Modi Govt’s GST Cuts Are Draining Revenues Into Crisis: When it comes to taxes, what goes down often needs to come back up somewhere else. Recently, the Modi Govt’s GST cuts have been making headlines after former Finance Secretary Subhash Chandra Garg warned that these tax concessions are draining government revenues and pushing India toward a fiscal crunch. Sounds intense? Don’t worry. We’ll break this down in plain English, with examples, stats, and practical advice. Whether you’re a 10-year-old curious about money or a professional investor tracking India’s fiscal health, you’ll walk away smarter and better informed.

Modi Govt’s GST Cuts Are Draining Revenues Into Crisis

The Modi Govt’s GST cuts may feel like a generous gift today, but experts like S.C. Garg warn of long-term risks. Lower revenues mean states and the Centre will face tough choices: borrow more, cut spending, or raise other taxes. For India to grow sustainably, reforms must balance short-term relief for consumers with long-term fiscal responsibility. Otherwise, today’s celebration could turn into tomorrow’s crisis.

| Point | Details |

|---|---|

| What Happened? | Modi Govt announced major GST cuts, including scrapping the 28% slab and moving many goods from 12% to 5%. |

| Warning | Ex-Finance Secretary S.C. Garg says the cuts are creating a “spree of tax-receipt destruction.” |

| Revenue Shortfall | GST receipts fell short by ₹35,000 crore in FY 2024–25. |

| Impact on States | States may lose revenue worth 0.36% of GDP; the Centre loses ~0.15%. |

| Govt’s Claim | Modi govt still insists it will meet its fiscal deficit target of 4.4%. |

| Official Website | Goods and Services Tax (GST) Council |

A Quick History of GST in India

Before GST (Goods and Services Tax) was introduced in 2017, India’s tax system was complex and fragmented. Every state had its own rules—sales taxes, excise duties, and VAT (value-added tax). For example, buying the same car in Delhi cost a different amount than buying it in Bangalore, simply because of tax differences.

GST simplified that mess by merging most indirect taxes into one national system with slabs of 5%, 12%, 18%, and 28%. It was marketed as “One Nation, One Tax”, making trade easier and improving compliance.

But now, the Modi Govt wants to simplify it even more. The 28% slab is being eliminated, and many goods that were taxed at 12% are shifting down to 5%. On paper, this sounds consumer-friendly, but the trade-off is massive revenue losses.

Why Former Finance Secretary Garg is Raising the Red Flag?

S.C. Garg—who served as India’s finance secretary—reviewed recent data and raised concerns. His worry is not just about tax cuts but about the broader picture of declining revenues.

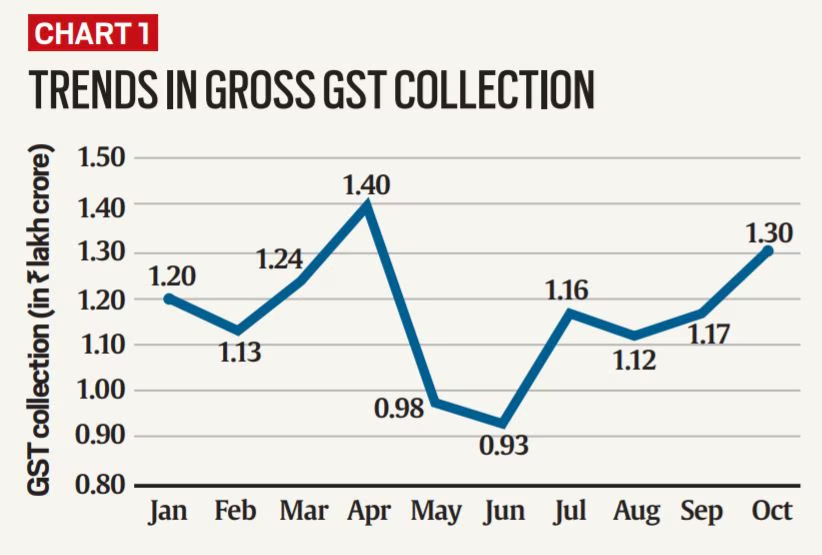

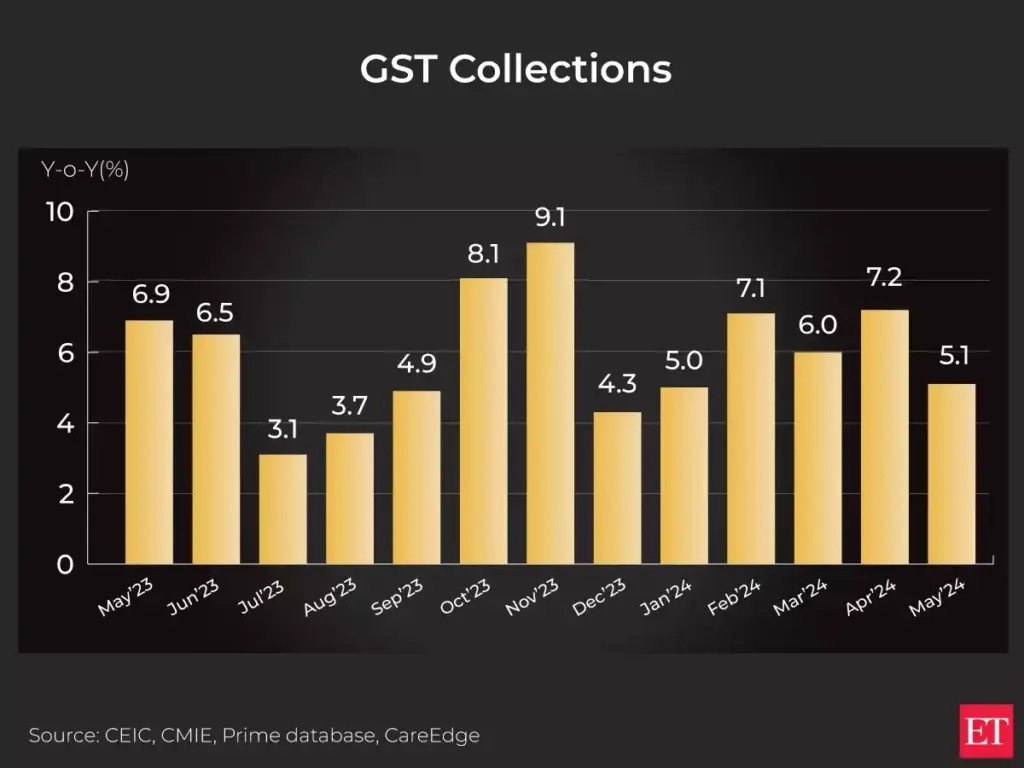

- In FY 2024–25, GST receipts were ₹35,000 crore short of target.

- In the first quarter of FY 2025–26, GST appeared to grow 10%, but this was largely because the Centre delayed handing ₹27,312 crore of IGST revenues to states. When adjusted, actual growth was only about 1%.

- Direct taxes also took a hit:

- Personal income tax: down 0.52%.

- Corporate tax: down a worrying 12%.

- Net direct taxes overall: down 3.9%.

Garg concluded that the government is indulging in a “spree of tax-receipt destruction,” where short-term tax concessions are eroding the long-term financial foundation of the country.

Modi Govt’s GST Cuts Are Draining Revenues Into Crisis: Breaking It Down

Centre vs States

The Centre (federal government) is expected to lose about 0.15% of GDP in revenues. However, the states lose about 0.36%, nearly three times more.

This is significant because states handle critical services like schools, hospitals, local infrastructure, and social programs. If states lose revenue, it directly affects everyday citizens.

Ending GST Compensation Cess

Since GST’s launch, states were promised compensation for revenue losses. This was provided through a GST compensation cess, mainly on luxury and “sin goods” like tobacco and cars. But the government has declared that this cess will end by December 2025. Without it, states are left to fend for themselves.

Fiscal Deficit Concerns

The government insists it will maintain the fiscal deficit at 4.4% of GDP. But with falling revenues, this becomes harder. To bridge the gap, the government may:

- Borrow more money, increasing national debt.

- Or cut public spending, which slows down growth and hurts citizens.

Either option poses risks.

Global Context: Lessons from Other Countries

To understand India’s dilemma, it helps to look abroad.

- In the United States, sales taxes are state-based. The federal government doesn’t rely on them for revenue. Instead, it leans on income and corporate taxes.

- In the European Union, VAT (value-added tax) is a critical revenue source. In many EU countries, VAT is above 20%. If they cut VAT, they typically compensate by raising other taxes or reducing subsidies.

India’s situation is unique. GST is one of its largest revenue sources. By cutting slabs without alternative revenues, the government risks destabilizing its fiscal framework.

Political and Economic Motivations

So, why is the Modi Govt pushing these GST cuts despite revenue concerns? Several reasons stand out:

- Boosting Consumption – Lower taxes on goods make them cheaper, encouraging people to spend more. This boosts short-term growth.

- Managing Inflation – India has struggled with rising food and fuel prices. Lower GST helps reduce inflationary pressure.

- Electoral Strategy – Lower consumer prices are politically popular, especially before elections.

- Global Trade Image – India wants to present itself as a growth-driven, business-friendly economy amid international trade challenges.

While these reasons make sense politically, the long-term costs are concerning.

Impact on Everyday Citizens and Businesses

Households

For families, GST cuts mean cheaper electronics, clothing, and appliances. This is welcome relief in times of high inflation.

Small Businesses

Small and medium enterprises (SMEs) benefit from lower compliance costs and cheaper inputs. But they risk being hit later if states raise other local taxes to recover revenue.

Corporates

Corporations are under pressure. With corporate tax collections already down 12%, reduced GST could hurt government spending on infrastructure, which corporates rely on for growth.

Investors

Investors are watching closely. Falling revenues often lead to credit rating concerns. If India’s fiscal deficit widens, global agencies like Moody’s or Fitch may lower ratings, impacting foreign investment inflows.

Practical Advice for Professionals

For Businesses

- Adjust pricing to pass GST savings to customers—this can improve competitiveness.

- Plan for uncertainty: States may impose new taxes or fees to make up for lost GST revenue.

For Policymakers

- Strengthen compliance: GST evasion is still a massive issue. According to government estimates, India loses ₹5–6 lakh crore annually in tax evasion.

- Diversify revenue sources: Explore taxes on the digital economy, luxury services, or carbon emissions.

For Investors

- Keep an eye on India’s fiscal deficit data in upcoming budgets.

- Diversify exposure: While consumer stocks may rise, infrastructure and public sector companies may suffer if government spending tightens.

Step-by-Step Guide to Understanding GST Reform

- Learn GST Basics – It’s India’s main indirect tax, replacing multiple older taxes.

- Know the Changes – The 28% slab is gone; 12% goods have shifted to 5%.

- Track the Numbers – Follow monthly GST updates on the GST Council website.

- Watch State Budgets – States will adjust revenue gaps with their own taxes or spending cuts.

- Think Beyond Today – Short-term cheaper goods could mean weaker services tomorrow.

Big GST Cuts, But Who Really Benefits? Profiteering Worries Raise Red Flags

Will Modi’s GST Reforms Tame Inflation and Push RBI Toward Cuts?

Future Outlook: What Happens Next?

If revenues don’t pick up, India may face several scenarios:

- Borrow More – This increases debt, which is already around 83% of GDP.

- Cut Spending – Infrastructure projects, social programs, and subsidies may be scaled back.

- New Taxes – States may raise property taxes, fuel levies, or local service charges.

The best path forward is to expand the tax base. Currently, less than 6% of Indians pay income tax. Bringing more citizens and companies into the tax system is key to long-term fiscal health.