GST Relief

Rajat Sharma, President of NBDA, recently said:

“This is not about profits. It is about survival. Broadcasters are paying taxes on money they haven’t received, while still struggling to meet payroll and operational expenses.”

A senior media analyst with GroupM commented:

“Reducing GST rates will ripple through the economy. Cheaper ads mean more small businesses can market themselves. In the long run, the government may collect more revenue as the pie grows.”

The Numbers Tell the Story

- India’s ad market was valued at ₹1.3 trillion ($16B) in 2024.

- Projected growth: ₹1.6 trillion ($19.5B) by 2026 (source: GroupM).

- Growth slowed to 5% in 2024, compared to 15% before the pandemic.

- Outdoor advertising revenue dropped by 12% in 2023.

- Cable subscriptions fell by 8 million between 2021 and 2024.

These figures underline the sector’s fragility. Relief measures could reverse the decline.

Real-World Impact: Case Studies

Take City Mirror, a Hindi-language magazine. It prints 50,000 copies monthly and earns part of its revenue online. But with paper prices rising, GST on printing services, and blocked ITC, the publisher says:

“We’re one shock away from shutting down. Either ad rates go up, or our margins disappear.”

Or consider a small coaching center in Lucknow that used to spend ₹1 lakh on billboards annually. With GST at 18%, the same campaign now costs ₹1.18 lakh. For a local business, that extra 18% often means canceling the campaign altogether.

Policy Angle: What the Government Risks

The government fears lowering GST could shrink revenue collections. But experts argue the opposite:

- Short-term loss: Yes, collections dip.

- Long-term gain: More businesses advertise, growing the economy, which ultimately increases tax revenue.

Denying relief risks further contraction. Job losses, shrinking ad spends, and reduced competition could mean lower tax collections in the long run.

Step-By-Step Guide to Understanding GST Relief

- GST Basics: A tax applied at 18% on most advertising services.

- The Problem: Companies must pay GST upfront, even if payment hasn’t arrived.

- Industry’s Demand: Levy GST only when money is received, not invoiced. Cut rates for outdoor, digital, and cable.

- Who Benefits: Media companies, advertisers, small businesses, and consumers through lower prices.

Future Outlook: GST 2.0 on the Horizon

The GST Council is set to meet on September 3–4, 2025, to discuss GST 2.0 reforms. Plans include reducing slabs to 5% and 18%, with a 40% slab for sin and luxury goods.

If industry bodies succeed in lobbying, the sector could see lower rates, restored input credits, and relief on cash flow. If not, the struggles may deepen, and smaller players could be driven out of business.

Supreme Court Denies Plea Challenging GST ECL Blocking Relief

GST Overhaul Ahead Of Diwali – Relief For Consumers, Risk For Revenue

India’s Aggressive Investment Reforms: GST Relief, PLI Tweaks, and a Simpler Future